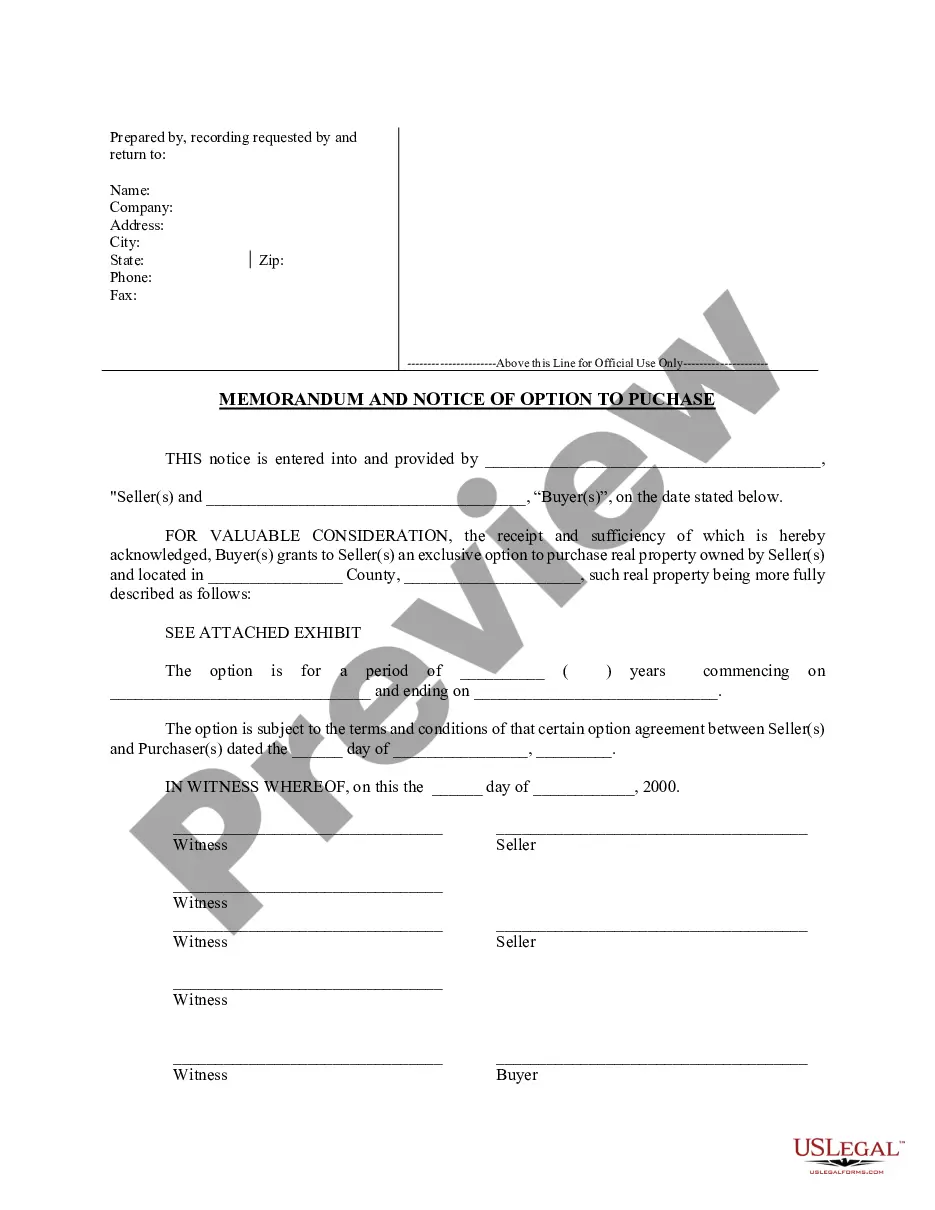

New Mexico Waiver of Lien

Description

How to fill out New Mexico Waiver Of Lien?

US Legal Forms is actually a special system where you can find any legal or tax template for submitting, such as New Mexico Waiver of Lien. If you’re tired of wasting time looking for appropriate examples and spending money on papers preparation/lawyer charges, then US Legal Forms is exactly what you’re looking for.

To reap all of the service’s advantages, you don't need to install any software but just select a subscription plan and sign up your account. If you already have one, just log in and get an appropriate template, download it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need New Mexico Waiver of Lien, have a look at the instructions below:

- Double-check that the form you’re taking a look at is valid in the state you want it in.

