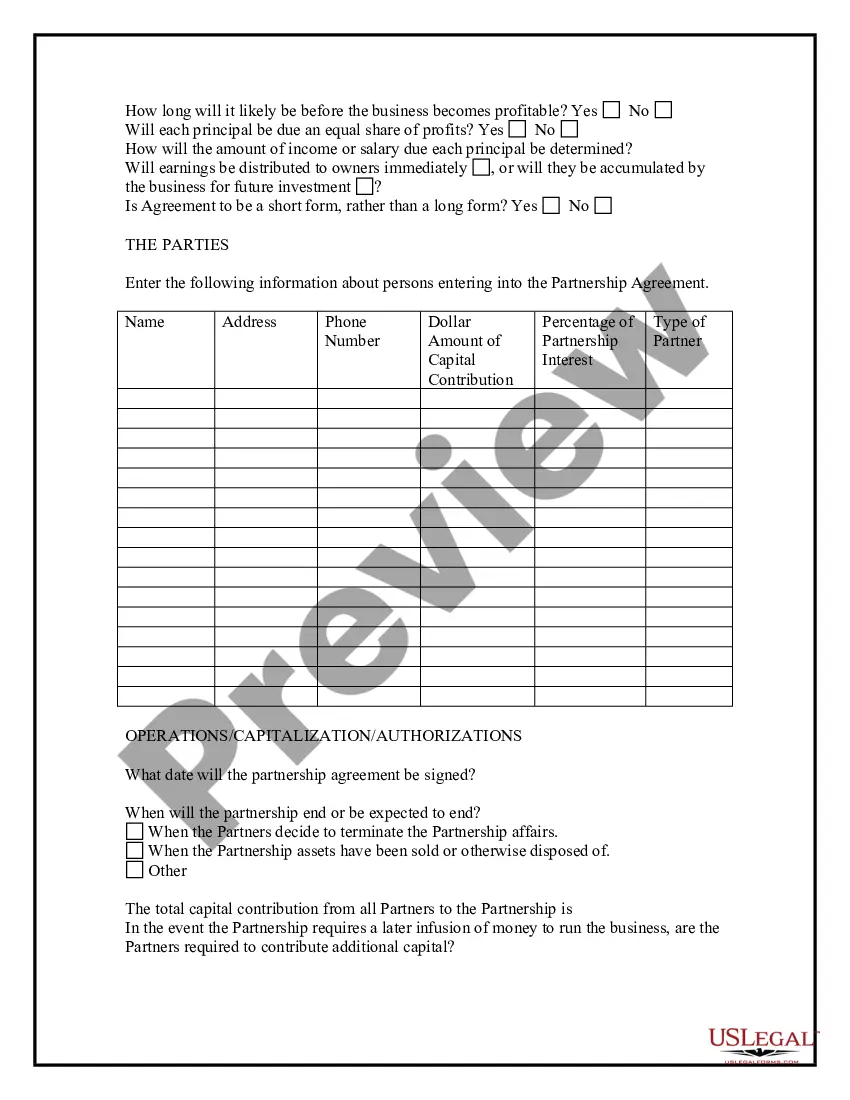

Partnership Formation Questionnaire

Description

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Partnership Formation Questionnaire?

When it comes to drafting a legal form, it is easier to delegate it to the professionals. Nevertheless, that doesn't mean you yourself can’t find a sample to use. That doesn't mean you yourself can not get a sample to utilize, nevertheless. Download Partnership Formation Questionnaire from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. As soon as you’re signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Partnership Formation Questionnaire quickly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Hit Buy Now.

- Select the appropriate subscription to suit your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Partnership Formation Questionnaire is downloaded you are able to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

