Register a foreign corporation in Utah.

Register a foreign corporation in Utah.

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Searching for a Utah Registration of Foreign Corporation online might be stressful. All too often, you find documents that you think are ok to use, but discover afterwards they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Have any document you’re searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will automatically be added in to the My Forms section. If you do not have an account, you should sign up and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Utah Registration of Foreign Corporation from our website:

Get access to 85,000 legal forms from our US Legal Forms library. Besides professionally drafted templates, users will also be supported with step-by-step guidelines regarding how to find, download, and complete forms.

Yes. Generally, there are no restrictions on foreign ownership of any company formed in the United States, except for S-Corporations. It is not necessary to be a U.S. citizen or to have a green card to own a limited liability company or corporation formed in the United States.

In most cases, all businesses in Utah are required by law to register with the Utah Department of Commerce, Division of Corporations and Commercial Code, the Utah Department of Workforce Services, the Utah State Tax Commission, the Utah Labor Commission, Internal Revenue Service and with local municipalities to obtain

Foreign corporation is a term used in the United States to describe an existing corporation (or other type of corporate entity, such as a limited liability company or LLC) that conducts business in a state or jurisdiction other than where it was originally incorporated.

Yes. California registered LLC may operate internationally. No California laws restrict international operation.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

Generally, there are no restrictions on foreign ownership of a company formed in the United States. The procedure for a foreign citizen to form a company in the US is the same as for a US resident. It is not necessary to be a US citizen or to have a green card to own a corporation or LLC.

A Foreign LLC is not an LLC that is formed outside of the United States. The requirement to file for a Foreign LLC is usually to expand one's business operations or to open an additional retail or brick-and-mortar location in a new state.

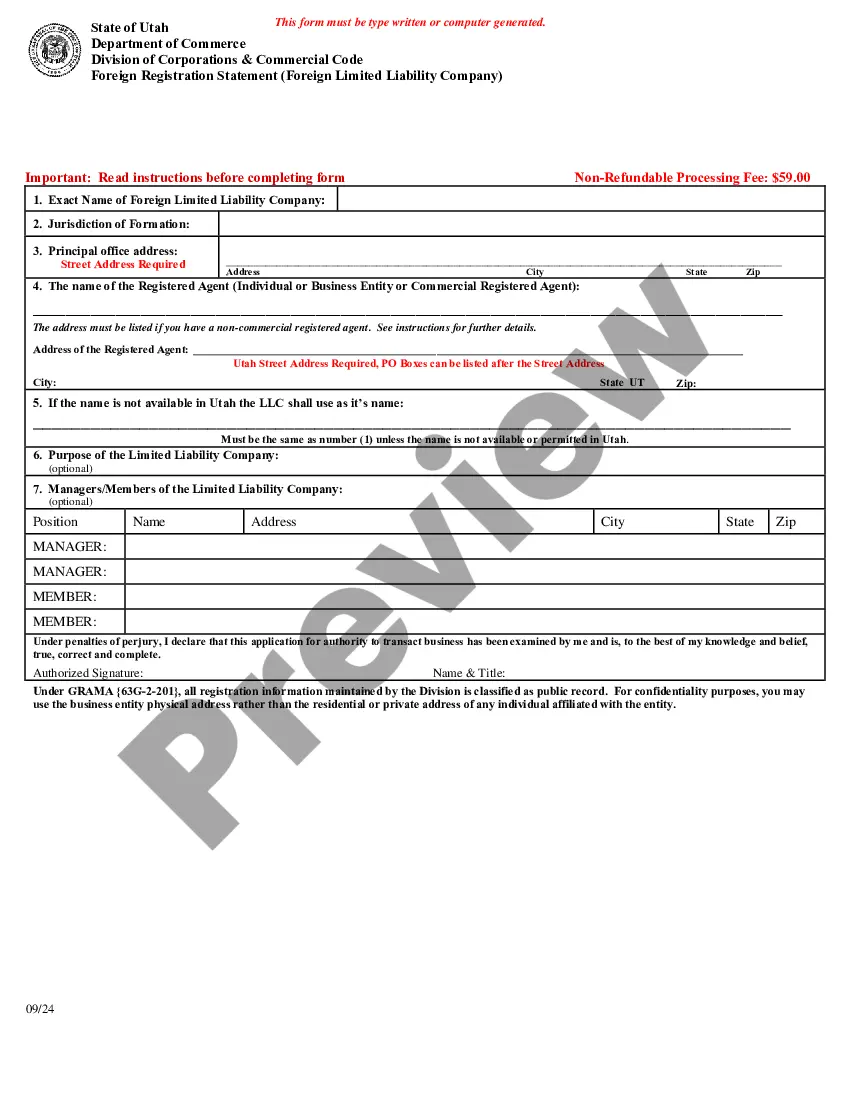

To register your business in Utah, you must file a Foreign Registration Statement (Foreign Limited Liability Company) with the Utah Division of Corporations and Commercial Code (DCCC). You can download a copy of the application form from the DCC website.

To register the foreign LLC, you will need the information from the Articles of Organization and you will need a copy of the official LLC document from the state. Next, determine if you are "doing business" in another state and are thus required to register as a foreign LLC in that state.