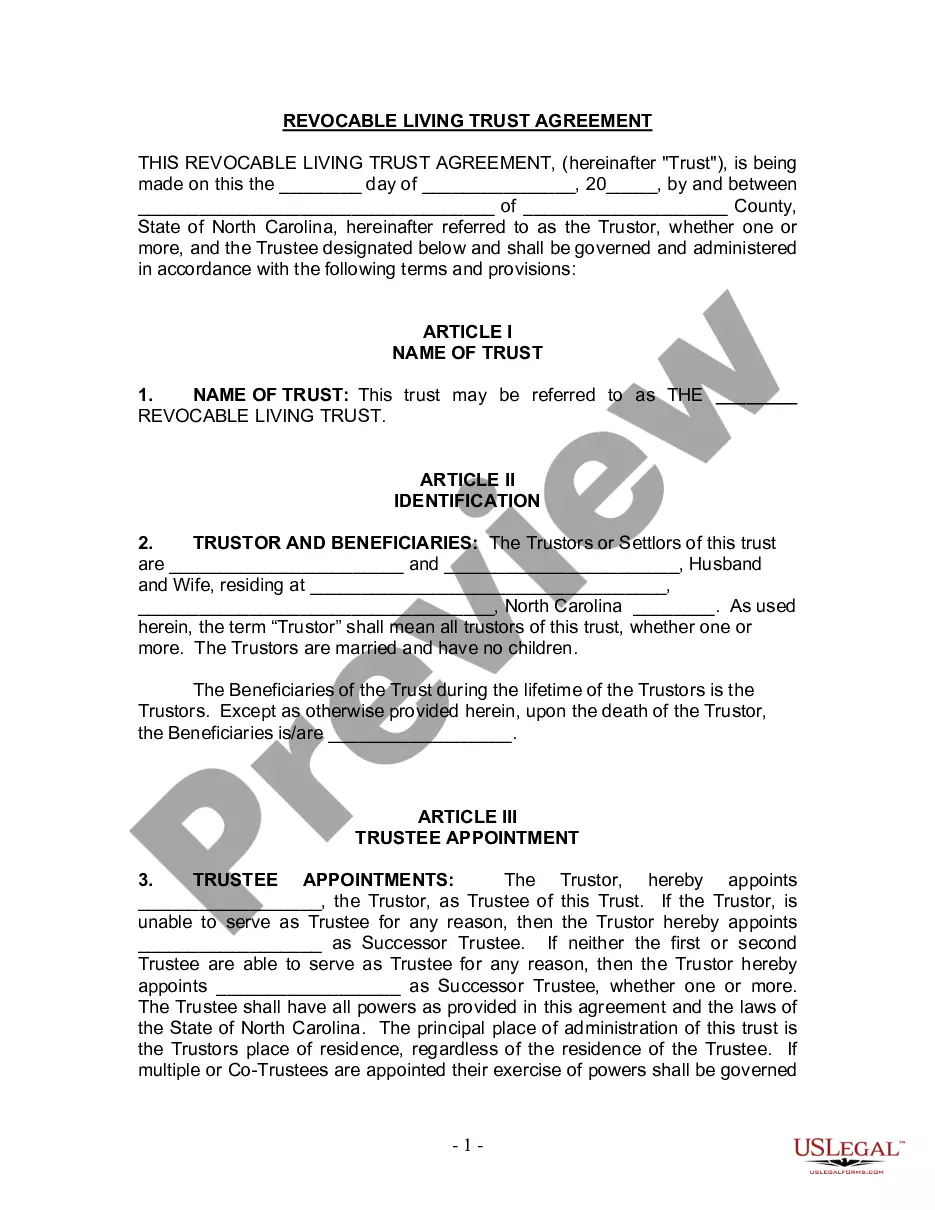

North Carolina Living Trust for Husband and Wife with No Children

Description

How to fill out North Carolina Living Trust For Husband And Wife With No Children?

Avoid costly lawyers and find the North Carolina Living Trust for Husband and Wife with No Children you need at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and obtain legal and tax files. Go through their descriptions and preview them well before downloading. In addition, US Legal Forms enables users with step-by-step instructions on how to obtain and fill out each and every form.

US Legal Forms customers just have to log in and obtain the specific document they need to their My Forms tab. Those, who have not obtained a subscription yet should follow the guidelines listed below:

- Make sure the North Carolina Living Trust for Husband and Wife with No Children is eligible for use where you live.

- If available, read the description and use the Preview option well before downloading the templates.

- If you’re confident the document is right for you, click Buy Now.

- In case the template is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you are able to complete the North Carolina Living Trust for Husband and Wife with No Children manually or with the help of an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

In North Carolina, any person 18-years of age and older can make a will or living trust, and that will or trust will be recognized by law. Whatever debts you owe upon your death, whether it is a car loan or fees owed for personal services, this will come from the assets of your estate.

It is true that in some states (such as California) probate administration can be lengthy and expensive. North Carolina is not one of those states. The maximum court cost that can be saved in North Carolina by using a funded living trust is $3,000, and those costs are generally much less in most estates.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Figure out the type of trust you'll need. Are you single? Take inventory of everything you own. Pick your trustee. Draw up the trust document, either by yourself or with a lawyer. Sign the trust document in front of a notary. Fund the trust this means putting your property into the trust.