Texas Assignment of Deed of Trust by Corporate Mortgage Holder

About this form

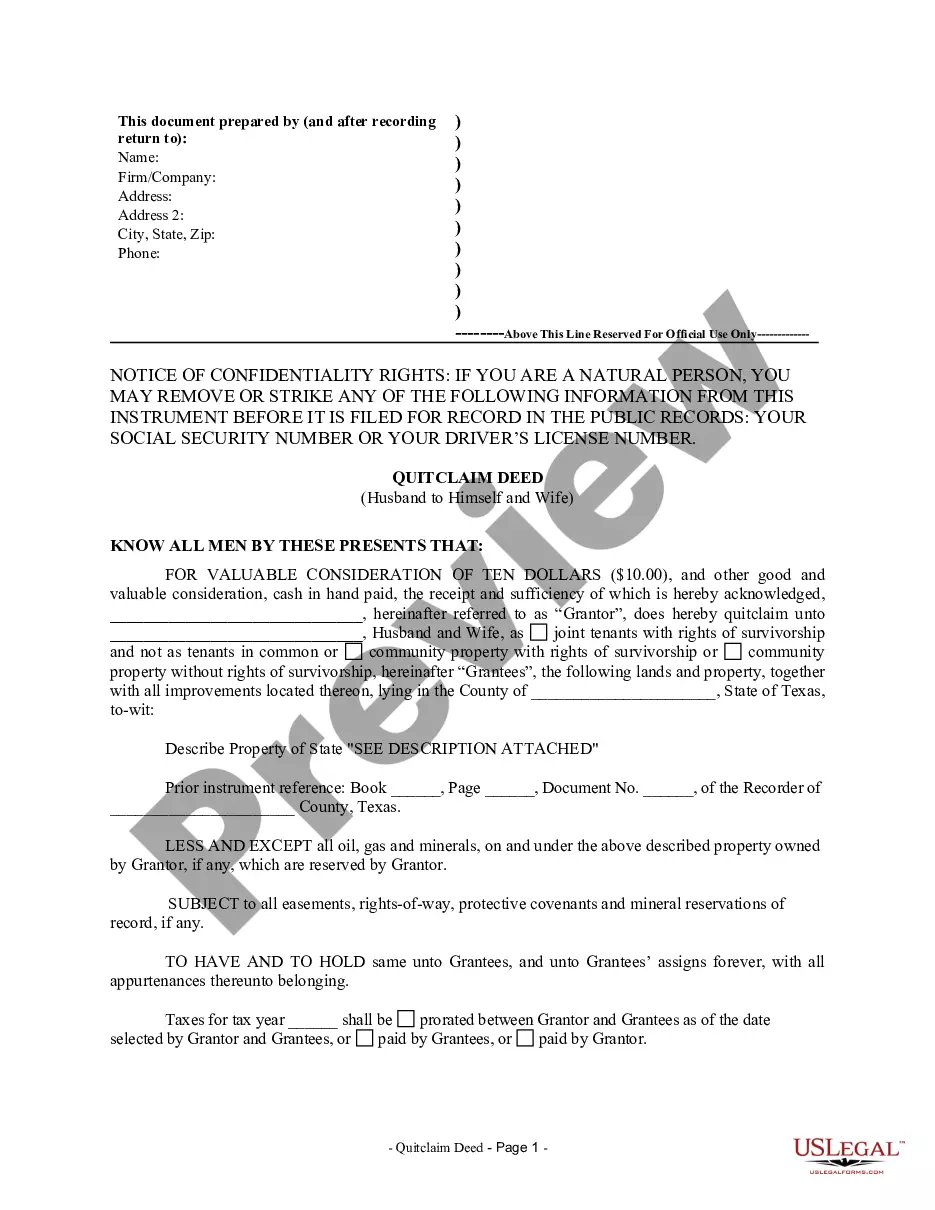

The Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document used when a corporation, as the holder of a deed of trust, conveys its rights and interests to a third party. This form differs from other mortgage assignment forms by specifically addressing the corporate assignment process, ensuring compliance with corporate legal standards and requirements.

