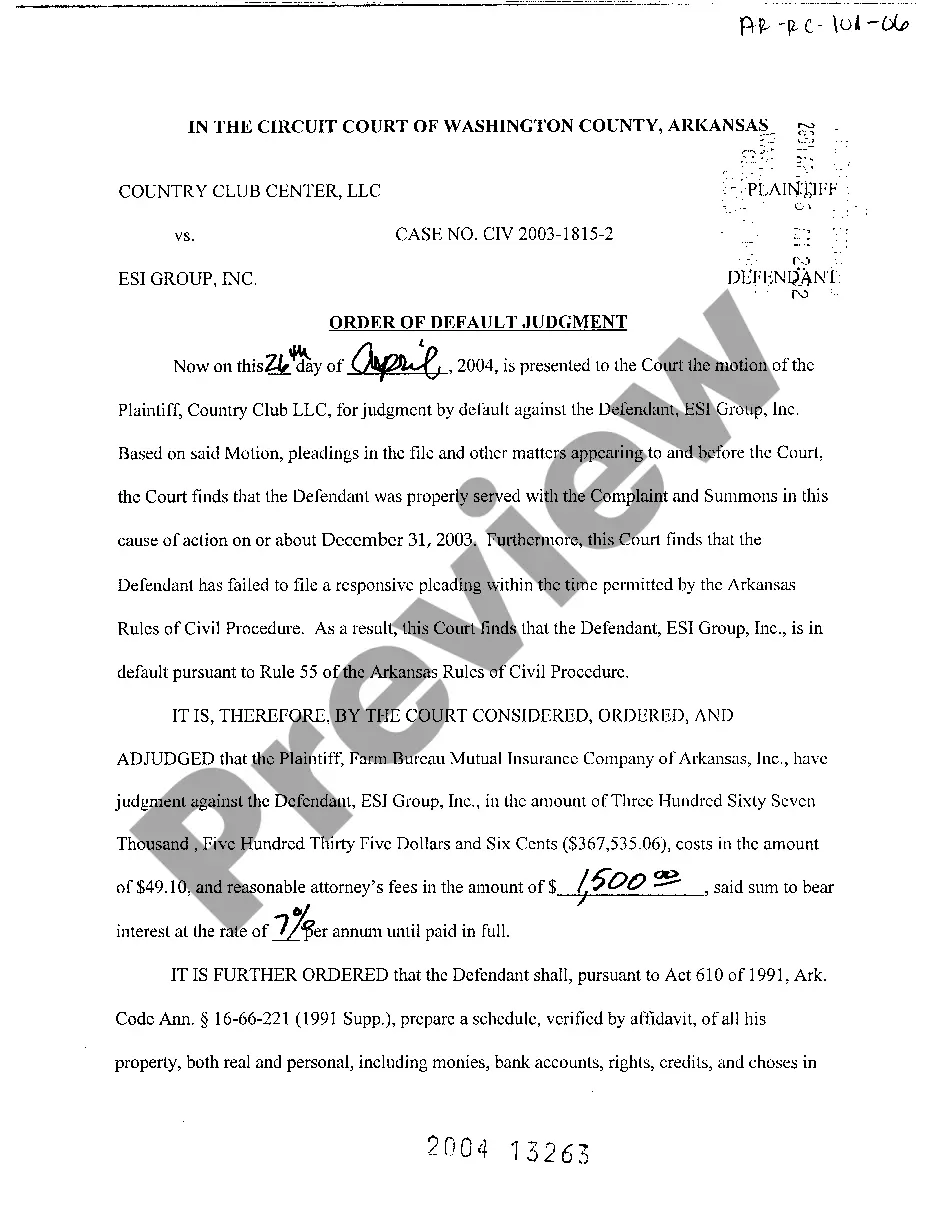

Arkansas Motion for Default Judgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

A09 Motion for Default Judgment: A legal document filed in court when a defendant fails to respond to a complaint, allowing the plaintiff to seek a judgment by default. Default Judgment: A binding judgment in favor of either party based on some failure to take action by the other party, typically used in debt collection scenarios. Statute of Limitations: The maximum time after an event within which legal proceedings may be initiated. Wage Garnishment: A court order directing an employer to withhold a portion of an employee's wages to pay off a debt.

Step-by-Step Guide to Filing an A09 Motion for Default Judgment

- Verify the Debt and Amount Owed: Confirm the details of the debt, including the amount and the identity of the debtor, to ensure the accuracy of your claim.

- Check the Statute of Limitations: Ensure that the statute of limitations has not expired for your type of debt.

- File a Complaint: Legally notify the debtor of your claims by filing a complaint in the appropriate court.

- Wait for Response: Allow the debtor a statutory period to respond or contest your complaint.

- File the Motion: If the debtor fails to respond, file an A09 motion for default judgment with the court.

- Obtain Judgment: Once approved, the judgment will enable you to seek remedies such as wage garnishment for debt recovery.

Risk Analysis

- Incorrect Documentation: An A09 motion could be denied if the documentation is incomplete or incorrect.

- Statute of Limitations: Filing after the statute of limitations has expired can invalidate your motion.

