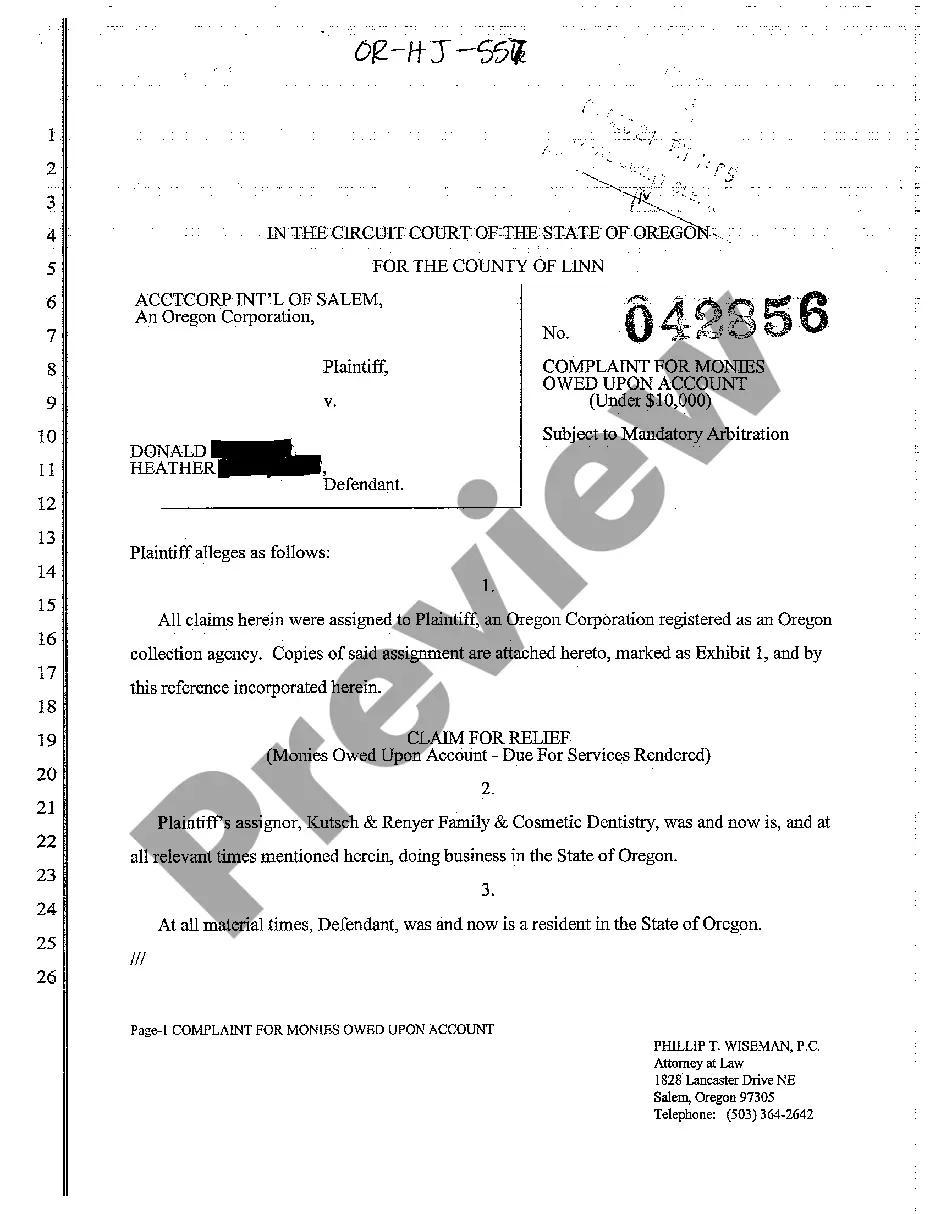

Oregon Complaint for Monies Owed Upon Account

Description

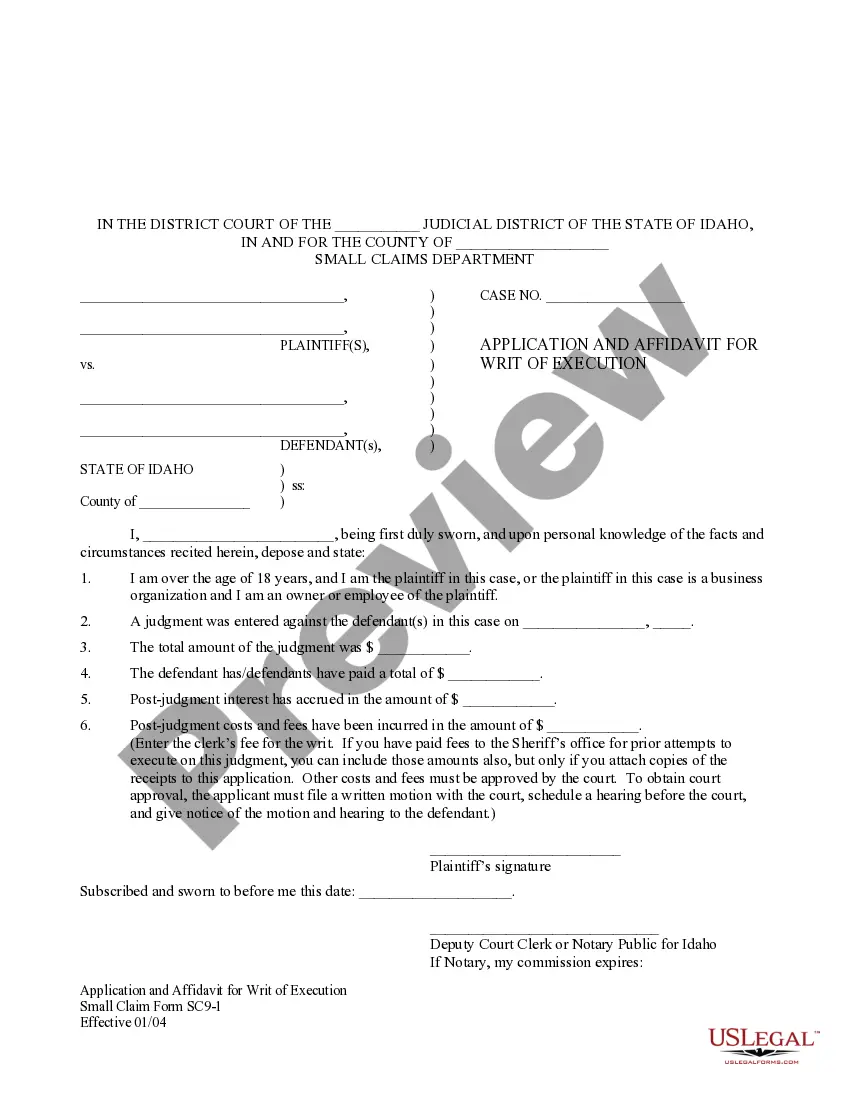

How to fill out Oregon Complaint For Monies Owed Upon Account?

The work with documents isn't the most easy job, especially for people who almost never deal with legal papers. That's why we recommend utilizing correct Oregon Complaint for Monies Owed Upon Account samples made by professional attorneys. It gives you the ability to avoid difficulties when in court or working with official institutions. Find the files you need on our site for high-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will immediately appear on the template webpage. Soon after getting the sample, it will be stored in the My Forms menu.

Users with no a subscription can quickly get an account. Use this simple step-by-step guide to get your Oregon Complaint for Monies Owed Upon Account:

- Make certain that the document you found is eligible for use in the state it’s necessary in.

- Confirm the file. Make use of the Preview option or read its description (if available).

