Utah Partial Release of Property From Deed of Trust for Individual

Definition and meaning

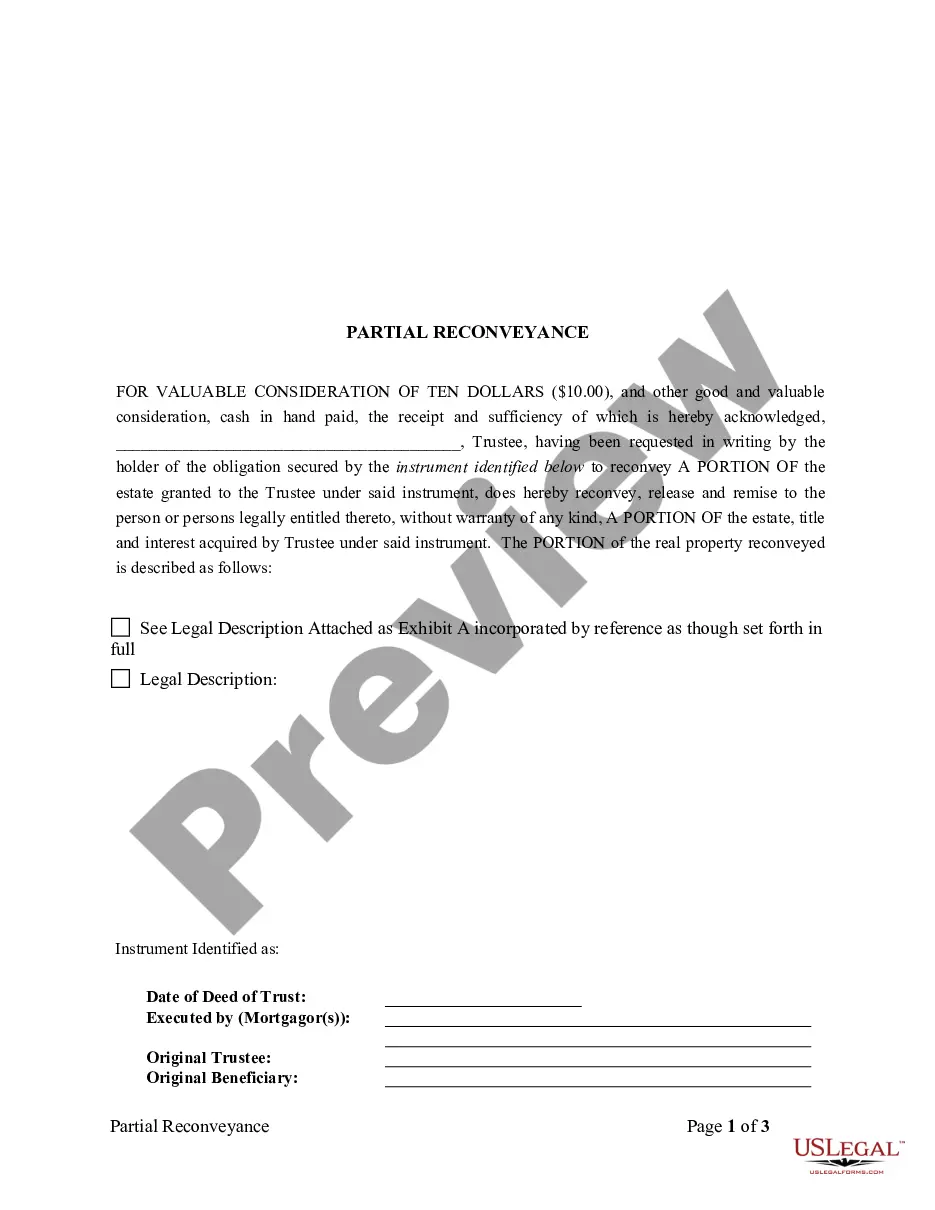

The Utah Partial Release of Property From Deed of Trust for Individual is a legal document used to release a portion of a property from a deed of trust. This form is especially important when a borrower has partially paid off a loan, allowing them to reclaim ownership of a specific section of the property without terminating the entire trust. Essentially, this process allows for the separation of ownership of a part of the property from the debt obligations attached to the property as a whole.

How to complete a form

To complete the Utah Partial Release of Property From Deed of Trust for Individual, follow these steps:

- Gather necessary information, including the legal description of the property and details of the original deed of trust.

- Fill in your name and contact information in the designated fields.

- Provide the date the deed of trust was executed and other relevant details.

- Specify the portion of the property you wish to release.

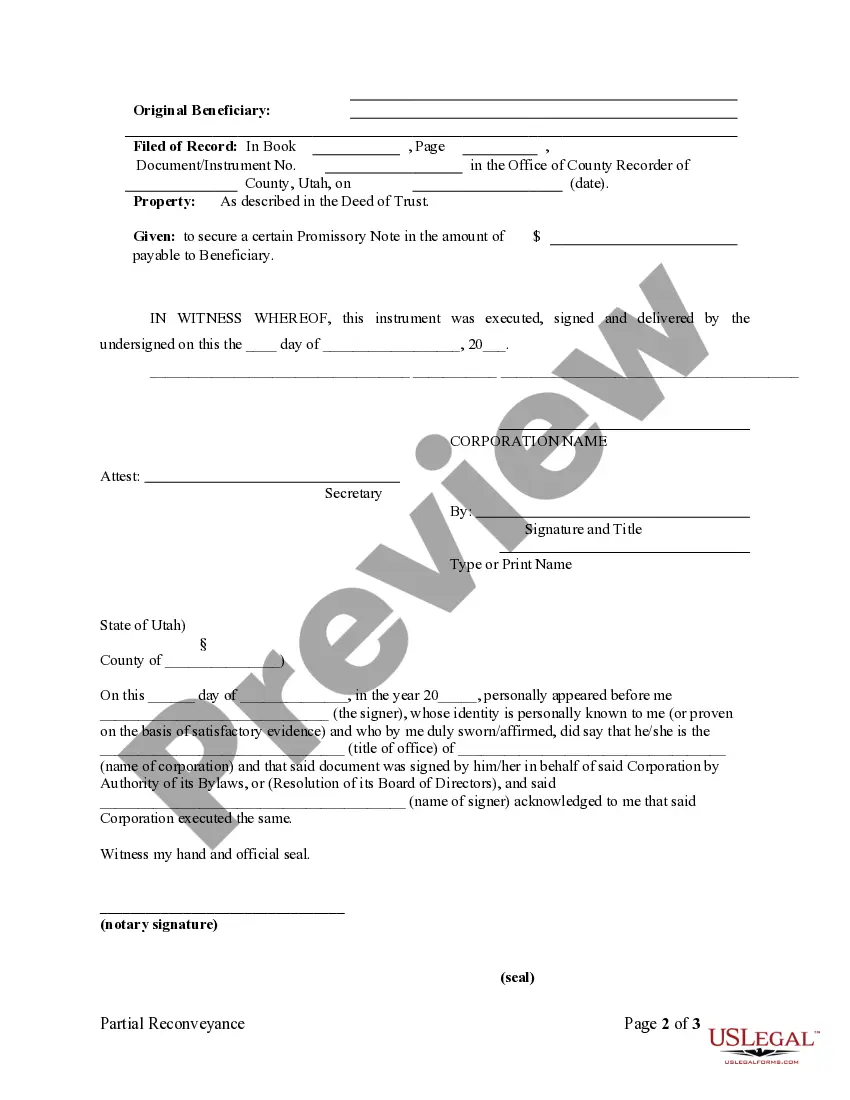

- Sign the document in the presence of a notary public to ensure its validity.

Who should use this form

This form is intended for individuals who have a deed of trust against their property and wish to release a portion of it. This includes homeowners, property investors, or anyone involved in real estate transactions looking to manage their property deeds effectively. By using this form, individuals can clarify their ownership titles and financial obligations with respect to the property.

Legal use and context

The Utah Partial Release of Property From Deed of Trust for Individual is legally recognized in Utah and must comply with state-specific requirements to ensure its enforceability. This form is commonly used when a borrower pays off a segment of their mortgage, allowing them to limit the lender's interest to only the remaining portion of the property. Clients are encouraged to seek legal counsel to confirm that all legal standards are met before submitting the form.

Common mistakes to avoid when using this form

When completing the Utah Partial Release of Property From Deed of Trust for Individual, be mindful of the following common errors:

- Failing to provide a precise legal description of the property being released.

- Not having the document notarized, which can invalidate the form.

- Omitting important details such as the date of the original deed of trust.

- Leaving signature fields blank or incorrectly filled out.

- Ignoring state-specific filing procedures that may apply to the form.

Form popularity

FAQ

A reconveyance is the official transfer of the property title after the mortgage has been paid in full. The processing time can vary based on the county in which the property is located and can take up to three months. You will need to contact your county for questions on their specific processing time.

Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee. Other states have no limitations.

