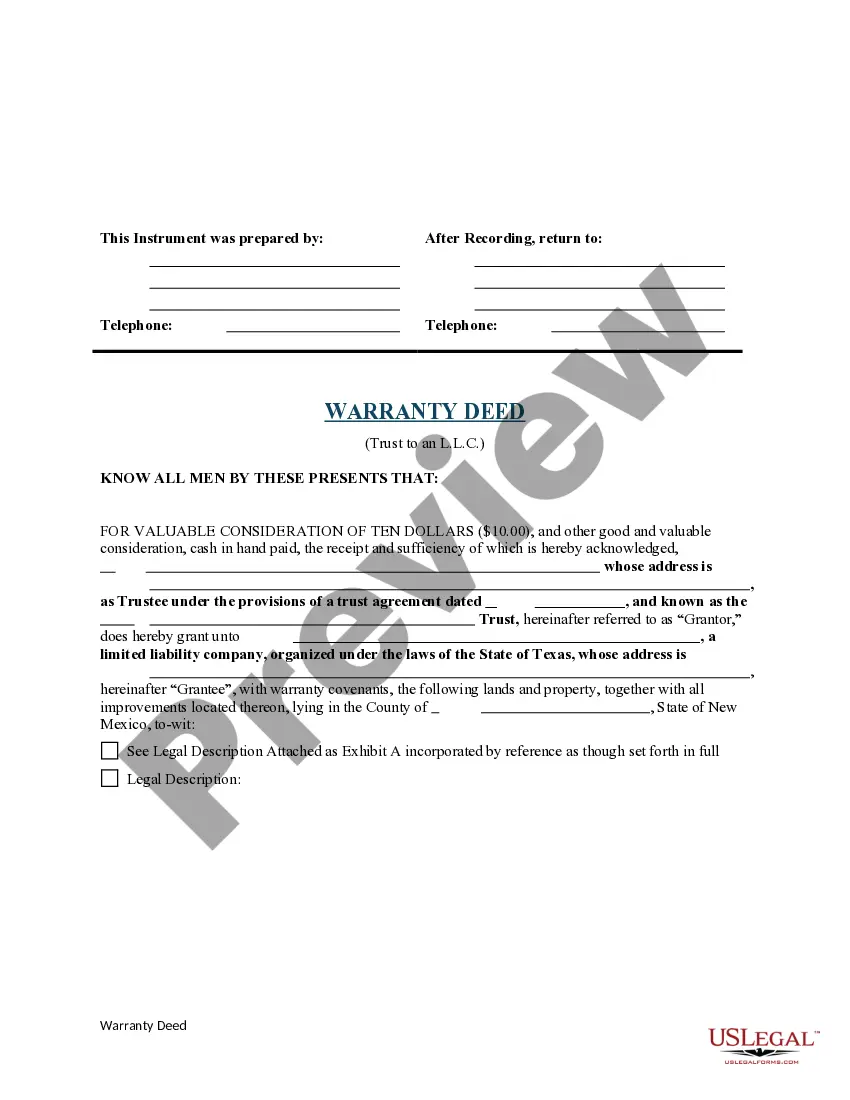

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is a limited liability company (LLC). Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

New Mexico Warranty Deed from a Trust to a Limited Liability Company

Description

How to fill out New Mexico Warranty Deed From A Trust To A Limited Liability Company?

US Legal Forms is really a special platform where you can find any legal or tax document for filling out, such as New Mexico Warranty Deed from a Trust to a Limited Liability Company. If you’re sick and tired of wasting time looking for perfect samples and paying money on papers preparation/attorney charges, then US Legal Forms is precisely what you’re seeking.

To reap all of the service’s benefits, you don't have to install any software but just select a subscription plan and register your account. If you already have one, just log in and look for a suitable template, save it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Warranty Deed from a Trust to a Limited Liability Company, check out the guidelines listed below:

- Double-check that the form you’re considering is valid in the state you need it in.

- Preview the sample and read its description.

- Simply click Buy Now to get to the sign up page.

