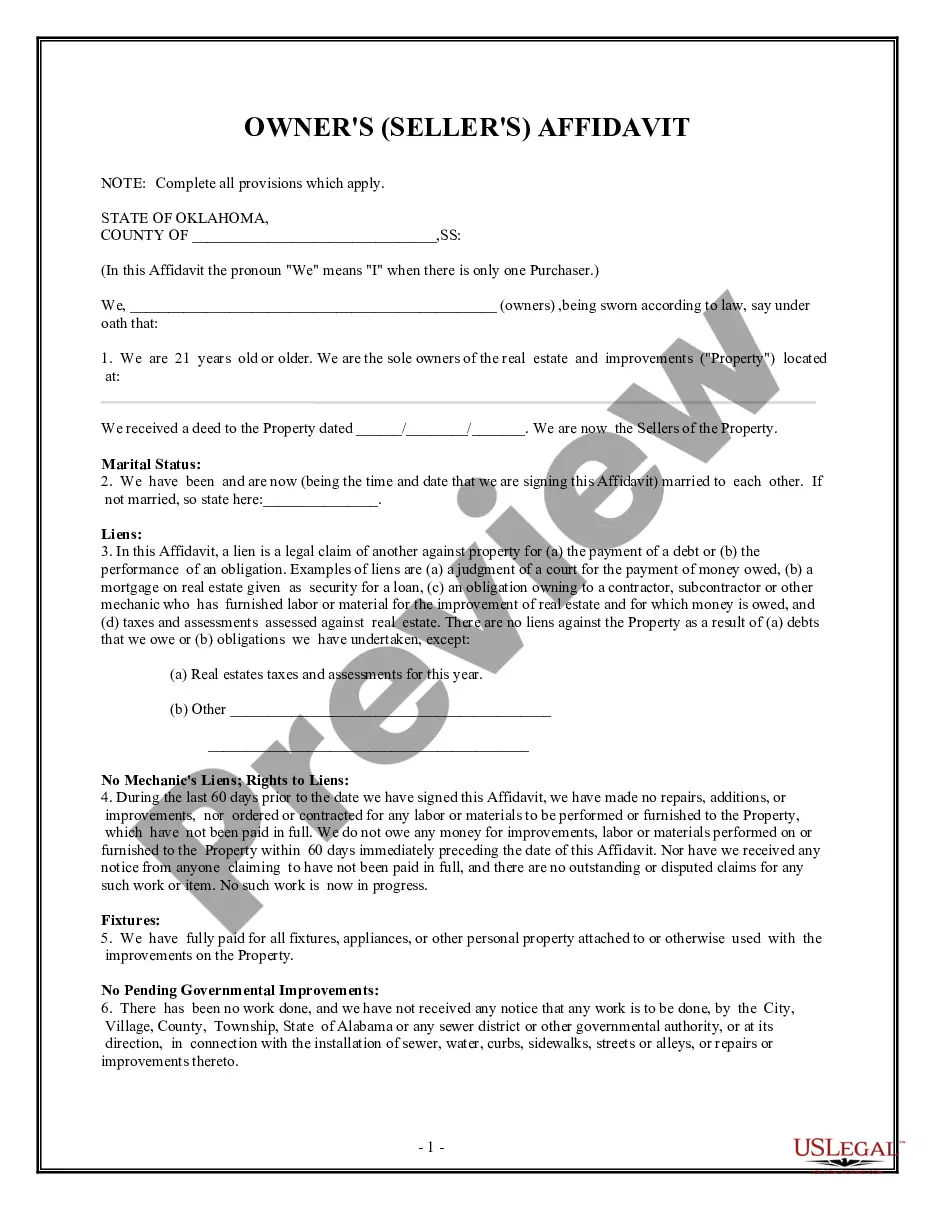

Oklahoma Owner's or Seller's Affidavit of No Liens

Description

How to fill out Oklahoma Owner's Or Seller's Affidavit Of No Liens?

In terms of submitting Oklahoma Owner's or Seller's Affidavit of No Liens, you most likely imagine an extensive procedure that involves choosing a perfect form among a huge selection of very similar ones then needing to pay an attorney to fill it out to suit your needs. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific document within clicks.

For those who have a subscription, just log in and then click Download to find the Oklahoma Owner's or Seller's Affidavit of No Liens sample.

In the event you don’t have an account yet but want one, stick to the step-by-step guideline listed below:

- Make sure the document you’re getting is valid in your state (or the state it’s required in).

