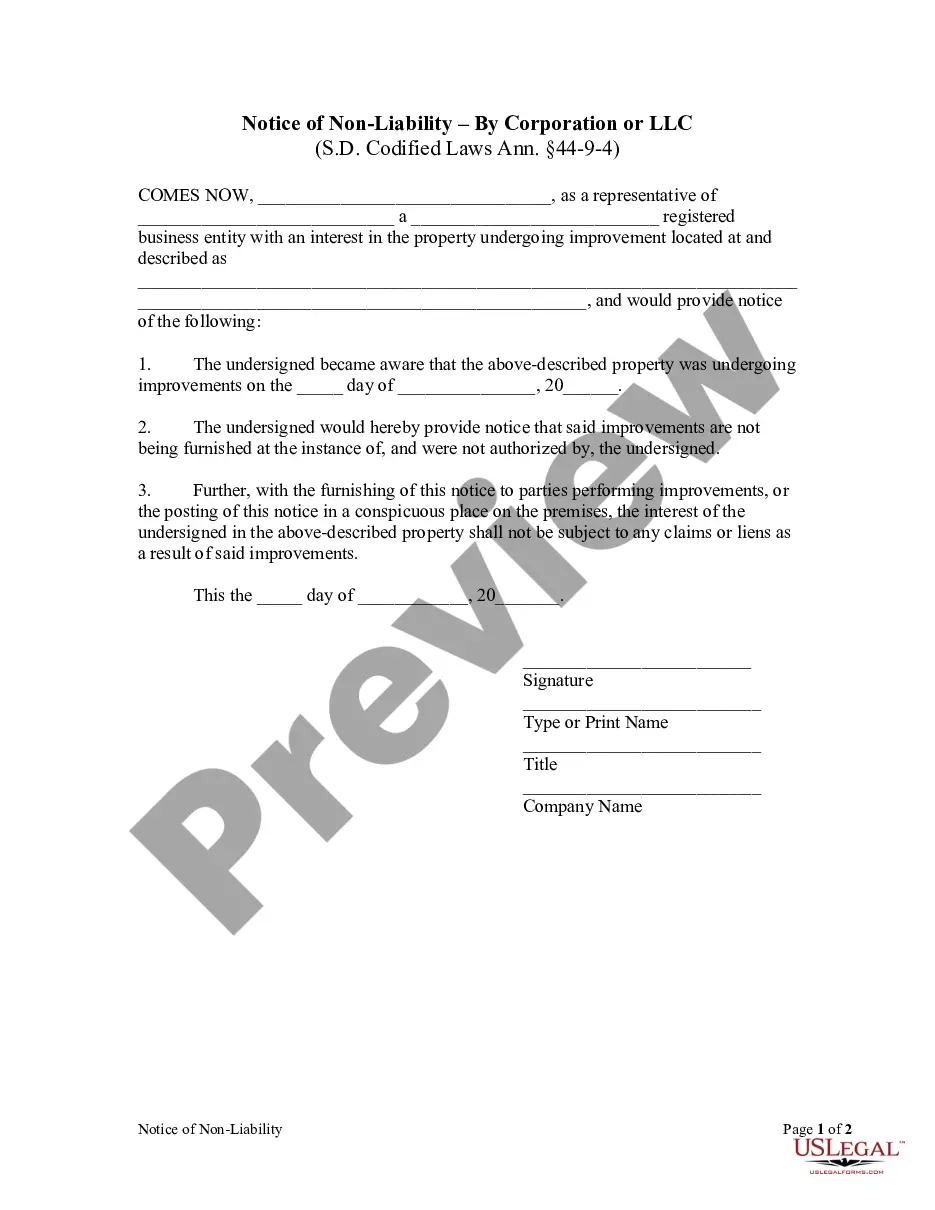

Any person who has not authorized the improvement may protect his interests from such liens by serving upon the persons doing the work or otherwise contributing to such improvement, within five days after knowledge thereof, written notice that the improvement is not being made at his instance, or by posting like notice, and keeping the same posted, in a conspicuous place on the premises.

South Dakota Notice of Nonliability by Corporation

Description

How to fill out South Dakota Notice Of Nonliability By Corporation?

Creating documents isn't the most simple process, especially for people who rarely work with legal paperwork. That's why we recommend making use of accurate South Dakota Notice of Nonliability by Corporation or LLC samples made by professional attorneys. It gives you the ability to prevent difficulties when in court or handling formal institutions. Find the samples you want on our site for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template web page. Soon after getting the sample, it will be stored in the My Forms menu.

Customers without a subscription can quickly get an account. Utilize this brief step-by-step guide to get your South Dakota Notice of Nonliability by Corporation or LLC:

- Make sure that the sample you found is eligible for use in the state it’s needed in.

- Confirm the file. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this form is the thing you need or return to the Search field to get another one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After doing these straightforward steps, it is possible to complete the sample in your favorite editor. Double-check filled in information and consider asking a legal professional to review your South Dakota Notice of Nonliability by Corporation or LLC for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

Unlike a corporation, an LLC is not considered separate from its owners for tax purposes. Instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship.While an LLC itself doesn't pay taxes, co-owned LLCs must file Form 1065, an informational return, with the IRS each year.

A series LLC is a regular business LLC that is set up to hold several properties or interests underneath one LLC. A series LLC can make distributions as allowed by state law. A restricted LLC, on the other hand, is a vehicle created to transfer assets within a family and is not meant for doing business.

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

A Series LLC can be a great way to separate your business assets and divide the responsibilities for investment and debt in different areas or divisions of your company. A Series LLC allows you to form multiple mini-LLCs, so to speak, and operate them all under a single umbrella company.

LLC ownership can be expressed in two ways: (1) by percentage; and (2) by membership units, which are similar to shares of stock in a corporation. In either case, ownership confers the right to vote and the right to share in profits.

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

When a business entity is incorporated, there are a number of steps to take to incorporate a business. The corporate entity owns its own assets and has liability for its own debts. The stock shareholders are considered the legal owners of the company.

The owners of a limited liability company (LLC) are called members. Each member is an owner of the company; there are no owner shares, as in a corporation. An LLC is formed in a state by filing Articles of Organization or similar document in some states.

A Limited Liability Company (LLC) is an entity created by state statute.A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.