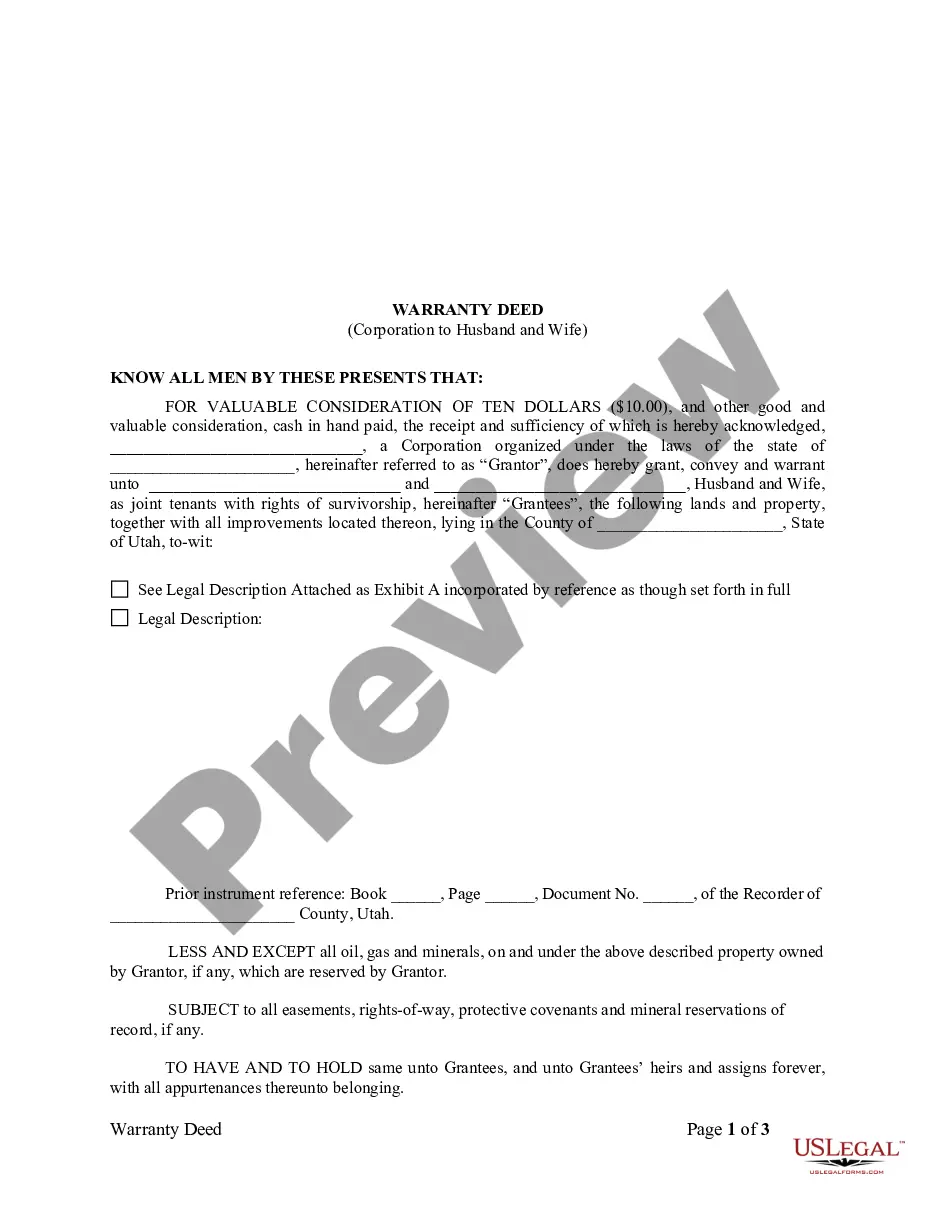

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Utah Warranty Deed from Corporation to Husband and Wife