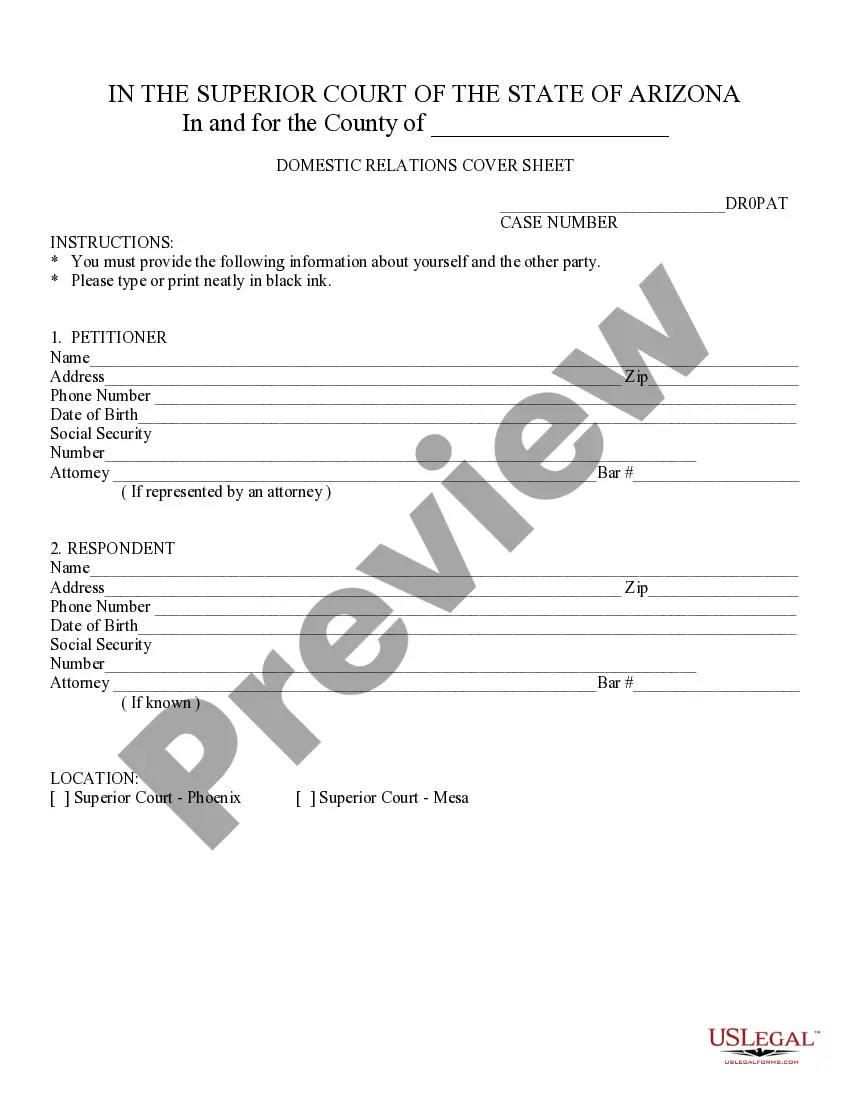

- Do this by reading through the form’s description and by clicking on the Preview function (if available) to find out the form’s content.

- Simply click Buy Now.

- Select the appropriate plan for your financial budget.

- Sign up for an account and choose how you want to pay: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Professional legal professionals work on creating our samples to ensure that after saving, you don't need to bother about modifying content outside of your individual information or your business’s details. Join US Legal Forms and get your Oklahoma Owner's or Seller's Affidavit of No Liens sample now.

Form popularity

FAQ

Unlike the buyer, who may have to attend the closing to sign original loan documents delivered by the lender to the closing, you, as the seller, may or may not need to attend. For either a conventional escrow closing or a table closing, you may be able to pre-sign the deed and other transfer documents.

At your mortgage closing, you meet with various legal representatives to sign your mortgage and other documents, make any required payments and receive the keys to your new property.You give a certified or cashier's check to cover the down payment (if applicable), closing costs, prepaid interest, taxes and insurance.

But unlike buyers, sellers can't back out and forfeit their earnest deposit money (usually 1-3 percent of the offer price). If you decide to cancel a deal when the home is already under contract, you can be either legally forced to close anyway or sued for financial damages.

It's not necessary for either the buyer or the seller to be present during a real estate closing. A real estate attorney or title agent designated by the buyer may handle all necessary paperwork and verify monetary transactions. The real estate agents who facilitated the sale may or may not attend.

If the seller backs out for a reason that isn't provided by the contract, the buyer can take the seller to court and force the home sale.The seller may have to pay the buyer's legal fees and court costs. The buyer's escrow money is also returned, with interest.

Generally four to six weeks are required before a "Closing Date" can be set, sooner for a cash transaction. At the "Closing", the Buyer and Seller will meet to sign the final papers and transfer title via the deed.

Who Attends the Closing of a House? Depending on where you live, those at your closing appointment might include you (the buyer), the seller, the escrow/closing agent, the attorney (who might also be the closing agent), a title company representative, the mortgage lender, and the real estate agents.

Unlike the buyer, who may have to attend the closing to sign original loan documents delivered by the lender to the closing, you, as the seller, may or may not need to attend. For either a conventional escrow closing or a table closing, you may be able to pre-sign the deed and other transfer documents.