Mississippi Business Credit Application

Understanding this form

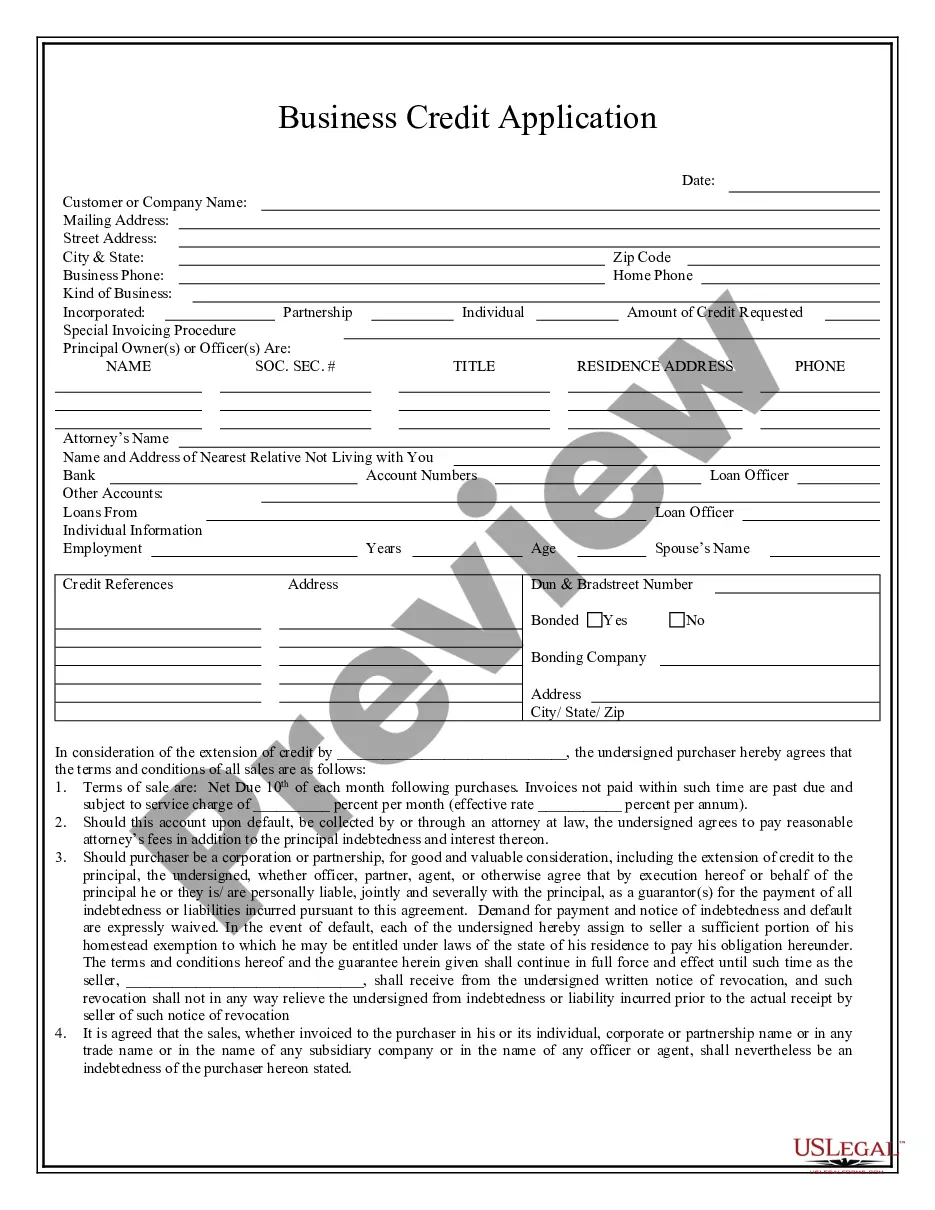

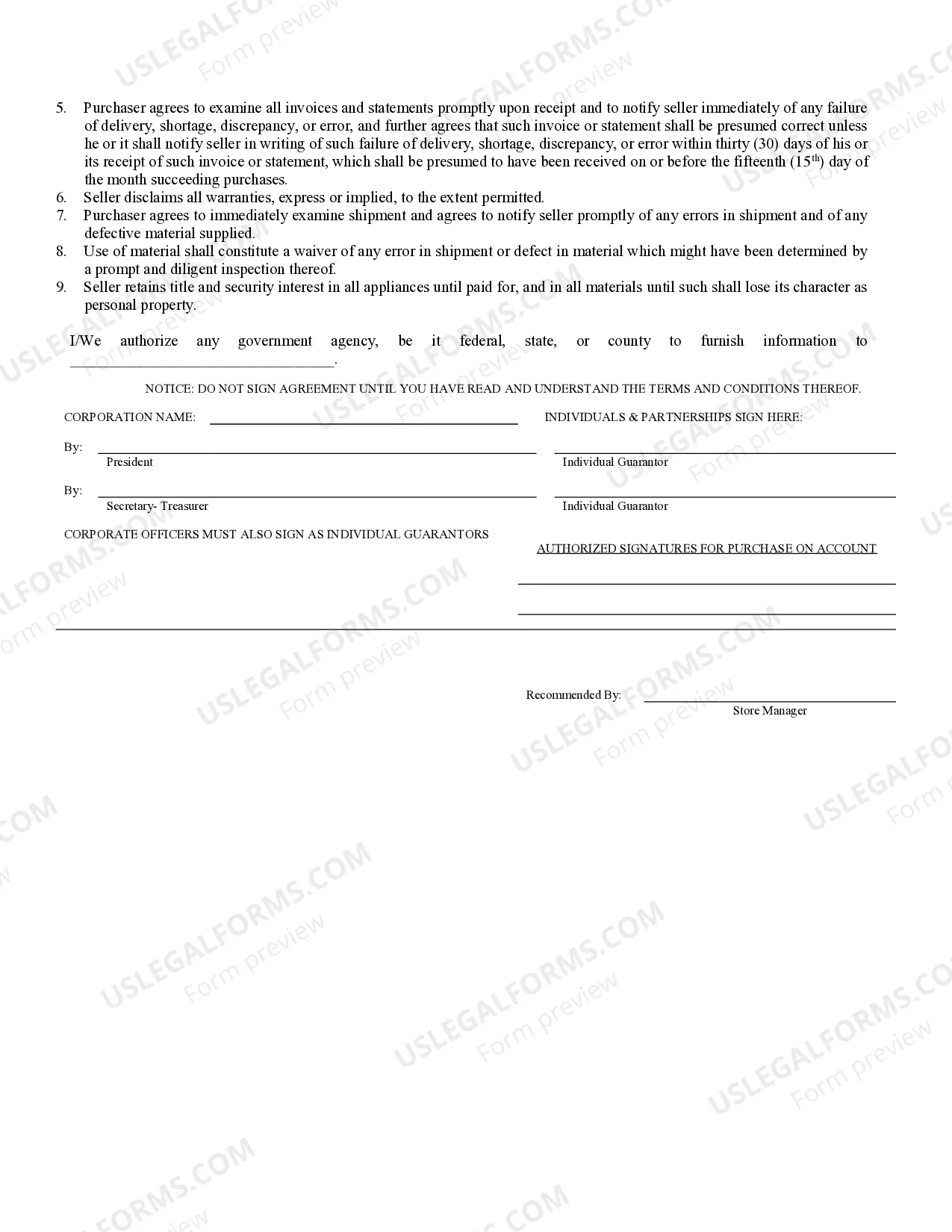

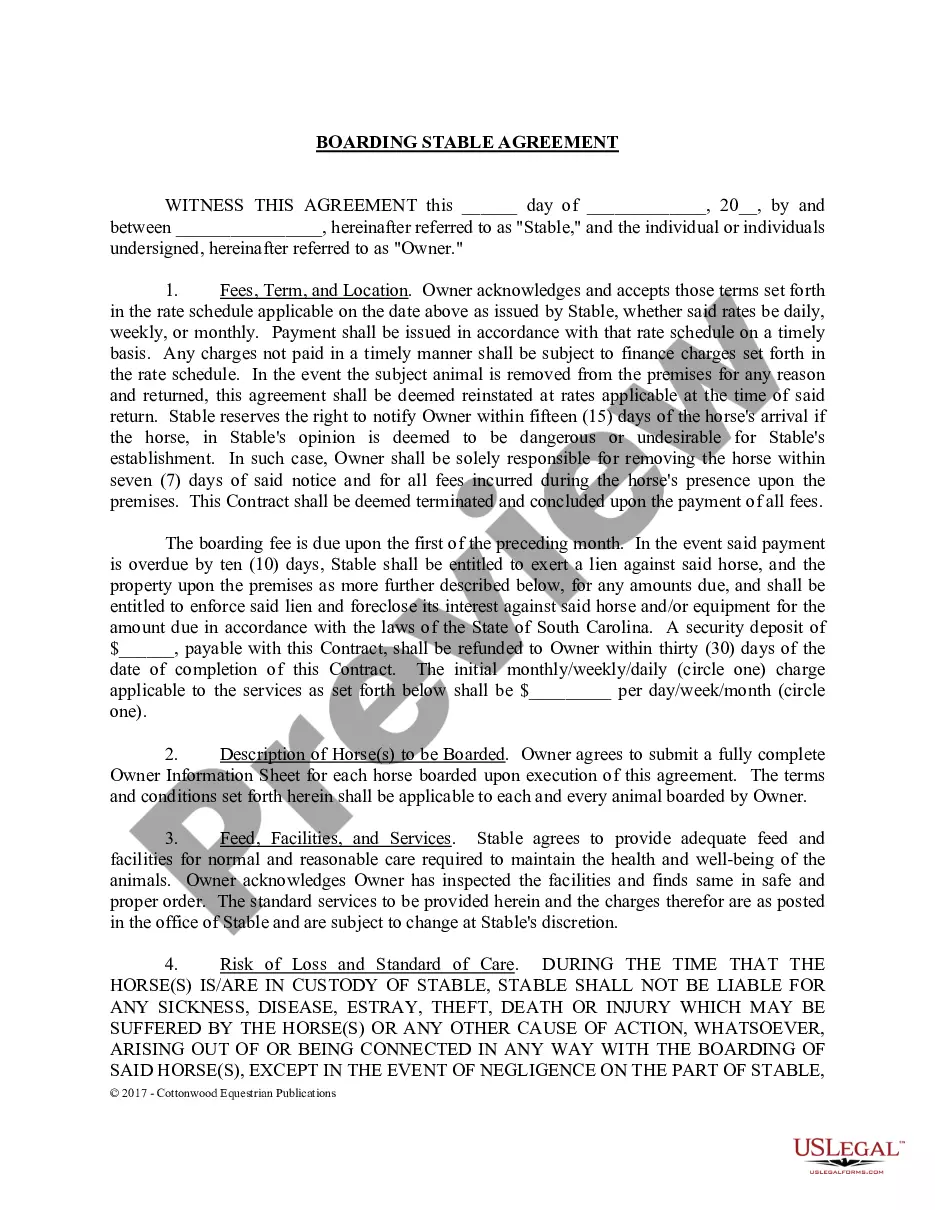

The Business Credit Application is a legal document used by individuals or entities to request credit from a seller for purchasing goods or services. This form specifies the repayment terms, interest rates, and default provisions, distinguishing it from other financial forms by emphasizing the seller's rights regarding title retention and warranties. By completing this application, you formalize a request for credit and agree to the terms set by the seller.

