Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider

Description

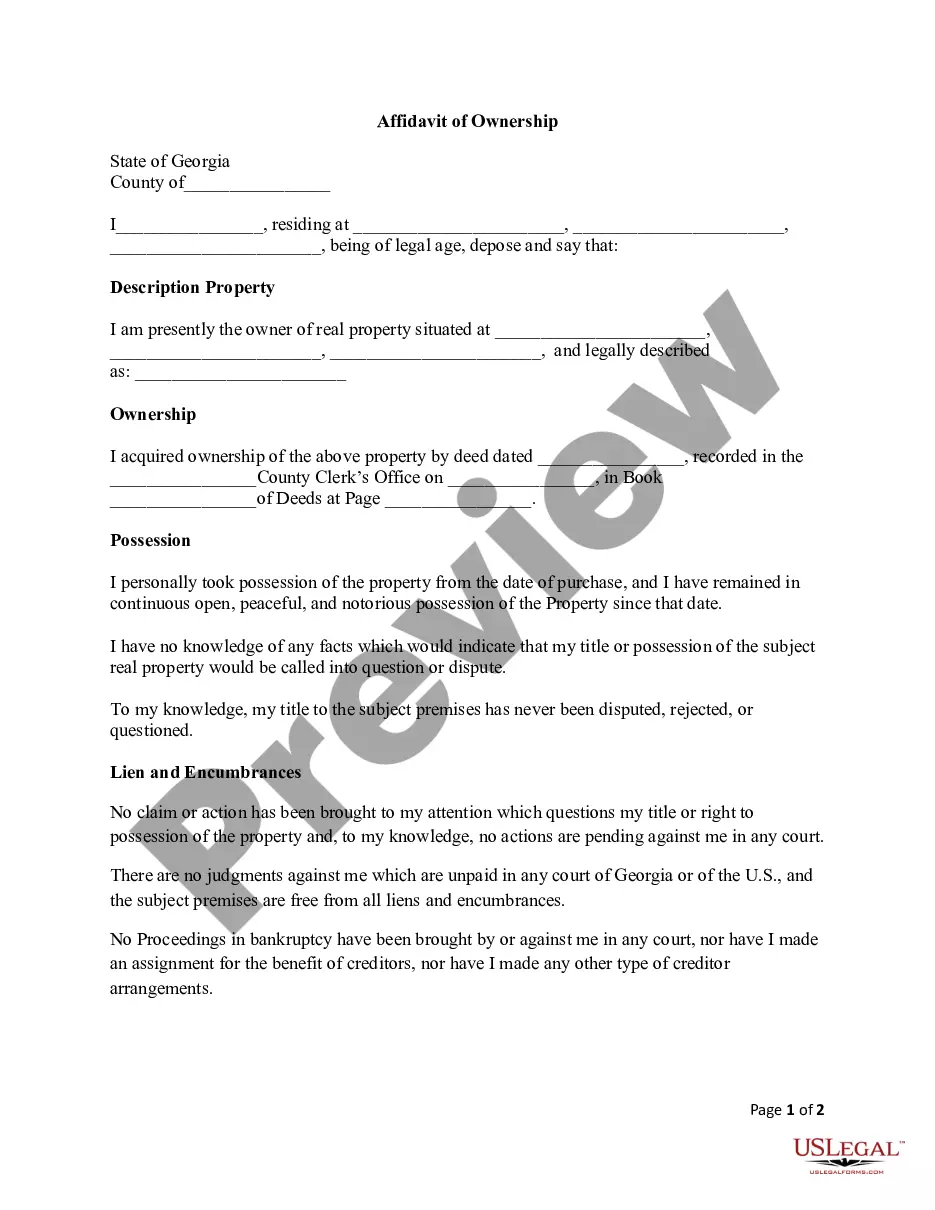

How to fill out Irrevocable Funded Life Insurance Trust Where Beneficiaries Have Crummey Right Of Withdrawal With First To Die Policy With Survivorship Rider?

Make use of the most complete legal catalogue of forms. US Legal Forms is the best place for finding up-to-date Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider templates. Our platform provides thousands of legal documents drafted by licensed lawyers and sorted by state.

To obtain a template from US Legal Forms, users simply need to sign up for a free account first. If you are already registered on our service, log in and select the template you are looking for and purchase it. After buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you have found is state-specific and suits your requirements.

- When the template features a Preview function, use it to check the sample.

- If the sample does not suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with yourr credit/bank card.

- Select a document format and download the template.

- Once it is downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and fill in the Form name. Join a huge number of delighted subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Despite the Tax Court's rulings, the IRS continues to review and challenge ILIT contributions and their qualifications as annual exclusion gifts during audits. Thus, clients generally should still be advised to give actual written notice to Crummey powerholders upon each gift to a trust.

What Is a Crummey Trust? A Crummey trust is part of an estate planning technique that can be employed to take advantage of the gift tax exclusion when transferring money or assets to another person while retaining the option to place limitations on when the recipient can access the money.

A special type of irrevocable life insurance trust, called a Crummey trust (aka irrevocable gift trust), allows a wealthy grantor to fund the trust in such a way that payments are treated as gifts of present interest to the trust's beneficiaries, thereby qualifying for the annual gift exclusion, then using the payments

A Crummey trust is part of an estate planning technique that can be employed to take advantage of the gift tax exclusion when transferring money or assets to another person while retaining the option to place limitations on when the recipient can access the money.

The Crummey Letter is a letter that is sent to the beneficiaries of an irrevocable trust informing them of that a gift has been made to the trust, and that they have the immediate and unrestricted right to withdraw those assets.

The Crummey Letter is a letter that is sent to the beneficiaries of an irrevocable trust informing them of that a gift has been made to the trust, and that they have the immediate and unrestricted right to withdraw those assets.

Named after the court case that gave rise to the rule, a Crummey Notice is simply a letter letting a beneficiary know that assets have been added to a trust and informing the beneficiary of his/her right to withdraw those assets if applicable.

The Crummey notices may be made via electronic mail, i.e., email, to each of the current beneficiaries. If your trustee elects to do this, he or she should request the beneficiary acknowledge receipt in a return e-mail. The e-mail can also be electronically filed and/or printed and stored for record keeping.

Crummey notices are a crucial part of the administration of a trust because they are necessary in order to classify the gift as a completed gift for tax purposes. Unless a gift is considered completed, it will not qualify for the annual gift tax exclusion.