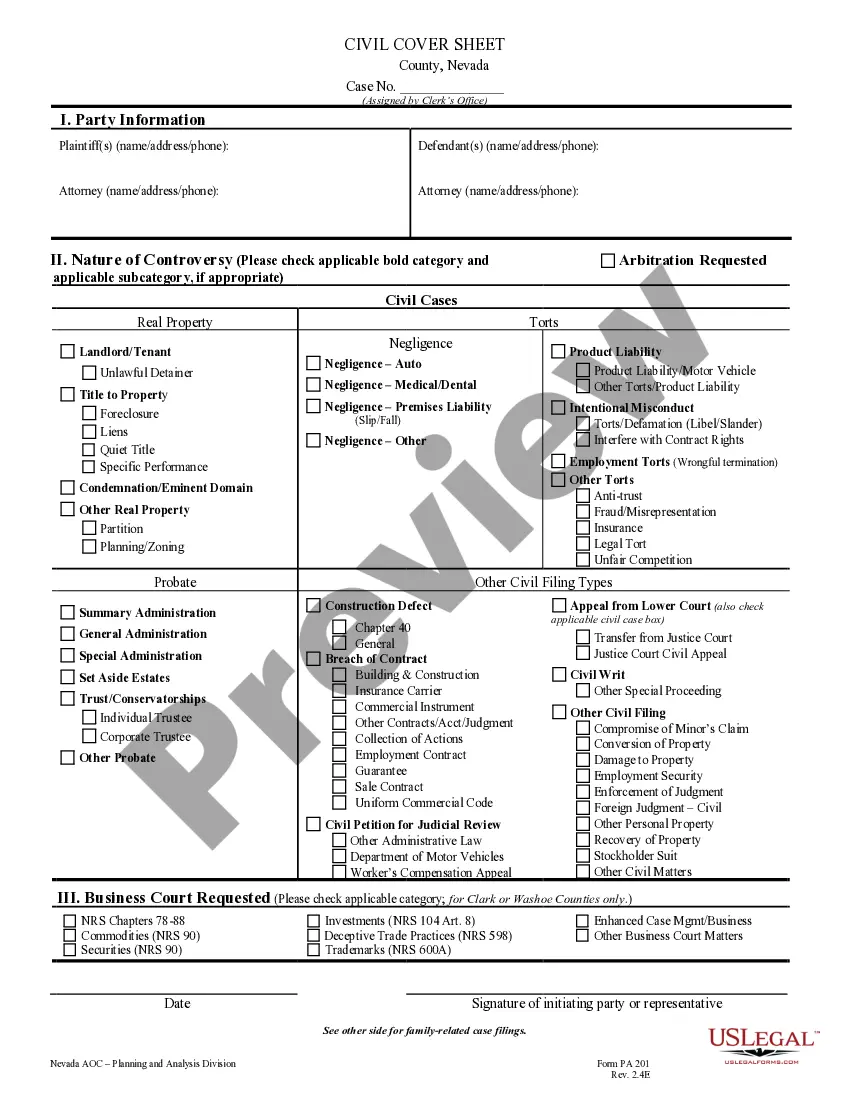

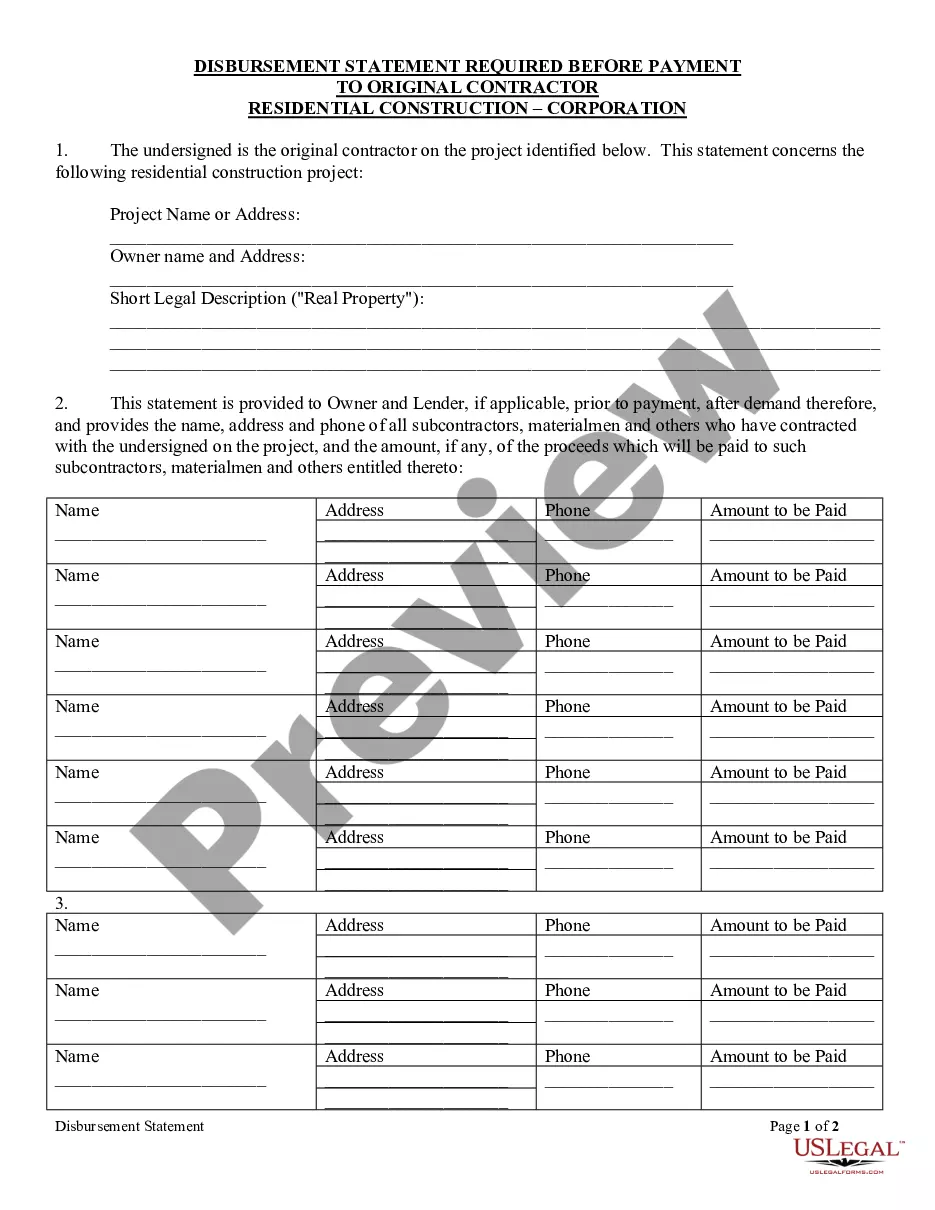

Key components of this form

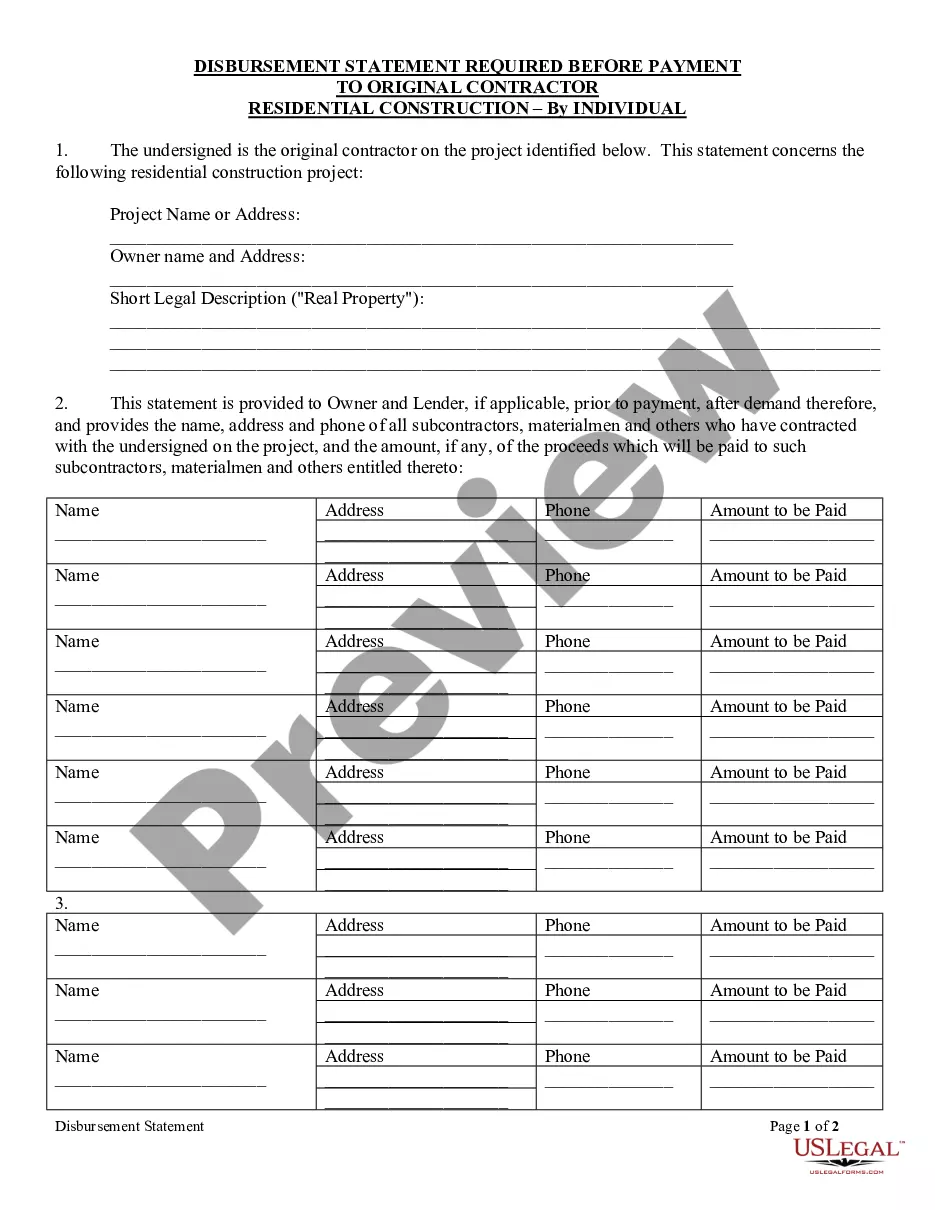

- Date of the original deed of trust

- Identifying details of the mortgagor(s), original trustee, and original beneficiary

