Michigan Limited Power of Attorney

Description

Definition and meaning

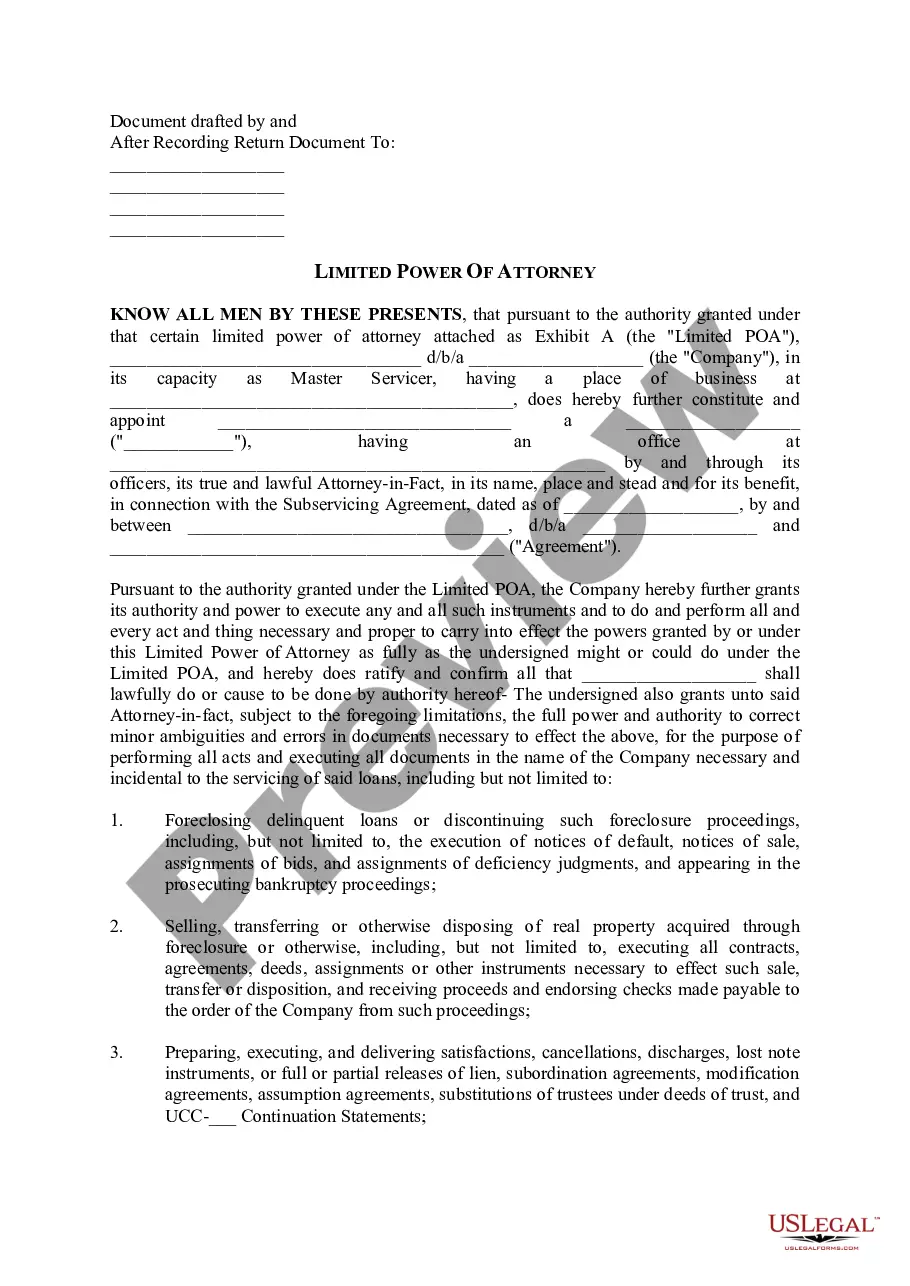

A Michigan Limited Power of Attorney is a legal document that allows one person, known as the principal, to appoint another person, called the agent, to act on their behalf in specified matters. This type of power of attorney is limited in scope, meaning it grants the agent only specific powers outlined in the document. Such powers may include managing financial transactions, handling real estate matters, or making decisions related to medical care, depending on the needs of the principal.

