Small Estate Affidavit

Definition and meaning

A Small Estate Affidavit is a legal document used to settle the estate of a deceased person whose total value of property does not exceed a certain threshold defined by state law. This affidavit allows individuals, typically beneficiaries or successors, to claim the decedent's assets without going through a lengthy probate process. It is designed to simplify the transfer of property and streamline the inheritance process when the estate's value is modest.

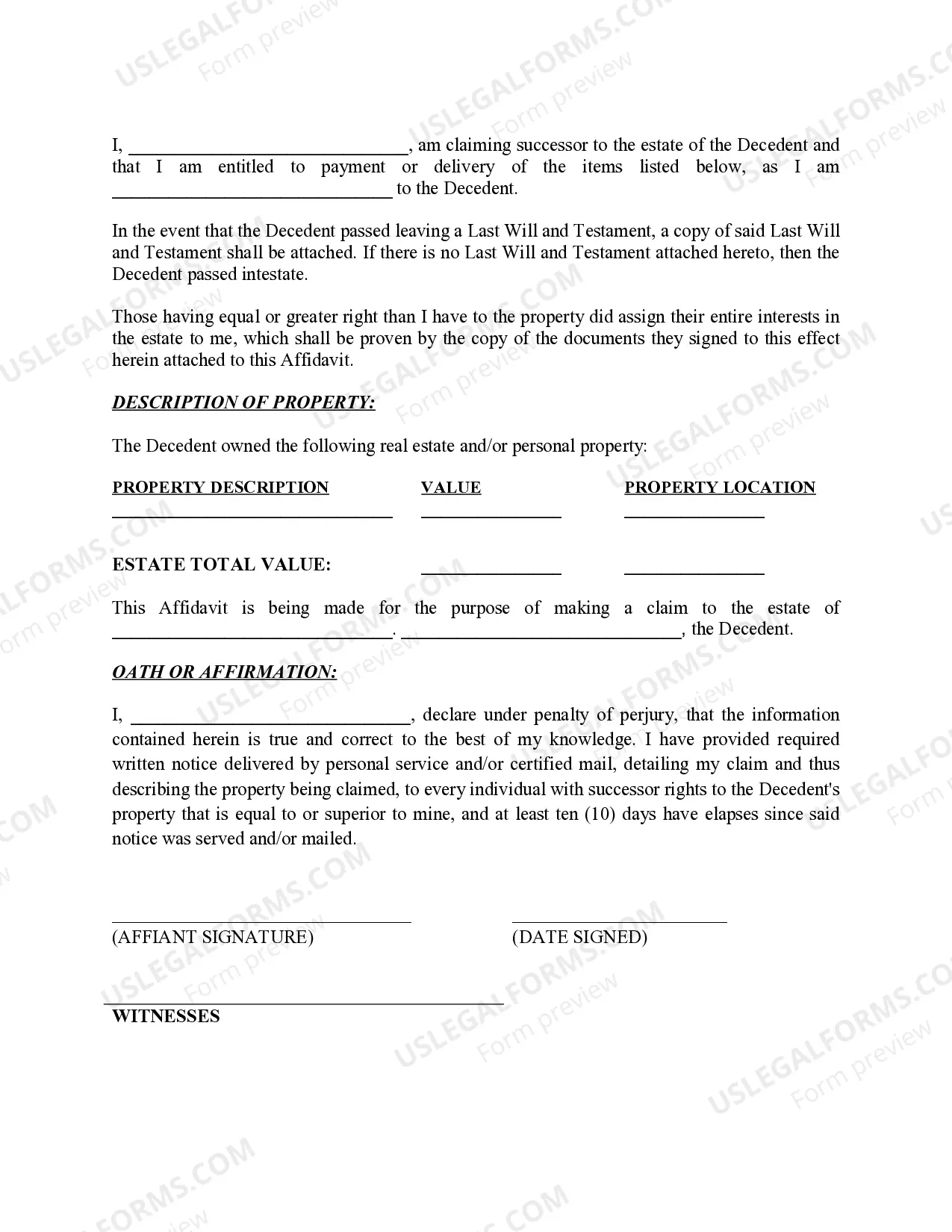

How to complete a form

Completing a Small Estate Affidavit involves several key steps. Begin by gathering necessary information about the decedent, including their name, date of death, and last known address. Ensure that you have a certified copy of the death certificate, as it must be attached to the affidavit.

- Fill in details such as the estimated value of the estate, ensuring it meets the state threshold.

- Provide information regarding your relationship to the decedent.

- List all property owned by the decedent, including real estate and personal property.

