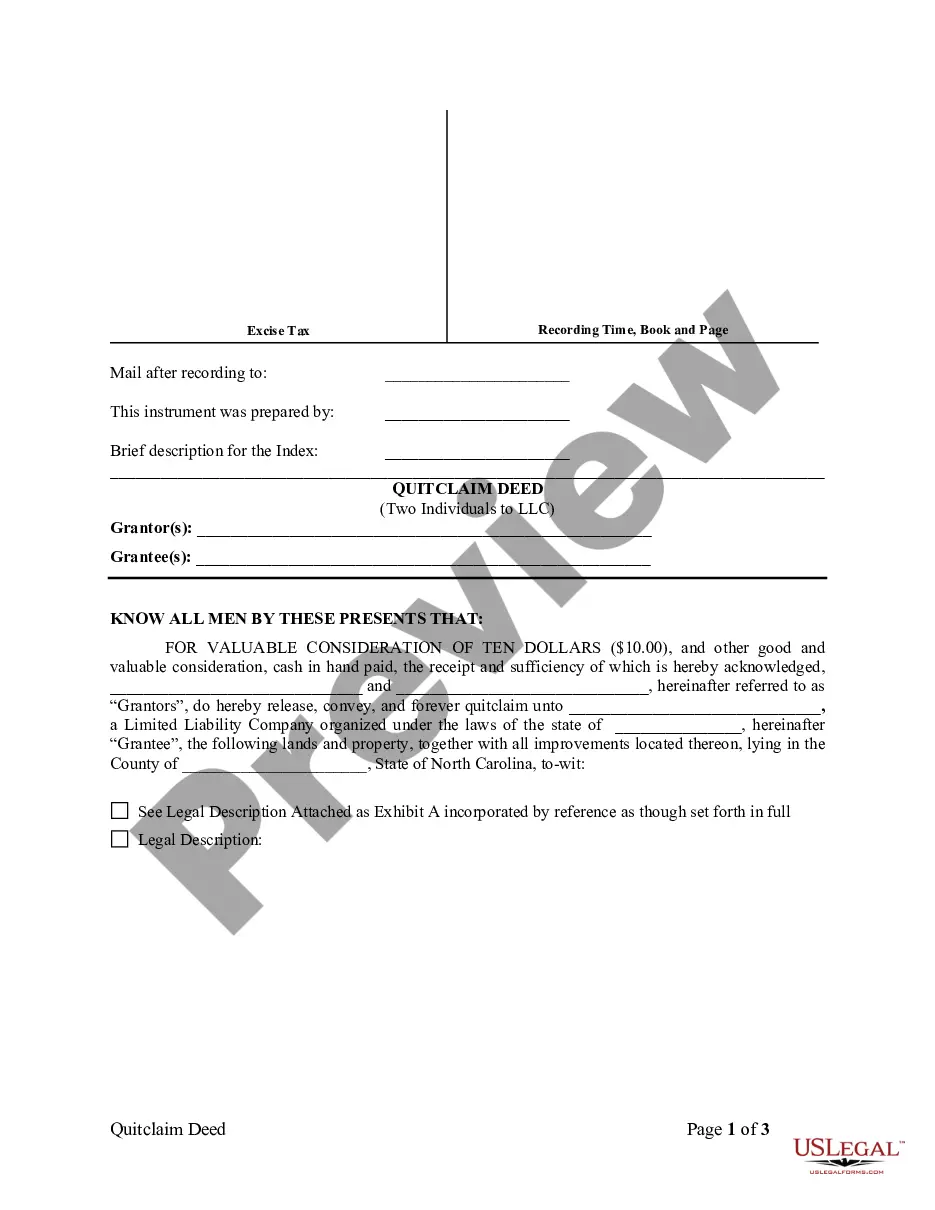

North Carolina Quitclaim Deed by Two Individuals to LLC

What this document covers

The Quitclaim Deed by Two Individuals to LLC is a legal document that allows two individuals (the Grantors) to transfer ownership of a property to a limited liability company (the Grantee). Unlike warranty deeds, this form does not guarantee that the Grantors hold clear title to the property. Instead, it conveys whatever interest the Grantors may have in the property, making it essential for real estate transactions involving multiple parties turning over property to an LLC.

Main sections of this form

- Identification of Grantors and Grantee.

- Legal description of the property being transferred.

- Consideration amount, typically set at ten dollars.

