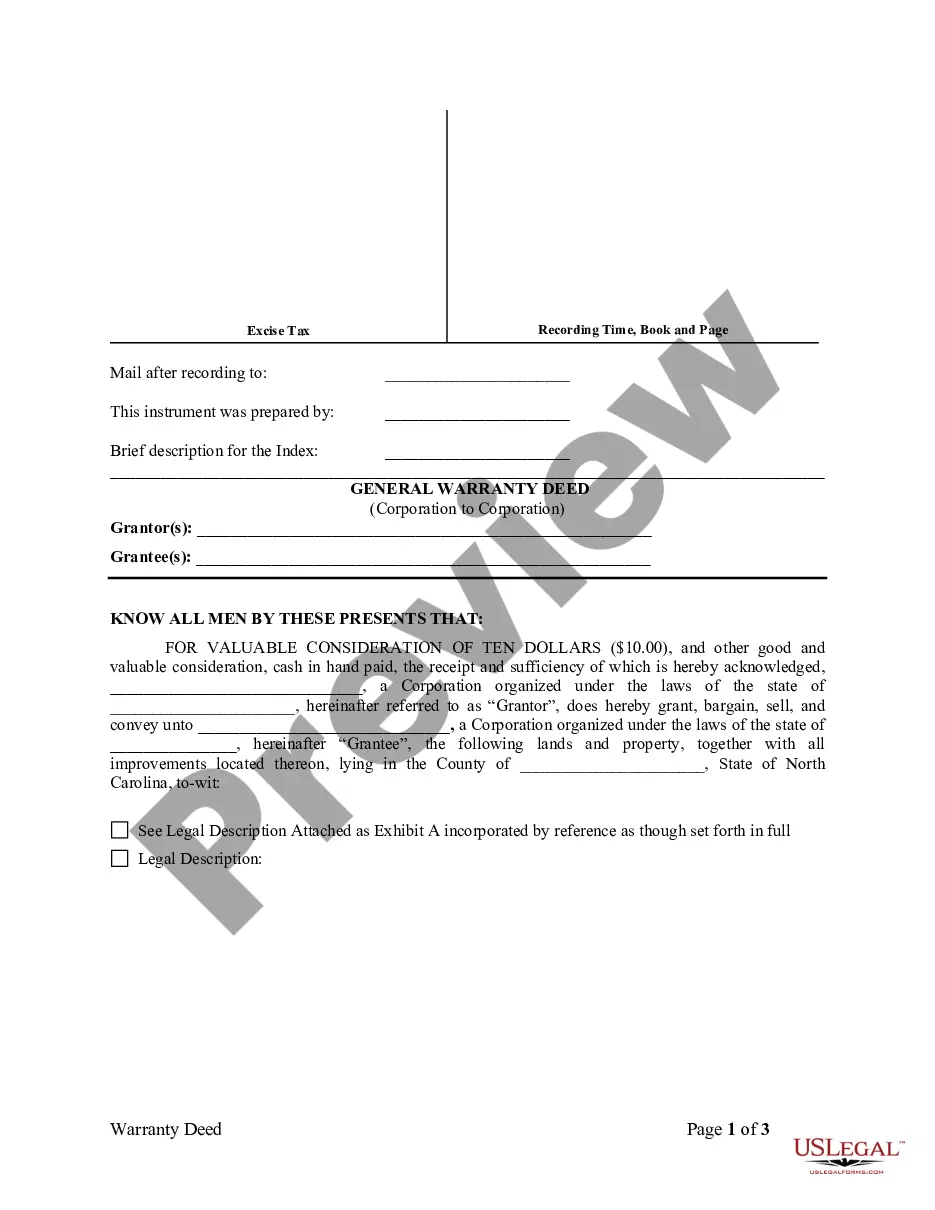

North Carolina General Warranty Deed from Corporation to Corporation

Description

How to fill out North Carolina General Warranty Deed From Corporation To Corporation?

Steer clear of pricey lawyers and locate the North Carolina General Warranty Deed from Corporation to Corporation you require at an affordable price on the US Legal Forms site.

Utilize our straightforward category feature to discover and acquire legal and tax documents. Peruse their descriptions and preview them before downloading.

Choose to receive the document in PDF or DOCX format. Click Download and locate your document in the My documents section. Feel free to store the template on your device or print it out. After downloading, you can complete the North Carolina General Warranty Deed from Corporation to Corporation manually or using editing software. Print it out and reuse the document multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms provides users with detailed instructions on how to download and complete each template.

- Clients of US Legal Forms simply need to Log In and retrieve the particular form they require in their My documents section.

- Those who do not possess a subscription yet must adhere to the steps outlined below.

- Ensure the North Carolina General Warranty Deed from Corporation to Corporation is permissible for use in your location.

- If possible, examine the description and utilize the Preview feature prior to downloading the document.

- If you are confident the template fulfills your requirements, click Buy Now.

- If the template is not correct, employ the search bar to find the appropriate one.

- Subsequently, establish your account and choose a subscription option.

- Make a payment using a credit card or PayPal.

Form popularity

FAQ

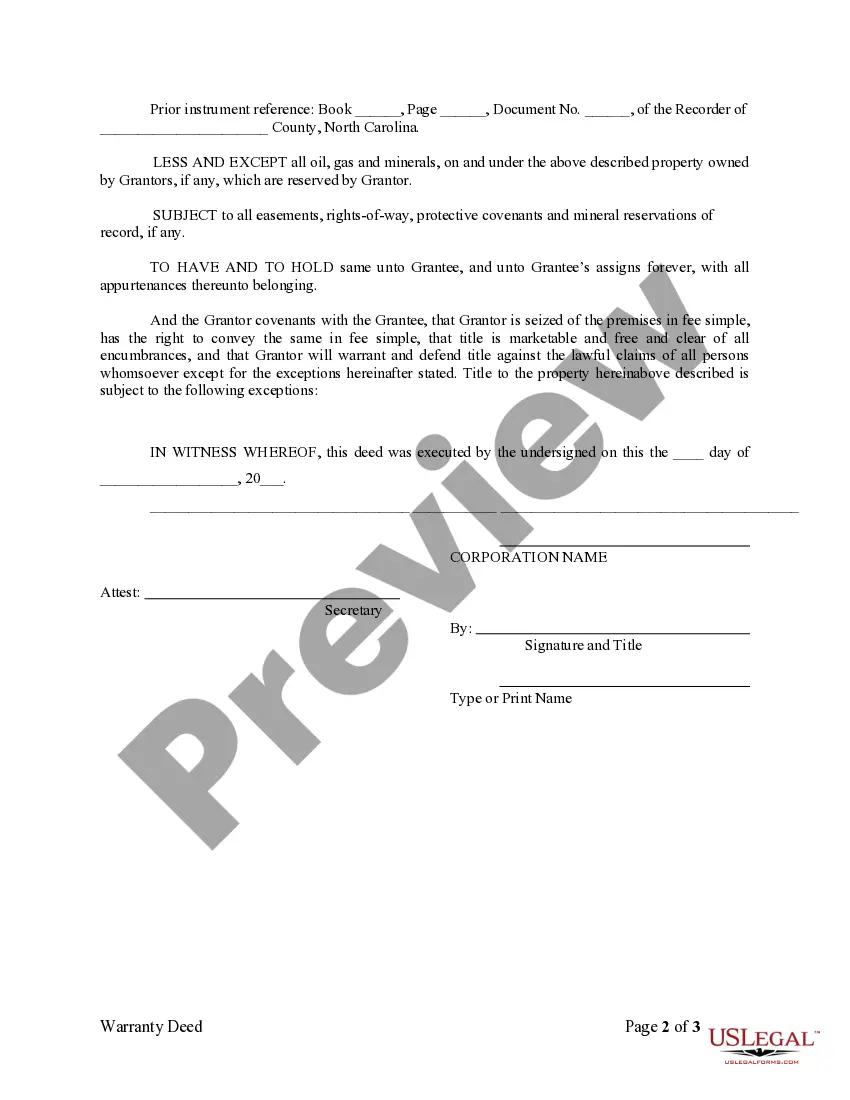

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

The North Carolina general warranty deed is used to transfer property in North Carolina from one person to another legally.In other words, the seller is liable to the buyer if the buyer finds out there was an undisclosed claim against the property.

