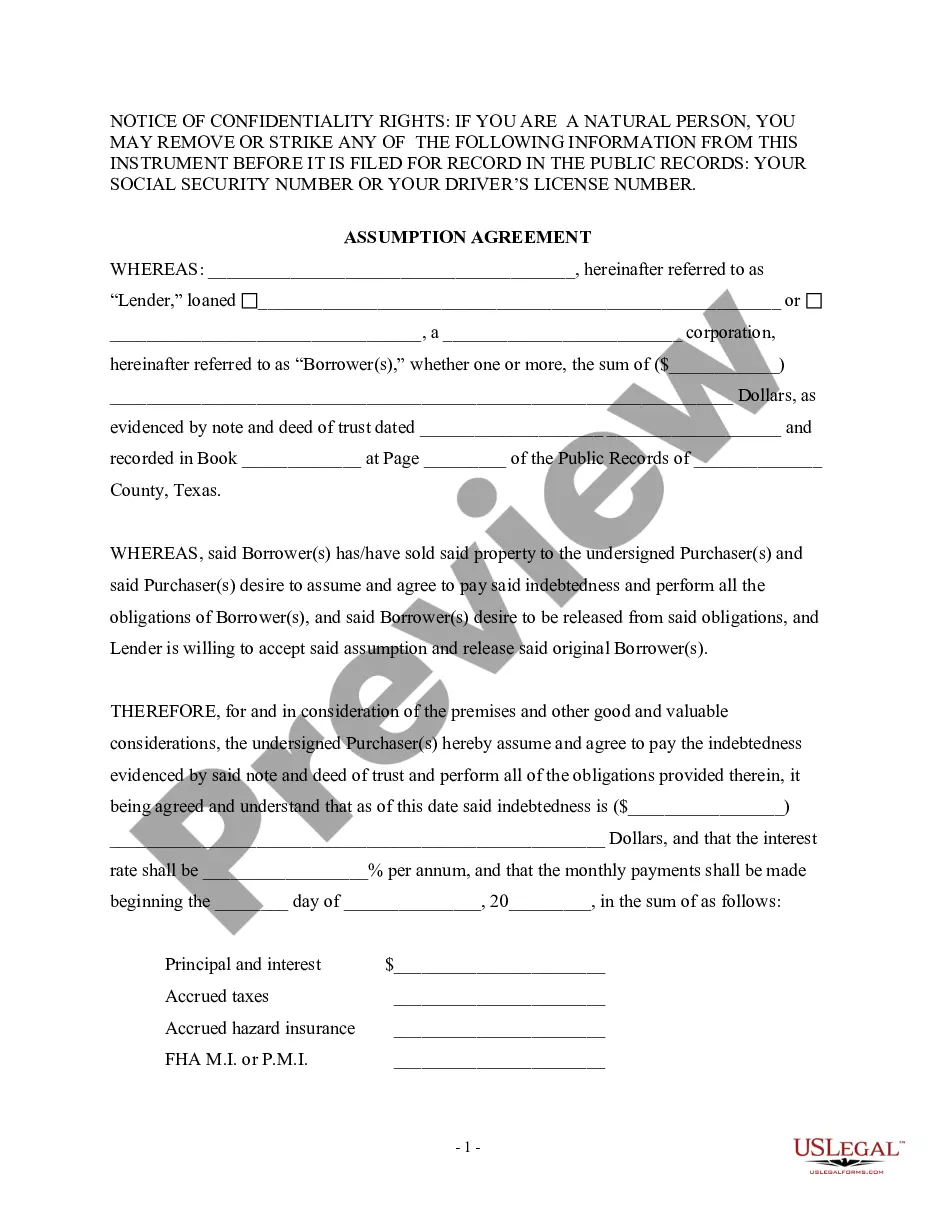

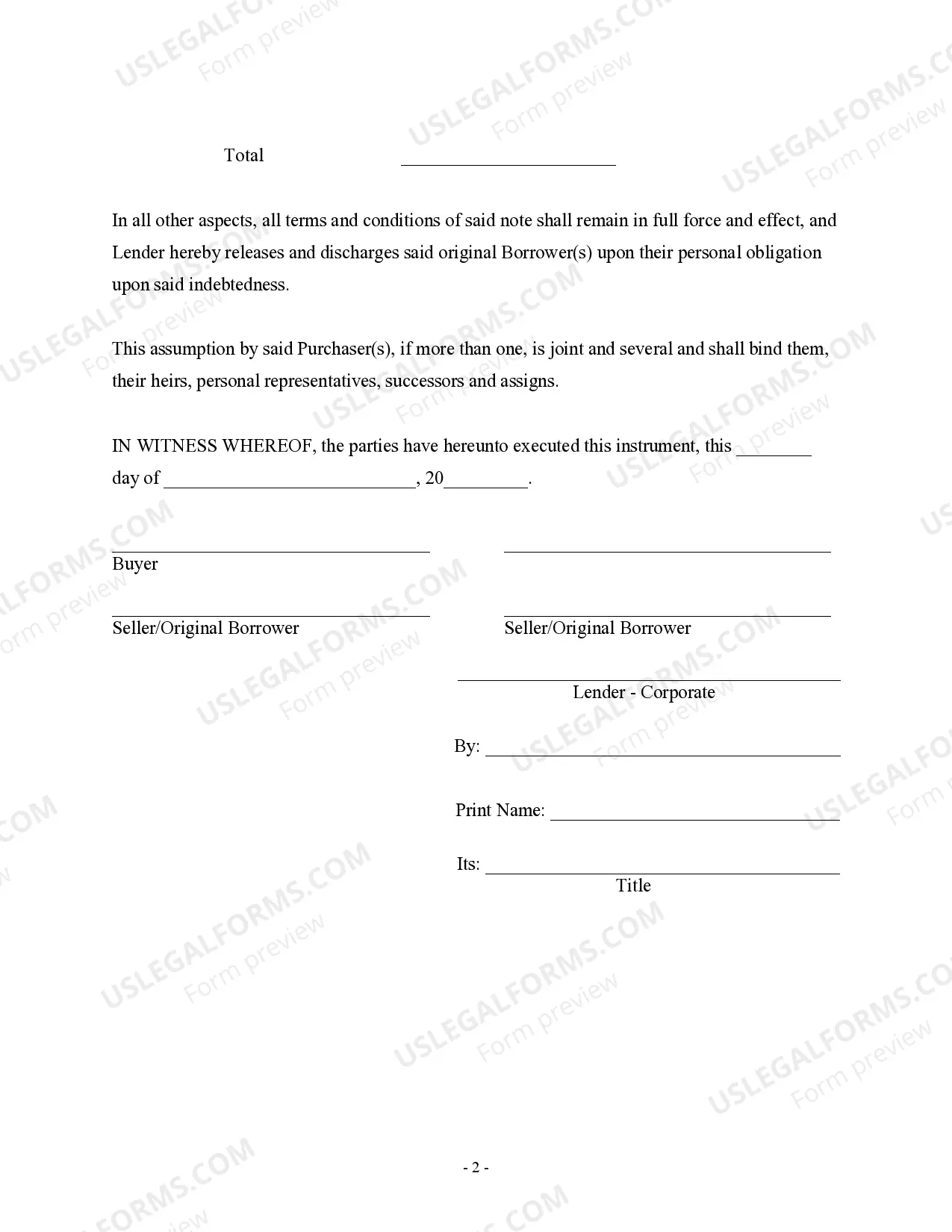

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Texas Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Get access to top quality Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors forms online with US Legal Forms. Avoid days of misused time seeking the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find around 85,000 state-specific legal and tax templates that you could save and complete in clicks in the Forms library.

To find the example, log in to your account and then click Download. The document is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Check if the Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors you’re looking at is appropriate for your state.

- See the sample making use of the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to continue on to sign up.

- Pay by card or PayPal to finish creating an account.

- Choose a preferred format to save the document (.pdf or .docx).