- Legal description of the property

- Details regarding the promissory note secured by the deed of trust

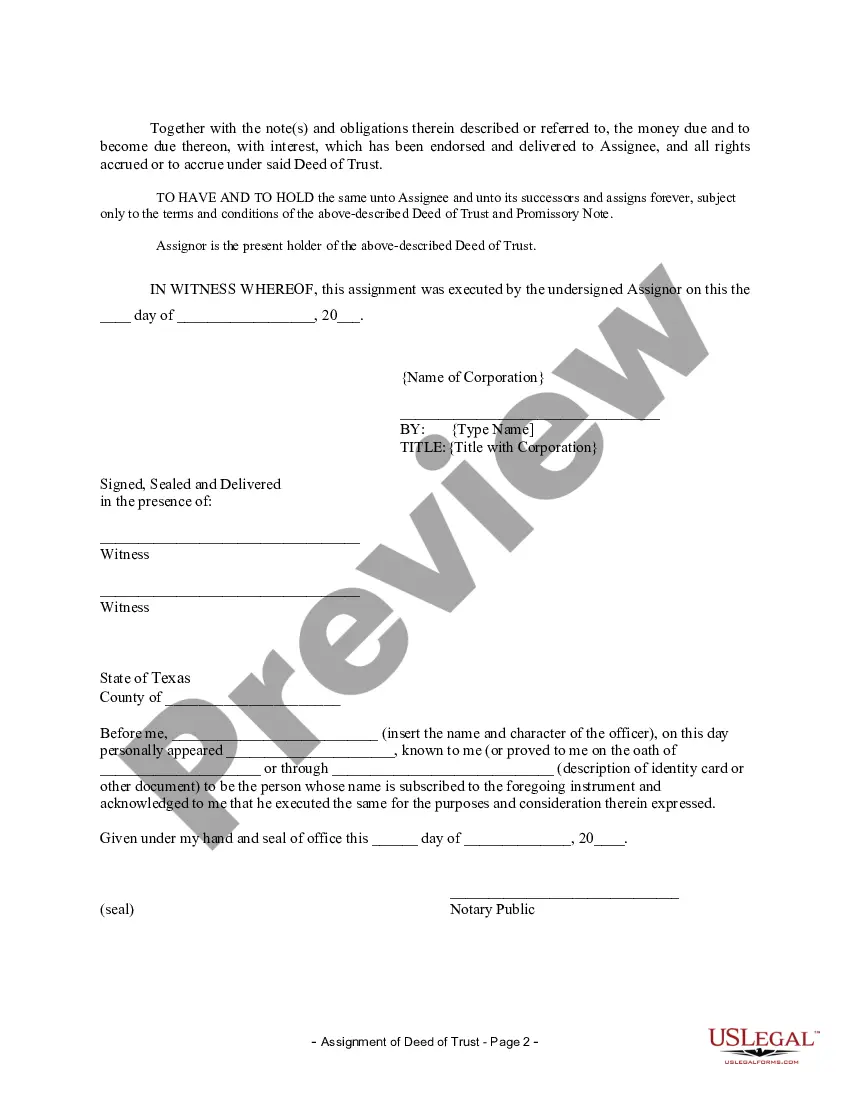

- Signature section for the assignor (corporation) and witnesses

- Notary acknowledgment section

Situations where this form applies

This form should be used when a corporate mortgage holder wishes to transfer its rights under a deed of trust to another party. Common scenarios include financial transactions, corporate mergers, or selling part of a mortgage portfolio where the corporation needs to assign its interests in a specific deed of trust.