- Wage Garnishment Caps: Federal and state laws limit the amount that can be garnished from wages, potentially affecting the recovery amount.

- Debtor's Financial Status: The effectiveness of a default judgment may be limited if the debtor is financially insolvent.

Best Practices

- Accurate Record Keeping: Maintain precise records of all communications and transactions related to the debt.

- Legal Advice: Consult with a lawyer familiar with collection laws to ensure compliance and proper filing.

- Follow Up: Regularly follow up with the court and involved parties to stay informed about the status of your case.

Key Takeaways

- Filing an A09 motion for default judgment can expedite the debt collection process when the debtor fails to respond.

- Understanding local collection laws and ensuring compliance with the statute of limitations are crucial to the success of the motion.

- While effective, wage garnishment as a financial relief measure should be approached with a full understanding of its limitations and implications for the debtor.

How to fill out Arkansas Motion For Default Judgment?

Among numerous paid and complimentary templates available online, you cannot guarantee their precision and dependability.

For instance, who created them or whether they possess sufficient expertise to handle the matter you require them for.

Stay calm and utilize US Legal Forms!

Ensure the document you find is valid in your residing state. Examine the template by reading the description using the Preview function. Hit Buy Now to initiate the purchasing process or search for another sample using the Search field located in the header. Select a pricing plan and set up an account. Complete the payment for the subscription via your credit/debit card or PayPal. Download the document in your desired format. Once you've signed up and paid for your subscription, you can use your Arkansas Motion for Default Judgment as often as you need it or for as long as it remains valid in your area. Modify it in your preferred editor, complete it, sign it, and print it. Do more for less with US Legal Forms!

- Obtain Arkansas Motion for Default Judgment templates crafted by expert lawyers.

- Sidestep the expensive and lengthy process of searching for an attorney.

- Avoid paying for them to draft a document that you can access yourself.

- If you have an existing subscription, Log In to your account to locate the Download button next to the file you’re searching for.

- You will also gain access to all previously acquired files in the My documents section.

- If you’re using our platform for the first time, follow the steps below to quickly acquire your Arkansas Motion for Default Judgment.

Form popularity

FAQ

A default judgment in Arkansas occurs when one party fails to respond to a legal action, leading the court to grant judgment in favor of the other party. This process often involves an Arkansas Motion for Default Judgment. It is essential to understand the implications of such a judgment, as it can affect your legal rights. For detailed assistance, consider the resources available through US Legal Forms to guide you.

Rule 41 dismissal in Arkansas allows a party to voluntarily dismiss their case without prejudice. This means you can refile later if needed. If you’re navigating an Arkansas Motion for Default Judgment, understanding this rule could be vital. Utilizing US Legal Forms can help you navigate these legal nuances effectively.

Once you file for a default, the court will review your submission. If everything is in order, you may receive a hearing date for your Arkansas Motion for Default Judgment. This is an essential step in the process, as it allows you to present your case. Staying informed through platforms like US Legal Forms can help clarify the subsequent steps.

In Arkansas, the response time to a motion is typically 15 days. This timeline is crucial, especially when dealing with an Arkansas Motion for Default Judgment. Failing to respond within this period might result in a default judgment against you. To ensure you stay on track, consider using resources from US Legal Forms for proper guidance.

Yes, you can potentially stop or vacate a default judgment in Arkansas without hiring an attorney. You must file specific motions in court, outlining your reasons for the request. However, the process can be complex and having guidance can be beneficial. Utilizing resources like UsLegalForms can provide you with templates and information to navigate the Arkansas Motion for Default Judgment effectively.

In Arkansas, the statute of limitations for collecting most debts is typically 5 years. After this period, the debt becomes uncollectible through legal means, although creditors may still attempt collection informally. An Arkansas Motion for Default Judgment may serve as a strategic tool if you act promptly within this timeframe. By using resources from USLegalForms, you can better understand your rights and options regarding debt collection.

In Arkansas, a judgment lasts for 10 years from the date it was entered in the court. This duration can be extended if you file for a renewal before the 10-year period ends. Remember, an Arkansas Motion for Default Judgment could be beneficial for securing a timely resolution to your case, preventing delays that might affect this timeline. Keeping track of your judgment status is essential for effective collection.

Rule 55 in Arkansas addresses default judgment and the associated procedures when a party fails to respond to a legal action. This rule details the steps a plaintiff must take to secure a default judgment. Familiarizing yourself with Rule 55 is critical for anyone involved in a litigation process, especially when considering the Arkansas Motion for Default Judgment as part of your legal strategy.

To vacate a judgment in Arkansas, you typically must file a motion under Rule 60 or similar provisions. It's vital to provide valid reasons, such as mistakes or newly discovered evidence, that warrant the judgment being set aside. Successfully vacating a judgment requires a solid understanding of the rules and procedures involved. If you've received a default judgment, engaging with the Arkansas Motion for Default Judgment may help provide clarity on your situation.

Rule 55 C in Arkansas outlines the procedure for entering a default judgment against a defendant who fails to respond to a claim. This rule clarifies how a plaintiff can pursue their claims efficiently. It's essential to follow the procedures set forth in this rule to ensure that your motion, particularly the Arkansas Motion for Default Judgment, is correctly filed and processed.