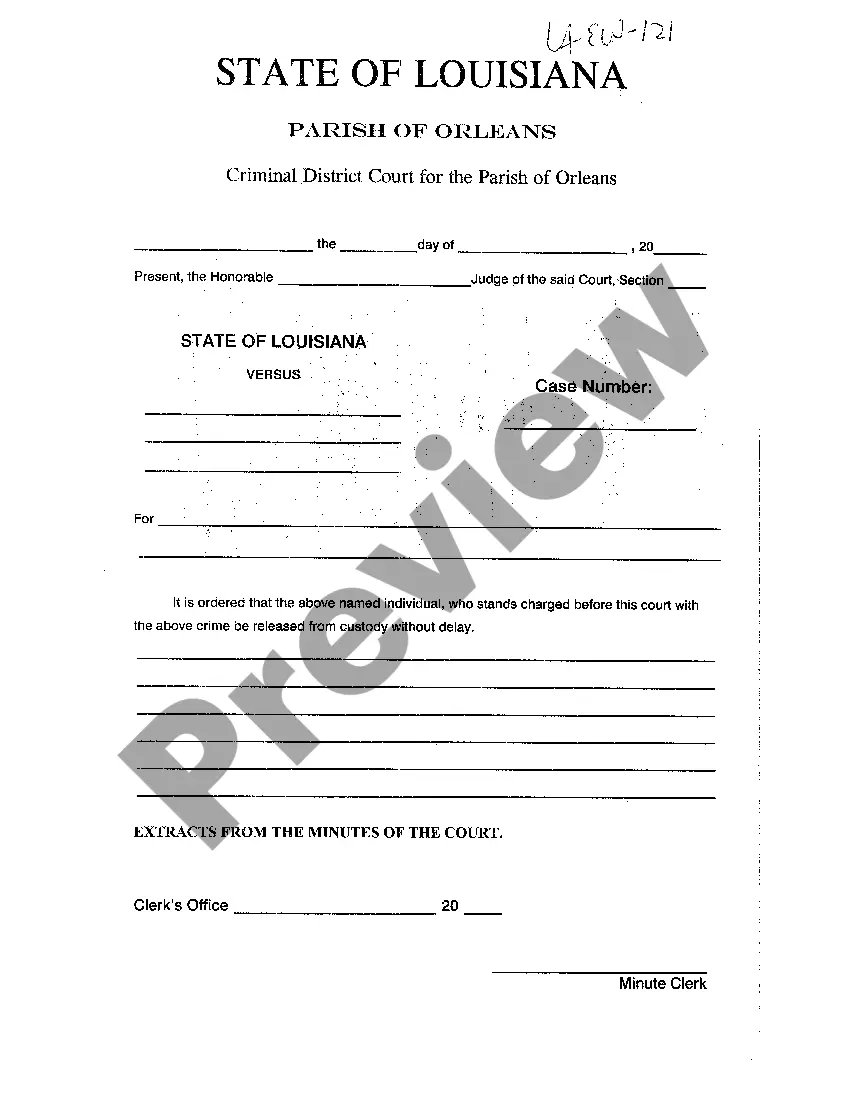

Oregon Motion For Stay of Payment Of Income Tax is a motion filed in Oregon to temporarily stop or suspend the payment of income tax. This motion is used by taxpayers to postpone the payment of their income tax due to certain financial hardships, such as unexpected medical bills or job loss. It allows the taxpayer to reduce their tax burden in order to maintain financial stability. There are two types of Oregon Motion For Stay of Payment Of Income Tax: partial stay and full stay. A partial stay postpones the payment of some taxes due, while a full stay postpones the entire amount of tax due. In both cases, the taxpayer must show evidence of financial hardship in order to be granted the stay.

Oregon Motion For Stay of Payment Of Income Tax

Description

How to fill out Oregon Motion For Stay Of Payment Of Income Tax?

If you’re searching for a way to appropriately complete the Oregon Motion For Stay of Payment Of Income Tax without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business scenario. Every piece of paperwork you find on our online service is created in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Oregon Motion For Stay of Payment Of Income Tax:

- Make sure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and choose your state from the dropdown to find another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Oregon Motion For Stay of Payment Of Income Tax and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

If you're a part-year resident, your income tax is based on taxable income from Oregon sources while you're a nonresident plus your taxable income from all sources while you're a resident.

Because California allows Oregon residents to claim a credit for mutually taxed income on the California nonresident return, Elizabeth is not allowed to claim the credit on the Oregon resident return.

Oregon has a 6.60 percent to 7.60 percent corporate income tax rate and levies a gross receipts tax. Oregon does not have a state sales tax and does not levy local sales taxes.

Refund, complaint, audit and appeal procedures You can claim a refund for a previous tax year by filing an amended return up to (a) three years from the due date of your original return or the date you filed your tax return or (b) two years from the date you paid your tax or a portion of your tax, whichever is later.

Personal income tax penalties You will owe a 5 percent late-payment penalty on any Oregon tax not paid by the original due date of the return, even if you have filed an extension. If you file more than three months after the due date (including extensions), a 20 percent late-filing penalty will be added.

Generally, you must file a claim for a credit or refund within three years from the date you filed your original tax return or two years from the date you paid the tax, whichever is later.

The credit for taxes paid to another state is automatically calculated in your account when you add a Nonresident return to your already created resident return; if you pay taxes to both states.