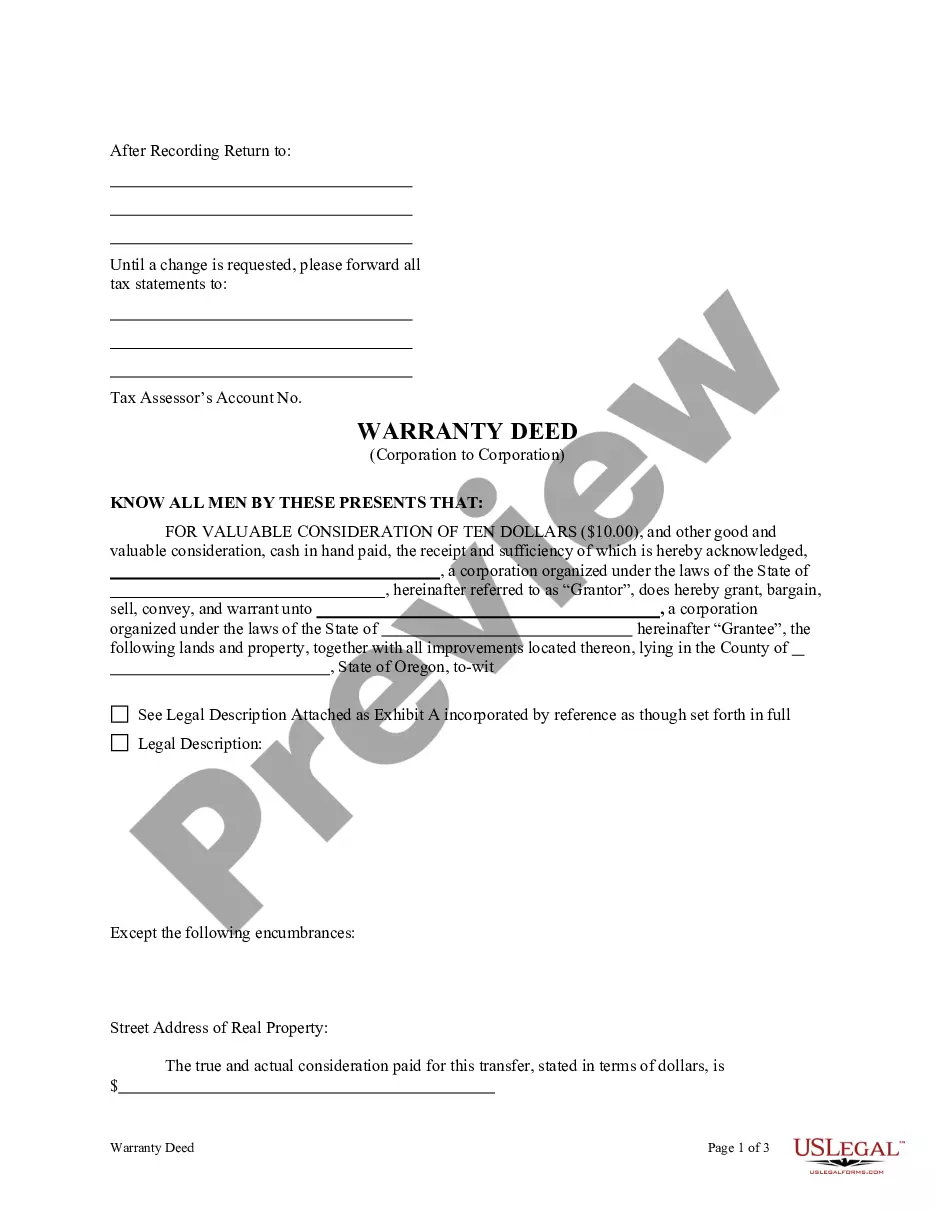

Wisconsin Schedule I: Your Income (individuals) is a form used by individuals who are filing Wisconsin income tax returns. It is used to report the individual’s gross income, adjusted gross income, taxable income, and income tax liability. The form has two types: Schedule I-A for residents and Schedule I-B for part-year and nonresidents. Both forms require the filer to provide information about their income sources, deductions, and credits. This form must be completed, signed, and attached to Form 1 or Form 1NPR for Wisconsin income tax returns.

Wisconsin Schedule I: Your Income (individuals)

Description

How to fill out Wisconsin Schedule I: Your Income (individuals)?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are checked by our specialists. So if you need to prepare Wisconsin Schedule I: Your Income (individuals), our service is the best place to download it.

Obtaining your Wisconsin Schedule I: Your Income (individuals) from our library is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the proper template. Afterwards, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance check. You should carefully review the content of the form you want and make sure whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Wisconsin Schedule I: Your Income (individuals) and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

For single taxpayers in 2023, the bottom rate of 3.54% applies to taxable income below $13,810; the second rate of 4.65% applies to taxable income between $13,810 and $27,630; the third rate of 5.3% applies to taxable income between $27,630 and $304,170; the top rate of 7.65% applies to taxable income exceeding

What are the individual income tax rates? overbut not over2022 tax is$0$12,7603.54%$12,760$25,520$451.70 + 4.65%$25,520$280,950$1,045.04 + 5.3%$280,950$14,582.83 + 7.65%

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

How does Wisconsin's tax code compare? Wisconsin has a graduated individual income tax, with rates ranging from 3.54 percent to 7.65 percent. Wisconsin also has a flat 7.90 percent corporate income tax rate.

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

Wisconsin law requires that you pay tax on your income as it becomes available to you. Your employer will generally withhold income tax from your wages. However, if you have taxable non-wage income or other income not subject to withholding, you may need to make quarterly estimated tax payments.

Make the election using Wisconsin Schedule I, Adjustments to Convert 2021 Federal Adjusted Gross Income and Itemized Deductions to the Amounts Allowable for Wisconsin. Example: For federal tax purposes you claim the credit under sec. 45E of the IRC for 50 percent of the startup costs of a small employer pension plan.

What are the individual income tax rates? overbut not over2022 tax is$0$12,7603.54%$12,760$25,520$451.70 + 4.65%$25,520$280,950$1,045.04 + 5.3%$280,950$14,582.83 + 7.65%