Mortgage Loan Officer Agreement - Self-Employed Independent Contractor

Definition and meaning

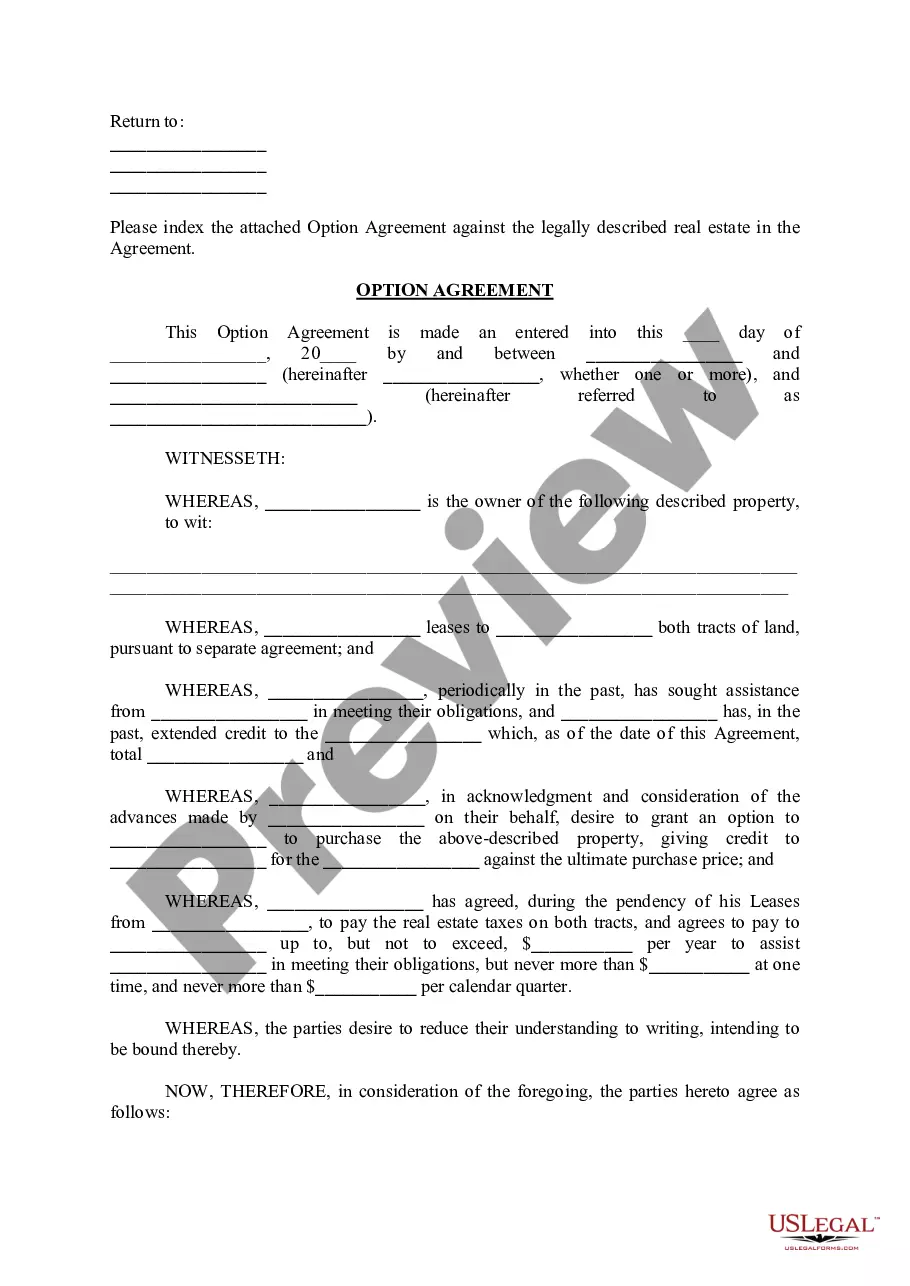

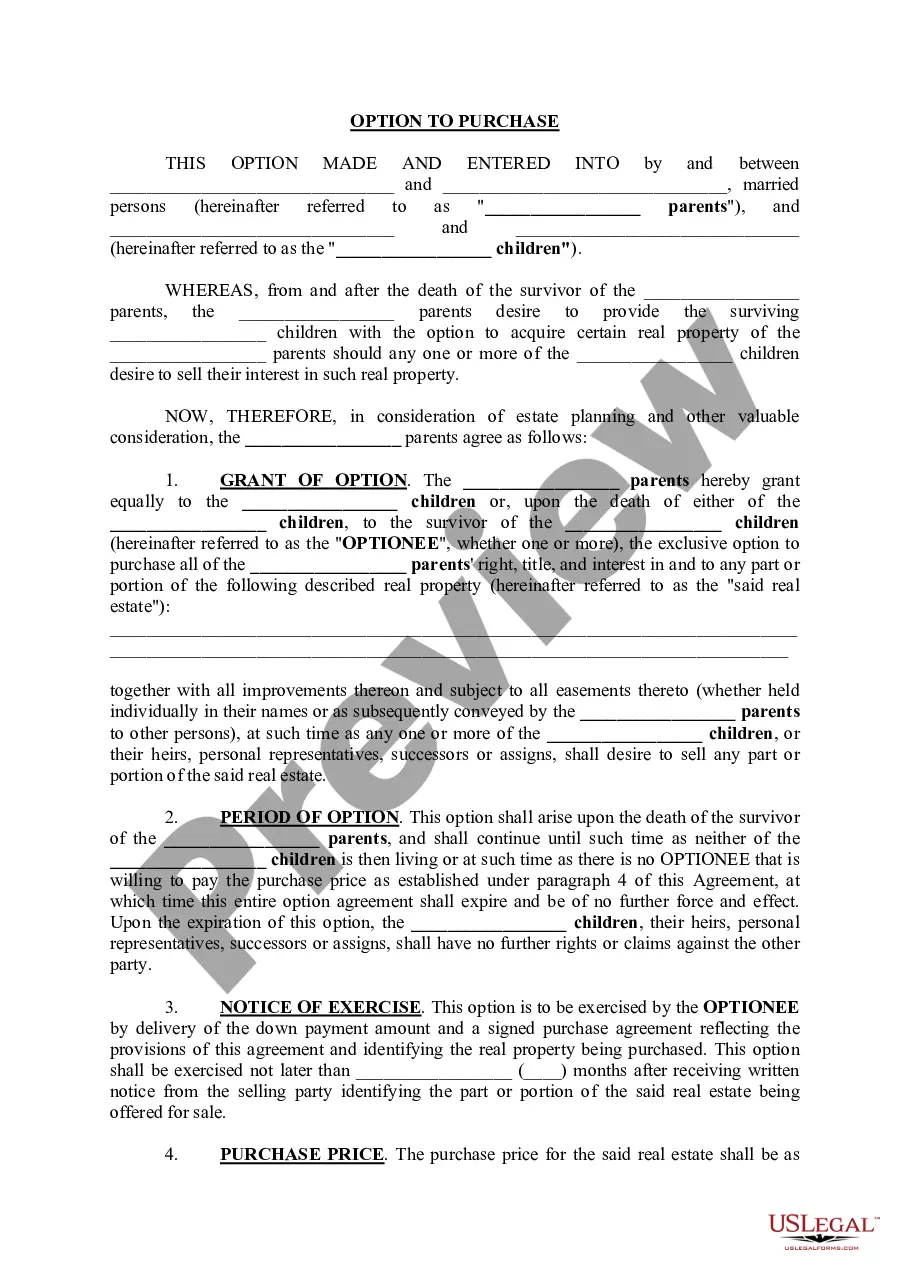

The Mortgage Loan Officer Agreement - Self-Employed Independent Contractor is a legal document that outlines the terms and conditions under which a self-employed loan officer provides services to an employer or lending institution. This agreement defines the roles, responsibilities, and expectations of both parties, ensuring clarity and adherence to professional standards in the industry.

Key components of the form

This agreement typically includes several vital components:

- Scope of duties: Clearly outlines the tasks the loan officer is expected to perform.

- Compensation details: Specifies how and when the loan officer will be paid for their services.

- Confidentiality provisions: Protects sensitive information shared during the collaboration.

- Termination clauses: Details the conditions under which either party may terminate the agreement.

- Independent contractor status: Affirms the loan officer's classification as an independent contractor rather than an employee.