How to complete a form

To complete the Michigan Limited Power of Attorney form, follow these steps:

- Download the form from a reliable source.

- Fill in your name and the agent's name clearly.

- Specify the powers being granted to the agent; be as detailed as possible.

- Indicate any conditions or limitations on the agent’s authority.

- Sign the document in front of a notary public to ensure its validity.

Once completed, it is advisable to provide copies to your agent and any relevant financial or medical institutions.

Who should use this form

The Michigan Limited Power of Attorney form is ideal for individuals who wish to give another person the authority to act on their behalf in specific situations. It is commonly used by:

- Individuals managing chronic health issues who may need assistance with financial matters.

- People traveling abroad who want to ensure their affairs are handled in their absence.

- Individuals selling property or managing real estate projects.

This form is suitable for anyone seeking to delegate authority without granting a broad power of attorney.

Legal use and context

In Michigan, a Limited Power of Attorney is governed by state laws, which require specific components to ensure its enforceability. The document serves various legal purposes, including:

- Financial management during temporary incapacitation.

- Transaction authorization in real estate deals.

- Facilitation of medical decisions if the principal is unable to communicate their wishes.

It is important to ensure that the powers delegated are clear and consistent with Michigan laws regarding powers of attorney.

Common mistakes to avoid when using this form

When completing the Michigan Limited Power of Attorney form, it is crucial to avoid common pitfalls, such as:

- Failing to specify the powers granted to the agent, which could lead to misinterpretation.

- Not signing the document in the presence of a notary public, making it invalid.

- Forgetting to provide copies to relevant parties, which may cause confusion later on.

Taking the time to carefully review the completed form can prevent these issues.