- Preview the sample and read its description.

- Click on Buy Now button to access the register page.

- Choose a pricing plan and proceed signing up by entering some info.

- Pick a payment method to complete the registration.

- Save the file by choosing your preferred format (.docx or .pdf)

Now, complete the file online or print out it. If you feel unsure concerning your New Mexico Waiver of Lien sample, speak to a lawyer to check it before you send or file it. Start hassle-free!

Form popularity

FAQ

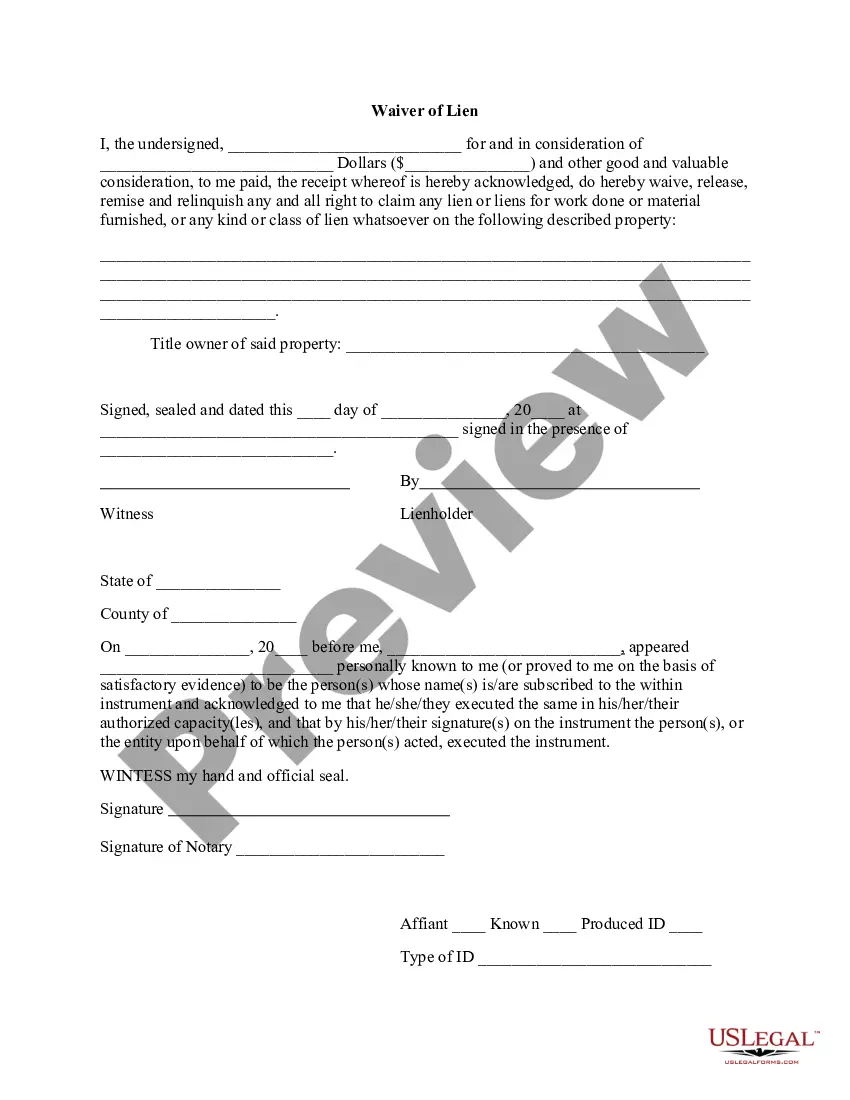

LIen waivers are not required to be notarized. The primary times that a document needs to be notarized is if it is going to be filed with the county recorder or it is an affidavit. There are some other documents that often use notarization, but lien waivers don't fall into any of those that "need to be notarized."

Lien waivers that are given after payment is received and which generally cover payments received in a prior pay period are considered trailing lien waivers.Lien waiv- ers are typically provided with each requisition during the course of the project and at final completion of the project.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

A lien waiver is signed before a lien is actually filed. The party submitting the lien waiver states that they waive the right to lien against the project. In some instances, the property owner or general contractor may request that you sign and deliver a lien waiver before payment is disbursed.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.