New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out New York Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Use US Legal Forms to get a printable New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms catalogue on the web and offers cost-effective and accurate samples for consumers and lawyers, and SMBs. The templates are grouped into state-based categories and some of them can be previewed prior to being downloaded.

To download samples, users must have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to easily find and download New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract:

- Check out to ensure that you get the correct template in relation to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Over three million users have already used our platform successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

Real Estate Transfer Disclosure Statement (TDS) The Transfer Disclosure Statement, also known as the TDS, is a form required by California law in most residential real estate transactions pursuant to California Civil Code 1102.

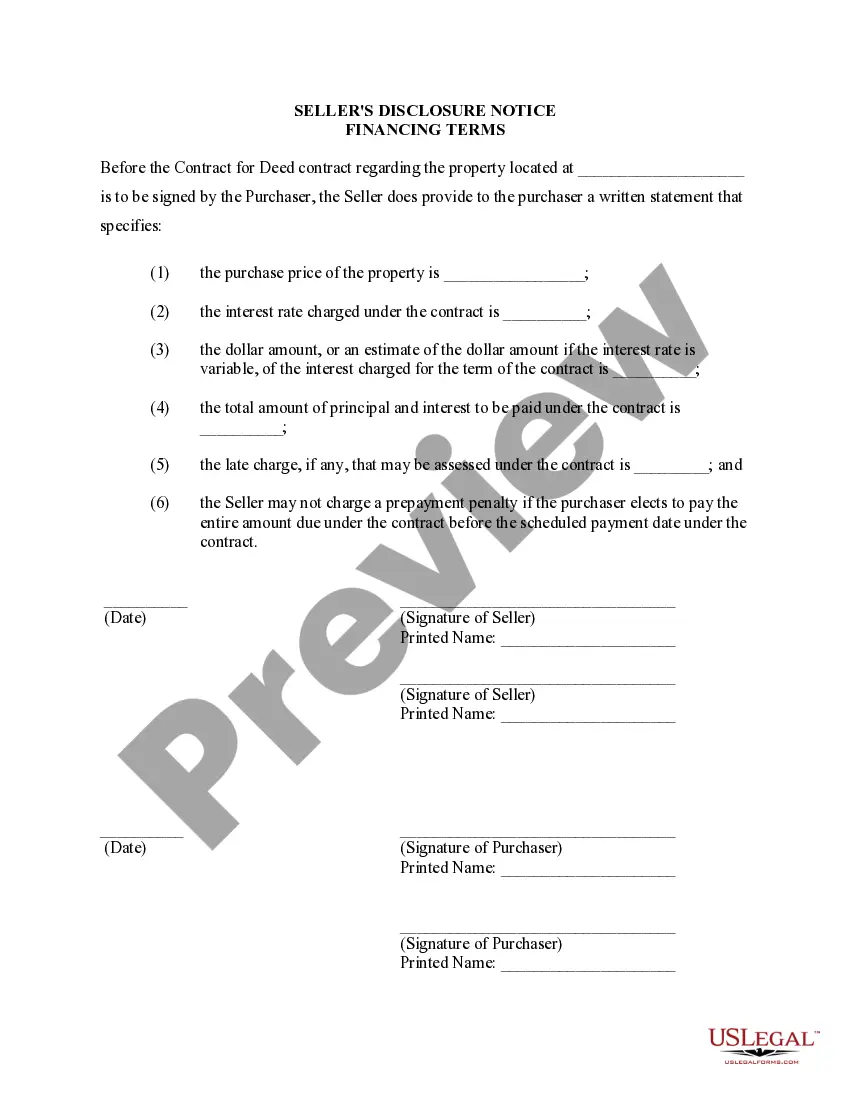

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

A seller disclosure form is a document required by State law that discloses certain physical and/or title conditions of a one- to four-unit residential property by a seller to a buyer during a title transfer. The laws regarding what sellers are required to disclose vary State-to-State.

A Seller is not required to provide a PCDS in British Columbia. If a Seller is not willing to provide a PCDS, they may not be disclosing a major issue with the property. The fact a Seller is not willing to provide a PCDS to a potential Buyer should be cause for concern to the Buyer.

Who Must Make These Seller Disclosures in California. As a broad rule, all sellers of residential real estate property containing one to four units in California must complete and provide written disclosures to the buyer.

Property disclosure statements essentially outline any flaws that the home sellers (and their real estate agents) are aware of that could negatively affect the home's value. These statements are required by law in most areas of the country so buyers can know a property's good and bad points before they close the deal.

But unlike buyers, sellers can't back out and forfeit their earnest deposit money (usually 1-3 percent of the offer price). If you decide to cancel a deal when the home is already under contract, you can be either legally forced to close anyway or sued for financial damages.

One such alternative is the contract for deed. In a contract for deed, the purchase of property is financed by the seller rather than a third-party lender such as a commercial bank or credit union.

You will need to include information about all appliances in the home, including which are included in the sale as well as whether they are operational. You will also need to disclose any room additions, damage, or neighborhood noise problems.