Who needs this form

- Corporate entities acting as mortgage holders

- Financial institutions involved in mortgage transactions

- Corporations seeking to convey real property interests to another entity

- Attorneys or legal professionals handling corporate mortgages

Steps to complete this form

- Identify the date of the original deed of trust and enter it at the top.

- Provide the names of the mortgagor(s), original trustee, and original beneficiary.

- Include the legal description of the property being assigned, or attach it to the form.

- Enter the details regarding the promissory note associated with the deed of trust.

- Ensure the assignor (corporation) signs the document with the title of the signer.

- Have the form acknowledged by a notary public to validate the assignment.

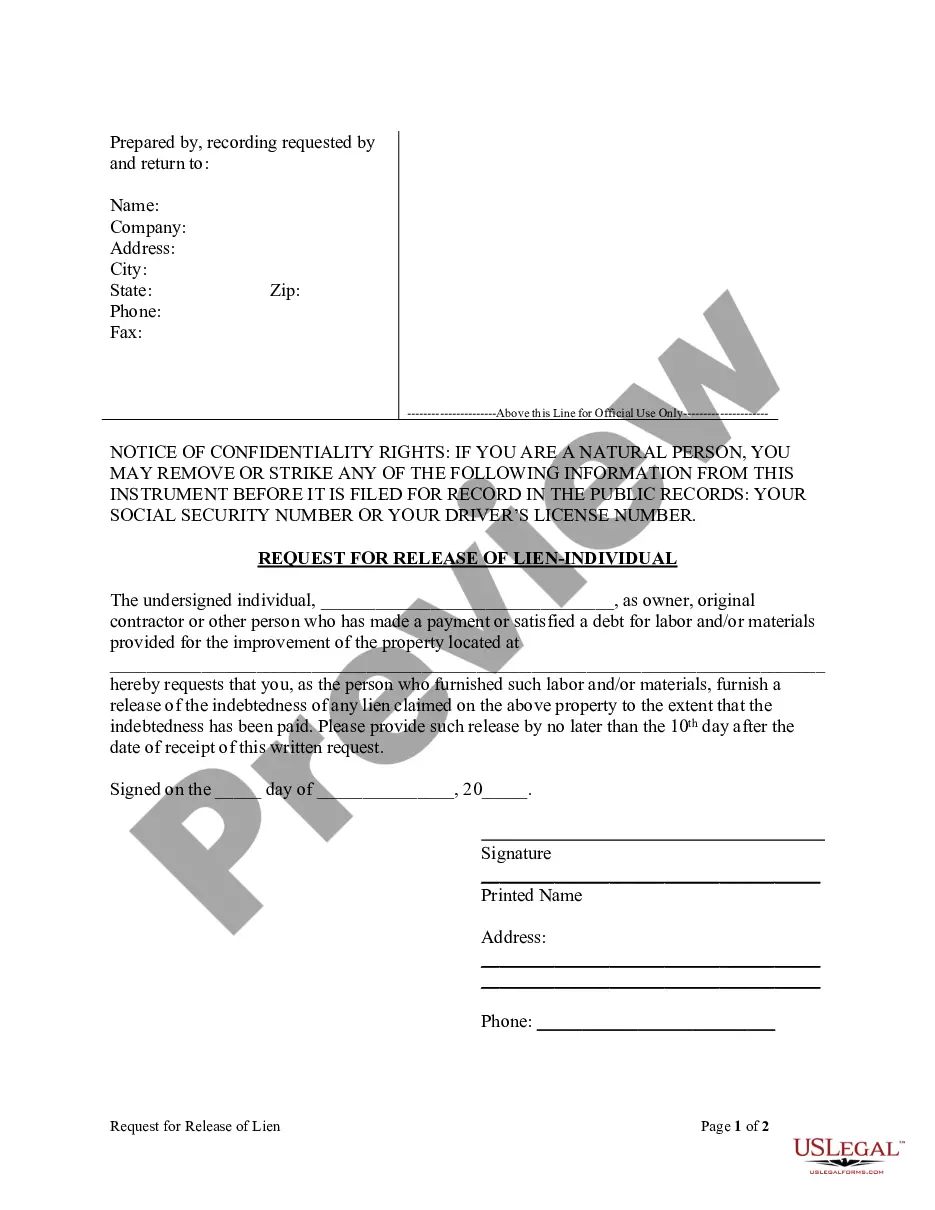

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not having the document notarized, if required.