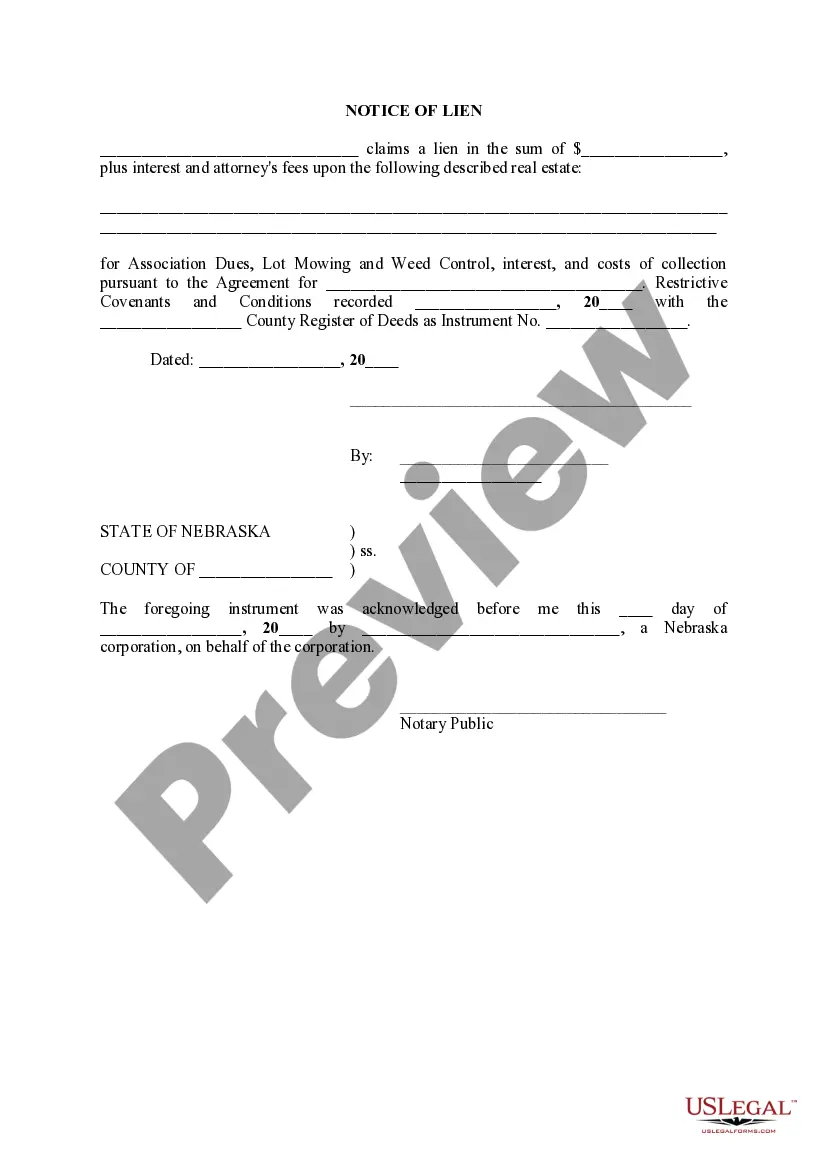

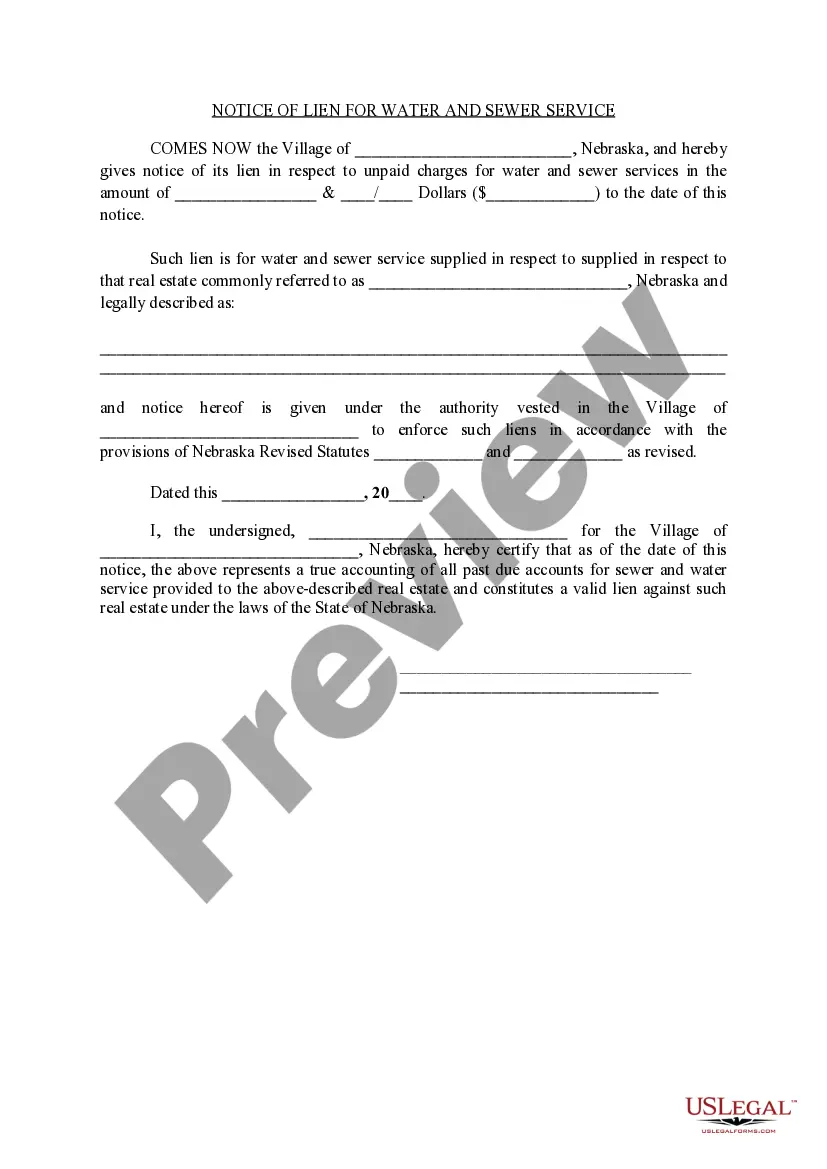

How to complete a form

To complete the Mortgage Loan Officer Agreement, follow these steps:

- Fill in the names and contact information of both parties involved: the employer and the loan officer.

- Clearly define the scope of duties and responsibilities to avoid ambiguity.

- Insert the compensation rate and terms for payment.

- Include confidentiality clauses to protect sensitive information.

- Specify the methods and conditions for termination of the agreement.

- Finalize the document by signing and dating it at the bottom.

Who should use this form

This agreement is suitable for self-employed mortgage loan officers who wish to formalize their relationship with lenders or employers. It is particularly important for those entering into a contractual relationship where clear expectations and terms need to be established to avoid potential disputes.

Benefits of using this form online

Using the Mortgage Loan Officer Agreement online offers several advantages:

- Convenience: Easily access the form from anywhere without the need for physical paperwork.

- Time-saving: Quick fillable fields streamline the completion process.

- Templates by licensed attorneys: Ensure compliance with legal standards and regulations.

- Instant downloads: Receive a completed form immediately after filling it out, allowing for quick implementation.

Common mistakes to avoid when using this form

When completing the agreement, be mindful of these potential errors:

- Failing to detail the scope of duties adequately, which can lead to misunderstandings.

- Not including a clear payment schedule, resulting in confusion over compensation.

- Neglecting to specify confidentiality terms, which may expose sensitive information.

- Ignoring state-specific regulations that could affect the agreement's enforceability.

Form popularity

FAQ

