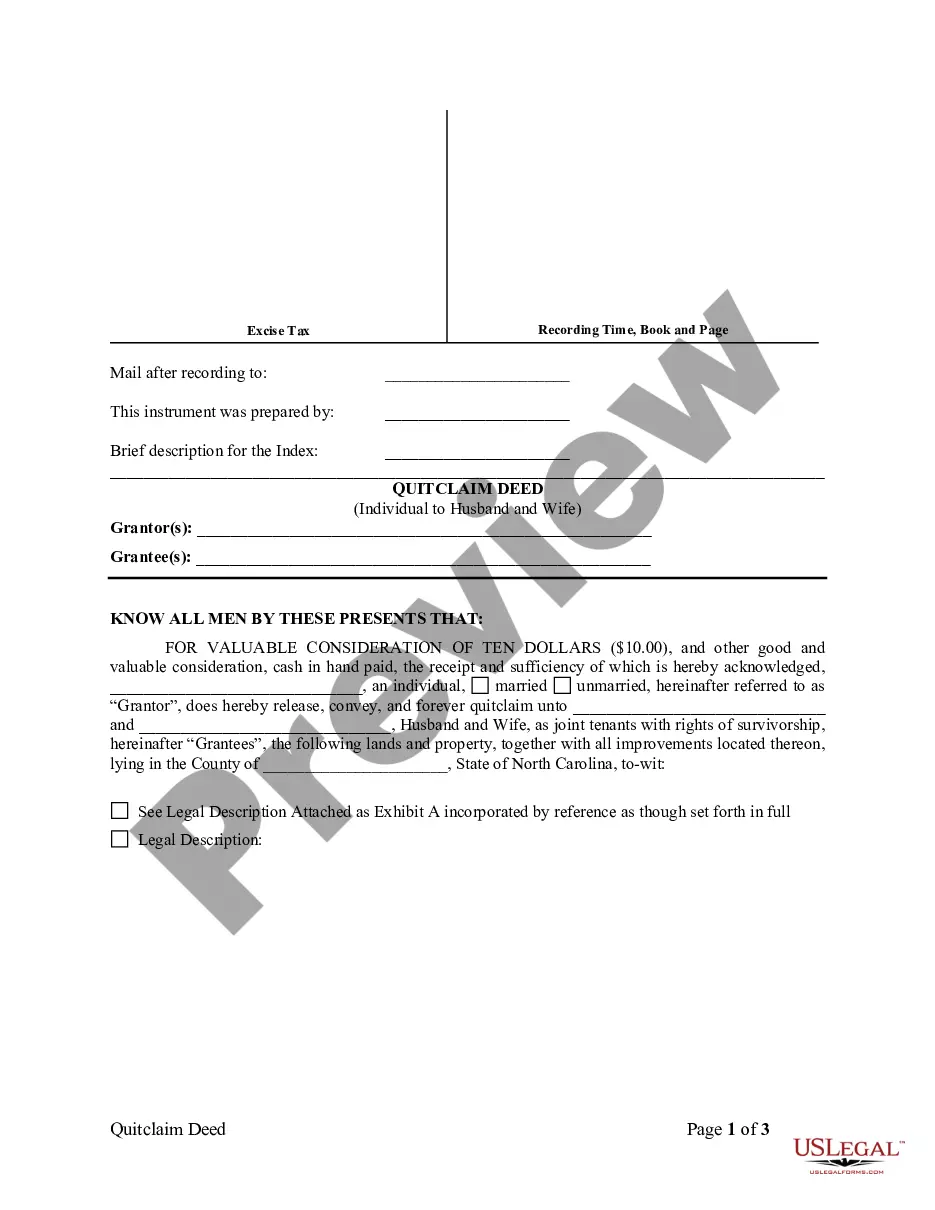

North Carolina Quitclaim Deed from Individual to Husband and Wife

Description

How to fill out North Carolina Quitclaim Deed From Individual To Husband And Wife?

Steer clear of costly attorneys and discover the North Carolina Quitclaim Deed from Individual to Husband and Wife you desire at a reasonable price on the US Legal Forms website.

Utilize our straightforward groups feature to locate and acquire legal and tax documents.

Then, create your account and choose a subscription option. Make payment via credit card or PayPal. Opt to receive the form in PDF or DOCX format. Click on Download and locate your form in the My documents section. You can save the form to your device or print it out. After downloading, you may complete the North Carolina Quitclaim Deed from Individual to Husband and Wife either manually or with editing software. Print it and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Examine their descriptions and preview them prior to downloading.

- Furthermore, US Legal Forms offers clients detailed instructions on how to obtain and complete each template.

- US Legal Forms users simply need to Log In and retrieve the specific form they require in their My documents section.

- Those who haven't subscribed yet should adhere to the following steps.

- Verify that the North Carolina Quitclaim Deed from Individual to Husband and Wife is valid for use in your state.

