Oregon Property Manager Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Property Manager Agreement?

When it comes to completing Oregon Property Manager Agreement, you probably think about an extensive process that requires getting a suitable form among numerous similar ones and then needing to pay out legal counsel to fill it out for you. Generally, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific form within just clicks.

If you have a subscription, just log in and click Download to get the Oregon Property Manager Agreement sample.

If you don’t have an account yet but need one, follow the step-by-step guide below:

- Be sure the file you’re getting is valid in your state (or the state it’s needed in).

- Do so by looking at the form’s description and also by clicking the Preview function (if available) to view the form’s information.

- Simply click Buy Now.

- Select the suitable plan for your financial budget.

- Join an account and select how you want to pay out: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Find the file on the device or in your My Forms folder.

Skilled attorneys work on creating our templates to ensure that after downloading, you don't need to bother about modifying content material outside of your personal info or your business’s information. Sign up for US Legal Forms and receive your Oregon Property Manager Agreement example now.

Form popularity

FAQ

The percentage collected will vary, but is traditionally between 8% and 12% of the gross monthly rent. Managers will often charge a lower percentage, between 4% and 7%, for properties with 10 units or more or for commercial properties, and a higher percentage, 10% or more, for smaller or residential properties.

While the industry average is anywhere from 25 to 30% of the rental cost, the fees that are charged by the vacation rental property management companies vary. They vary based on the location of the property and the company themselves. The can go anywhere from 10% all the way up to 50%.

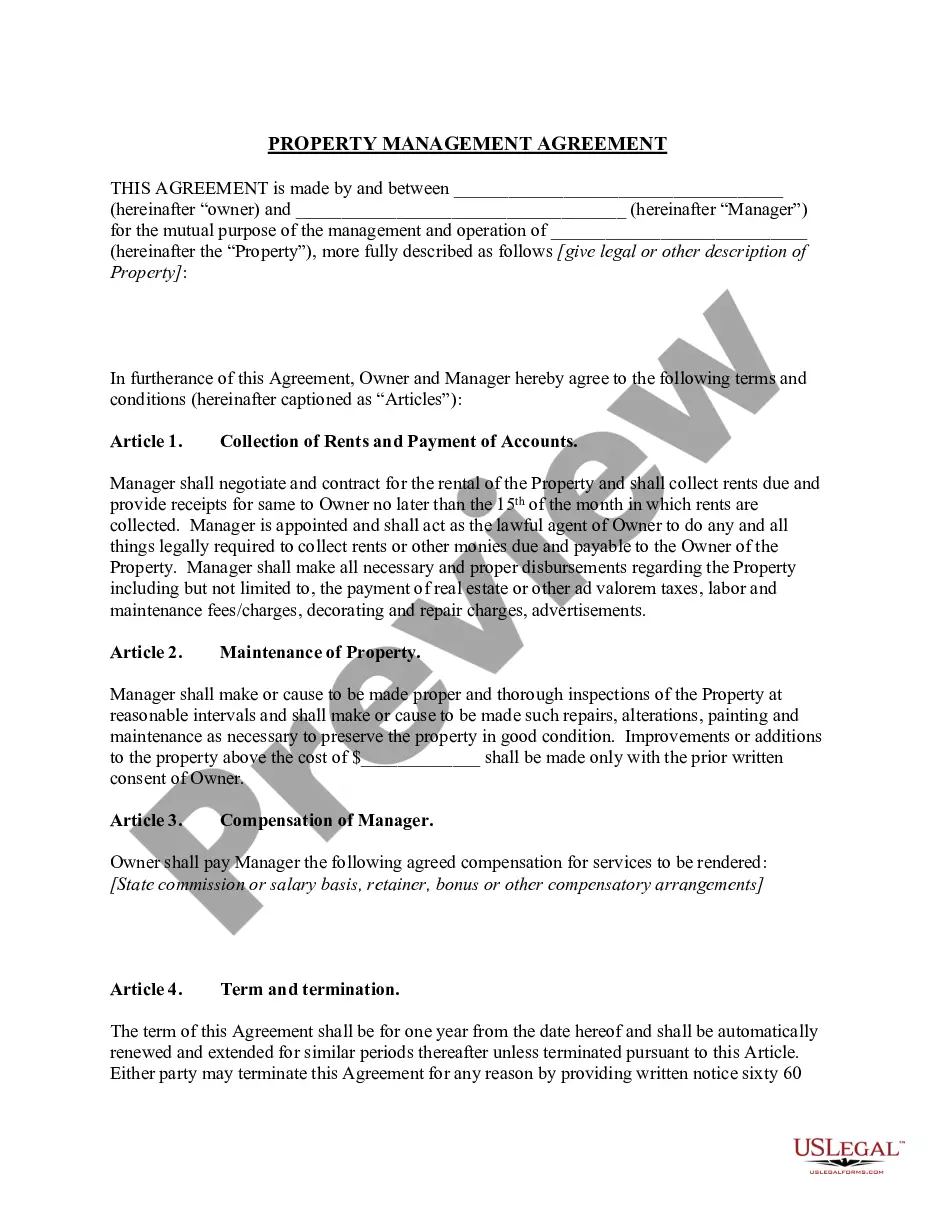

A property management agreement is a contract between a property owner and the company or person hired to manage the property.A well-drafted agreement includes a clause about the type of insurance coverage a building owner must carry for the building.

Increase the rent. Manage multiple rental properties. Leverage technology. Offer additional services. Cut down expenses. Get a real estate agent license. Add value to rental properties. Market effectively- both to tenants and to clients.

The property manager can provide full leasing services. They effectively negotiate leases with tenants and prepare those leases for signature. They make suggestions regarding the tenant mix and prospective tenants.

A property manager costs approximately 7-10% of your total rental income, however the services and expertise offered by a good property manager is worth much much more than this fee, plus in many cases the agents service fee is tax deductable.

Must Oregon Property Management Companies Have a Real Estate Broker's License? NO. Oregon is one of the few states that provides for a separate property management license option for property managers. Real estate brokers and salespeople (working under a broker) may also engage in property management.

Property management isn't worth the money to some investors.One important note, even if you choose to manage your own properties it pays to have a backup plan in case you're no longer able to handle them. For others investing in real estate, there's no way they'd choose to manage their own rental properties.

Fees and services. The exact breakdown and total of all services and associated fees should be included in the property management contract. The responsibilities of the property owner. Equal opportunity housing. Liability. Contract duration. Termination clause.