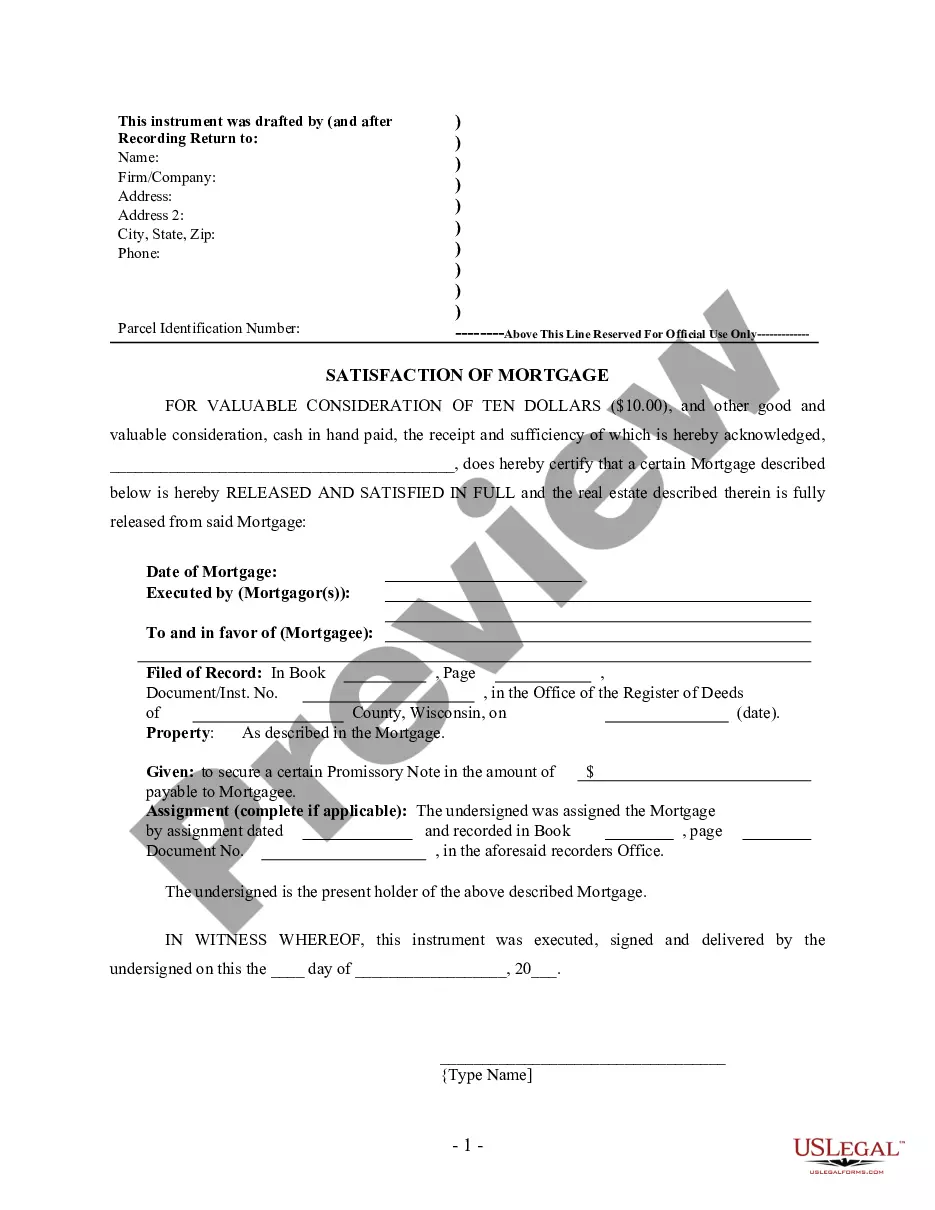

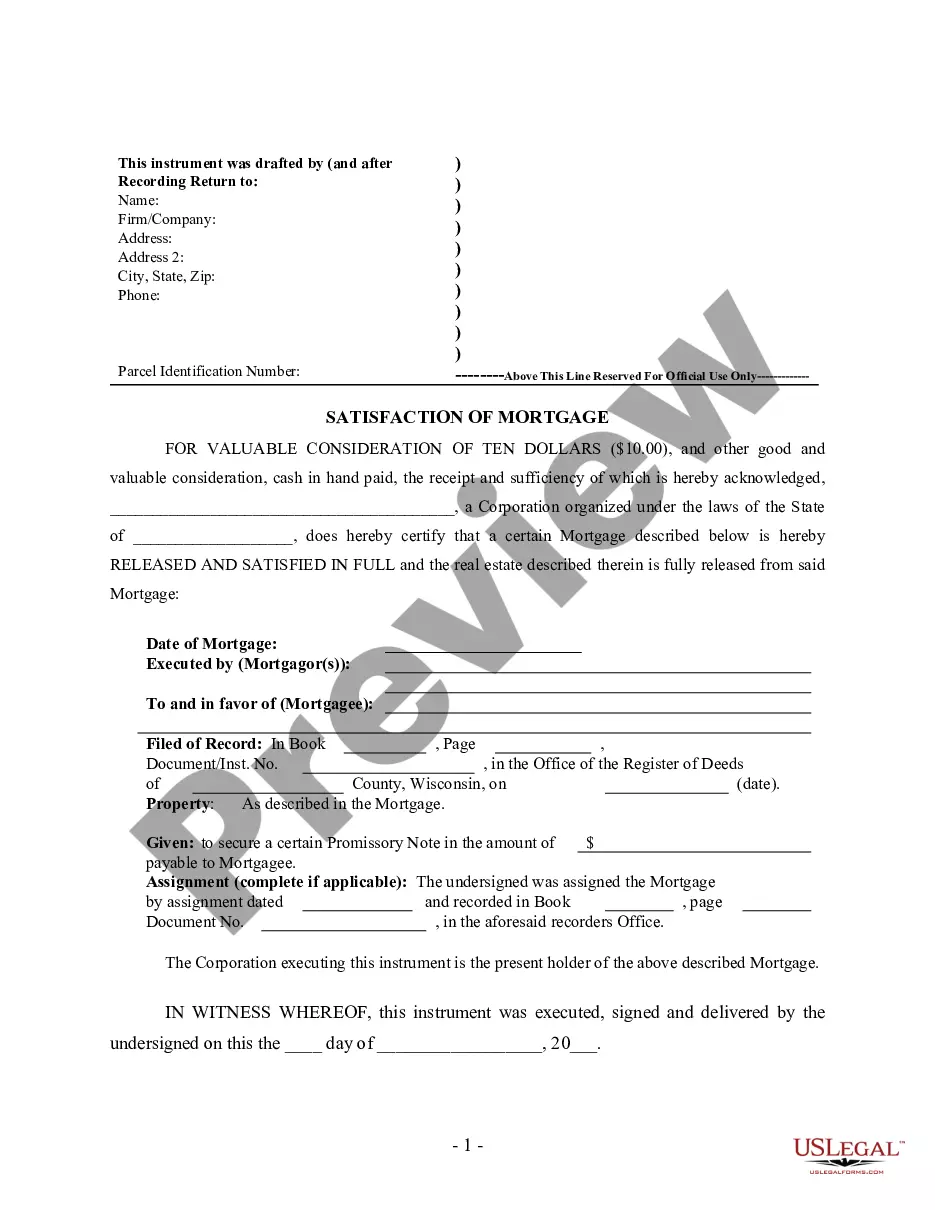

This form is for the satisfaction or release of a deed of trust for the state of Wisconsin by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Wisconsin Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Wisconsin Satisfaction, Release Or Cancellation Of Mortgage By Individual?

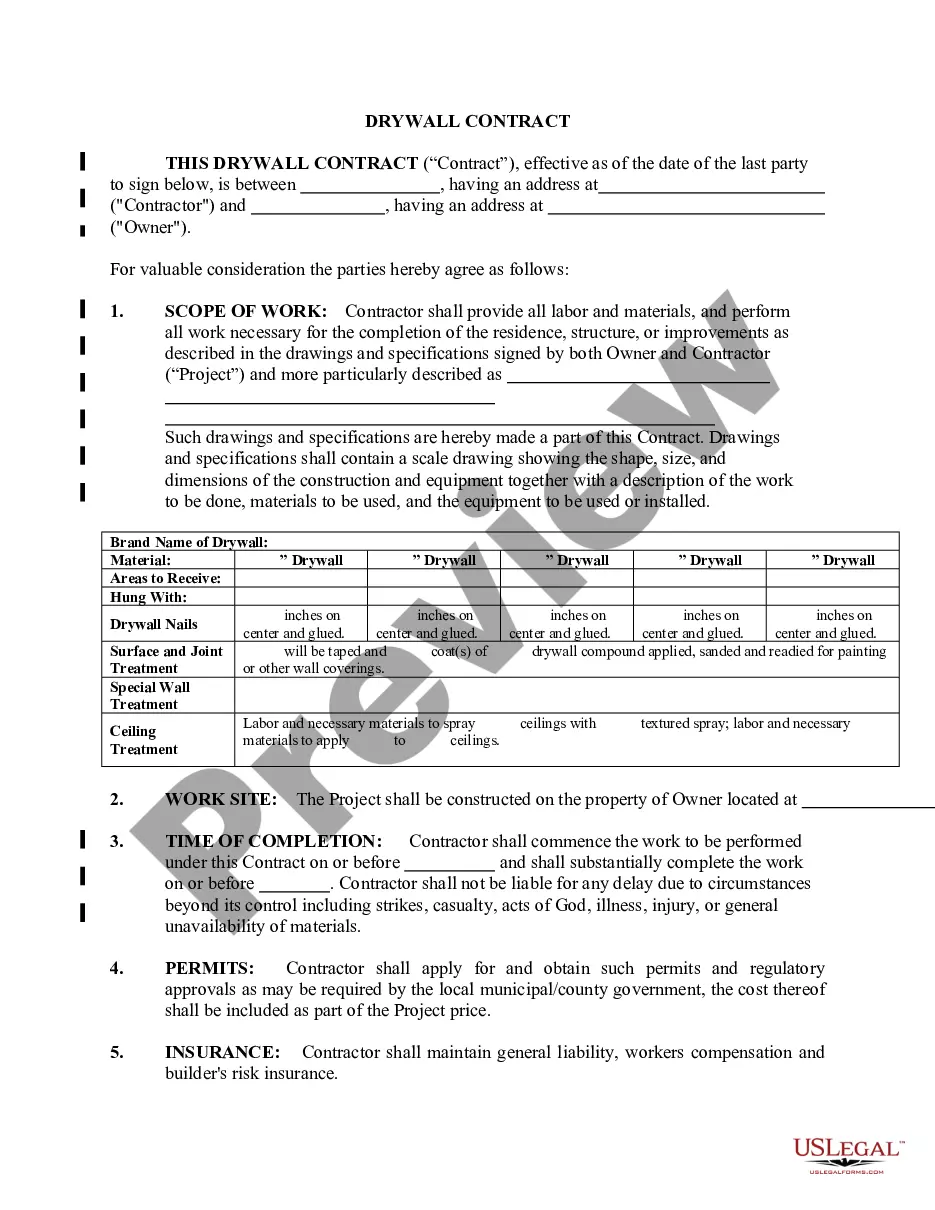

Out of the large number of platforms that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates prior to buying them. Its extensive library of 85,000 samples is categorized by state and use for simplicity. All of the forms available on the service have already been drafted to meet individual state requirements by accredited lawyers.

If you have a US Legal Forms subscription, just log in, search for the form, click Download and access your Form name from the My Forms; the My Forms tab holds all your downloaded documents.

Keep to the tips below to get the form:

- Once you find a Form name, make sure it is the one for the state you really need it to file in.

- Preview the form and read the document description before downloading the sample.

- Look for a new sample through the Search engine if the one you’ve already found isn’t proper.

- Click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

Once you have downloaded your Form name, you can edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most updated version in your state. Our platform provides quick and easy access to templates that fit both legal professionals as well as their customers.

Form popularity

FAQ

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.