- If accessible, read the description and utilize the Preview feature before downloading the templates.

- If you’re confident the document meets your requirements, click on Buy Now.

- If the form is inaccurate, employ the search tool to find the correct one.

Form popularity

FAQ

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

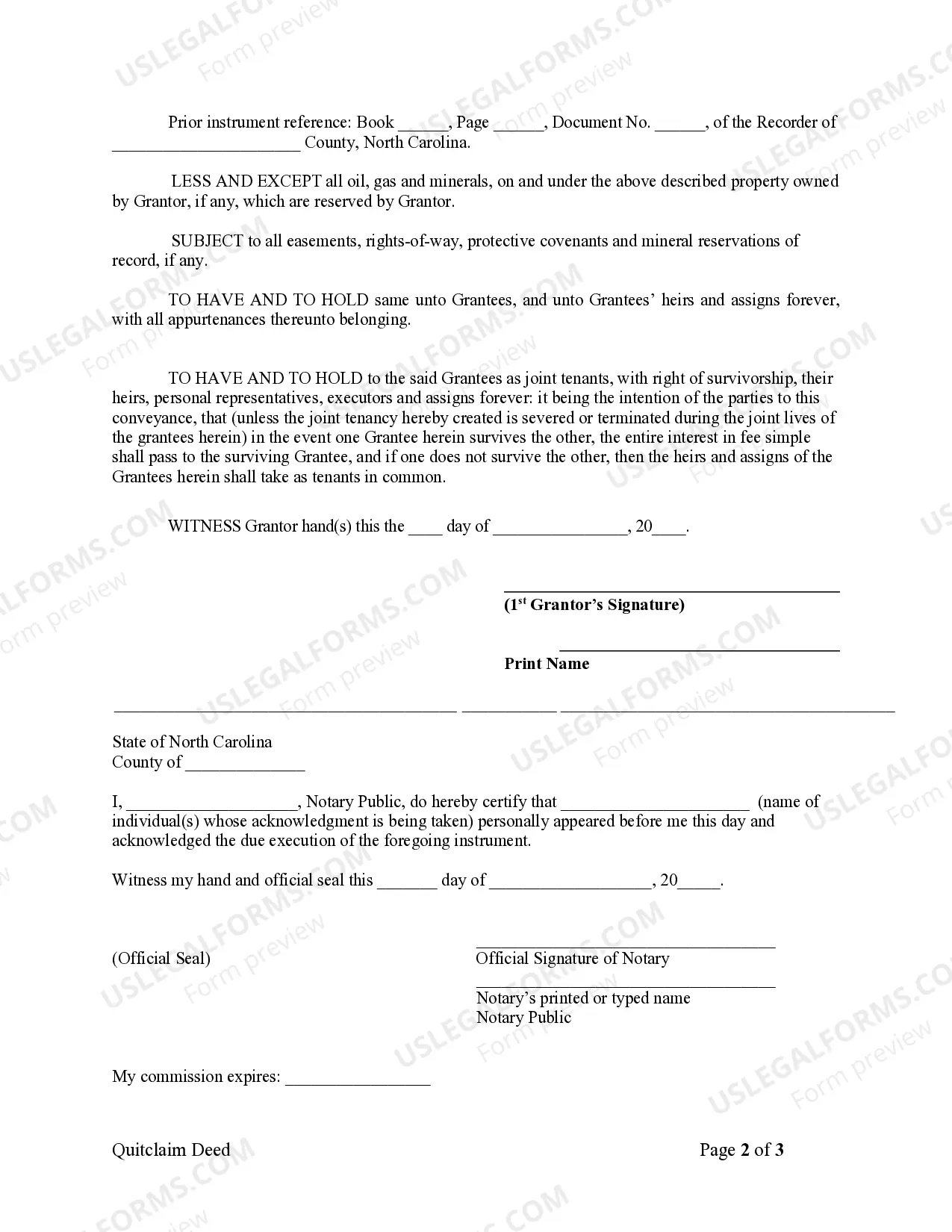

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

In North Carolina, the rule of thumb for married couples is that one spouse may purchase real property, but both spouses must sign the deed to sell property.If a married person can buy property in cash, with no deed of trust required, then he/she can buy the property without his/her spouse signing anything.

A married person buying property individually The owner needs to sign, but their spouse may not be required to sign documents at closing. North Carolina has a specific statute allowing a married buyer of real estate to sign their purchase-money Deed of Trust without requiring the signature of the buyer's spouse.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

Laws § 47B-8. Recording This form must be submitted, after completion and signature, to the Register of Deeds in the county where the real estate is located. Signing (A§ 47-38) All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

In divorces, states have two options for dividing property: community property division (where marital property belongs to both spouses equally, regardless of who bought it) or equitable division (where the court divides marital property equitably (justly.) North Carolina is not a community property state.