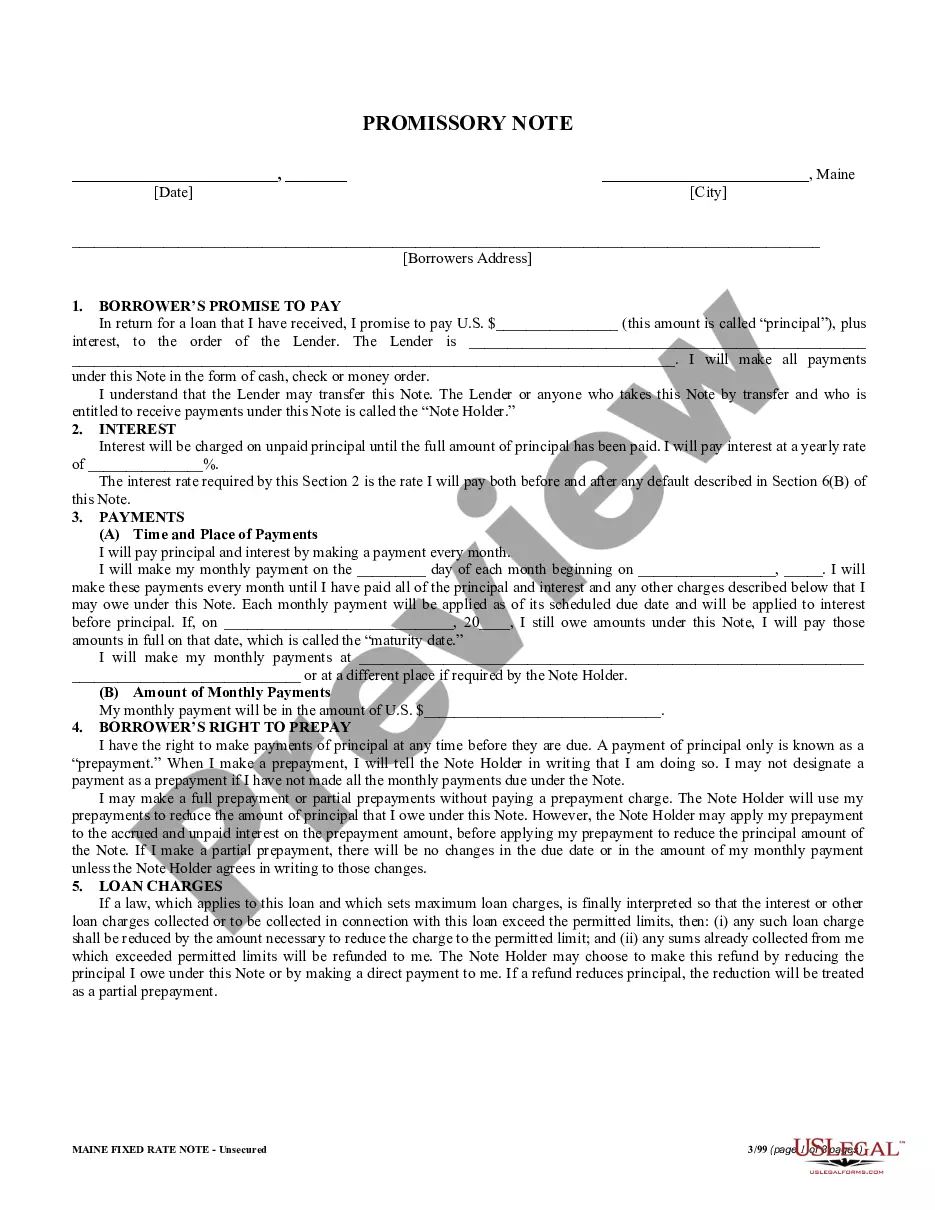

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

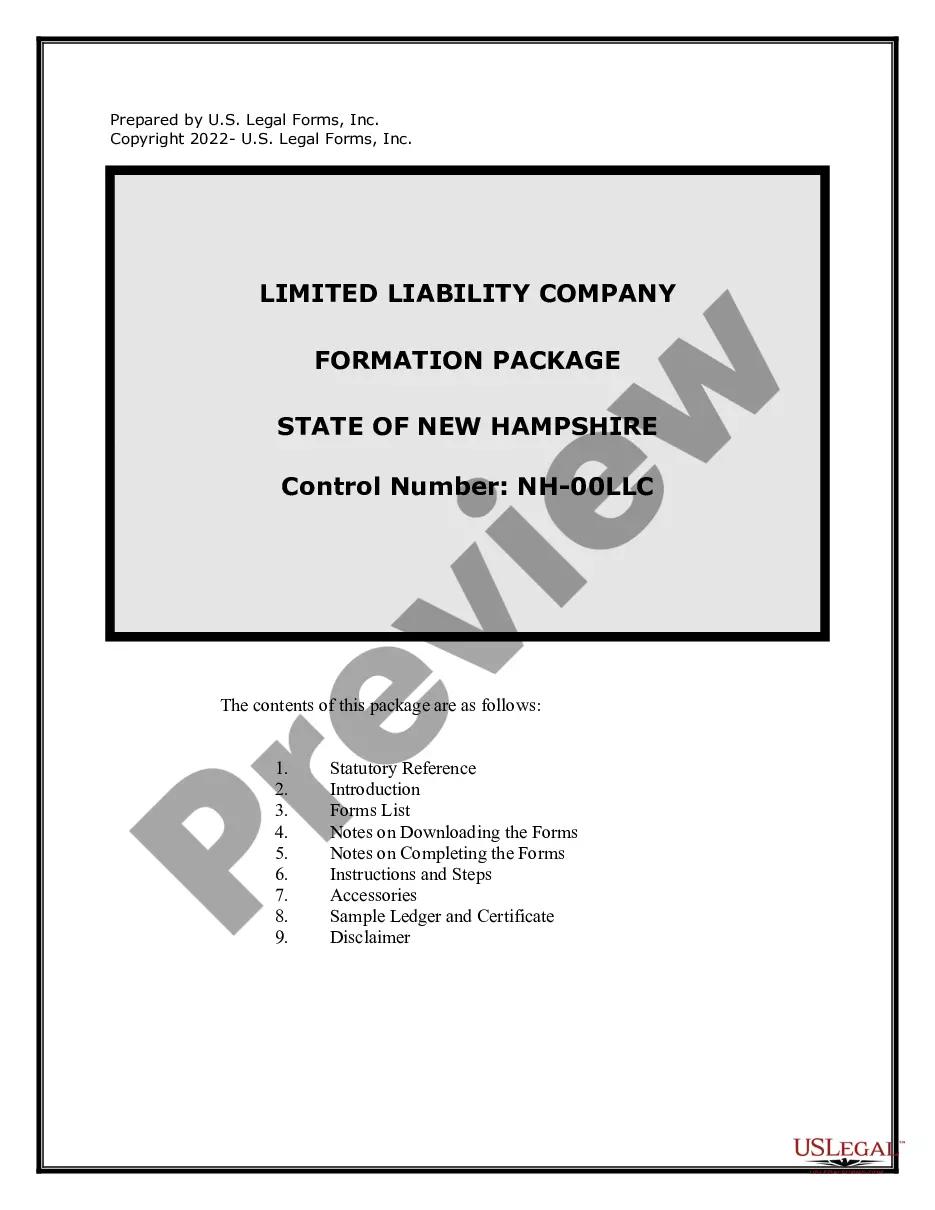

Out of the large number of services that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before purchasing them. Its complete catalogue of 85,000 samples is grouped by state and use for efficiency. All the forms available on the platform have already been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, hit Download and gain access to your Form name in the My Forms; the My Forms tab holds all your saved documents.

Keep to the guidelines listed below to get the form:

- Once you find a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description before downloading the sample.

- Search for a new template using the Search field in case the one you’ve already found isn’t appropriate.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

Once you have downloaded your Form name, you can edit it, fill it out and sign it in an online editor of your choice. Any form you add to your My Forms tab can be reused multiple times, or for as long as it remains the most updated version in your state. Our service provides quick and simple access to samples that suit both attorneys as well as their clients.

Form popularity

FAQ

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

The following states use Deed of Trusts: Alaska, Arizona, California, District of Columbia, Georgia, Mississippi, Missouri, Nevada, North Carolina, and Virginia.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Deeds of trust are used in conjunction with promissory notes. The deed of trust is the security for the amount loaned to finance the real estate purchase, and is secured by the underlying piece of real estate. The deed of trust is what secures the promissory note.

Small businesses frequently borrow money, or extend credit, in the course of their operations. A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

1. What is the Difference Between the Note and Deed of Trust? A note, usually known as a promissory note, which is a written promise to repay a loan. Whereas, a trust deed is a document used to protect paying back of a loan that is being documented as a lien counter to the borrowers real estate.