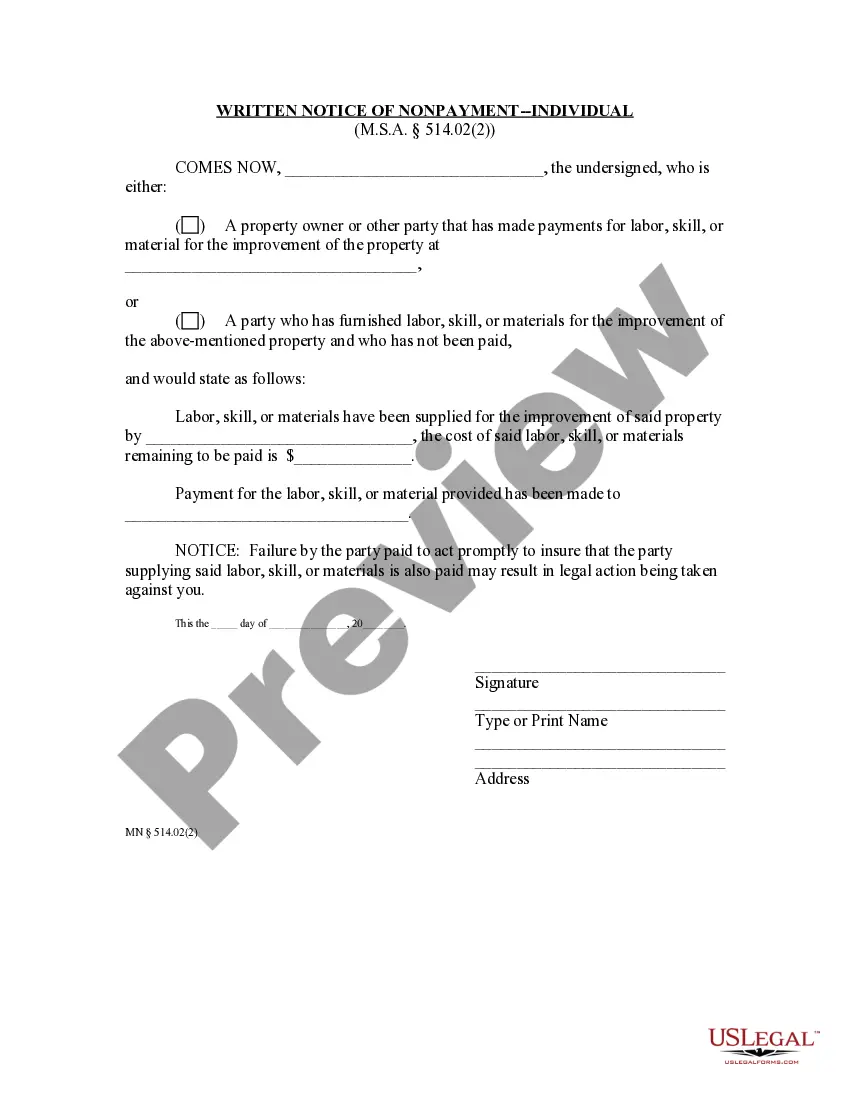

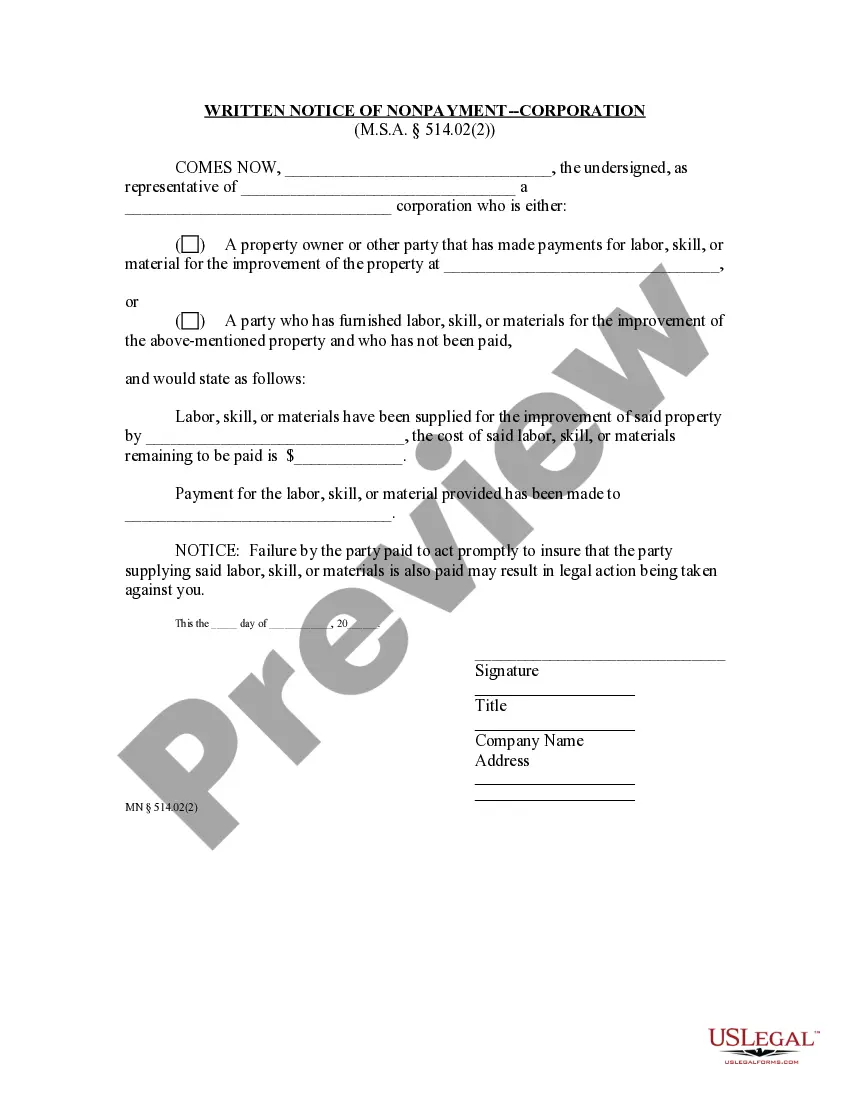

Minnesota law has many provisions which require mandatory communication between the different parties involved in a construction project. In this form, the party that has been paying the contractor, or the subcontractor that has not been paid, provides notice to the contractor that a subcontractor has not yet been paid for services provided.

Minnesota Written Notice of Nonpayment - Corporation or LLC

Description

How to fill out Minnesota Written Notice Of Nonpayment - Corporation Or LLC?

Obtain any template from 85,000 legal documents including Minnesota Written Notification of Nonpayment - Corporation or LLC online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you possess a subscription, Log In. When you’re on the form’s page, hit the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the instructions outlined below.

With US Legal Forms, you will consistently have swift access to the appropriate downloadable template. The service provides you access to documents and categorizes them to facilitate your search. Utilize US Legal Forms to obtain your Minnesota Written Notification of Nonpayment - Corporation or LLC quickly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Written Notification of Nonpayment - Corporation or LLC you wish to utilize.

- Review the description and preview the example.

- When you are certain the example meets your needs, click Buy Now.

- Select a subscription plan that suits your financial plan.

- Establish a personal account.

- Pay in just one of two suitable methods: by card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents tab.

- Once your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

Shutting down an LLC in Minnesota involves several key steps. First, you must file Articles of Dissolution with the Secretary of State. You also need to settle any outstanding debts and distribute remaining assets among members. Following these steps carefully will ensure a smooth closure of your business and compliance with state regulations. If you seek guidance on drafting the necessary notices, including the Minnesota Written Notice of Nonpayment - Corporation or LLC, uslegalforms can provide valuable support.

To issue a public notice in Minnesota, you must include specific details such as the nature of the notice, relevant dates, and the parties involved. It should be published in a qualified newspaper or an approved online platform to reach the intended audience. Adhering to these requirements not only fulfills legal obligations but also protects your interests. For assistance with the Minnesota Written Notice of Nonpayment - Corporation or LLC, consider utilizing the resources available through uslegalforms.