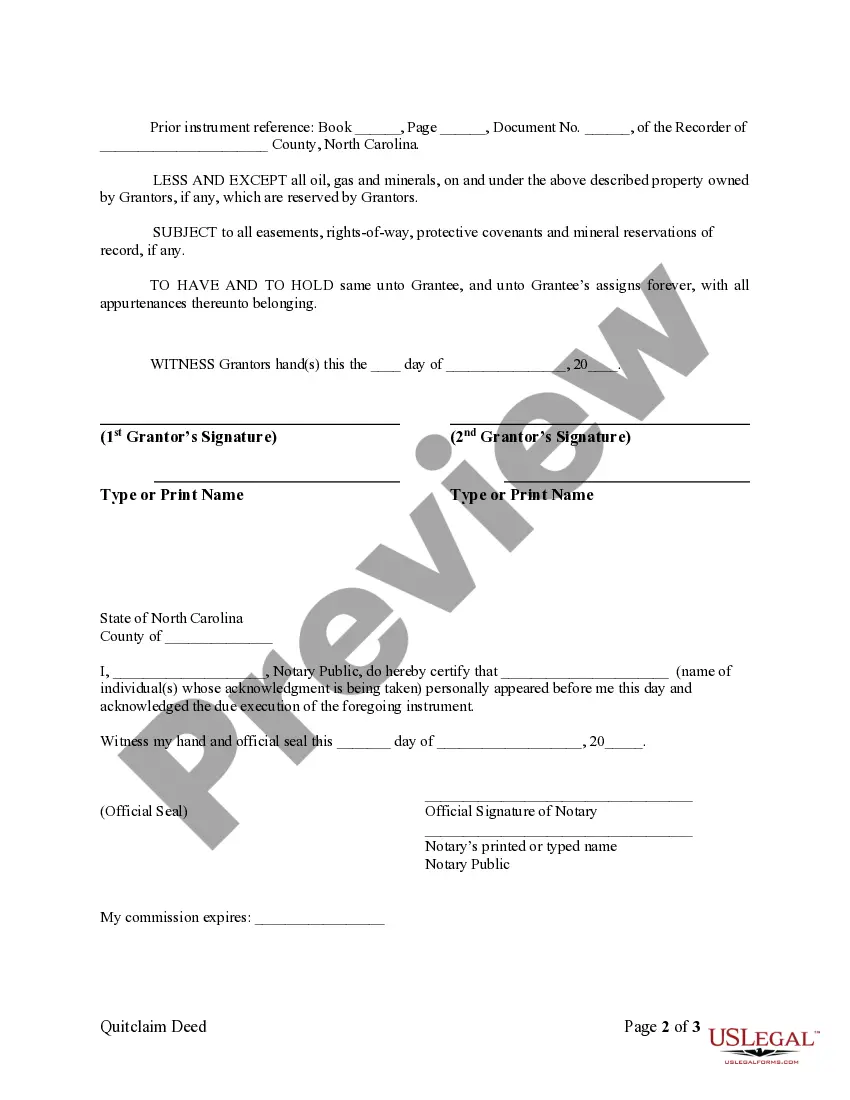

- Reservation of rights for oil, gas, and minerals, if applicable.

- Signatures of both Grantors and notarization section.

When to use this document

This form is ideal when two individuals want to transfer ownership of real estate to an LLC. It's commonly used in situations such as changing property ownership for better liability protection, during estate planning where property needs to be shifted to an LLC, or when simplifying the ownership structure for business purposes.

Who should use this form

This form is appropriate for:

- Individuals who are co-owners of a property.

- Members of an LLC who are acquiring property from individual owners.

- Those looking to formalize the transfer of property without warranties.

Instructions for completing this form

- Identify the Grantors by entering their full legal names.

- Enter the name of the LLC as the Grantee.

- Provide a complete legal description of the property being transferred.

- Include the date of the transaction and the signatures of both Grantors.

- Have the form notarized to ensure its legality.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include a complete legal description of the property.

- Not having the document notarized, which may affect its validity.

- Omitting the reservation of rights for any mineral interests, if applicable.

Why use this form online

- Convenience of downloading the form immediately.

- Editable fields make it easy to customize the form to your needs.

- Access to legal templates that ensure compliance with state laws.

Looking for another form?

Form popularity

FAQ

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Laws § 47B-8. Recording This form must be submitted, after completion and signature, to the Register of Deeds in the county where the real estate is located. Signing (A§ 47-38) All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.