Main sections of this form

- Identification of the purchaser and seller

- Terms of sale, including payment due dates and interest rates

- Provisions addressing default and collections

- Disclaimer of warranties by the seller

- Retention of title until payment is made

- Authorization for information to be shared by government agencies

When this form is needed

This form should be used when an individual or business seeks to establish a credit account with a seller. It's particularly useful in scenarios where goods are purchased on credit, requiring a mutual understanding of payment terms and obligations. Use this form when you want to ensure clarity in the credit arrangement and to protect both parties' interests.

Who can use this document

- Individuals or sole proprietors seeking credit for business purchases

- Corporations or partnerships applying for credit

- Business owners in need of a structured repayment plan

- Entities wanting to formalize their credit agreements with sellers

How to complete this form

- Identify the parties involved by entering the names of the purchaser and seller.

- Specify the payment terms, including due dates and any service charges for late payments.

- Review and include any default provisions, outlining consequences for non-payment.

- Sign the application and include any required signatures from partners or corporate officers as guarantors.

- Provide a written notice of revocation if you choose to withdraw your agreement in the future.

Does this form need to be notarized?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not clearly indicating the terms of payment and interest rates.

- Failing to include all required signatures, especially from personal guarantors.

- Ignoring the need for prompt examination of invoices and statements.

- Overlooking the terms of default and attorney fees.

- Assuming electronic submissions are acceptable without proper review of local laws.

Advantages of online completion

- Convenience of downloading and completing the form at your own pace.

- Editability, allowing you to customize the form to fit your specific business needs.

- Reliability of templates drafted by licensed attorneys, ensuring compliance with legal standards.

Legal use & context

- Enforceable upon proper completion and agreement by both parties.

- Includes provisions that protect the sellerâs interests in case of default.

- Clarifies the roles and obligations of each party involved in the transaction.

Quick recap

- The Business Credit Application is crucial for establishing a credit relationship.

- Understanding and completing the form correctly helps avoid future disputes.

- It is important to consult local laws for specific compliance requirements.

Looking for another form?

Form popularity

FAQ

# 1 TOP SCHOOL, LLC. #1 COCHRAN BUICK GMC INC. #1 NORTH AMERICAN INVESTMENT COMPANY, LLC. #1 QUALITY ELECTRIC INC. #3 ZIMMIES, INC. #4429, INC. #7 ZIMMIES, INC. #8 ZIMMIES, INC.

The now infamous Paycheck Protection Program (PPP) was put in place by Congress at the onset of the COVID-19 pandemic.In a new improvisation, a list of recipients of PPP loans is going to be made public because, according to Congress, the public has a right to know who is getting the loans.

Small business owners will have to complete an application through a portal at www.BackToBusinessMS.org. The Legislature last month set aside $300 million of federal CARES Act money for small business owners, of which $240 million was dedicated to this grant program.

Step 1: Choose a Business Idea. Step 2: Write a Business Plan. Step 3: Select a Business Entity. Step 4: Register a Business Name. Step 5: Get an EIN. Step 6: Open a Business Bank Account. Step 7: Apply for Business Licenses & Permits. Step 8: Find Financing.

To be eligible for the program, Australian businesses must currently employ at least 20 workers and overseas businesses must employ at least 80 workers. All businesses must be able to create at least 30 net new full-time equivalent (FTE) jobs in NSW before 30 June 2024. Further conditions apply.

The public pulled out the PPP pitchforks when news broke that big, well-known companies like Shake Shack, Ruth's Chris Steak House, and the Los Angeles Lakers had received Small Business Association (SBA) coronavirus loans under the Paycheck Protection Program.

Sole proprietorships, with or without employees. Gig workers. Small businesses with less than 500 employees. Agricultural businesses.

Gov. Tate Reeves said small business owners impacted by the coronavirus pandemic can apply for up to $25,000 worth of grant money starting noon Thursday. Small business owners will have to complete an application through a portal at www.BackToBusinessMS.org.

According to the guidance released by the SBA, this grant will only be available to small businesses in low-income communities that applied for EIDL assistance on or before December 27th 2020.