Description

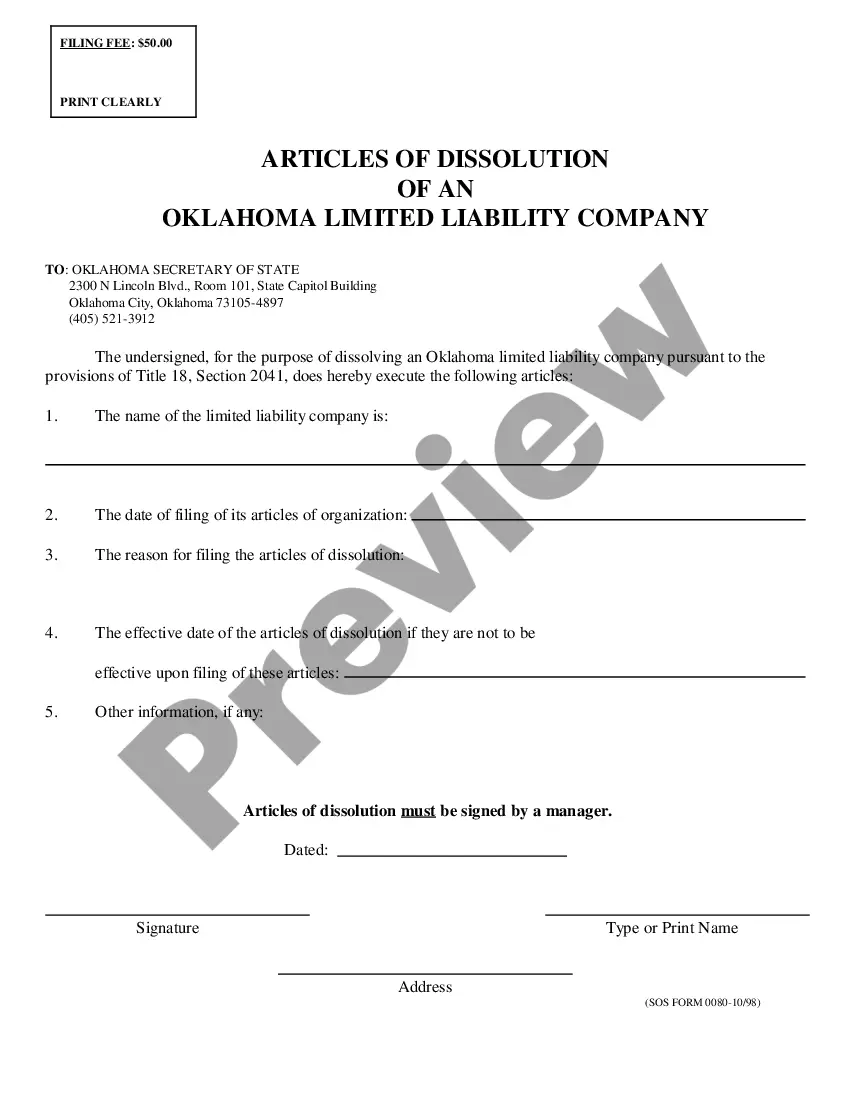

How to fill out Utah Warranty Deed From Corporation To Husband And Wife?

Searching for a Utah Warranty Deed from Corporation to Husband and Wife on the internet can be stressful. All too often, you find files that you simply believe are alright to use, but discover later on they are not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Get any form you’re searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be included to your My Forms section. If you do not have an account, you have to sign-up and select a subscription plan first.