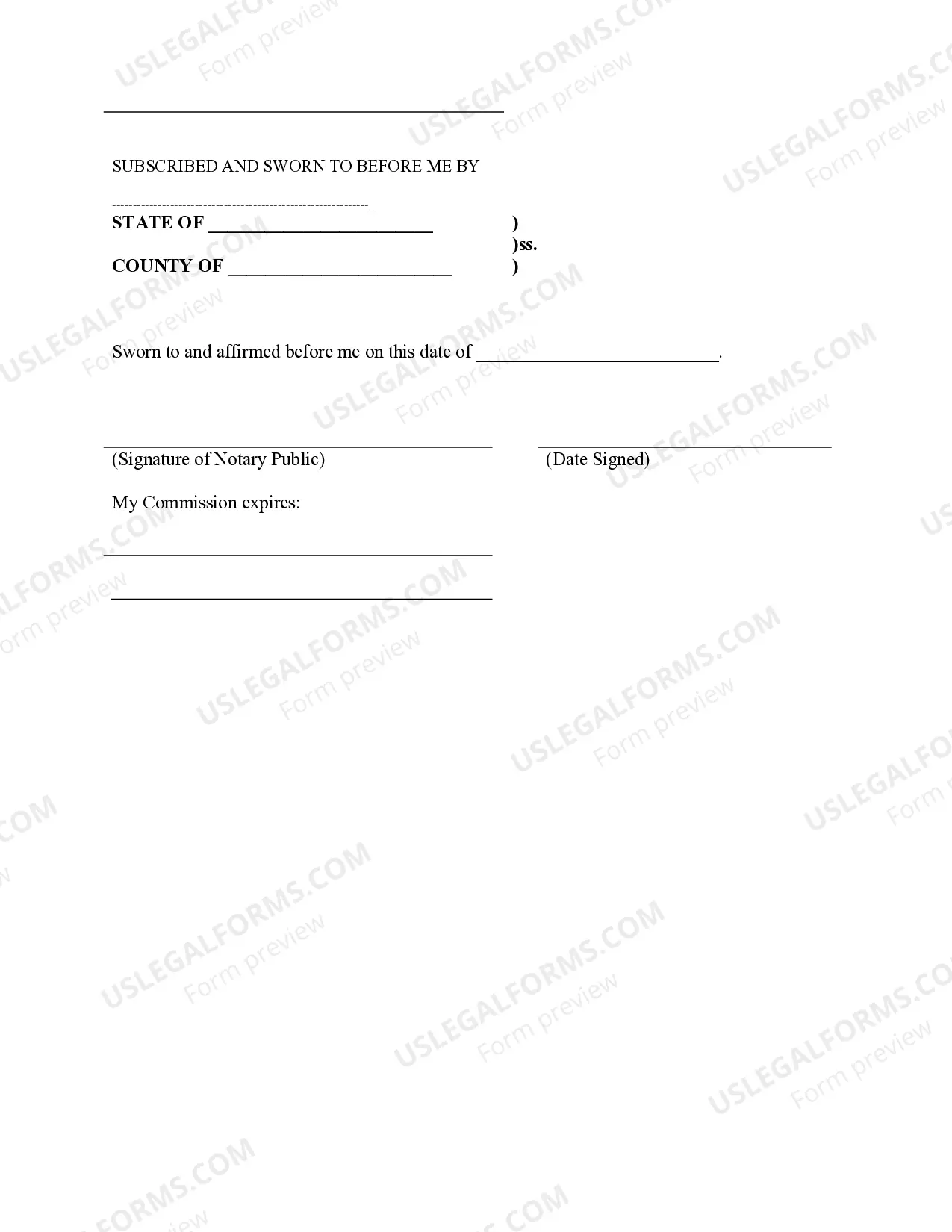

- Sign the affidavit in the presence of a notary public to validate the document.

Finally, submit the affidavit to the appropriate court or authority in your jurisdiction. Ensure that you comply with any waiting period requirements as defined by state law.

Who should use this form

This form is intended for individuals who are beneficiaries or successors of a deceased person's estate that is classified as a small estate under state law. It is suitable for users who are looking to simplify the process of claiming property and settling debts without engaging in extensive probate proceedings. If the estimated total value of the estate is below the state-mandated limit, this form is a convenient option for the decedent’s heirs or designated representatives.

Common mistakes to avoid when using this form

When completing a Small Estate Affidavit, it is crucial to avoid several common mistakes to ensure the affidavit is accepted:

- Incomplete information: Ensure all sections of the affidavit are filled out completely.

- Incorrect estimation of the estate value: Double-check that the total value of the estate does not exceed the state limit.

- Failing to attach the death certificate: Always include an original or certified copy of the death certificate.

- Not allowing for the mandatory waiting period: Verify that enough time has elapsed since the decedent's passing as required by your state.

What documents you may need alongside this one

When filing a Small Estate Affidavit, it is essential to ensure that the following documents are gathered:

- A certified copy of the decedent’s death certificate.

- Any existing wills that the decedent may have left.

- Documentation proving your relationship to the decedent.

- Assent or consent forms from other heirs if applicable.

Having these documents ready will facilitate the filing process and help avoid potential delays.

Key takeaways

The Small Estate Affidavit is a useful tool for expediting the process of settling a deceased person's estate when its value is below a specified limit. Users should be mindful to complete the form accurately, include all necessary documentation, and adhere to state-specific rules. This legal document simplifies the transfer of assets and helps heirs avoid the complexities of probate, making it an accessible option for many individuals settling an estate.

Form popularity

FAQ

The form must be notarized, so make sure you don't sign it until you can do so in the presence of a notary public. You'll also need to attach a copy of the death certificate and a certified copy of the will if there is one.

An Illinois small estate affidavit provides a streamlined way for an heir to gather and distribute the assets of a person who died, provided that the estate does not exceed $100,000. This form allows an heir to collect the personal property of the decedent without going to court.

Who may execute the Small Estate Affidavit? In Illinois, the Small Estates Affidavit may be executed by one or more heirs or legatees of the decedent. There is no requirement that all heirs sign. If the affiant is not a resident of Illinois, he submits himself to the jurisdiction thereof.

A small estate affidavit is a sworn legal document a person can use to assert a claim to assets from the estate of someone who has died. In Illinois, the affidavit is not filed with the court but can be presented to a person, bank, brokerage or other holder of an asset from the estate.

To be able to use the small estate affidavit in Illinois, you must meet the following requirements: The person who died didn't own any real property at the time of death. The total of all other property does not exceed $100,000.

A California small estate affidavit, or ?Petition to Determine Succession to Real Property,? is used by the rightful heirs to an estate of a person who died (the ?decedent?). The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate.

It is not necessary to hire a lawyer to file a small estate affidavit. In fact, many probate courts provide forms on their website for the public's use.