- Pick a pricing plan and continue registering by entering some information.

- Pick a payment method to finish the registration.

- Download the file by selecting your preferred format (.docx or .pdf)

Now, complete the document online or print out it. If you are unsure regarding your New Mexico Warranty Deed from a Trust to a Limited Liability Company template, speak to a legal professional to analyze it before you decide to send out or file it. Begin hassle-free!

Form popularity

FAQ

Like all deeds, these two legal documents are both used to transfer titles from one owner to another. A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

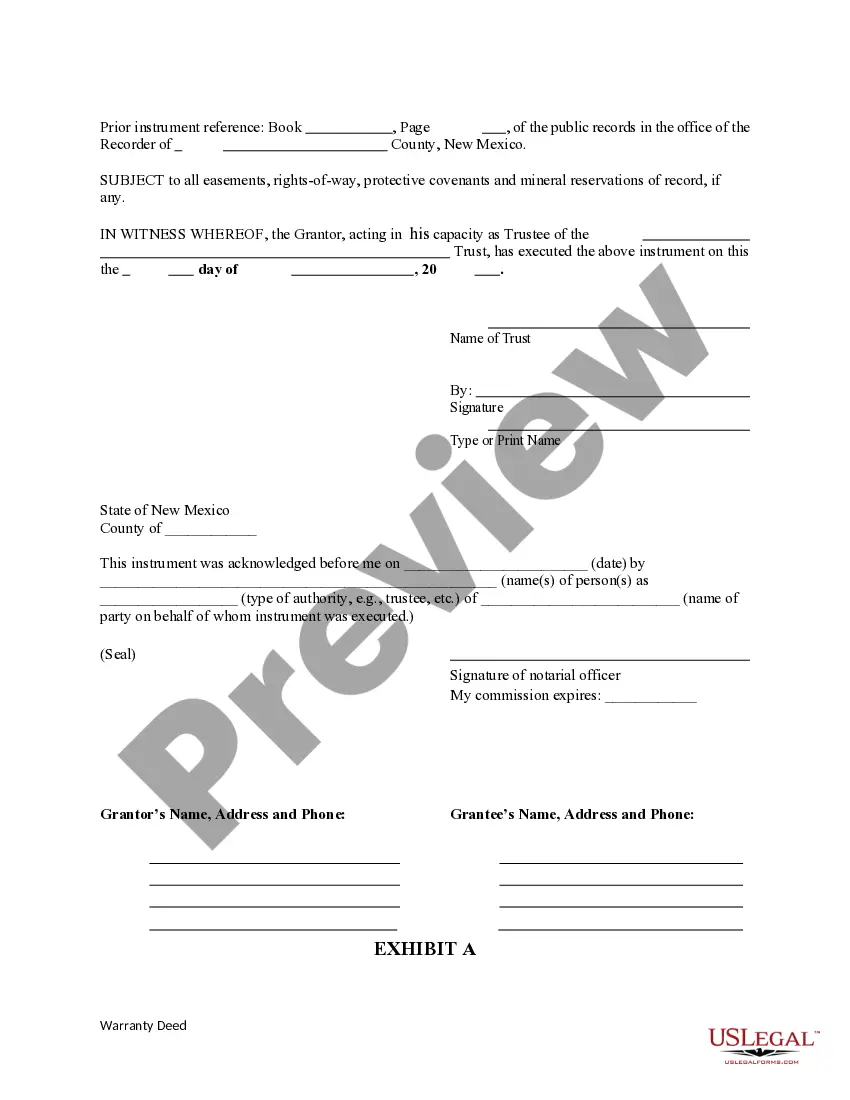

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

A trustee deed offers no such warranties about the title.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

A deed conveys ownership; a deed of trust secures a loan.

In a Limited Warranty Deed, the seller usually gives two warranties. The seller only warrants to the buyer that:This is a very limited warranty in comparison to the broad warranty in a General Warranty Deed where the seller warrants that the seller not only owns the property, but also all rights in the property.