Rhode Island Quitclaim Deed from Individual to Two Individuals in Joint Tenancy

Overview of this form

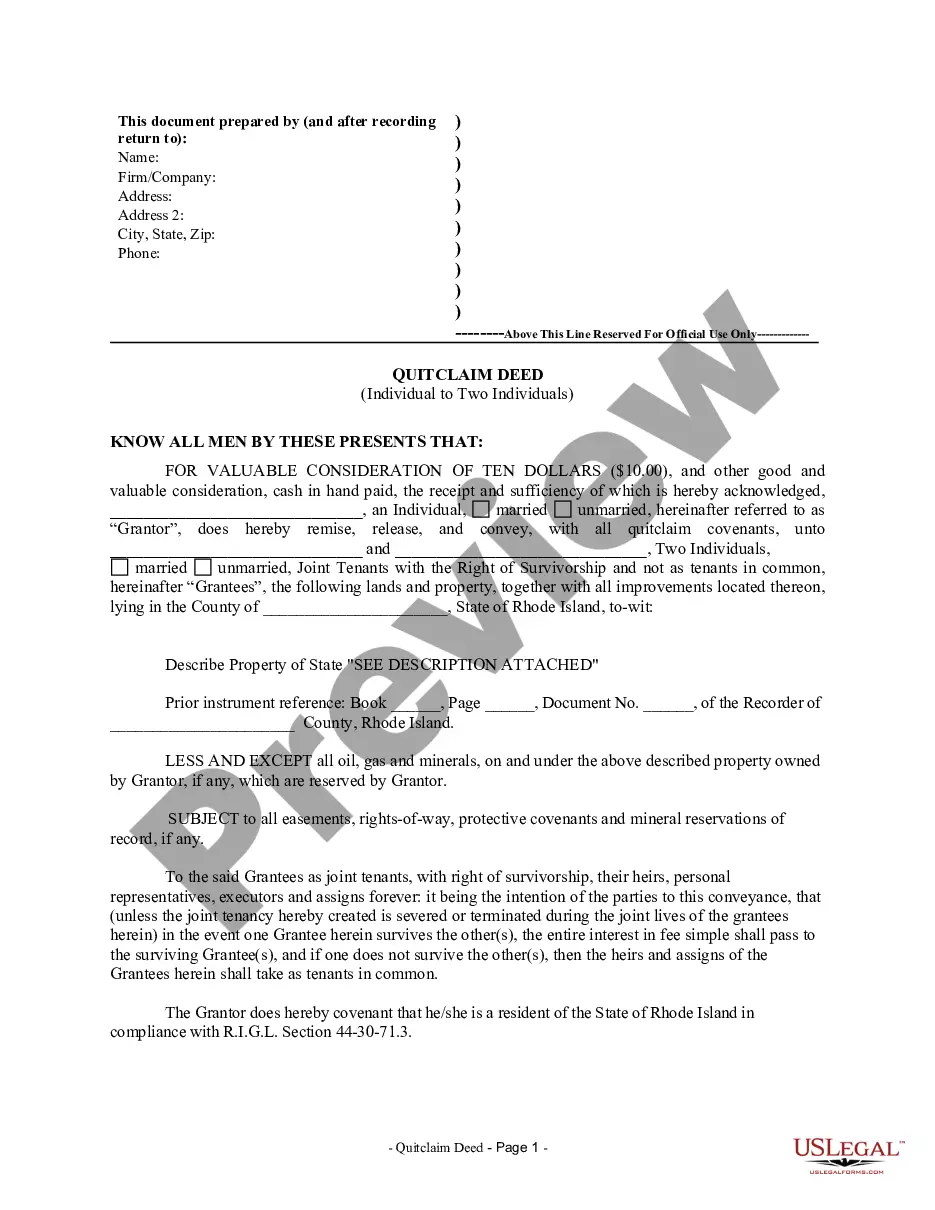

The Quitclaim Deed from Individual to Two Individuals in Joint Tenancy is a legal document through which an individual (the Grantor) transfers ownership of property to two other individuals (the Grantees) as joint tenants. This form is essential for establishing joint ownership of real estate, ensuring that if one owner passes away, the surviving owner retains full rights to the property. Unlike a warranty deed, a quitclaim deed does not guarantee that the title is clear of other claims or liens, making it a simpler option for transferring property between parties who may know each other well.

Main sections of this form

- Grantor: The individual transferring the property.

- Grantees: The two individuals receiving property as joint tenants.

- Property Description: Detailed information about the real estate being transferred.

- Reservation Clause: Specifies that oil, gas, and minerals beneath the property are not included in the transfer.

- Joint Tenancy Clause: States that after the death of one Grantee, the property will automatically pass to the surviving Grantee.

- Compliance Certification: Certifies compliance with local smoke detector laws.

When to use this document

This form is suitable when an individual wishes to transfer ownership of property to two individuals who will hold it in joint tenancy. You might use this form in scenarios such as transferring a property to a family member and a partner, establishing joint ownership for estate planning, or removing one owner from the title while retaining joint ownership with another. This deed is particularly useful for ensuring that upon a co-owner's death, the surviving co-owner automatically inherits the deceased's share of the property.

Who this form is for

- Individuals transferring real estate to two other individuals.

- People looking to establish joint tenancy with right of survivorship for family or partners.

- Grantors wanting to convey property without making warranties on the title.

- Real estate professionals assisting clients with property transfers.

How to prepare this document

- Identify the parties involved: Clearly state the name of the Grantor and the two Grantees.

- Specify the property: Accurately describe the property being transferred, including any legal descriptions attached.

- Indicate the reservation: Note any exceptions regarding oil, gas, and minerals being retained by the Grantor.

- Sign and date the form: The Grantor must sign and date the document to validate the transfer.

- Get notarized: Ensure the form is notarized to meet legal requirements, if necessary.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to accurately describe the property being transferred.

- Not including all necessary signatures, especially from both Grantees.

- Omitting the reservation clause for oil, gas, or minerals.

- Not notarizing the form when required.

- Using outdated or incorrect state-specific language or references.

Looking for another form?

Form popularity

FAQ

In some instances, however, quitclaim deeds are used when the grantor has a mortgage. In this case, the grantor remains liable for the mortgage even after ownership has transferred through the execution of a quitclaim deed. Quitclaim deeds transfer title but do not affect mortgages.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Filing a quitclaim deed is a right of any property owner. You can file a quitclaim deed without refinancing your mortgage, but you are still responsible for the payments. Transferring the mortgage without refinancing is possible through an assumption of the loan, which requires lender approval.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.