- Forgetting to include the signatures of witnesses.

- Not specifying the correct date for the assignment.

Advantages of online completion

- Convenient access to the form for immediate download.

- Editability allows users to fill in their specific details quickly.

- Drafted by licensed attorneys, ensuring legal compliance.

- Easy storage and retrieval for future reference.

Looking for another form?

Form popularity

FAQ

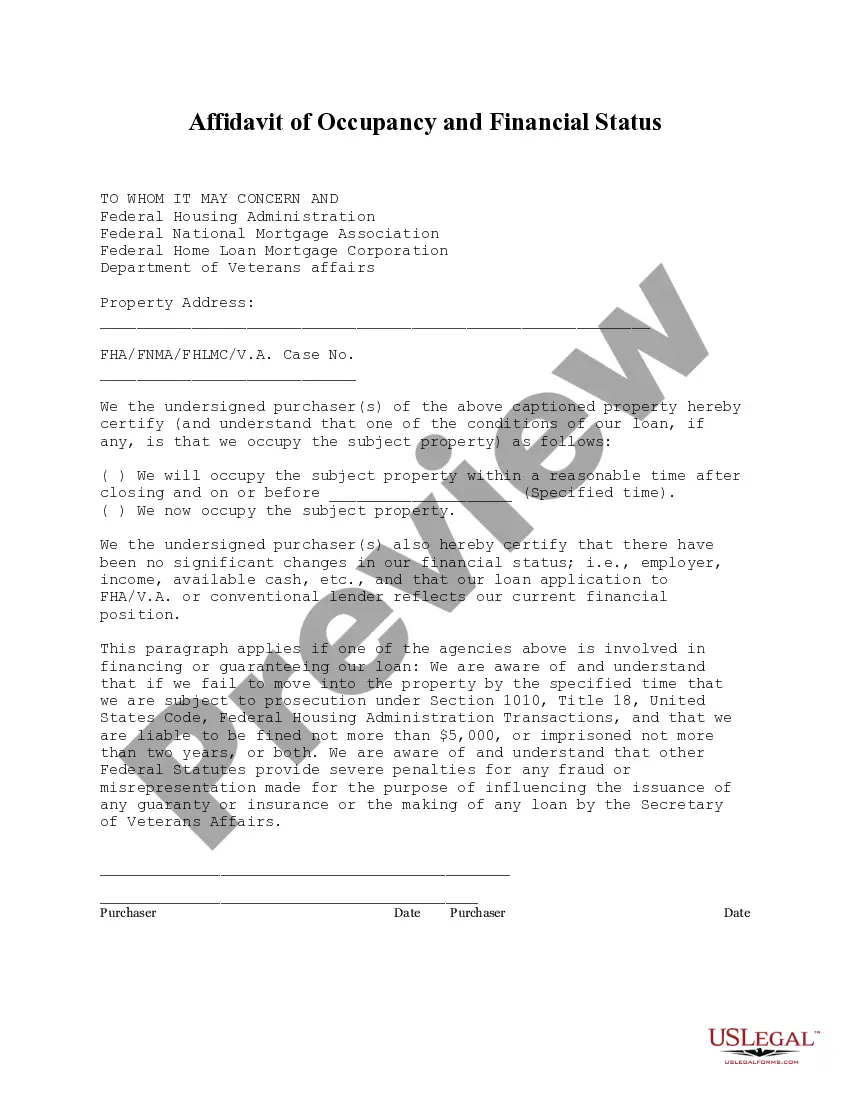

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Visit the land records division in the county clerk's office in the county where the land at issue in the deed of trust is located. Ask the clerk to record the deed of trust. Pay the required filing fee.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Essentially, the Deed of Assignment (DOA) is a legal document that transfers the ownership of a property from one party to another.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

A deed of trust is the most commonly used mortgage instrument in Texas for both residential and commercial transactions. A mortgage has also been described as a grant of fee on condition of the payment of a debt.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.