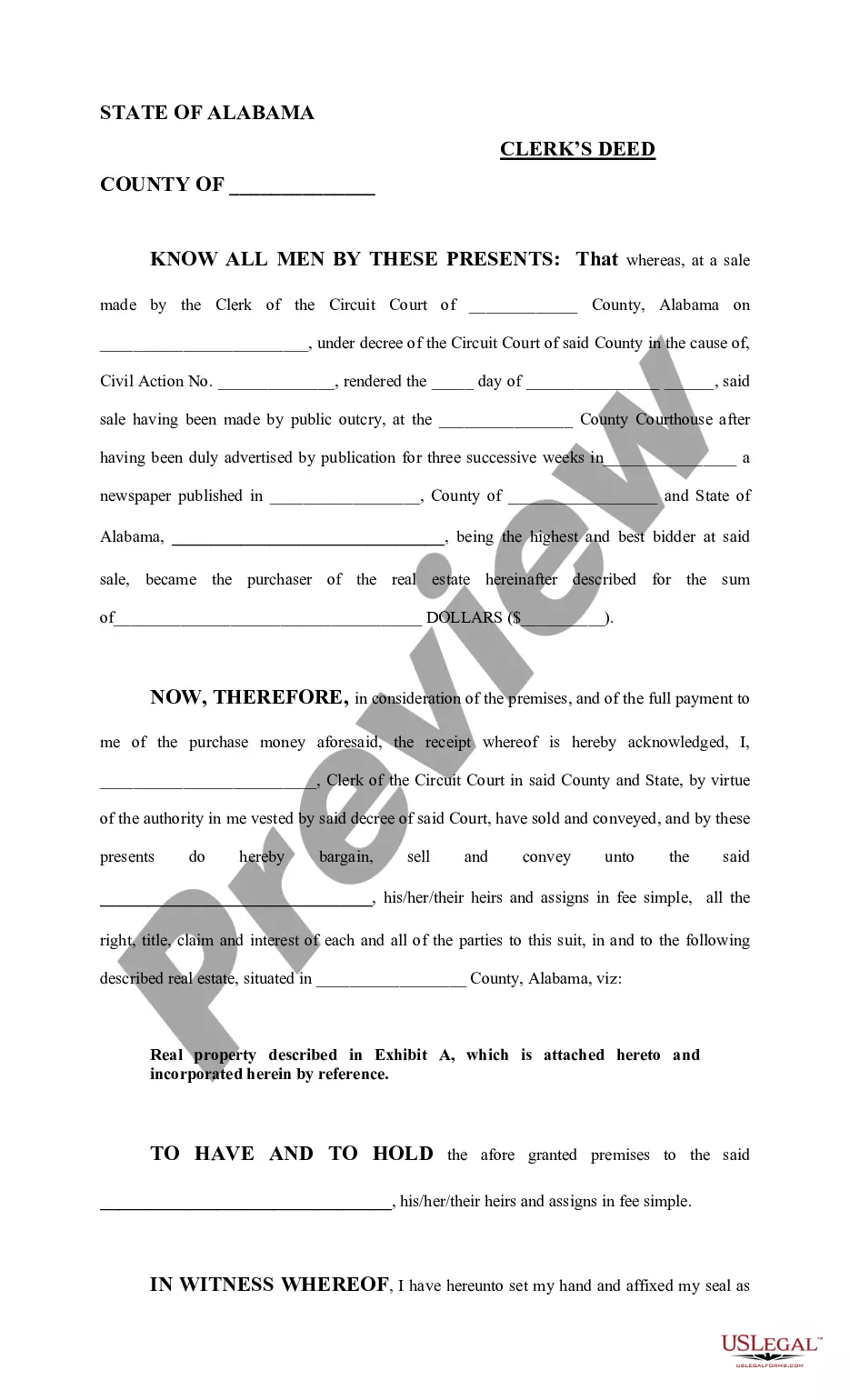

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. This document states that the conditions of the loan have been met and you have no further financial obligations to the lender.

A Deed of Trust is a three party document prepared, signed and recorded to secure repayment of a loan. The Borrower (property owner) is named as Trustor, the Lender is called the Beneficiary, and a third party is called a Trustee.

The act or process of reconveying property. A discharge acts as a reconveyance of the legal title from the mortgagee to the holder of the equity. 2. rare, archaic. the act or process of conveying something or someone back to their original location.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form. is completed and signed by the trustee, whose signature must be notarized.

A form of partial reconveyance of real property in California by a trustee under a deed of trust for use when the beneficiary (lender) agrees to release a portion of the real property from the lien of the deed of trust while the trustor's (borrower's) obligations are not yet fully satisfied.