South Carolina LLC Notices, Resolutions and other Operations Forms Package

About this form

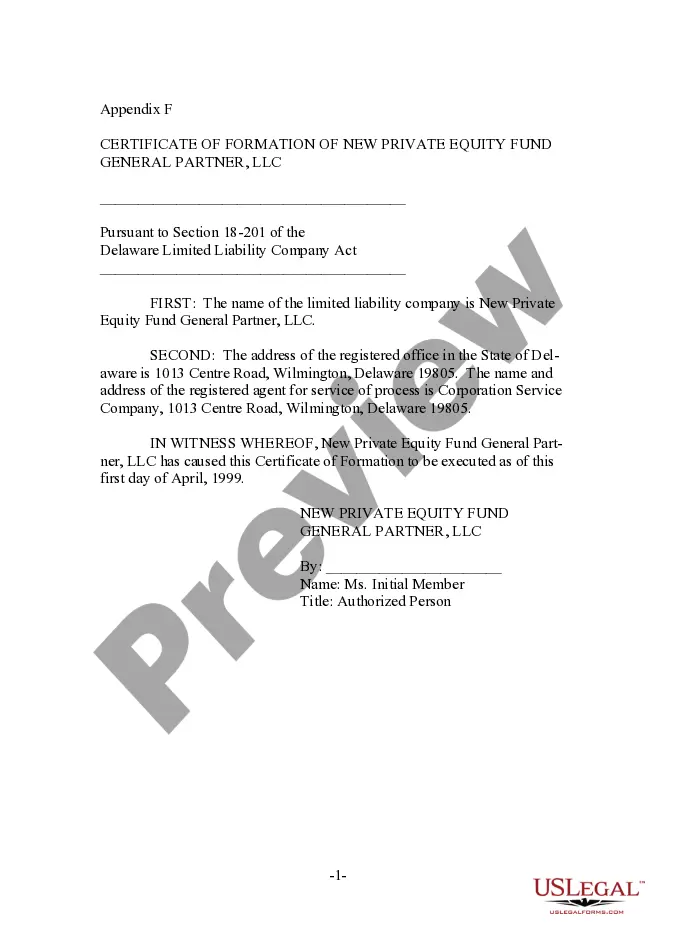

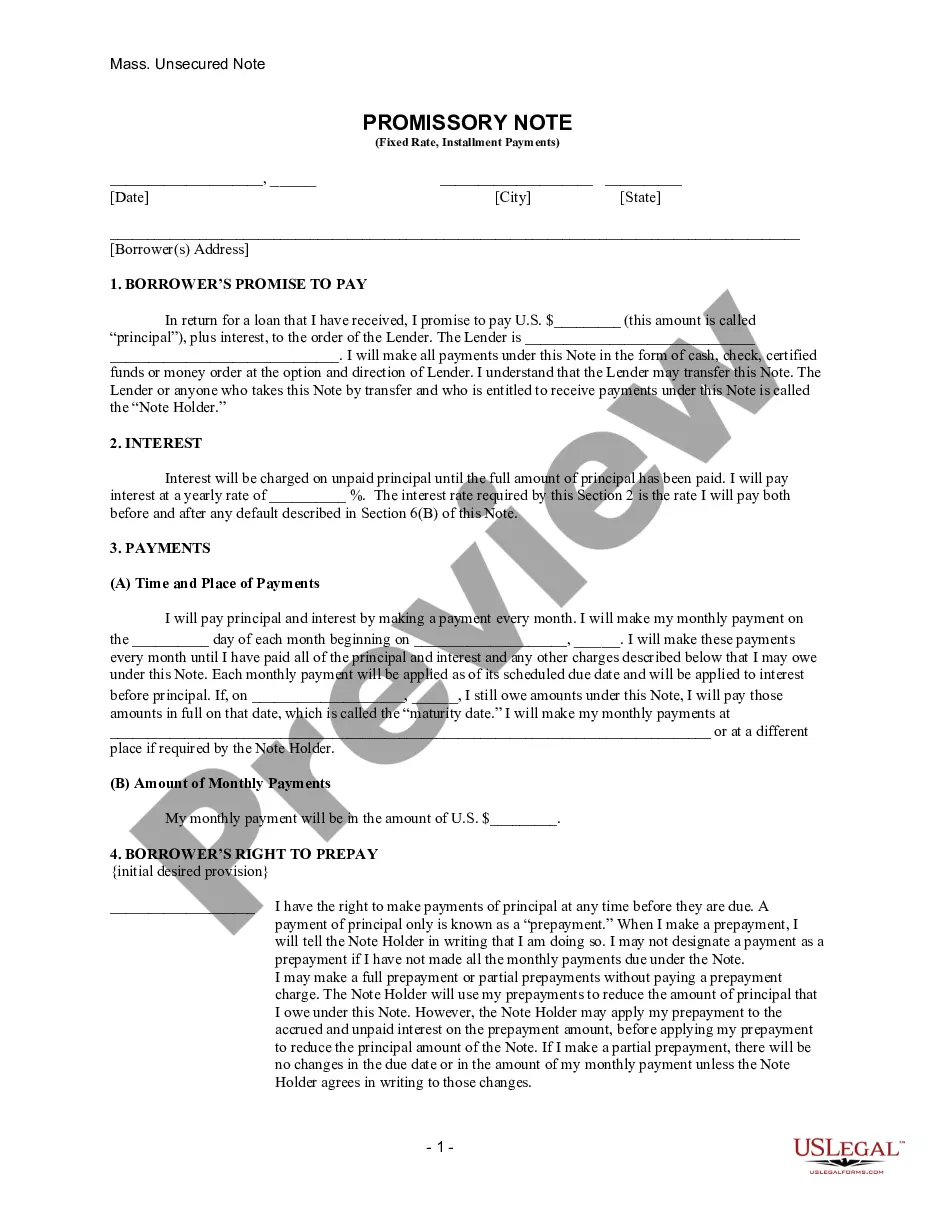

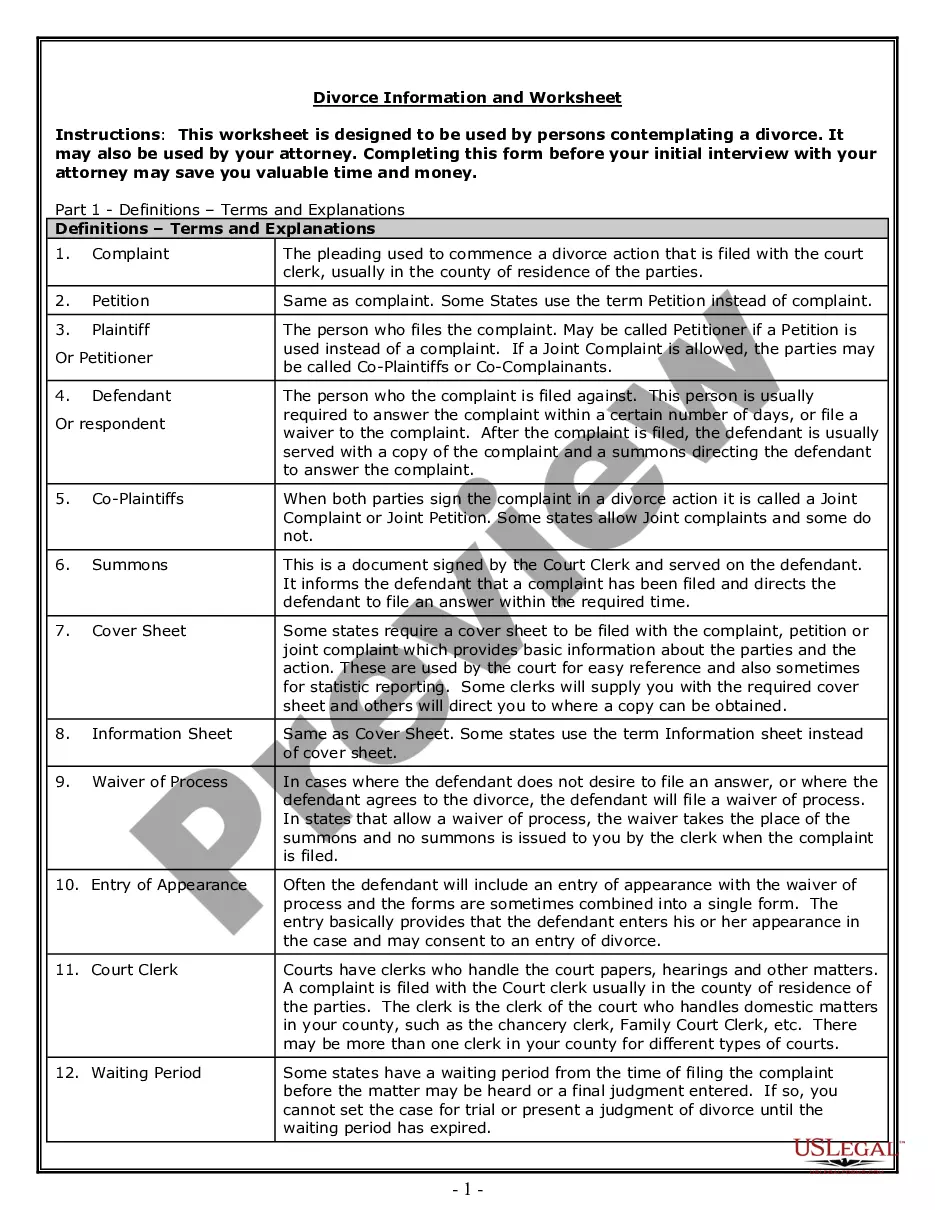

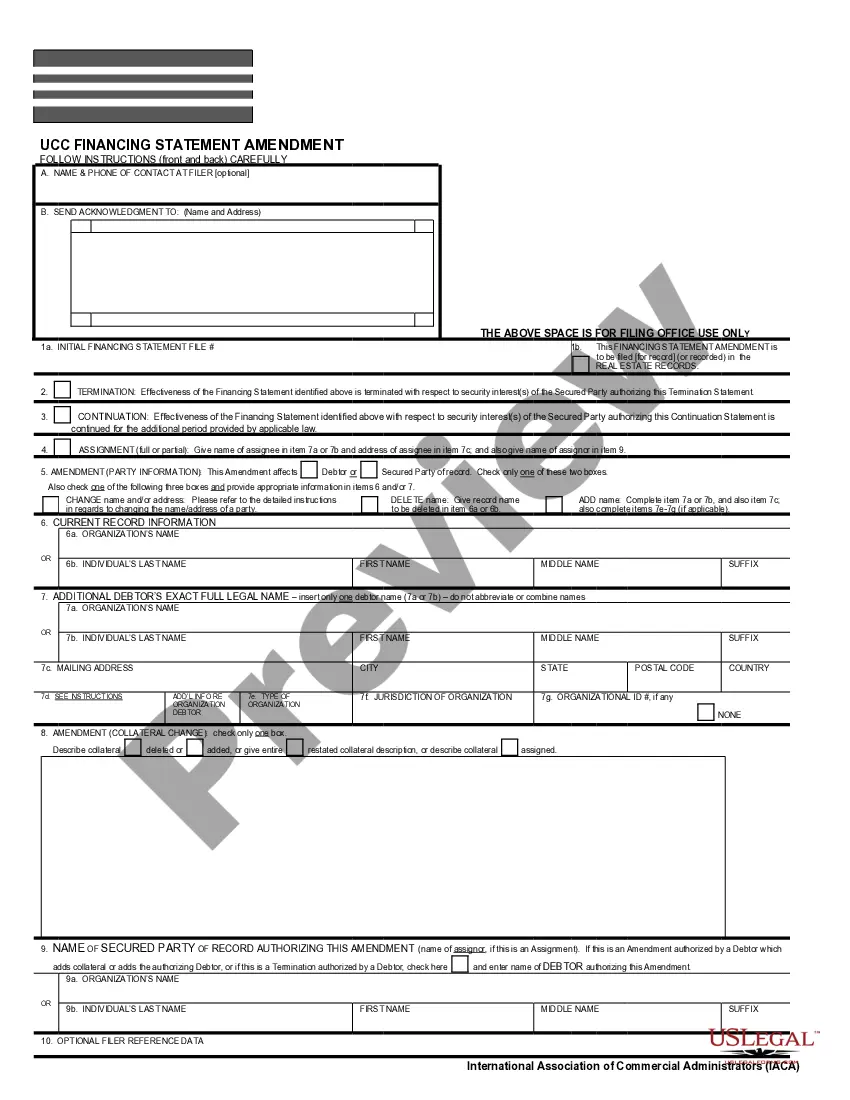

The LLC Notices, Resolutions and other Operations Forms Package is a comprehensive collection of over 15 essential forms designed for the operation of a Limited Liability Company (LLC). This package provides various notices and resolutions which are essential for managing meetings, amending articles of organization, admitting new members, and addressing dissolution procedures. Unlike other legal form packages, this one is specifically tailored for LLC operations, ensuring all relevant aspects are covered in one place.