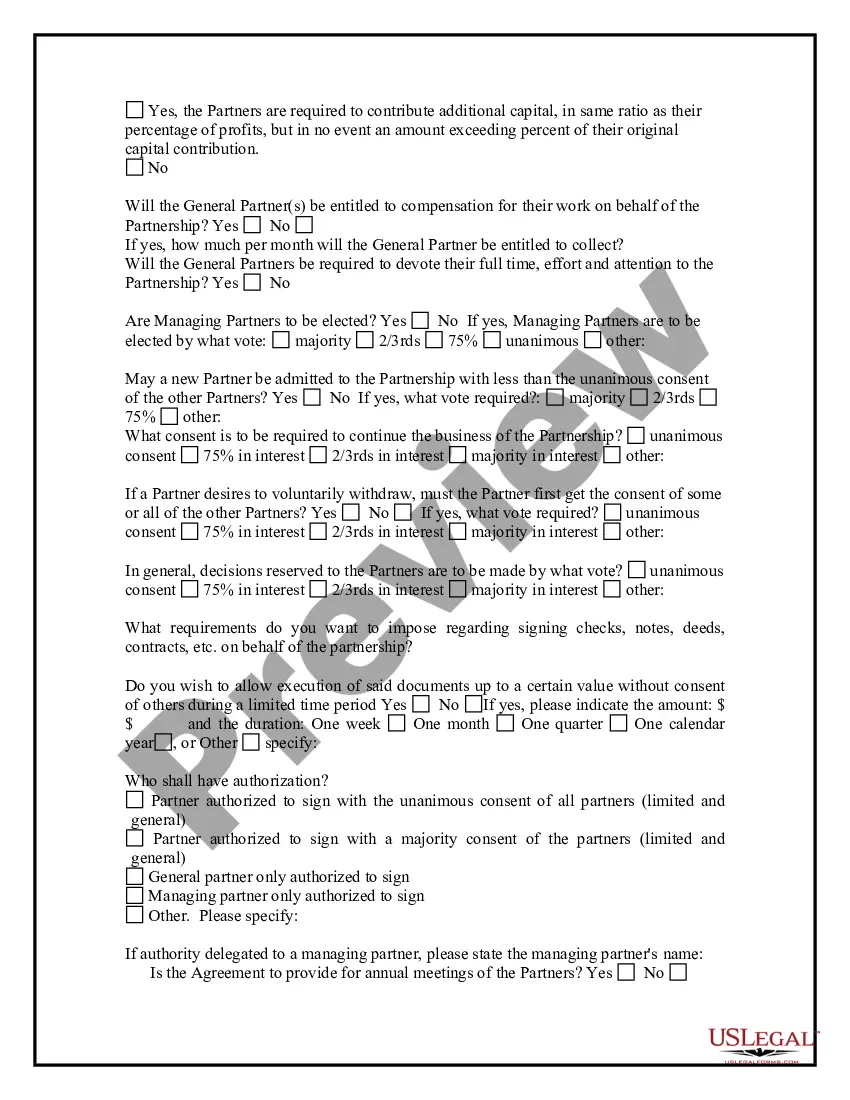

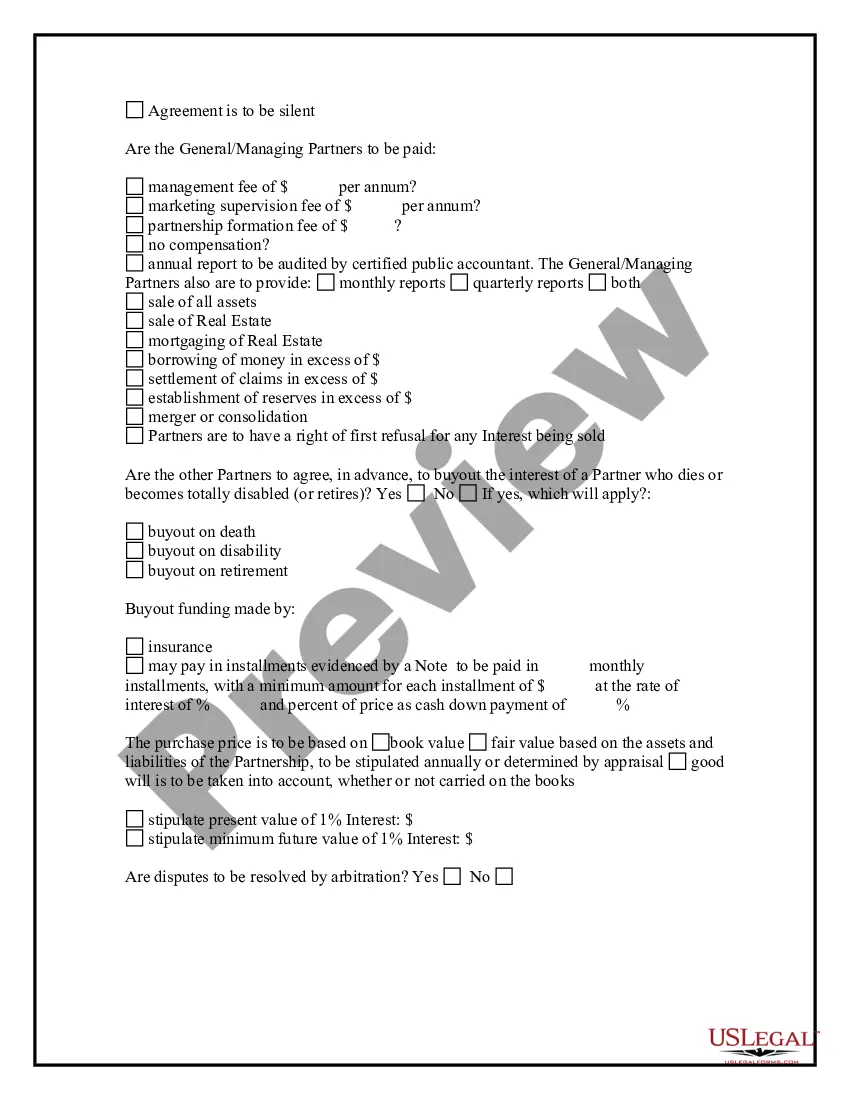

Name of your partnership. Contributions to the partnership and percentage of ownership. Division of profits, losses and draws. Partners' authority. Withdrawal or death of a partner.