In Minnesota, a warn notice must be issued to employees when a business plans to lay off a significant number of workers. This notice should be sent at least 60 days before the layoff occurs. It is crucial for corporations and LLCs to follow these requirements to avoid penalties and ensure transparency. The Minnesota Written Notice of Nonpayment - Corporation or LLC can guide you through the process and help you meet all legal obligations.

A public notice serves as an official announcement to the public regarding legal matters. In the context of the Minnesota Written Notice of Nonpayment - Corporation or LLC, it informs interested parties about financial obligations or disputes. Typically, these notices are published in local newspapers or online platforms to ensure wide visibility. Understanding the importance of public notices can help you remain compliant with Minnesota laws.

The notice of nonpayment must include specific details to ensure it is legally valid. It should state the amount owed, the due date of the payment, and the time frame within which the payment must be made to avoid further action. Additionally, it should clearly identify the recipient and the property in question, aligning with the requirements for Minnesota Written Notice of Nonpayment - Corporation or LLC. US Legal Forms can assist you in drafting a compliant notice that meets all statutory requirements.

Minnesota's statute 504B applies to several key areas regarding the rights and responsibilities of landlords and tenants. It encompasses residential leases, commercial leases, eviction processes, and the issuance of Minnesota Written Notice of Nonpayment - Corporation or LLC. Understanding these aspects is crucial for both landlords and tenants to navigate their legal obligations effectively. For those seeking clarity, US Legal Forms offers comprehensive resources to help you understand these statutes.

Go to the Business Filings Online page to get started. Search by Business Name: type the Business Name in the search box, click Search Search by File Number: click File Number (above the search box), enter the file number, and click Search

All LLCs doing business in Minnesota must file an Annual Renewal each year.You need to file an Annual Renewal in order to keep your LLC in compliance and in good standing with the state of Minnesota. You can file your LLC's Annual Renewal by mail or online.

Get Started. 2022 Search your LLC. Search for your LLC at the top of the page. Click File Amendment/Renewal. At the top of your LLC's record page, click the File Amendment/Renewal link. Manager. Principal Executive Office Address.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Renewals.