Key components of this form

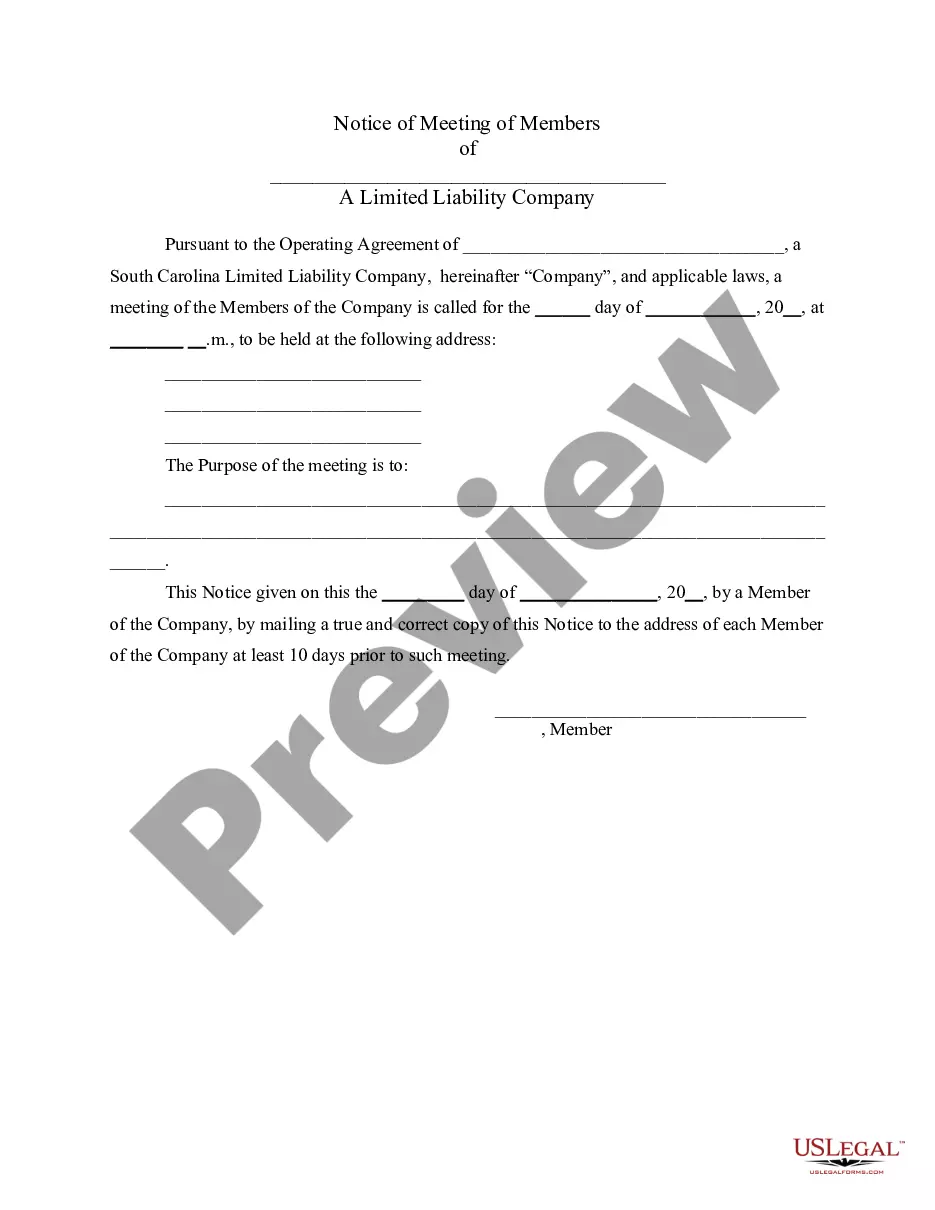

- Notice of Meeting for General Purpose

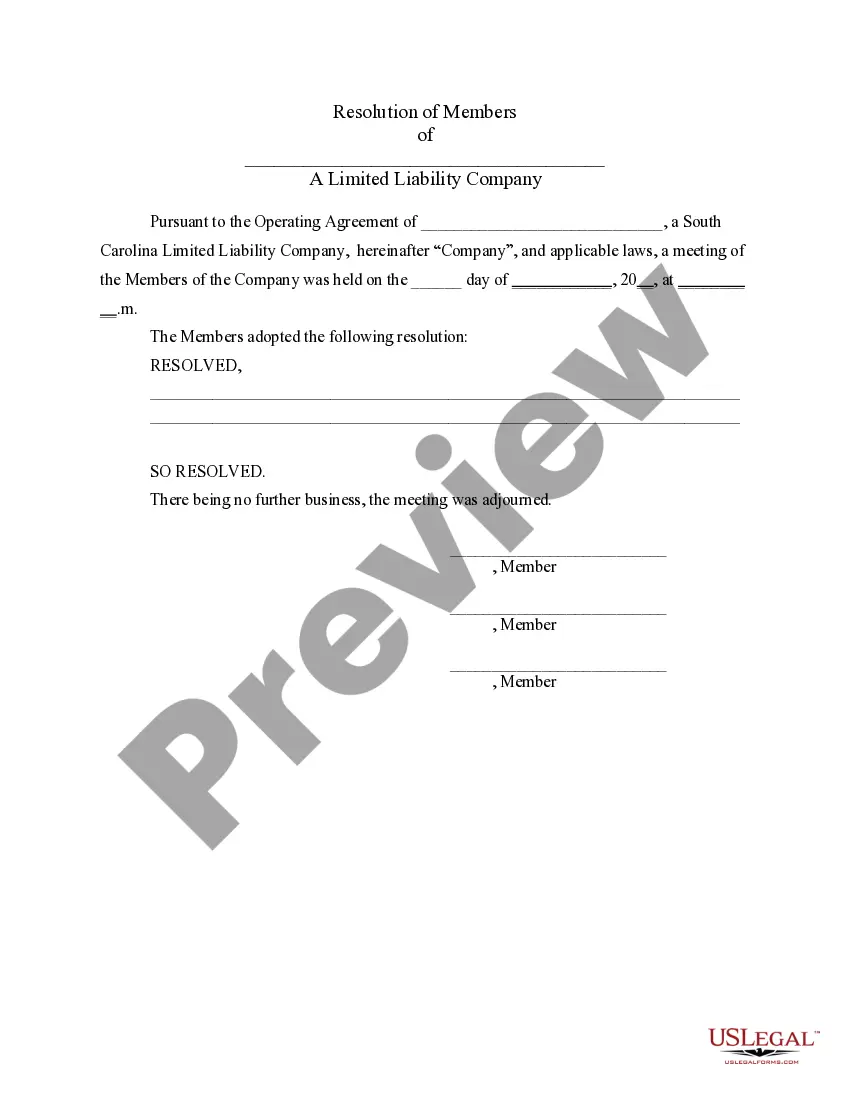

- Resolution of Meeting for General Purpose

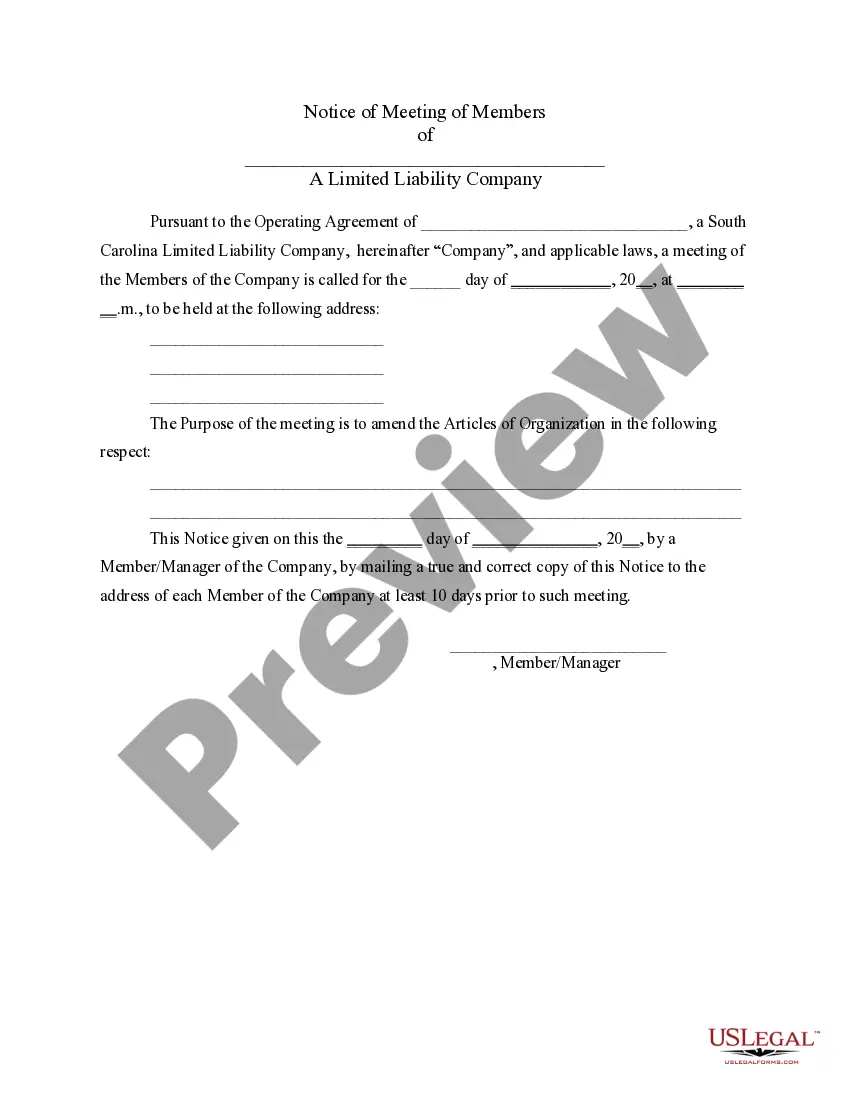

- Notice of Meeting to Amend Articles of Organization

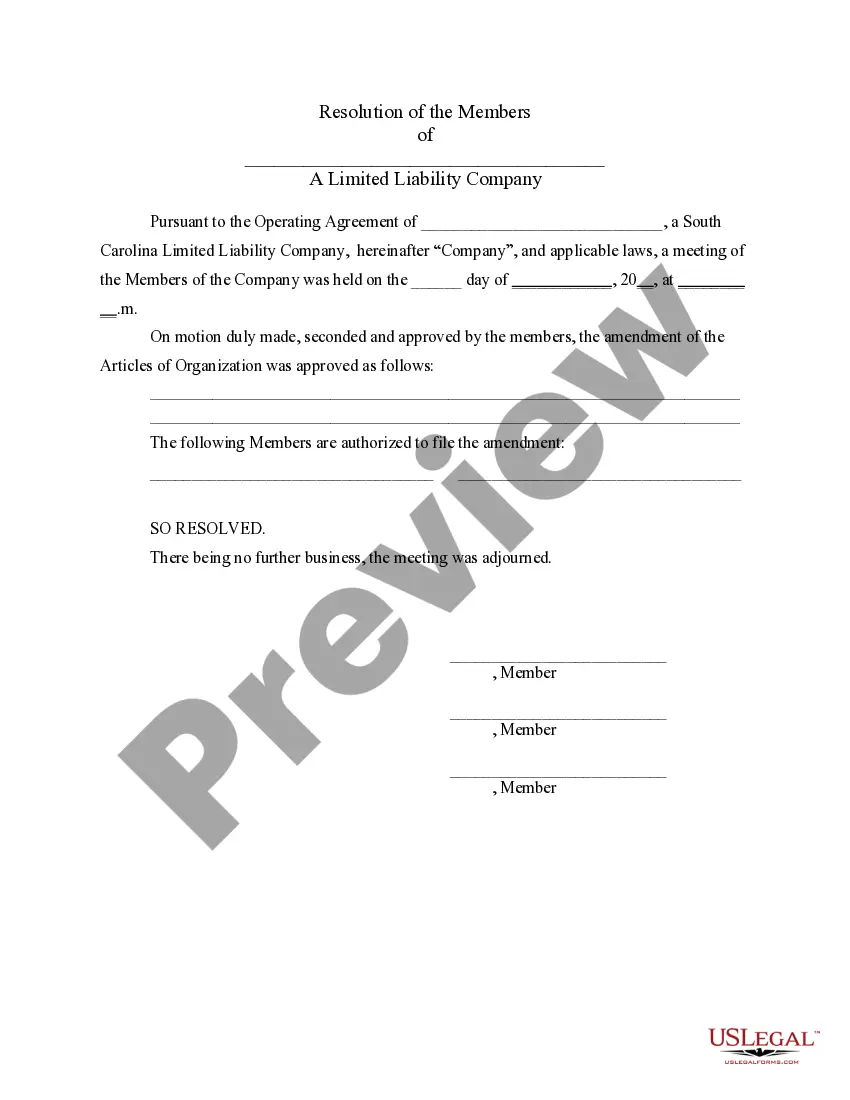

- Resolution to Amend Articles of Organization

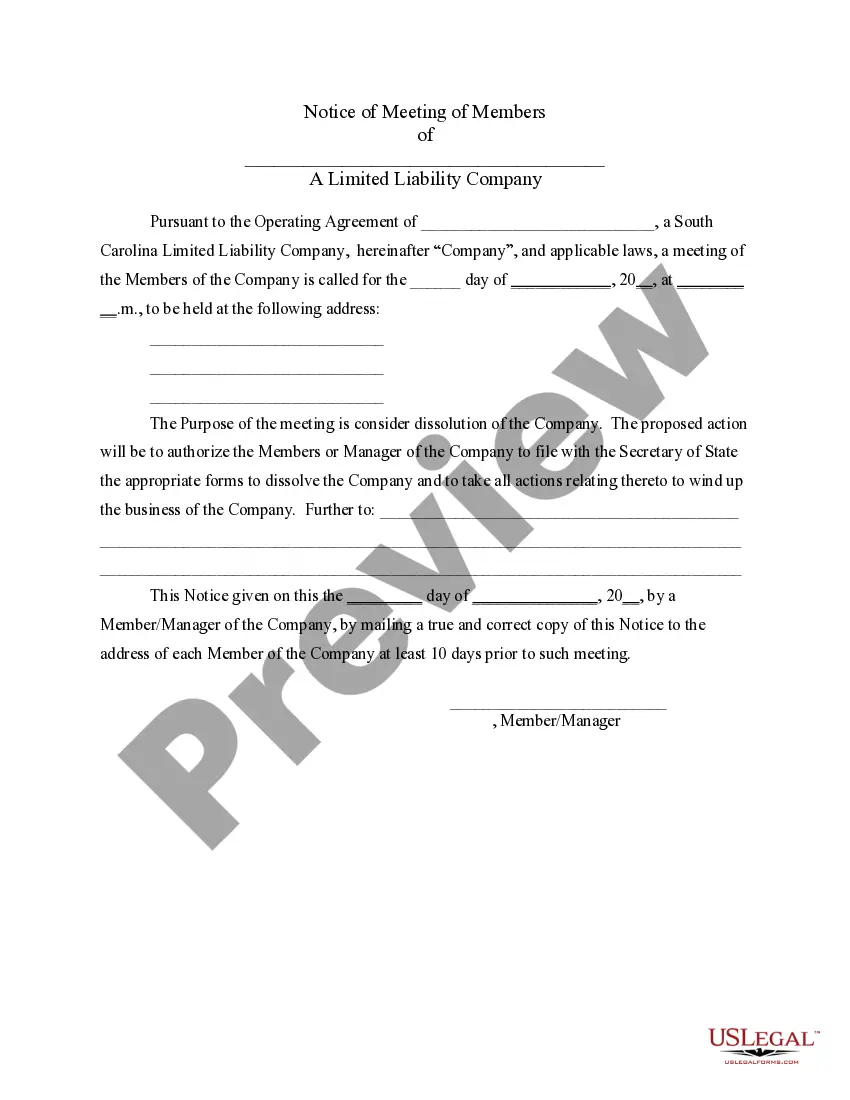

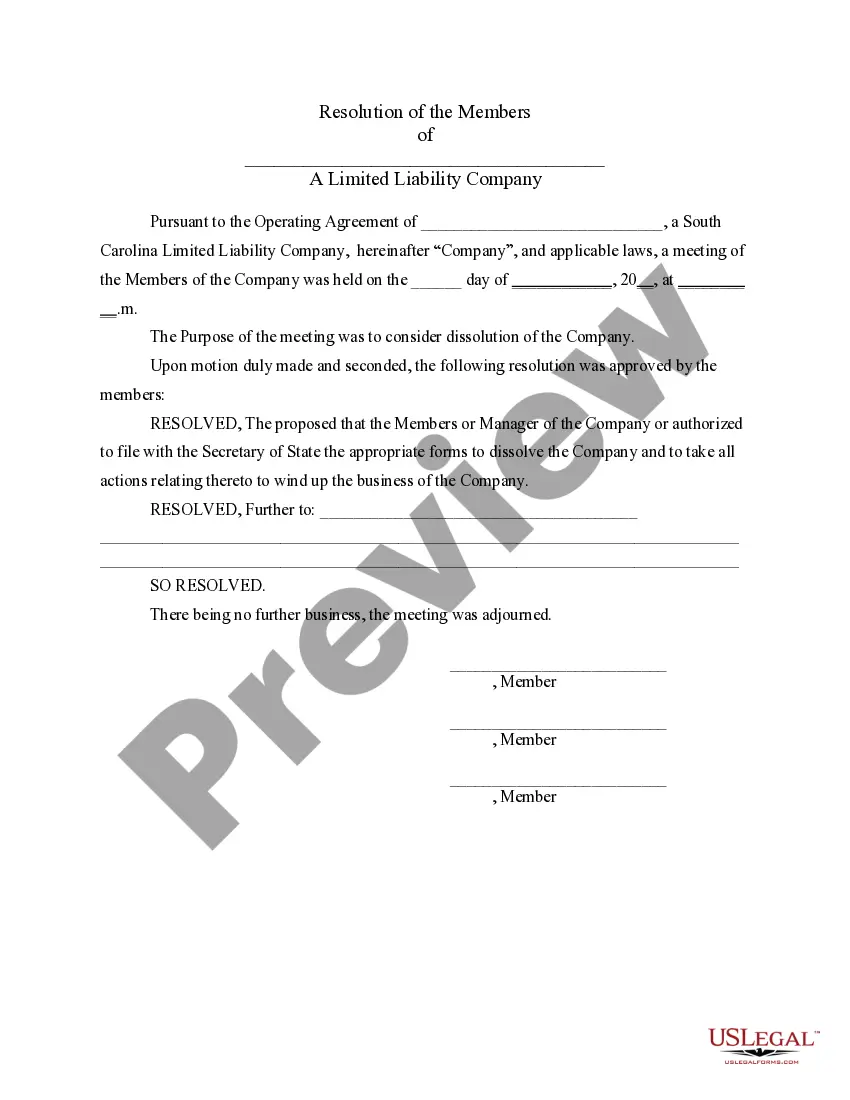

- Notice of Meeting to Consider Dissolution

- Resolution Regarding Dissolution

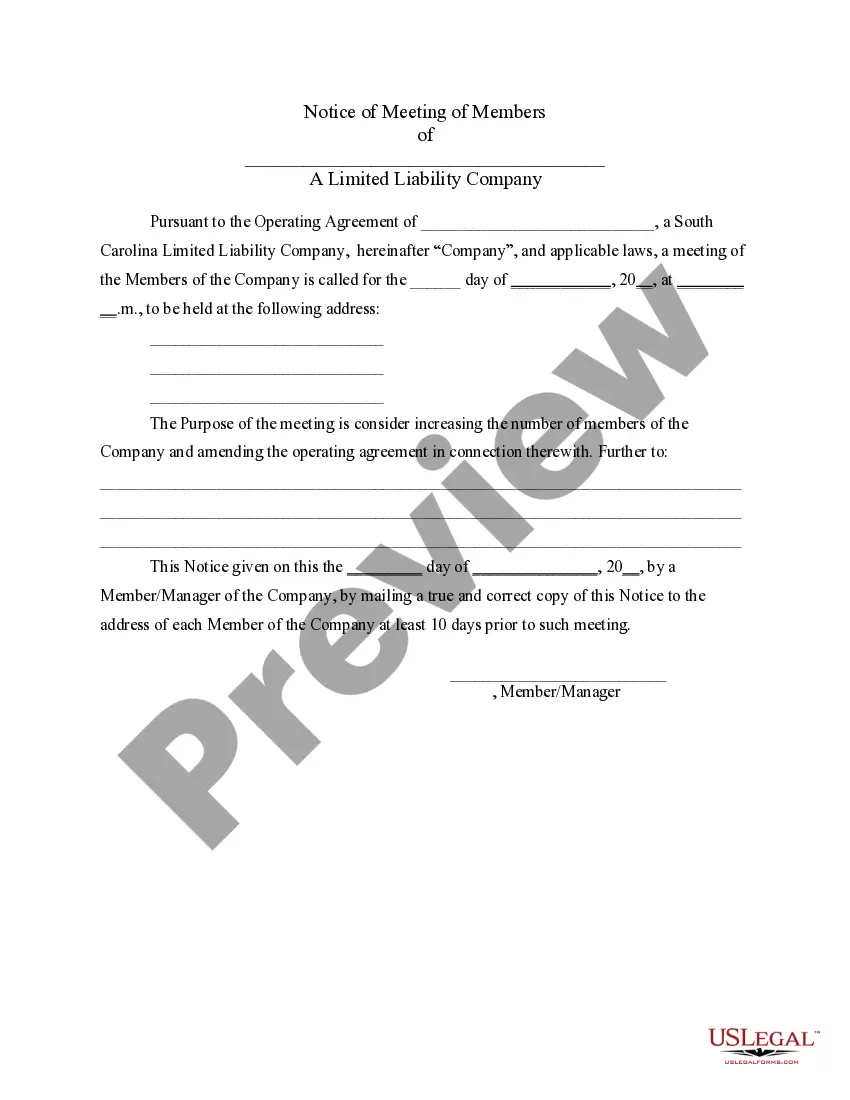

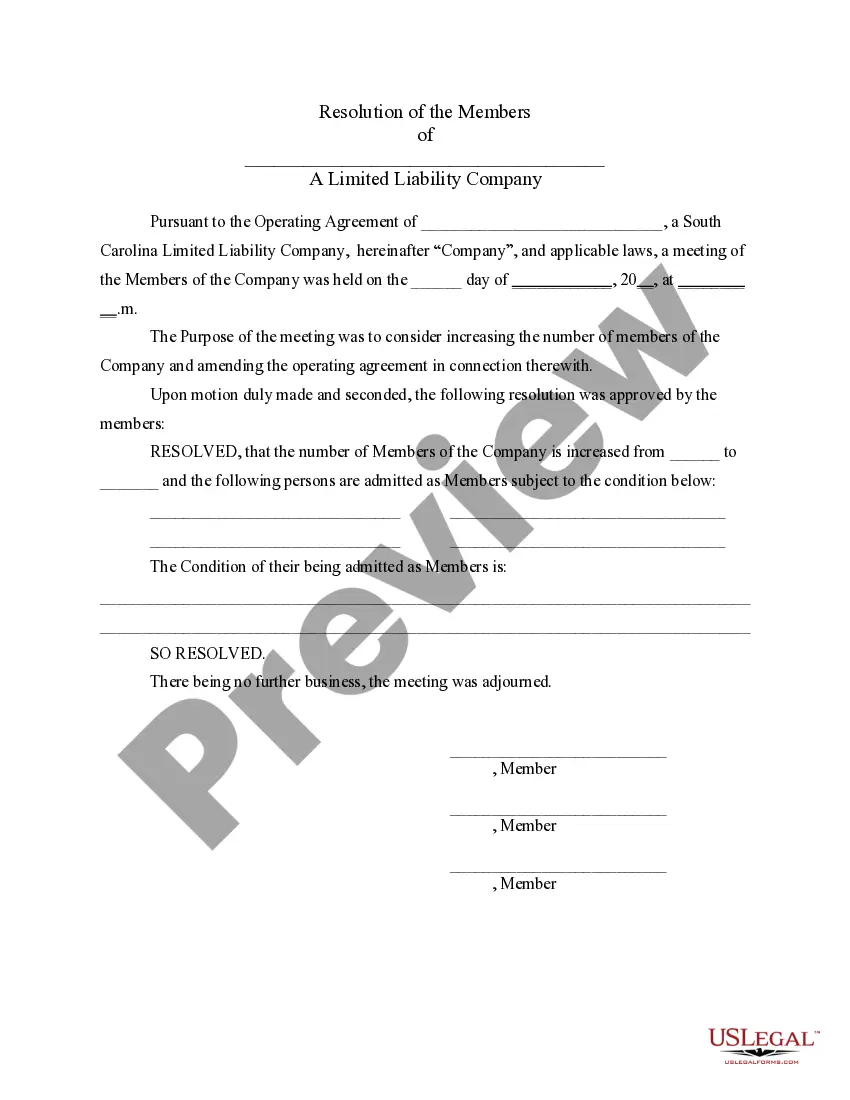

- Notice to Admit New Members

- Resolution Concerning Admitting New Members

- Notice of Meeting Concerning Accepting Resignation of Manager

- Resolution Accepting Resignation of Manager

- Notice of Meeting to Remove Manager

- Resolution Concerning Removal of Manager

- Notice of Meeting to Consider Disbursements to Members

- Resolution Concerning Disbursements

- Assignment of Member Interest

- Demand for Indemnity by Member/Manager

- Application for Tax Identification Number

When to use this document

This form package is useful in various scenarios related to the management of an LLC. Use this package when you need to convene meetings for any significant changes in your LLC, such as amending operational agreements, adding or removing members, dissolving the company, or managing distributions among members. It ensures that all procedural requirements are followed and documented appropriately.

Intended users of this form

This form package is intended for:

- Members of a Limited Liability Company who participate in management decisions.

- Managers of an LLC responsible for handling operational and administrative tasks.

- Legal representatives assisting LLCs in fulfilling statutory requirements.

- Any business owner seeking to formalize changes within their LLC.

Instructions for completing this form

- Identify the LLC's name and include it in the designated fields.

- Specify the date, time, and location for the meeting in the relevant notices.

- Clearly state the purpose of each meeting, citing specific resolutions and amendments as needed.

- Have all members or managers sign the resolutions and notices as required.

- Distribute copies of the completed notices to all LLC members at least ten days prior to the meeting.

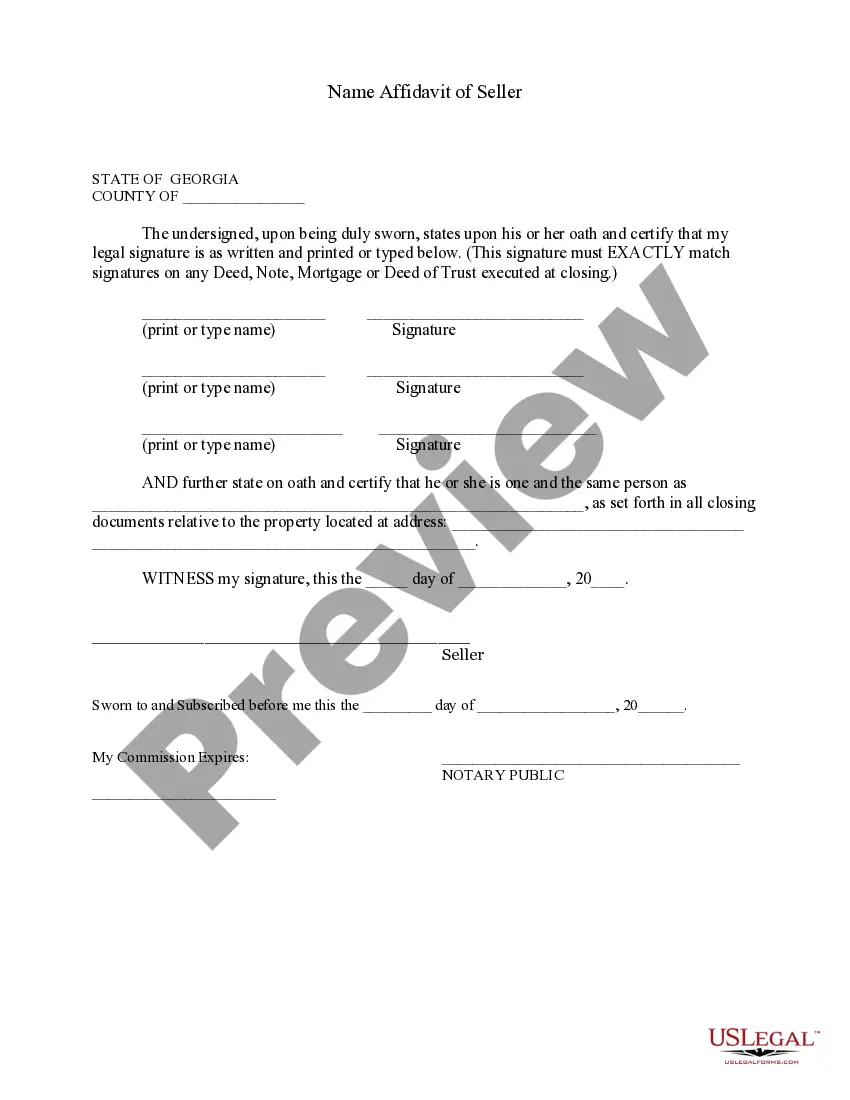

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Avoid these common issues

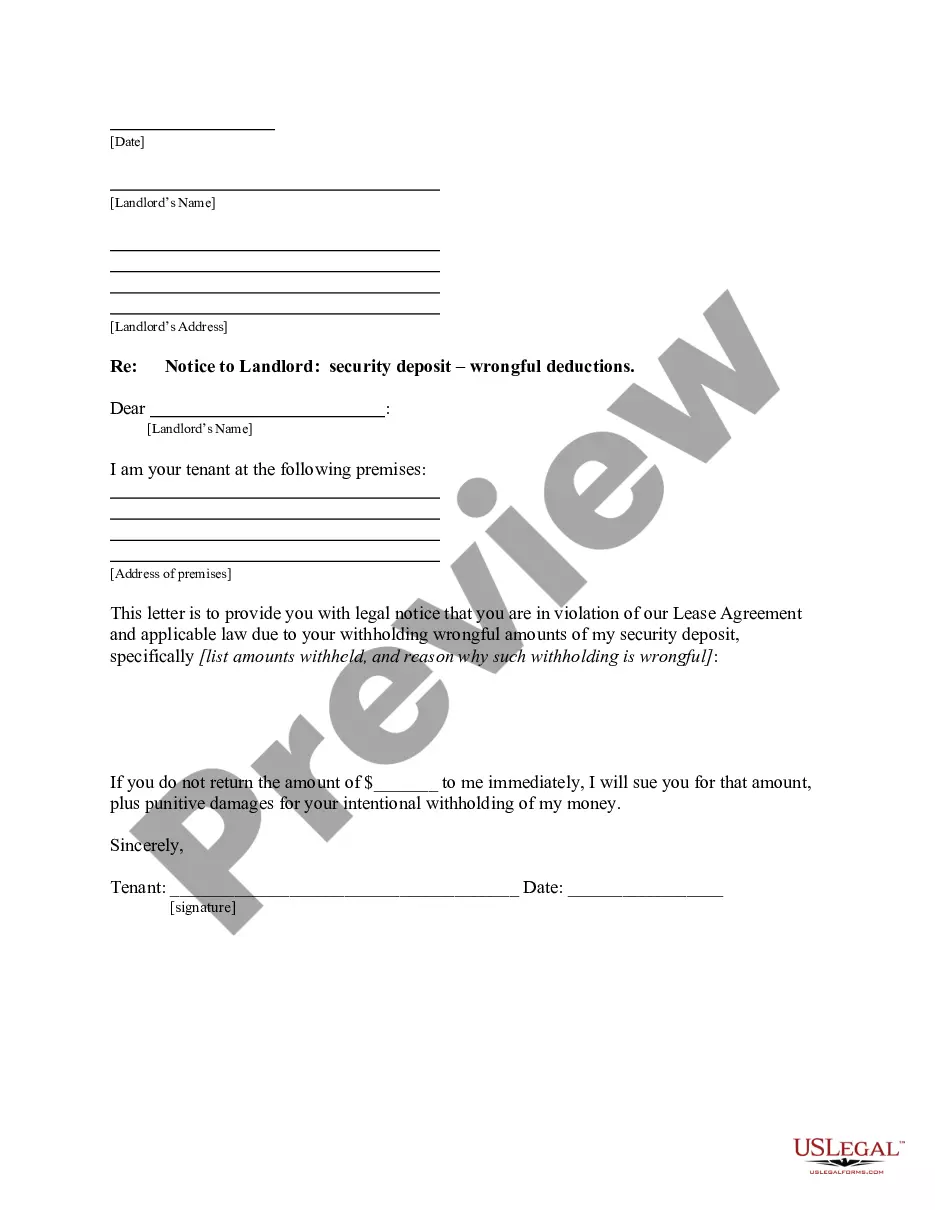

- Failing to provide proper notice to all members in advance of meetings.

- Not detailing the purpose of the meeting clearly, leading to confusion.

- Omitting signatures from resolutions, making them invalid.

Why complete this form online

- Easy access to a comprehensive set of forms specifically designed for LLC operations.

- The ability to fill out and customize each form according to your LLC's specific needs.

- Time-saving convenience of downloading and printing forms immediately.

Legal use & context

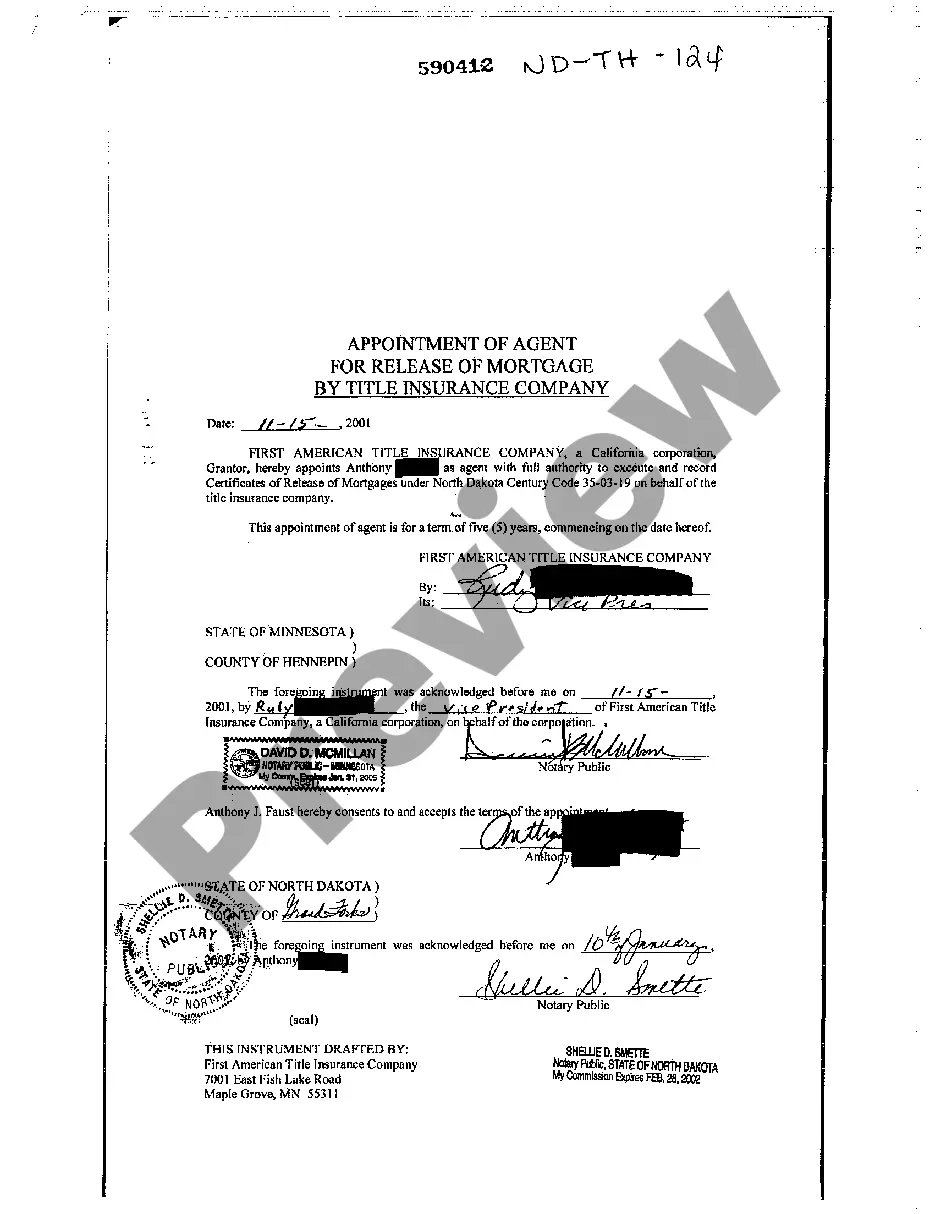

- The provided forms facilitate compliance with state regulations governing LLC management.

- Properly completed forms serve as legal evidence of decisions made during meetings.

- Using these forms helps mitigate the risk of disputes among members regarding business decisions.

Form popularity

FAQ

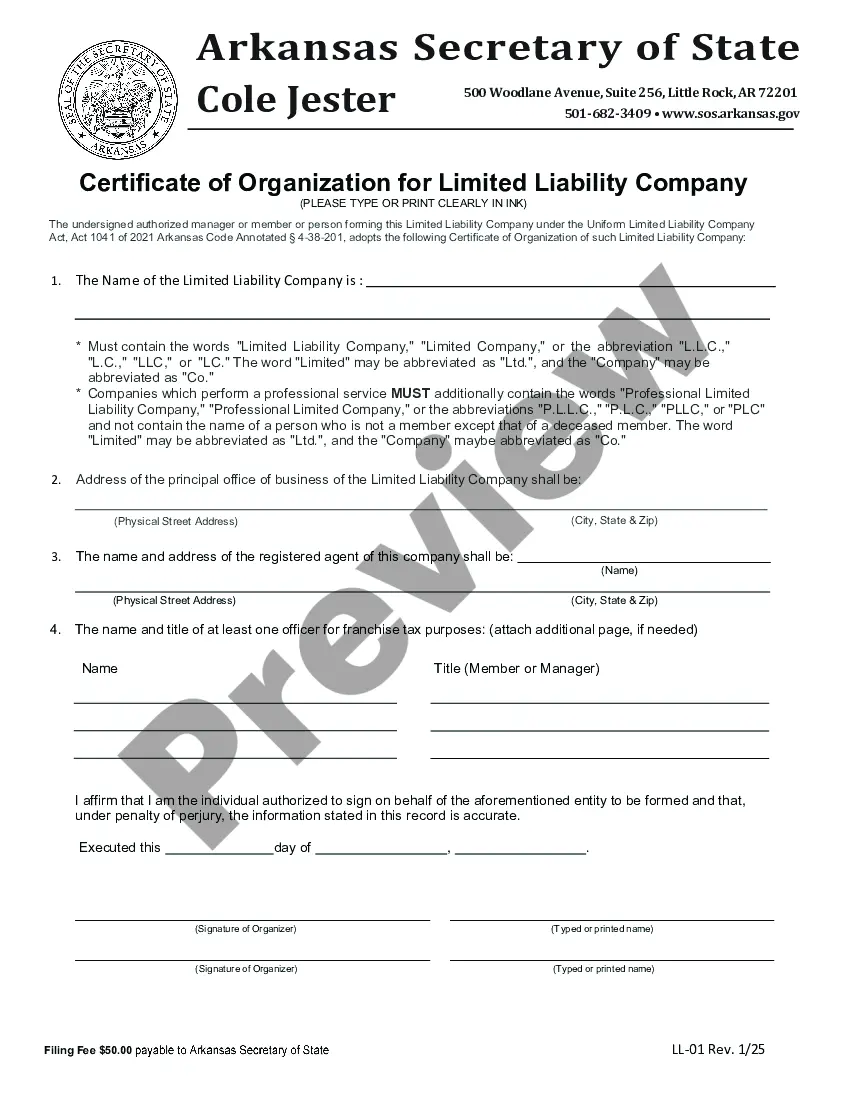

To file Article of Organization in paper format, file with the South Carolina Secretary of State and pay a fee of $110. Fill out the pdf form online, print and mail 2 copies, the original and either a duplicate original or a conformed copy.

A South Carolina LLC operating agreement is a legal document that is designed to guide the users of any size business in properly creating an agreement that would provide needed protections for any company. This agreement is not required in this State in order to conduct business within the State.

If you are a Limited Liability Company (LLC), professional organization, or other association taxed as a corporation and not exempt under SC Code Section 12-20-110, you must submit a CL-1 and include a $25 payment.

A limited liability company (LLC) is a business structure in the United States whereby the owners are not personally liable for the company's debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship. 1feff

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

How much does it cost to form an LLC in South Carolina? The South Carolina Secretary of State charges a $110 fee to file the Articles of Organization. You can reserve your LLC name with the South Carolina Secretary of State for $25.

Businesses operating in South Carolina will file their annual report along with their tax returns the form itself is essentially a tax return that also renews your business' status in the state. To file, complete your taxes and determine what must be paid.

To form an LLC in South Carolina you will need to file the Articles of Organization with the South Carolina Secretary of State, which costs $110. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your South Carolina Limited Liability Company.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.