Minnesota Articles of Incorporation for Domestic Nonprofit Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Articles Of Incorporation For Domestic Nonprofit Corporation?

Obtain any template from 85,000 legal documents including Minnesota Articles of Incorporation for Domestic Nonprofit Corporation online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you already have a subscription, Log In. Once you are on the form’s page, click on the Download button and go to My documents to access it.

If you have not subscribed yet, follow the steps below: Check the state-specific criteria for the Minnesota Articles of Incorporation for Domestic Nonprofit Corporation you need to utilize. Browse the description and preview the sample. Once you are confident the sample meets your needs, simply click Buy Now. Choose a subscription plan that fits your budget. Create a personal account. Make a payment using one of the two suitable methods: by card or via PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the document to the My documents tab. When your reusable template is prepared, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The platform organizes documents into categories to streamline your search. Utilize US Legal Forms to acquire your Minnesota Articles of Incorporation for Domestic Nonprofit Corporation quickly and efficiently.

- Obtain a template from 85,000 legal documents.

- Each template is crafted by state-certified attorneys.

- If subscribed, Log In and access your forms.

- Check state-specific criteria before purchasing.

- Browse the sample and description.

- Click Buy Now if satisfied with the sample.

- Select a budget-friendly subscription plan.

- Create a personal account for access.

- Pay via card or PayPal.

- Choose between PDF or Word format for download.

Form popularity

FAQ

Yes, non-profit corporations must file Articles of Incorporation to establish their legal status in Minnesota. The Minnesota Articles of Incorporation for Domestic Nonprofit Corporation outline the organization's purpose, structure, and governance. This document serves as the foundational legal paperwork that helps protect the non-profit's interests and ensures compliance with state laws. By properly filing these articles, your non-profit can gain credibility and access to funding opportunities.

To start a nonprofit organization, you will need several key documents. First, you must prepare the Minnesota Articles of Incorporation for Domestic Nonprofit Corporation, which lays the foundation for your organization. Additionally, you will need bylaws that govern your operations, a board of directors, and a federal Employer Identification Number (EIN). Using a platform like US Legal Forms can simplify this process, providing you with the necessary templates and guidance.

Yes, nonprofits need articles of incorporation to establish themselves legally. The Minnesota Articles of Incorporation for Domestic Nonprofit Corporation outlines your organization’s purpose, structure, and governance. This document is essential for obtaining tax-exempt status and protecting your personal assets. By filing these articles, you create a recognized entity that can operate under Minnesota law.

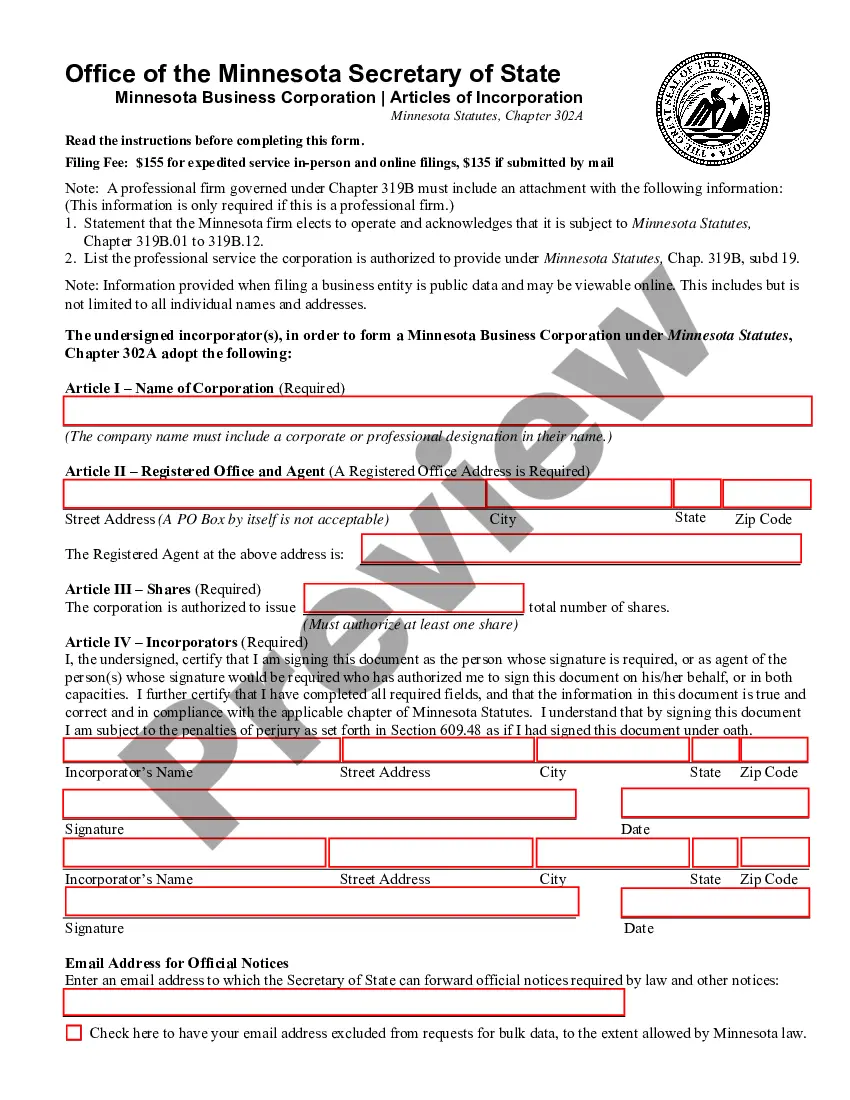

To create Articles of Incorporation for a nonprofit, start by gathering the necessary information about your organization. Include the name, purpose, and registered agent details, along with the names of the initial board members. You can utilize US Legal Forms to access easy-to-follow templates for the Minnesota Articles of Incorporation for Domestic Nonprofit Corporation, guiding you through each step and guaranteeing compliance with state laws.

In Minnesota, nonprofits need to file the articles of incorporation with the Secretary of State. This document must include the nonprofit's name, purpose, and details about its board members. Additionally, they should prepare bylaws and obtain an Employer Identification Number (EIN). Using US Legal Forms can simplify filing the Minnesota Articles of Incorporation for Domestic Nonprofit Corporation, ensuring all requirements are met.

Yes, nonprofits must have articles of incorporation. These articles serve as a foundational document that establishes the nonprofit's existence and outlines its purpose and governance structure. Filing the Minnesota Articles of Incorporation for Domestic Nonprofit Corporation is essential for obtaining tax-exempt status and protecting the organization from personal liability.

To write articles of incorporation for a non-profit, begin by outlining your nonprofit's name, purpose, and the address of your principal office. Include information about your board of directors and any limitations on their powers. You can use resources like US Legal Forms, which provides templates specifically for Minnesota Articles of Incorporation for Domestic Nonprofit Corporation, making the process easier and ensuring compliance.

Writing Minnesota Articles of Incorporation for Domestic Nonprofit Corporation involves several key steps. First, you need to include the organization's name, purpose, and registered agent information. Next, you must outline the nonprofit’s structure, including the board of directors and any membership details. For a smooth process, consider using the resources available on the US Legal Forms platform, which provides templates and guidance tailored specifically for Minnesota nonprofits.