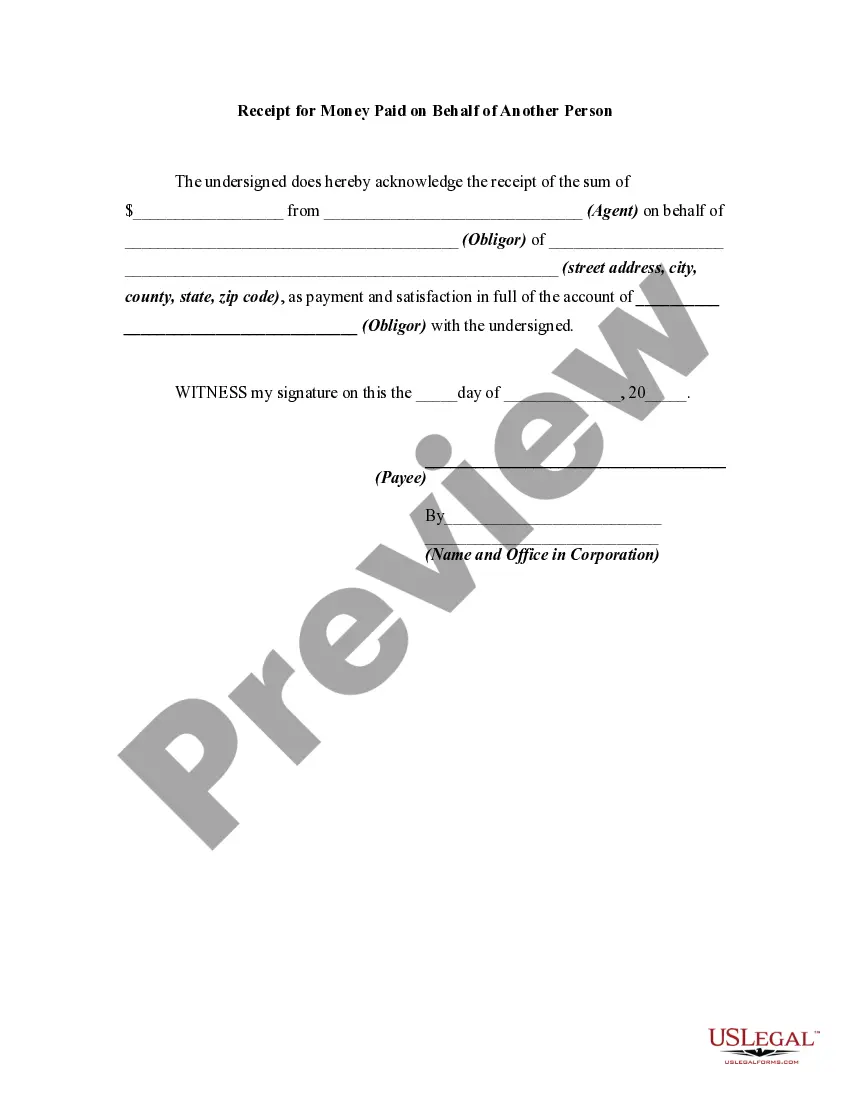

Receipt for Money Paid on Behalf of Another Person

Definition and meaning

A Receipt for Money Paid on Behalf of Another Person is a formal document acknowledging that a specific amount of money has been received on behalf of someone else. This form is essential for validating transactions where one party pays for another, ensuring transparency and clarity in the financial relationship.

How to complete a form

To complete the Receipt for Money Paid on Behalf of Another Person, follow these steps:

- Fill in the amount received in the designated space.

- Identify the person making the payment by filling their name and title in the 'Agent' section.

- Complete the 'Obligor' section with the name of the individual on whose behalf the payment is made.

- Provide the full address of the Obligor for clarity.

- Sign and date the form to validate it.

Who should use this form

This form is useful for anyone acting as an agent or representative, like a family member, friend, or professional, making payments on behalf of someone else. It provides legal proof of the transaction and can be important for record-keeping in various financial arrangements.

Key components of the form

The Receipt for Money Paid on Behalf of Another Person includes the following key components:

- The sum of money received.

- Name of the agent making the payment.

- Name of the person on whose behalf the payment is made.

- The full address of the obligor.

- Date and signature of the payee.

Common mistakes to avoid when using this form

When using the Receipt for Money Paid on Behalf of Another Person, consider avoiding these common mistakes:

- Failing to complete all sections of the form.

- Not providing accurate amounts or names.

- Neglecting to sign the receipt, which can render it invalid.

- Using informal language instead of clear and precise terms.

Benefits of using this form online

Using the Receipt for Money Paid on Behalf of Another Person online offers several benefits:

- Quick and easy access to the form.

- Convenience of filling out and storing the document digitally.

- Structured guidance through the completion process.

- Reduced risk of errors due to clear prompts and fields.

What to expect during notarization or witnessing

When notarizing or witnessing this document:

- Have valid identification ready for all parties involved.

- The notary will confirm identities and ensure voluntary signatures.

- The notary may require the presence of all signers at the same time.

- After notarization, the signed document becomes a legally recognized proof of payment.

Form popularity

FAQ

Fill in the name of the recipient. Write the name of the recipient of the money order in the pay to or pay to the order of field. Include your address in the purchaser section. Write the account or order number in the memo field. Sign your name in the purchaser's signature section.

No, you cannot make changes to a completed money order. Any form of alteration or correction will result in ineligibility for cashing.

Plan Before Endorsing a Check to Someone Else. Confirm the Person/Entity Will Accept a Signed-Over Check. Ensure the Person's/Entity's Bank Will Accept the Check. Sign the Back of the Check in the Top Section of the Endorsement Area. Write Pay to the Order of and the Third Party's Name Below Your Signature.

Legally, a purchaser's signature is not required for a money order to be negotiable since it has been already paid for in cash. The named payee must sign in order to receive the cash.

You are the purchaser and so you should write your current mailing address. Some money orders may use the words From, Sender, Issuer, Remitter, or Drawer. Putting your address allows the recipient (wherever they deposit the money order) to contact you if they want to confirm that it's real or if there is an issue.

To cash a money order, you'll need to first endorse it by signing your name on the back. You will also need to provide identification no matter where you're cashing your money order. If you don't have any ID, you can endorse the money order to someone else, like a sibling or friend, who does have an ID.

Banks will usually allow you to deposit checks or money orders into someone else's account for example, if you're giving a gift, helping a friend or family member cover bills, or paying someone back.You can also sign a money order over to another person so they can deposit the money order themselves.

Step 1: Fill in recipient's name. This is the name of the payee: the person or company receiving the payment. Step 2: Write your address on the purchaser line. Step 3: Add a memo or account number. Step 4: Sign the front of the money order. Keep the money order receipt. Drawbacks of money orders.

Money orders are made out to individuals or companies for a specific amount.Money orders can be purchased from such places as the U.S. Post Office, Western Union, Money Gram and even Wal-Mart. When you receive a money order, you must endorse it before turning it in for cash.