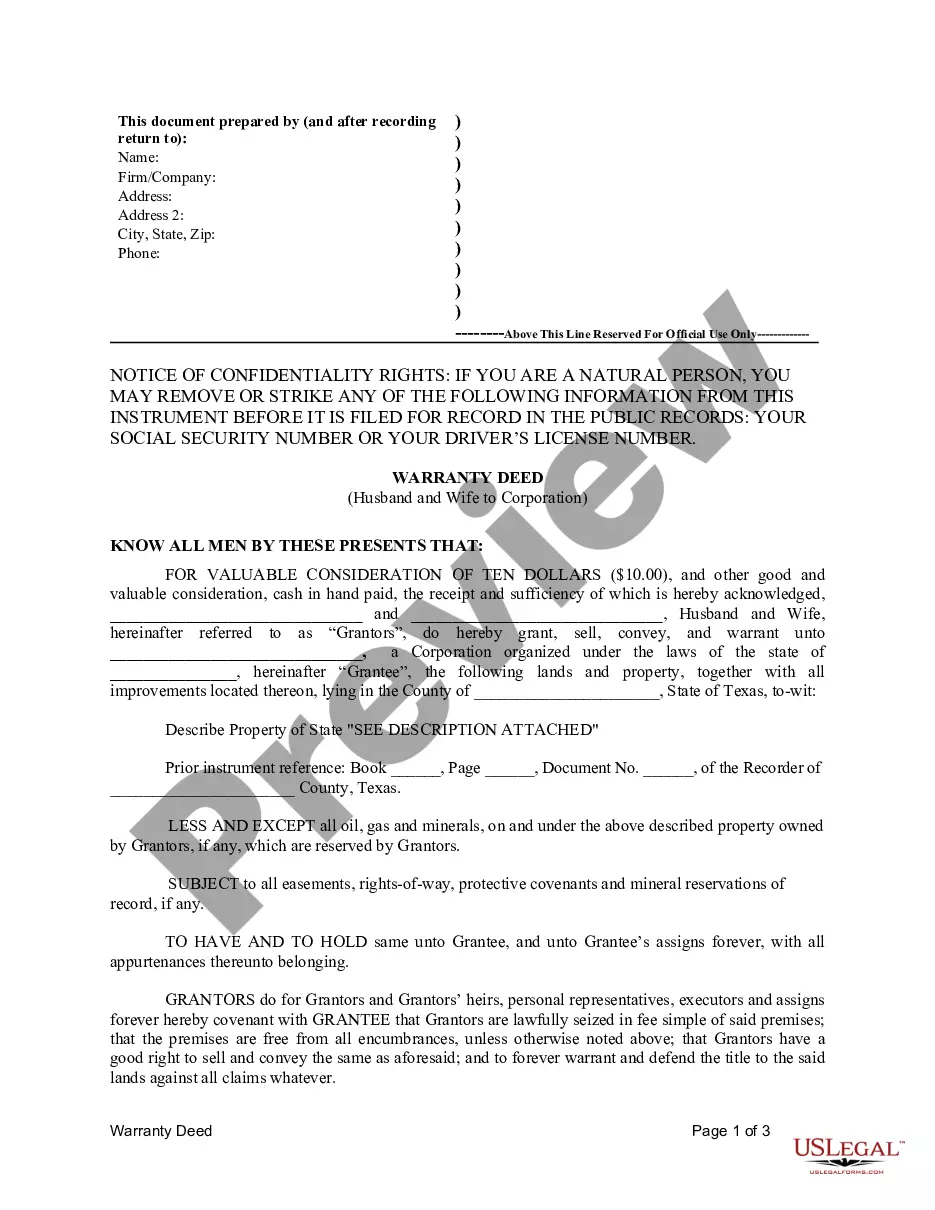

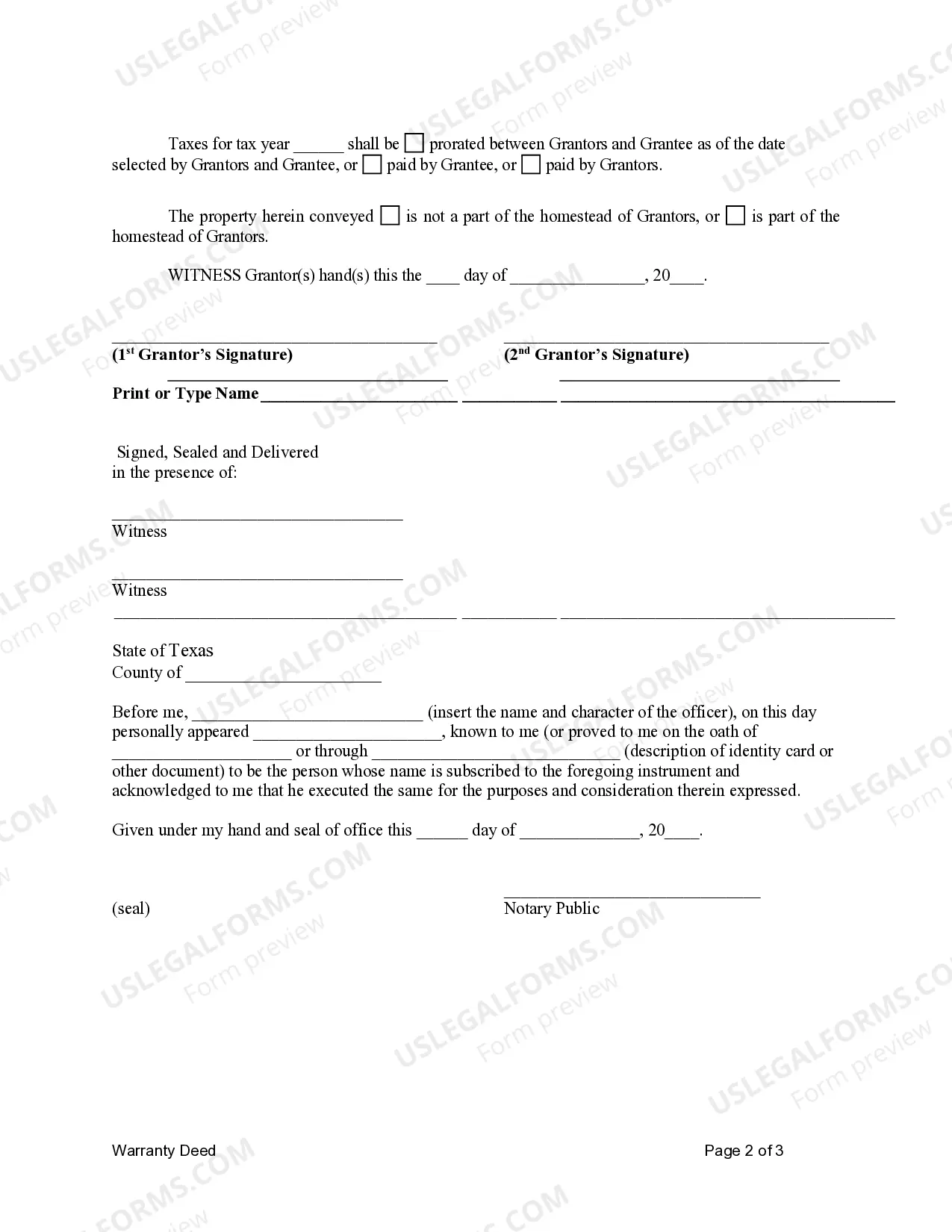

This Warranty Deed from Husband and Wife to Corporation form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Grantors warrant and convey the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Texas Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Texas Warranty Deed From Husband And Wife To Corporation?