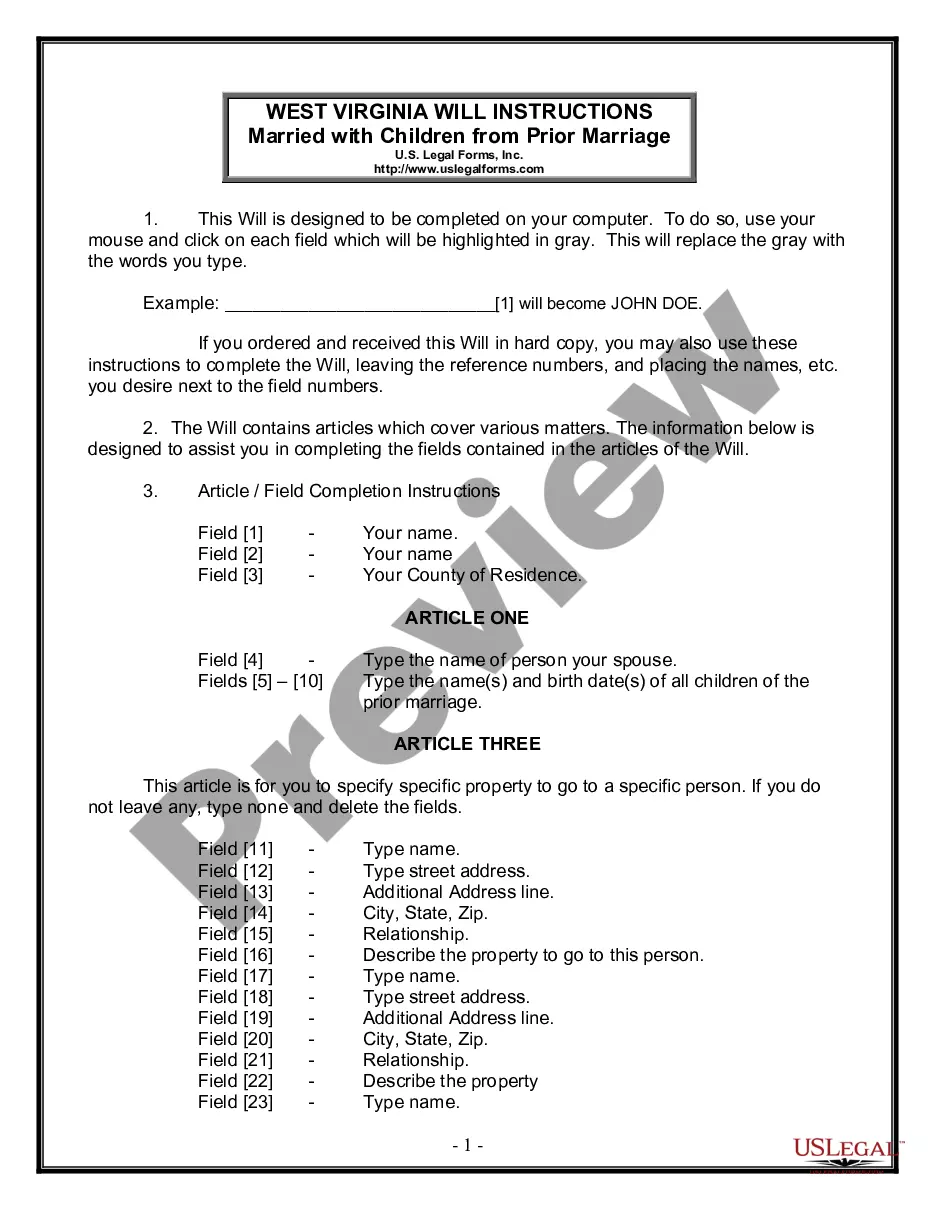

Follow the step-by-step recommendations listed below to download Utah Warranty Deed from Corporation to Husband and Wife from the website:

- See the form description and hit Preview (if available) to verify if the form meets your requirements or not.

- In case the form is not what you need, get others with the help of Search engine or the provided recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Get access to 85,000 legal forms right from our US Legal Forms library. In addition to professionally drafted templates, customers can also be supported with step-by-step instructions on how to get, download, and fill out forms.

Form popularity

FAQ

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In order to make the Warranty Deed legally binding, the Seller needs to sign it front of a notary public. Then signed and notarized deed must be filed at the city or county office for recording property documents. Before filing with this office all previously billed property taxes must be paid in full.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.