Washington Renunciation And Disclaimer of Property from Will by Testate

About this form

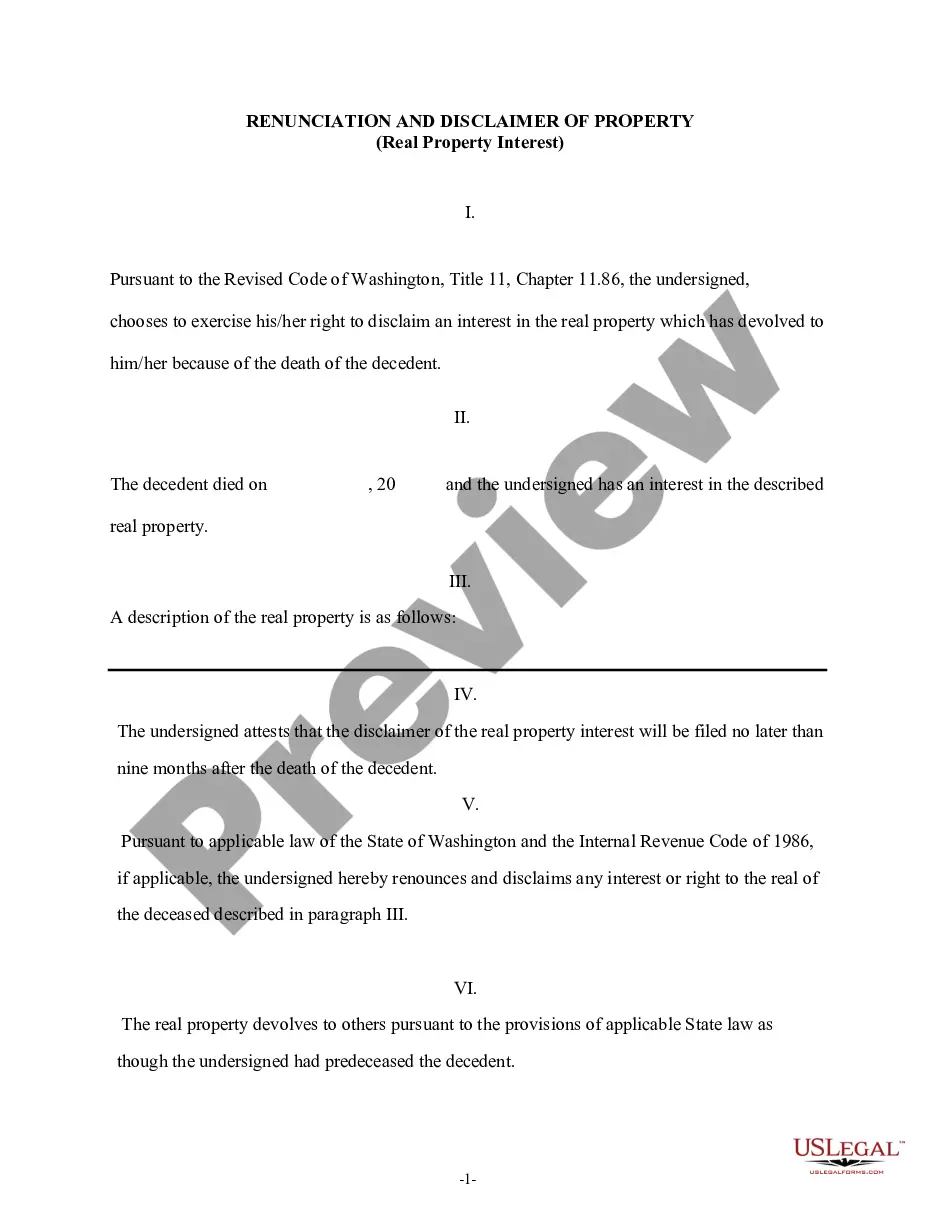

This Renunciation and Disclaimer of Property from Will by Testate is a legal document that allows a beneficiary to relinquish their interest in property acquired through intestate succession. This form is specifically used when the beneficiary wishes to terminate their interest in part or all of the property received upon the death of the decedent, in accordance with Washington state law. This form differs from a will in that it addresses the renunciation of property rather than the distribution of assets through a will document.

Key components of this form

- Identification of the decedent and the beneficiary.

- Specification of the property being disclaimed.

- Declaration of intent to renounce the property interest.

- Acknowledgment of understanding the legal consequences of the disclaimer.

- Certification of delivery of the document.

State-specific compliance details

This form adheres to the Revised Code of Washington, Title 11, Chapter 11.86. It is important to file the disclaimer no later than nine months after the decedent's death to ensure its validity in the state of Washington.

Situations where this form applies

This form should be used when a beneficiary inherits property under a will but chooses to disclaim their interest in it. Common scenarios include situations where the beneficiary does not want to assume the responsibilities or liabilities associated with the property, or when they wish to allow the property to pass to other heirs in accordance with state law.

Who should use this form

- Beneficiaries who have inherited property through a will and wish to relinquish their rights.

- Individuals who do not wish to accept the responsibilities tied to an inherited property.

- Anyone needing to ensure the legal validity of their disclaimer in Washington State.

How to prepare this document

- Identify the decedent and the beneficiary involved.

- Specify the property that is being disclaimed.

- Clearly state your intention to renounce your interest in the property.

- Sign the document in the presence of a notary, if required.

- File the completed disclaimer with the appropriate court or office within nine months of the decedent's death.

Notarization requirements for this form

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Common mistakes to avoid

- Failing to file the form within the nine-month timeframe after the decedent's death.

- Not providing clear identification of the property being renounced.

- Neglecting to understand the consequences of the renunciation.

Advantages of online completion

- Convenient access to customizable legal forms without the need for in-person consultations.

- Instant download and print options, allowing for quick preparation.

- Ensures compliance with state legal requirements, enhancing the form's validity.

Main things to remember

- This form allows beneficiaries to renounce inheritance rights to property received through a will.

- Filing must occur within nine months of the decedent's death for the disclaimer to be valid.

- Understanding the implications of renouncing property is crucial before completing this form.

Form popularity

FAQ

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.

The disclaimer deed is a legal document that has legal consequences. Further, the disclaimer deed will clearly state that the spouse signing it is waiving (disclaiming) any interest in the house being purchased.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

A disclaimer is essentially a refusal of a gift or bequest.Disclaimers typically arise in the context of postmortem estate planning where a beneficiary may desire to make a qualified disclaimer under Sec. 2518 to achieve certain tax results such as qualifying for a marital deduction.

Specifically, the IRS requires that: You make your disclaimer in writing.You disclaim the assets within nine months of the death of the person you inherited them from. (Note: There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.)