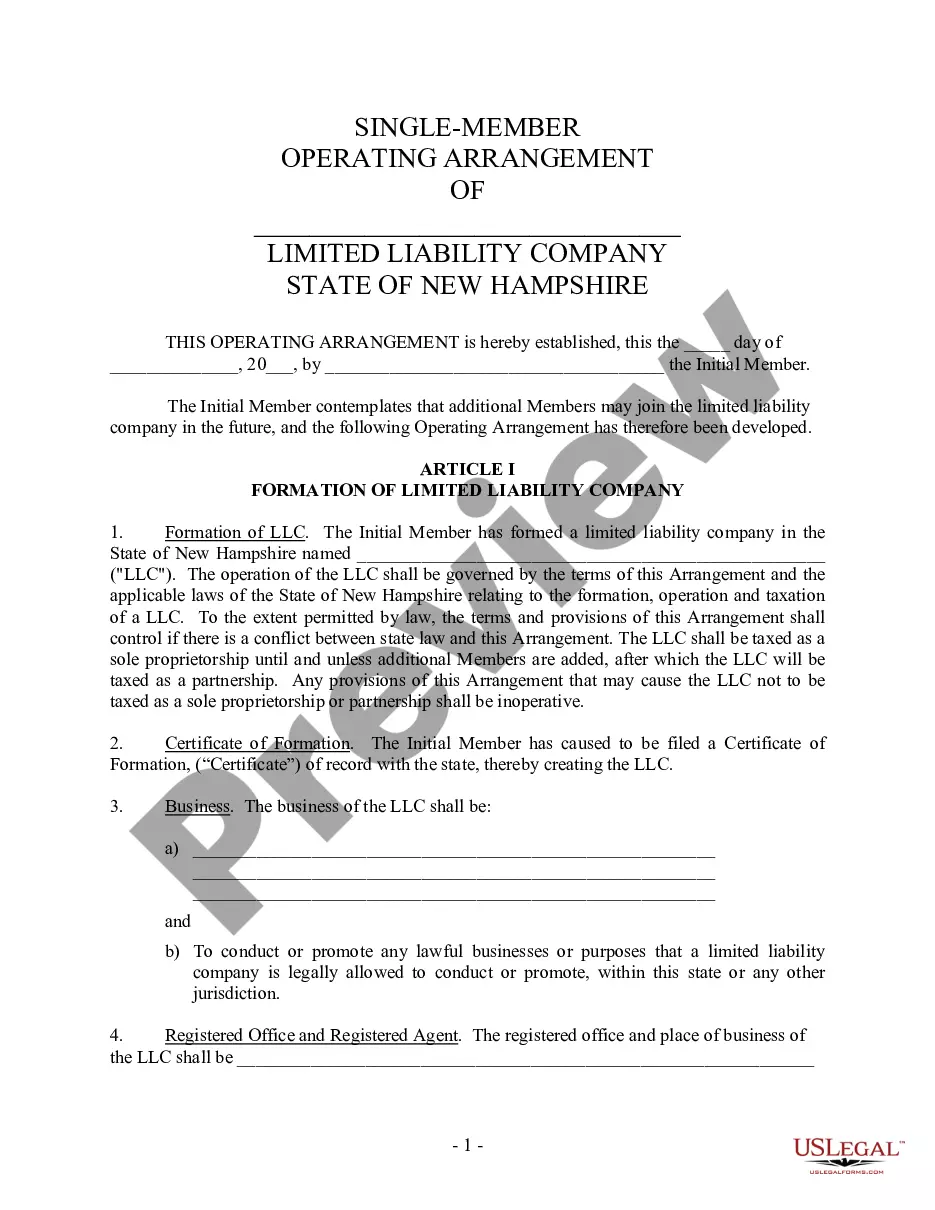

Access to high quality Texas Warranty Deed from Husband and Wife to Corporation templates online with US Legal Forms. Prevent hours of lost time browsing the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find over 85,000 state-specific authorized and tax templates you can save and fill out in clicks within the Forms library.

To receive the example, log in to your account and click Download. The document will be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- See if the Texas Warranty Deed from Husband and Wife to Corporation you’re considering is suitable for your state.

- Look at the sample utilizing the Preview function and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to register.

- Pay by credit card or PayPal to finish creating an account.

- Select a preferred format to save the document (.pdf or .docx).

Now you can open the Texas Warranty Deed from Husband and Wife to Corporation sample and fill it out online or print it out and get it done yourself. Consider sending the papers to your legal counsel to make certain everything is completed properly. If you make a mistake, print out and fill sample again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

Unlike most states Texas does not automatically recognize joint tenancies as having a right of survivorship. Instead the parties must agree, in writing, to include a right of survivorship.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

In Texas, a married couple can agree in writing that all or part of their community property will go to the surviving spouse when one person dies. This is called a right of survivorship agreement. The right of survivorship agreement must be filed with the county court records where the couple lives.

Texas law allows you to completely cut your spouse out of your will, but only with regard to those assets you control, considered yours to devise in your will.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

If you die without a Will, you are said to have died intestate. When someone dies intestate, Texas law lays out how the estate will be distributed in the Texas Probate Code.In the second common scenario, someone dies without a spouse but is survived by each of the children born to him or her during life.

On its face, an interspousal transfer grant deed or quitclaim deed between spouses involves one spouse foregoing or waiving any future interest he or she may have in the residence.

The laws in Texas surrounding intestate wills for married individuals without children are much simpler. The surviving spouse automatically receives all community property.If there are no surviving parents, siblings or descendants of siblings, the spouse gets the remainder of the estate's separate real property.