Under the Grantor section of the deed, write the name of the person transferring title. Under Grantee, write the name of the person receiving title. Describe the parcel of land. Use the street address and include the North Carolina County where the land is located.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

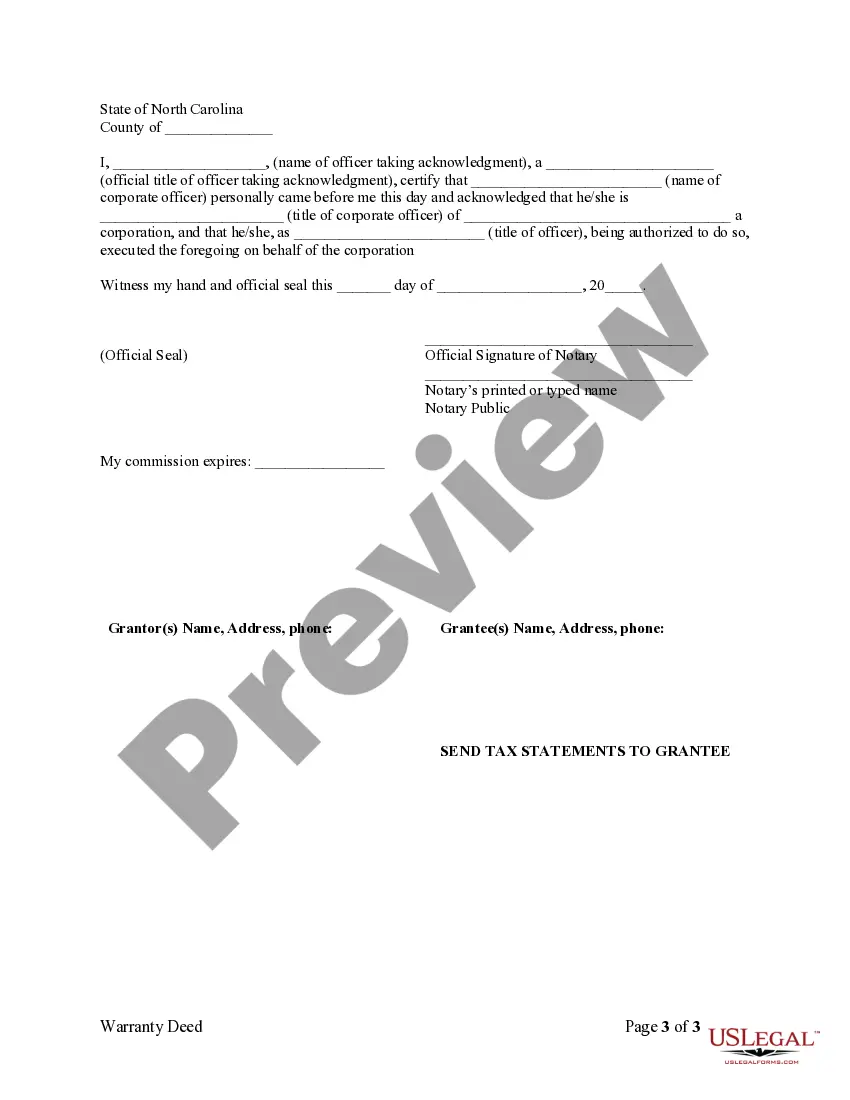

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

When ownership in North Carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home. Transfer taxes in North Carolina are typically paid by the seller.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

Basically it is exactly the same document. Title Deed is just a more common name that is used. The legal documentation submitted when transferring a property is called a Deed of Transfer.Next time you order a Title Deed and receive a Deed of Transfer, don't be alarmed, they are the same document.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.