Name of your partnership. Contributions to the partnership and percentage of ownership. Division of profits, losses and draws. Partners' authority. Withdrawal or death of a partner.

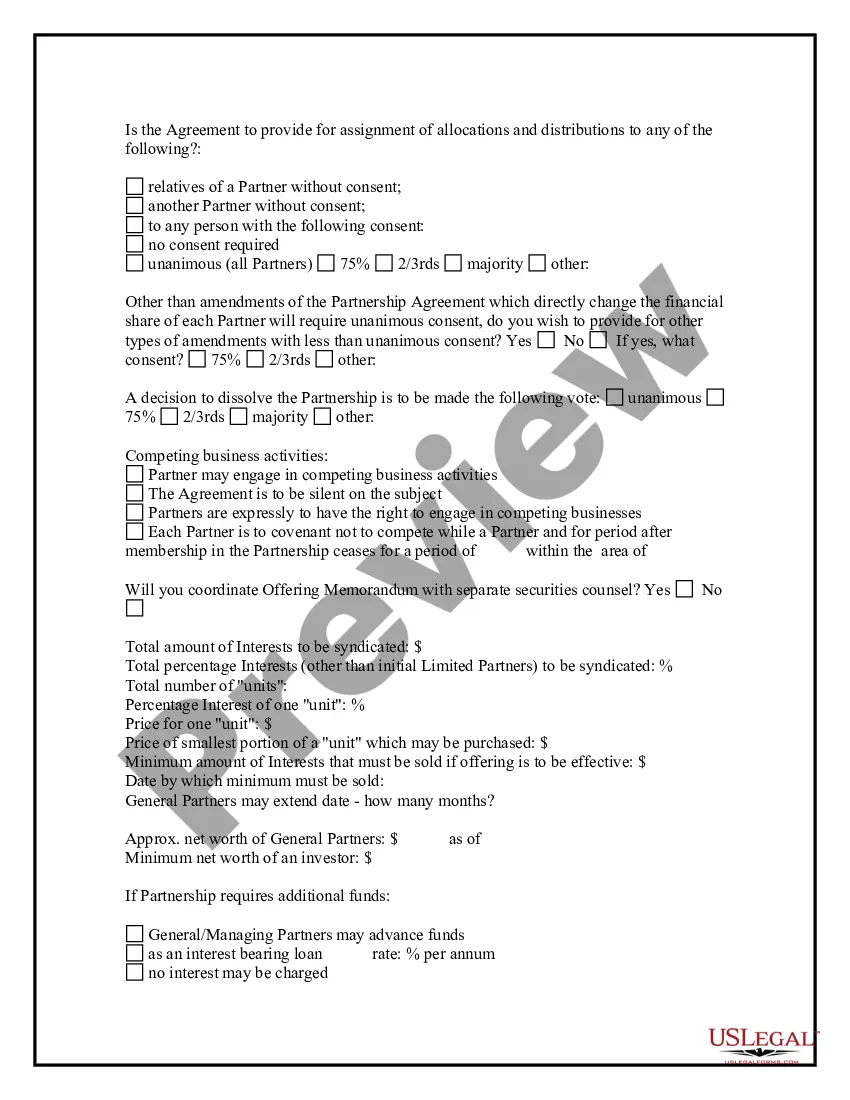

Persons can form a partnership by written or oral agreement, and a partnership agreement often governs the partners' relations to each other and to the partnership. The term person generally includes individuals, corporations, and other partnerships and business associations.

Share the same values. Choose a partner with complementary skills. Have a track record together. Clearly define each partner's role and responsibilities. Select the right business structure. Put it in writing. Be honest with each other.

A partnership is a business arrangement in which two or more people own an entity, and personally share in its profits, losses, and risks. The exact form of partnership used can give some protection to the partners. A partnership can be formed by a verbal agreement, with no documentation of the arrangement at all.

Accounting for partnership formation When partners introduce cash or any other asset, cash or the other asset account is debited at the value agreed by the partners and the corresponding partner's capital account is credited by the same amount.

Partnerships are businesses owned by two or more people. Doctors, dentists and solicitors are typical examples of professionals who may go into partnership together and can benefit from shared expertise. One advantage of partnership is that there is someone to consult on business decisions.

Name of the partnership. Contributions to the partnership. Allocation of profits, losses, and draws. Partners' authority. Partnership decision-making. Management duties. Admitting new partners. Withdrawal or death of a partner.