There is no blanket rule saying loan officers are, or are not, independent contractors; every situation is case by case, according to Garofalo. The gist of classification: If you supervise workers, they could be employees.

Self-employed mortgage borrowers can apply for all the same loans 'traditionally' employed borrowers can. There are no special requirements that make it harder for self-employed people to get a mortgage. You're held to the same standards for credit, debt, down payment, and income as other applicants.

Is it possible for a federally registered MLO to be employed by two different institutions at the same time? Yes, the system allows multiple employments to exist.

Most lenders will typically ask to see evidence of at least two years of self-employed income but, in some cases, they may ask for three years. If you have this proof, then you're likely to have access to a similar selection of mortgages to anyone else in your situation.

In California there is a new law defining independent contractors that applies to everyone in the state, including mortgage brokers (realtors have a special exemption).Alternatively, if the individual is self-employed, they must hold both MLO licensure and state mortgage lender/broker licensure.

Can the MLO use their federally registered MLO status to originate loans for their own non-federally regulated mortgage company? No! The SAFE Act exempts a federally registered MLO from state MLO licensing requirements only if the MLO is an employee of a federally regulated bank.

If you earn 1099 income as an independent contractor, freelance worker or a salesman, you can qualify for an FHA loan if you can document steady 1099 income for the past two years.

Federal law does not prohibit 1099 compensation to licensed loan originators.

If you earn 1099 income as an independent contractor, freelance worker or a salesman, you can qualify for an FHA loan if you can document steady 1099 income for the past two years.