A reverse mortgage is a loan from the U.S. Government for 50% to 75% of the value of a home owned by a homeowner aged 62 and older. Instead of making monthly payments to a lender, as with a regular mortgage, a lender makes payments to the homeowner. The funds from a reverse mortgage are tax-free. The loan doesn't have to be repaid in the homeowner's lifetime, however, when the homeowner dies, the money received plus approximately 4% interest is repaid by their estate. The loan is repaid when the homeowner ceases to occupy the home as a principal residence, due to the homeowner (the last remaining spouse, in cases of couples) passing away, selling the home, or permanently moving out.

Home Equity Conversion Mortgage - Reverse Mortgage

Description

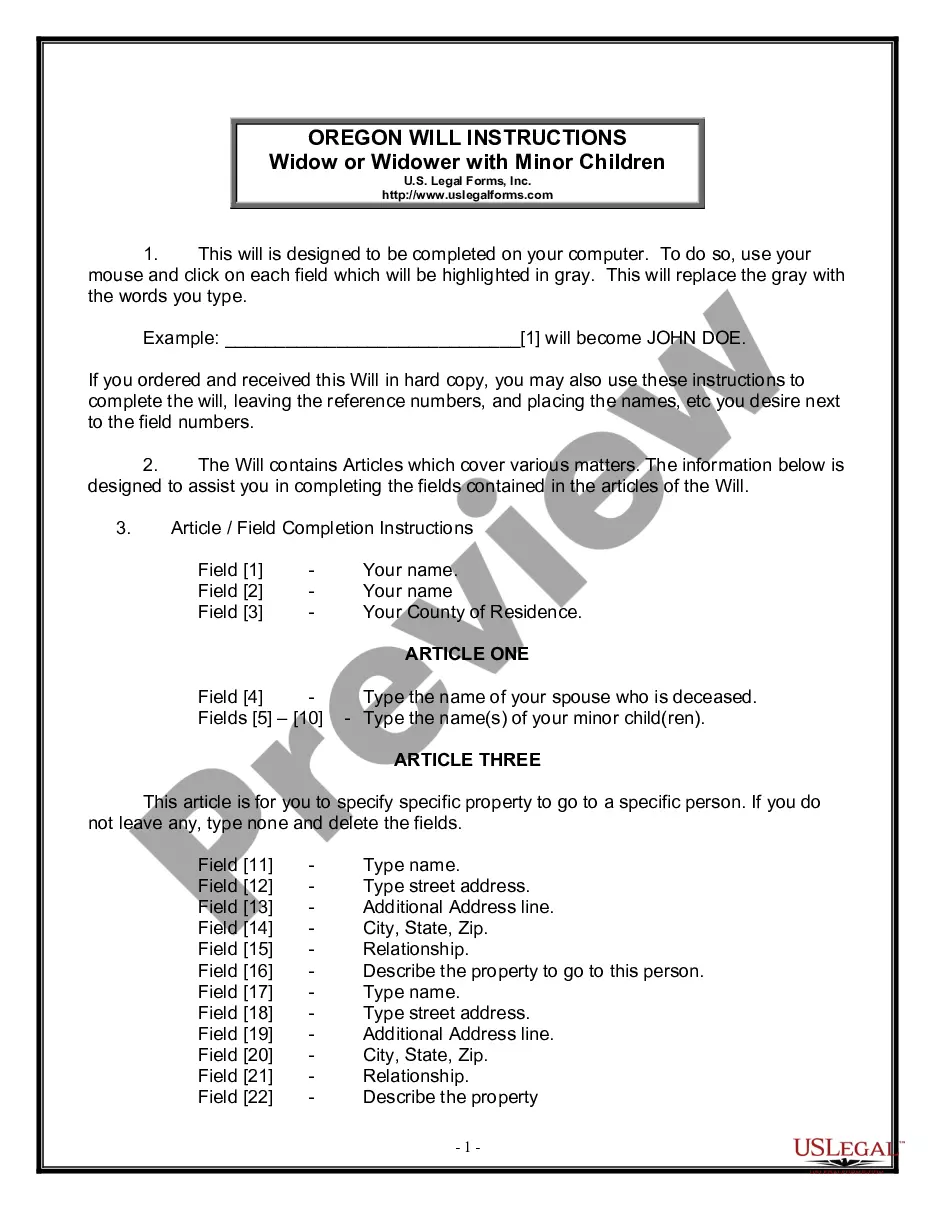

How to fill out Home Equity Conversion Mortgage - Reverse Mortgage?

Aren't you tired of choosing from hundreds of samples each time you need to create a Home Equity Conversion Mortgage - Reverse Mortgage? US Legal Forms eliminates the wasted time countless Americans spend surfing around the internet for ideal tax and legal forms. Our skilled team of attorneys is constantly changing the state-specific Templates collection, so that it always offers the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription need to complete a few simple actions before having the ability to get access to their Home Equity Conversion Mortgage - Reverse Mortgage:

- Use the Preview function and read the form description (if available) to ensure that it is the correct document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper example for your state and situation.

- Make use of the Search field on top of the web page if you have to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your file in a convenient format to complete, print, and sign the document.

Once you have followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever document you will need for whatever state you need it in. With US Legal Forms, finishing Home Equity Conversion Mortgage - Reverse Mortgage samples or any other legal paperwork is easy. Get going now, and don't forget to recheck your examples with certified attorneys!

Form popularity

FAQ

The only reverse mortgage insured by the U.S. Federal Government is called a Home Equity Conversion Mortgage (HECM), and is only available through an FHA-approved lender. The HECM is FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity.

The chief difference between a reverse mortgage and a home equity loan is that the reverse mortgage requires no payments.On a home equity loan, monthly payments are made until the loan is repaid, usually for a term of 30 years.

A home equity conversion mortgage (HECM) is a type of reverse mortgage that is Federal Housing Administration (FHA) insured.HECM terms are often better than those of private reverse mortgages, but the loan amount is fixed, and mortgage insurance premiums are required.

Inform the lender you have a reverse mortgage and want a HELOC. To take out a HELOC, you must have remaining equity in the home. Since you can't convert the reverse mortgage to a HELOC, you must pay off the mortgage. The loan balance can be rolled into the HELOC, resulting in a higher monthly payment.

What Is a HECM Reverse Mortgage? It is a loan to a senior secured by a mortgage lien on the senior's house, with most of the loan proceeds usually paid out over time rather than upfront, and with no repayment obligation so long as the senior lives in the house.

The general rule of thumb is that a reverse mortgage works better for someone who needs a long-term, steady source of income, while a home equity loan is better for someone who needs short-term cash that they can repay.

The Home Equity Conversion Mortgage (HECM) is Federal Housing Administration's. (FHA) reverse mortgage program which enables you to withdraw some of the equity. in your home. You choose how you want to withdraw your funds, whether in a fixed. monthly amount or a line of credit or a combination of both.