You can now open up the Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors sample and fill it out online or print it out and get it done yourself. Take into account sending the document to your legal counsel to ensure all things are completed appropriately. If you make a mistake, print out and fill sample once again (once you’ve registered an account every document you save is reusable). Make your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

The deed of trust to secure assumption is a document that names the spouse who did not receive the house as the beneficiary.If the spouse receiving the house fails to repay the mortgage lender, then the spouse who did not get the house can foreclose on the property just like any other creditor.

A deed of assumption is a single deed that includes both the language of a general warranty or other deed along with the acknowledgement that the buyer is taking over the mortgage on the property.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

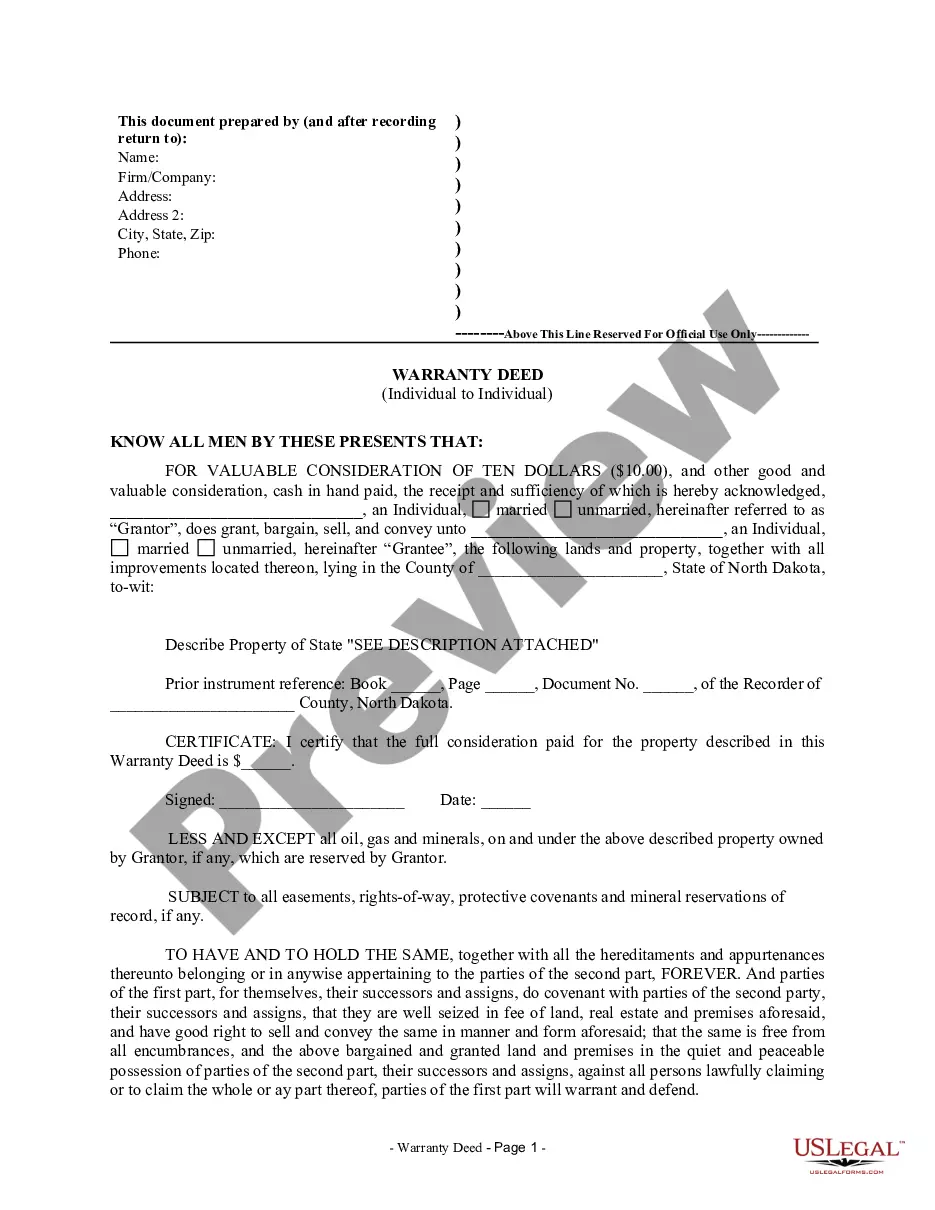

A warranty deed is a document often used in real estate that provides the greatest amount of protection to the purchaser of a property. It pledges or warrants that the owner owns the property free and clear of any outstanding liens, mortgages, or other encumbrances against it.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

