Mississippi Bylaws for Corporation

What this document covers

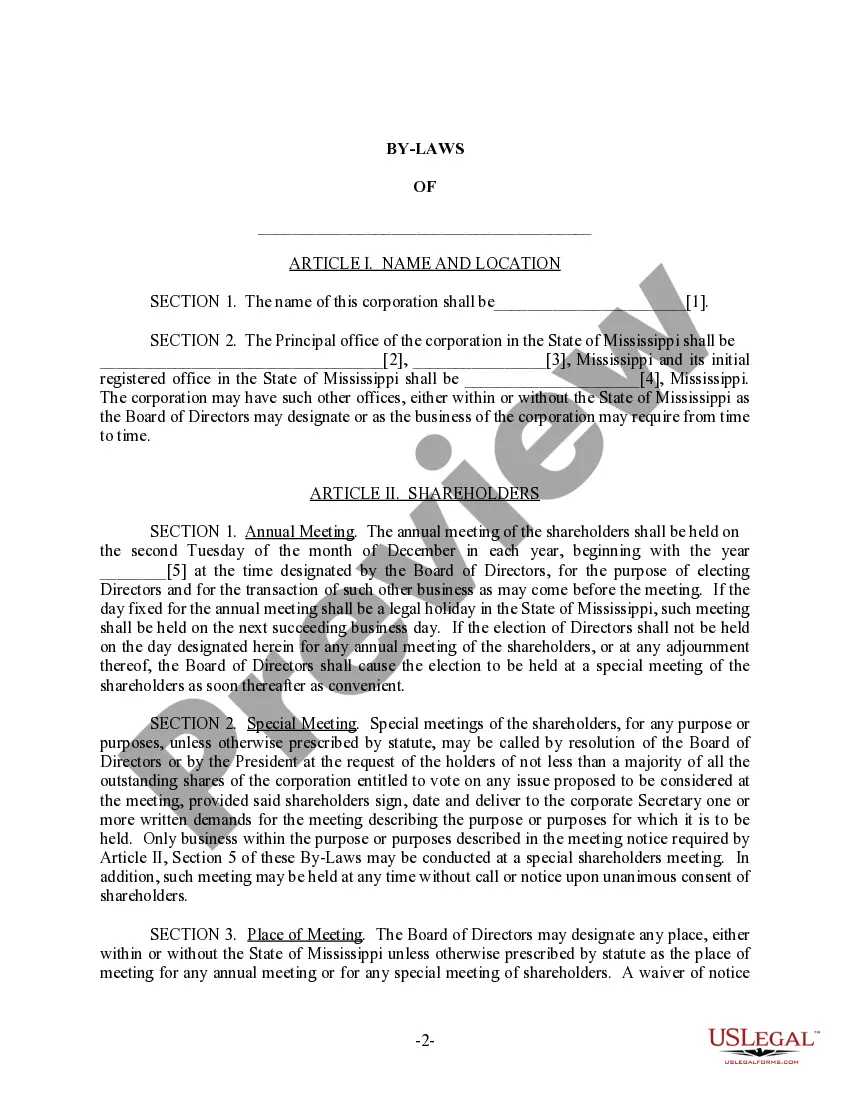

The Mississippi Bylaws for Corporation is a legal document that outlines how a corporation in Mississippi will operate. It includes provisions related to shareholder meetings, voting of shares, director responsibilities, and more. This form differs from other legal documents in that it specifically addresses the internal governance structure of the corporation, ensuring compliance with state laws and clarity among shareholders and directors.

Key components of this form

- Name and address of the corporation.

- Annual and special meeting protocols for shareholders.

- Details regarding the election and powers of directors.

- Officers of the corporation and their duties.

- Provisions concerning the transfer of shares and stockholder lists.

- Amendment procedures for the bylaws.

When to use this form

This form should be used when establishing a new corporation in Mississippi, as it sets the groundwork for the corporation's operations and governance. Additionally, it can be updated when changes in management or corporate structure occur, ensuring that all shareholders and directors are aware of their rights and responsibilities.

Who needs this form

- Business owners forming a new corporation in Mississippi.

- Current corporate directors and shareholders looking to update their bylaws.

- Legal professionals assisting clients with corporate governance.

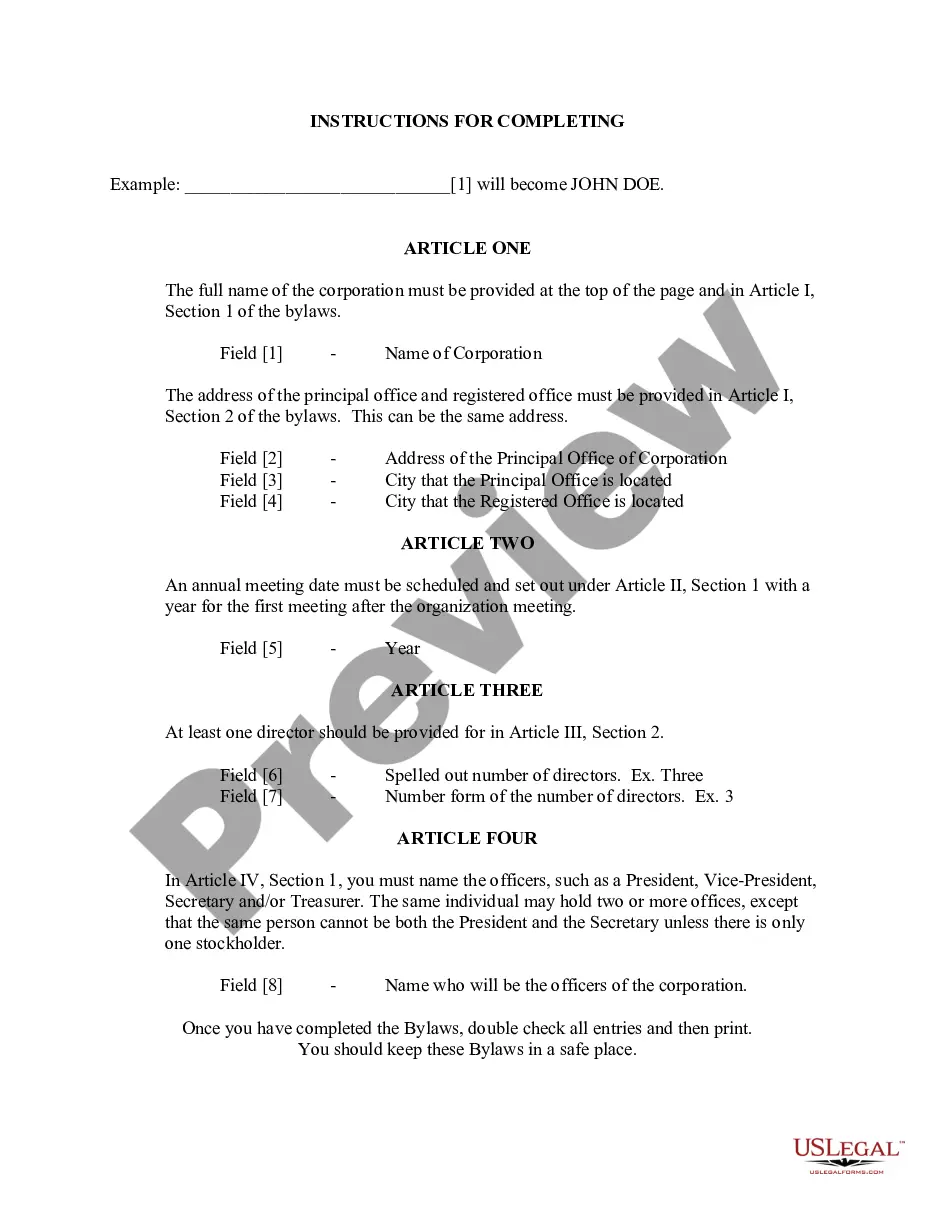

Instructions for completing this form

- Enter the full name of the corporation.

- Provide the addresses for the principal office and registered office.

- Set the date for the initial annual meeting and specify the number of directors.

- Name the officers of the corporation according to positions such as President, Secretary, etc.

- Review all entries for accuracy before finalizing the document.

Notarization guidance

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to specify the year for the initial annual meeting.

- Not including all required officers or mistakenly assigning multiple roles to one individual.

- Neglecting to update the bylaws when there are changes in the corporationâs structure or leadership.

Advantages of online completion

- Convenient access to the form anytime and anywhere.

- Easy to edit and customize for your specific corporation.

- Reliable legal language drafted by licensed attorneys to ensure compliance.

Looking for another form?

Form popularity

FAQ

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation.Aside from number of directors, all the matters typically covered in the bylaws are otherwise covered by California statute, which would apply in the absence of any contrary lawful bylaw provision.

Basic Corporate Information. The bylaws should include your corporation's formal name and the address of its main place of business. Board of Directors. Officers. Shareholders. Committees. Meetings. Conflicts of Interest. Amendment.

The bylaws of a corporation are the governing rules by which the corporation operates. Bylaws are created by the board of directors when the corporation is formed.

Bylaws are not public documents, but making them readily available increases your accountability and transparency and encourages your board to pay closer attention to them. Your board should review them regularly and amend them accordingly as your organization evolves.

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation. Any corporation whose articles of incorporation do not specify the number of directors must adopt bylaws before the first meeting of the board of directors specifying the number of directors.

Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping. Board meetings. Meeting minutes. State registration. Licensing.

The bylaws are the corporation's operating manual; they describe how the corporation is organized and runs its affairs. You do not file the bylaws with the state, but you need to explain the roles of the corporation's participants, and technology can play a role in carrying out the bylaws.

STEP 1: Name your Mississippi LLC. STEP 2: Choose a Registered Agent in Mississippi. STEP 3: File the Mississippi LLC Certificate of Formation. STEP 4: Create a Mississippi LLC Operating Agreement. STEP 5: Get an EIN.

Although the California General Corporation Law requires that the original or a copy of the bylaws be available to shareholders (Section 213), it does not require that corporate bylaws be signed.