- Buy Now if this template is what you need or use the Search field to get a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After completing these straightforward steps, you can complete the sample in your favorite editor. Recheck filled in information and consider asking a lawyer to review your Oregon Complaint for Monies Owed Upon Account for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Form popularity

FAQ

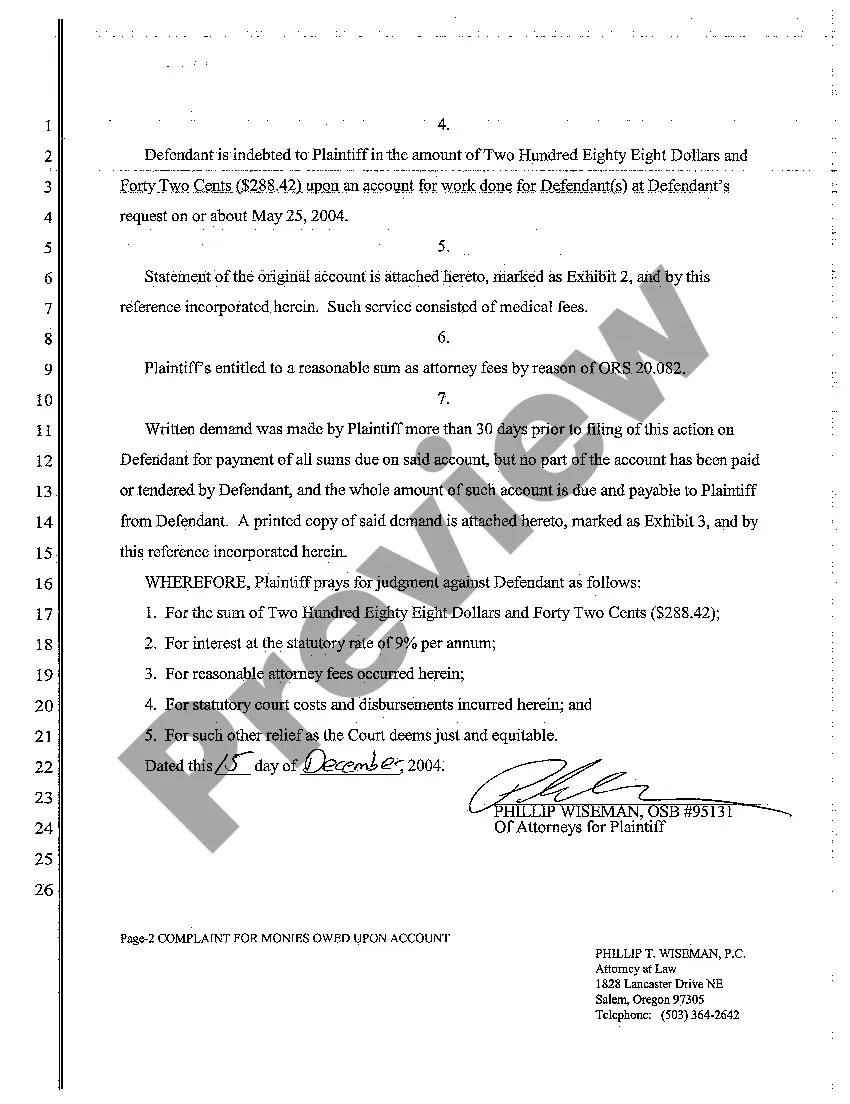

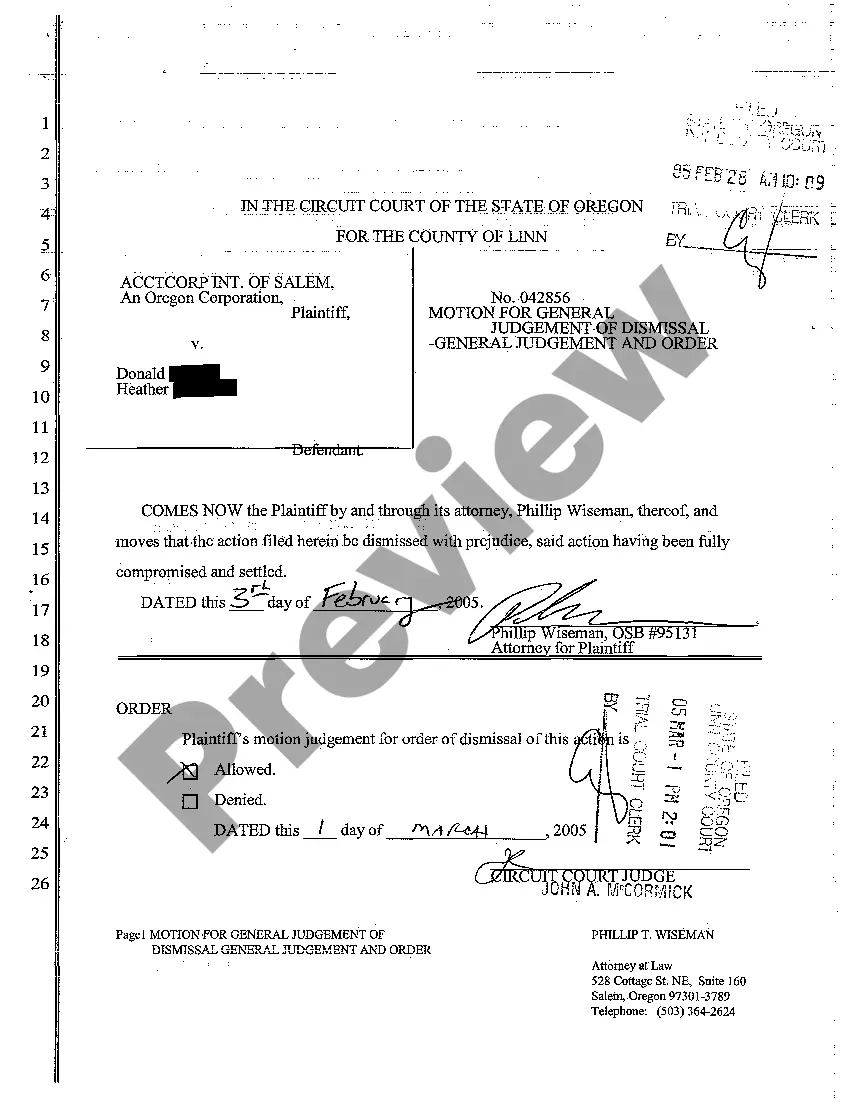

What happens when you get sued for debt. Lawsuits are a common and efficient debt collection tactic.The complaint will say why the creditor is suing you and what it wants. Typically, that's the money you owe plus interest, and maybe attorney fees and court costs.

It costs between $30-$75 to file a small claims lawsuit. Once the lawsuit is filed, the person you sued has to be notified that a lawsuit has been filed against them. This is called serving.

The debt collector may check into your bank accounts for a period of years to see if they can take that money to satisfy the debt. If they do find your account, they restrain the funds and legal take what is owed according to the judgment amount plus the interest accrued.

If a creditor fails to show in court, the case may get dismissed since the creditor won't be present to provide evidence regarding their claim.The creditor may obtain a judgment order that allows them to seize assets, property or wage garnishment to satisfy outstanding credit card debt.

You typically can't be arrested for debts, only sued, but in some states you can be arrested for failure to comply with a court-ordered judgment. You can't be arrested just because you owe money on what you might think of as consumer debt: a credit card, loan or medical bill.

A collection agency is a company that lenders use to recover funds that are past due or from accounts that are in default. Collection agencies work closely with the credit bureaus and lenders to try to retrieve delinquent funds.

Speak with an attorney. Determine who you need to sue. Determine where you need to sue. Fill out the small claims court forms. Gather all documents related to the money owed.

If the creditor wants you to pay them money, they can take you back to court on a Supplemental Process to garnish your wages. They can take money out of your paycheck before you get paid. If you are collection proof, the creditor cannot take any of your assets or income even though they have a judgment against you.

According to OregonLive, the statute of limitations for credit card debt in Oregon is six years.Ignoring your debt may seem to work for a while, but creditors and collection agencies may be using the time to prepare a lawsuit against you.