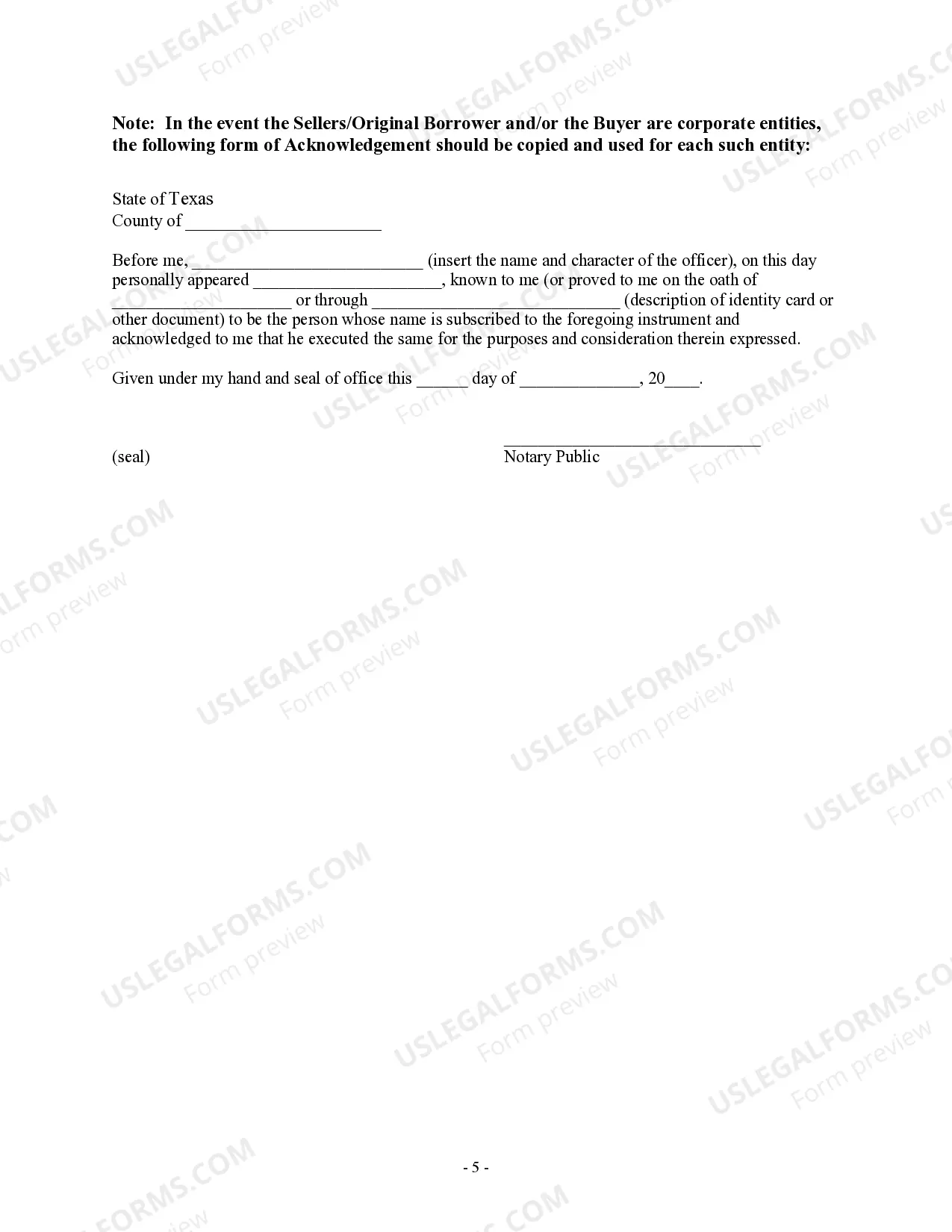

The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility. The lender usually requires a credit history from the buyer before approving the assumption and the payment of assumption fee(s).

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating