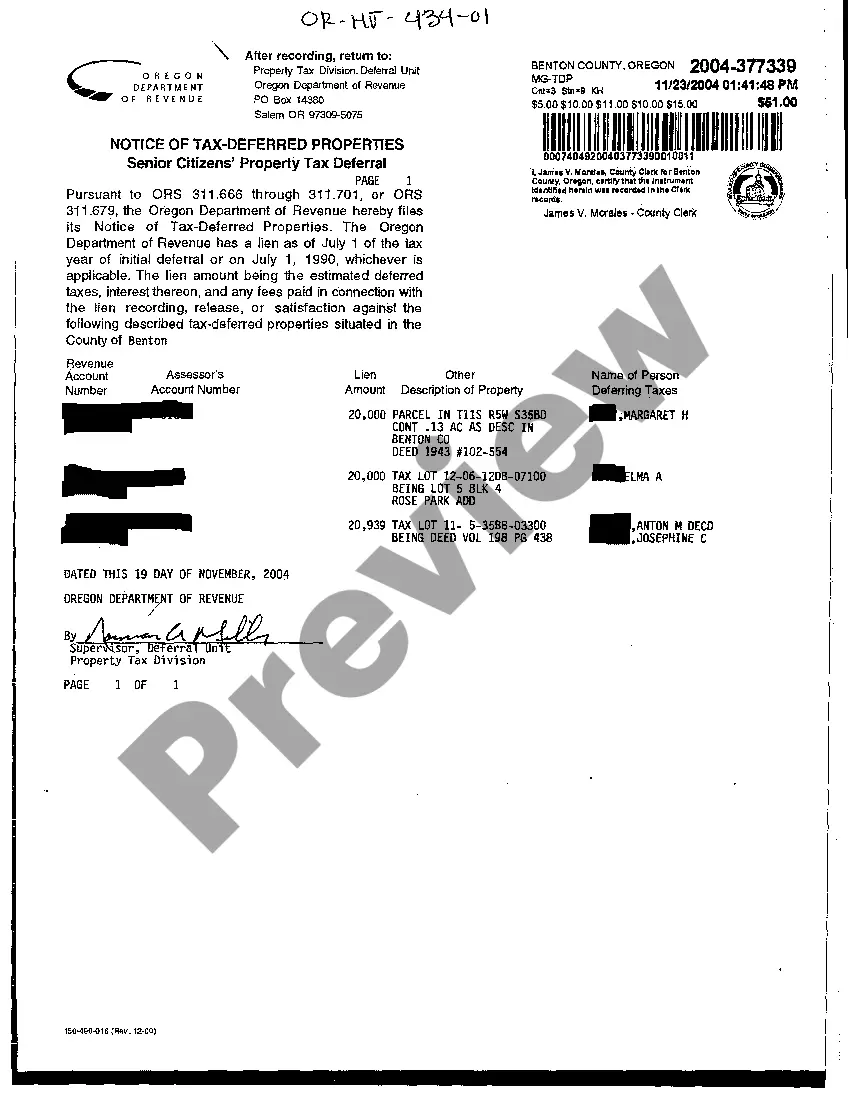

Oregon Notice of Tax-Deferred Properties

Description

How to fill out Oregon Notice Of Tax-Deferred Properties?

Creating papers isn't the most simple task, especially for those who almost never work with legal paperwork. That's why we advise making use of accurate Oregon Notice of Tax-Deferred Properties samples created by professional attorneys. It gives you the ability to prevent problems when in court or dealing with official organizations. Find the documents you need on our website for high-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will automatically appear on the template web page. After accessing the sample, it will be stored in the My Forms menu.

Users with no a subscription can easily create an account. Follow this simple step-by-step guide to get your Oregon Notice of Tax-Deferred Properties:

- Ensure that file you found is eligible for use in the state it’s necessary in.

- Confirm the file. Utilize the Preview feature or read its description (if available).

- Click Buy Now if this form is what you need or use the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

After doing these straightforward actions, you can fill out the form in your favorite editor. Double-check filled in information and consider requesting a legal representative to review your Oregon Notice of Tax-Deferred Properties for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

In Oregon, property taxes that aren't paid on or before May 15 of the tax year in which they're billed are delinquent. The property is subject to a tax foreclosure three years after the first date of delinquency.It then applies for a judgment with the court and publishes the foreclosure list in a newspaper.

Use multcoproptax.com to look up your property tax bill/statement. You can view copies of your bill back through 2018. You can see property value and tax information back through 2008.

There are a few ways to find tax liens on your property. First, you can search your local county assessor's website. Next, you can visit your local county assessor's office. Third, you can hire a title company to conduct a lien search on your property.

21e8 Oregon is the only U.S. state, imposing a property tax and providing property tax relief to low-income senior homeowners exclusively through a property tax deferral program (excluding the disabled war veterans exemption).

21e8 Oregon is the only U.S. state, imposing a property tax and providing property tax relief to low-income senior homeowners exclusively through a property tax deferral program (excluding the disabled war veterans exemption).

Forestland Deferral You may download an Application for Designation of Land as Forestland. If you have questions or wish to file an application, you can contact the Assessor's Office at (503) 623-8391 and ask for assistance with Forestland Deferral.

In Oregon, property taxes that aren't paid on or before May 15 of the tax year in which they're billed are delinquent. The property is subject to a tax foreclosure three years after the first date of delinquency.It then applies for a judgment with the court and publishes the foreclosure list in a newspaper.

In Oregon, real proper- ty is subject to foreclosure three years after the taxes become delinquent. When are taxes delinquent? Property taxes can be paid in full by November 15 or in three installments: November 15, February 15, and May 15. If the taxes aren't paid in full by May 16 they are delinquent.