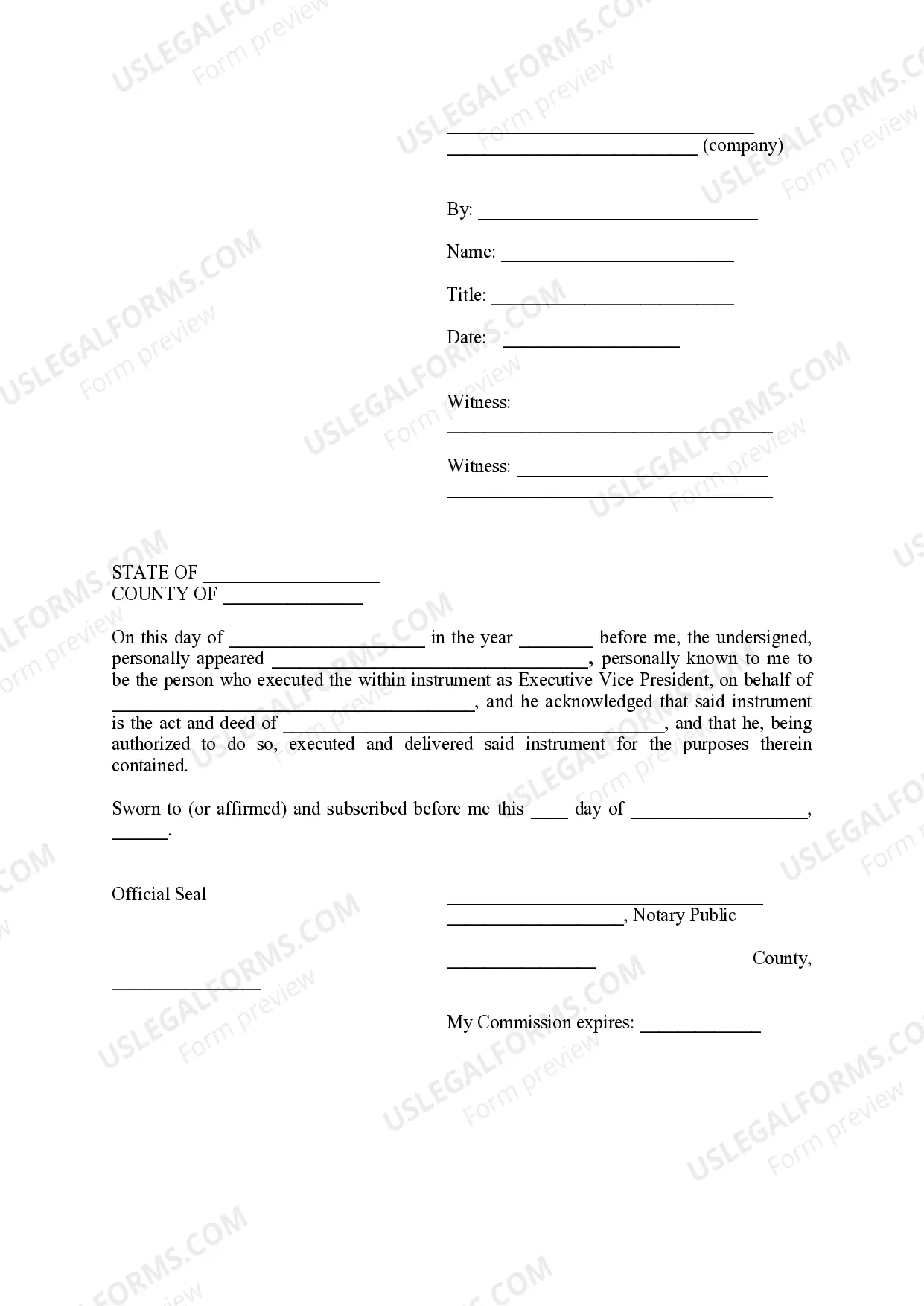

What to expect during notarization or witnessing

Notarization adds an extra layer of security to the Michigan Limited Power of Attorney. During this process:

- The notary will verify the identity of the principal.

- The principal must sign the document in the notary’s presence.

- The notary will apply their seal, certifying the document's authenticity.

It’s important to bring a valid form of identification to the notarization appointment.

Key takeaways

When considering a Michigan Limited Power of Attorney, remember to:

- Clearly define the powers you wish to grant.

- Have the document notarized to ensure its validity.

- Keep copies in a safe place and share them with your agent.

Understanding these aspects will help ensure that your Limited Power of Attorney meets your needs and complies with state laws.

How to fill out Michigan Limited Power Of Attorney?

Have any form from 85,000 legal documents such as Michigan Limited Power of Attorney on-line with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you have already a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Limited Power of Attorney you want to use.

- Look through description and preview the sample.

- When you’re sure the sample is what you need, click Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable template. The service provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Michigan Limited Power of Attorney fast and easy.

Form popularity

FAQ

First, the legal answer is however long you set it up to last. If you set a date for a power of attorney to lapse, then it will last until that date. If you create a general power of attorney and set no date for which it will expire, it will last until you die or become incapacitated.

Can the Power of Attorney be used by the agent to take my money or property without my permission? Unfortunately, you can run the risk that the agent you choose to give your Power of Attorney could abuse the power by spending your money or taking your money without your knowledge or worse without your permission.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian. The power of attorney ends at death.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

When you give someone the POA, there are important limitations to the power the agent has. First, your agent must make decisions within the terms of the legal document and can't make decisions that break the agreement, and the agent can be held liable for any fraud or negligence.

The biggest limitation on a power of attorney is that it can only be signed when the principal is of sound mind.If the principal is unable to make decisions, the principal's family will need to go to court to become a court appointed guardian before they can make financial or medical decisions.