Michigan Commercial Rental Lease Application Questionnaire

About this form

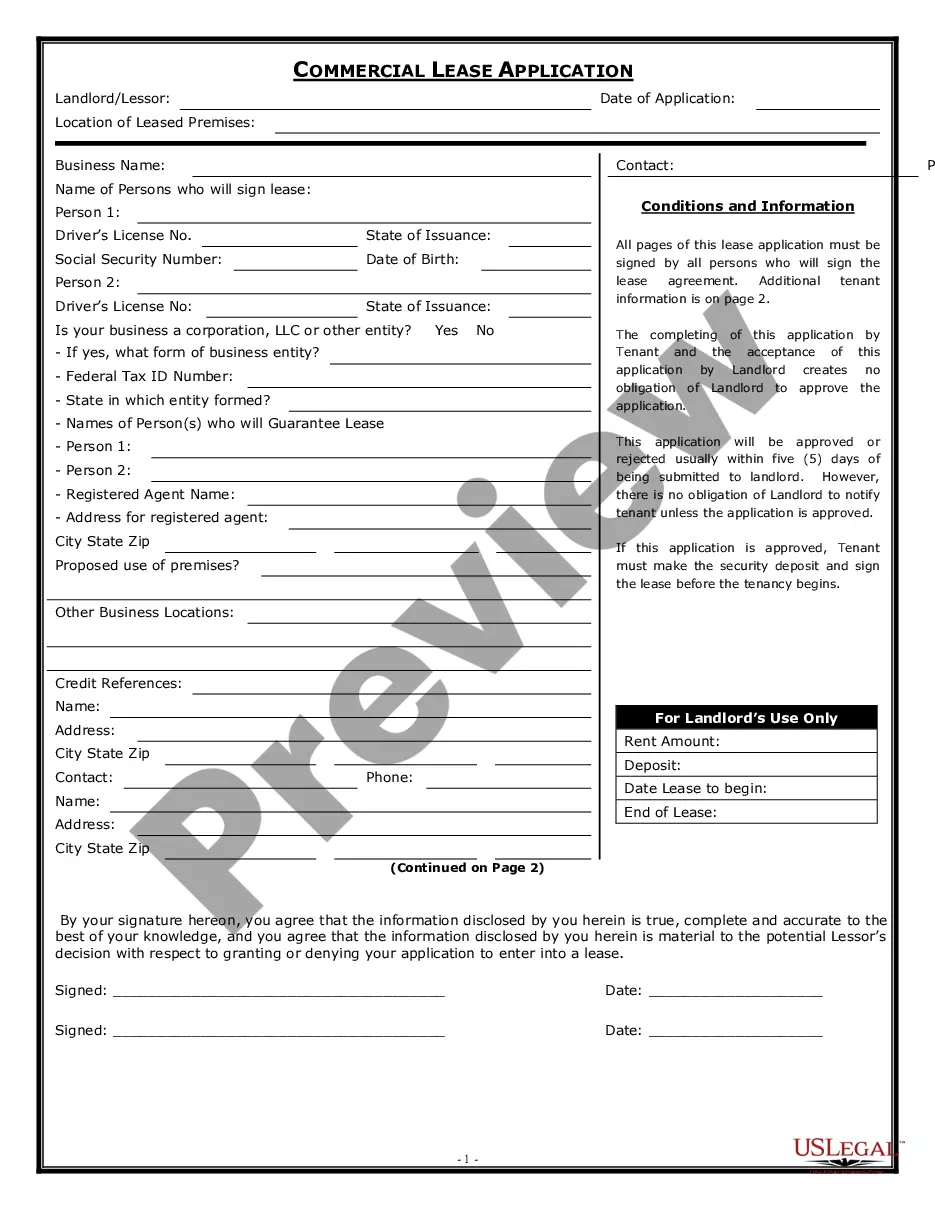

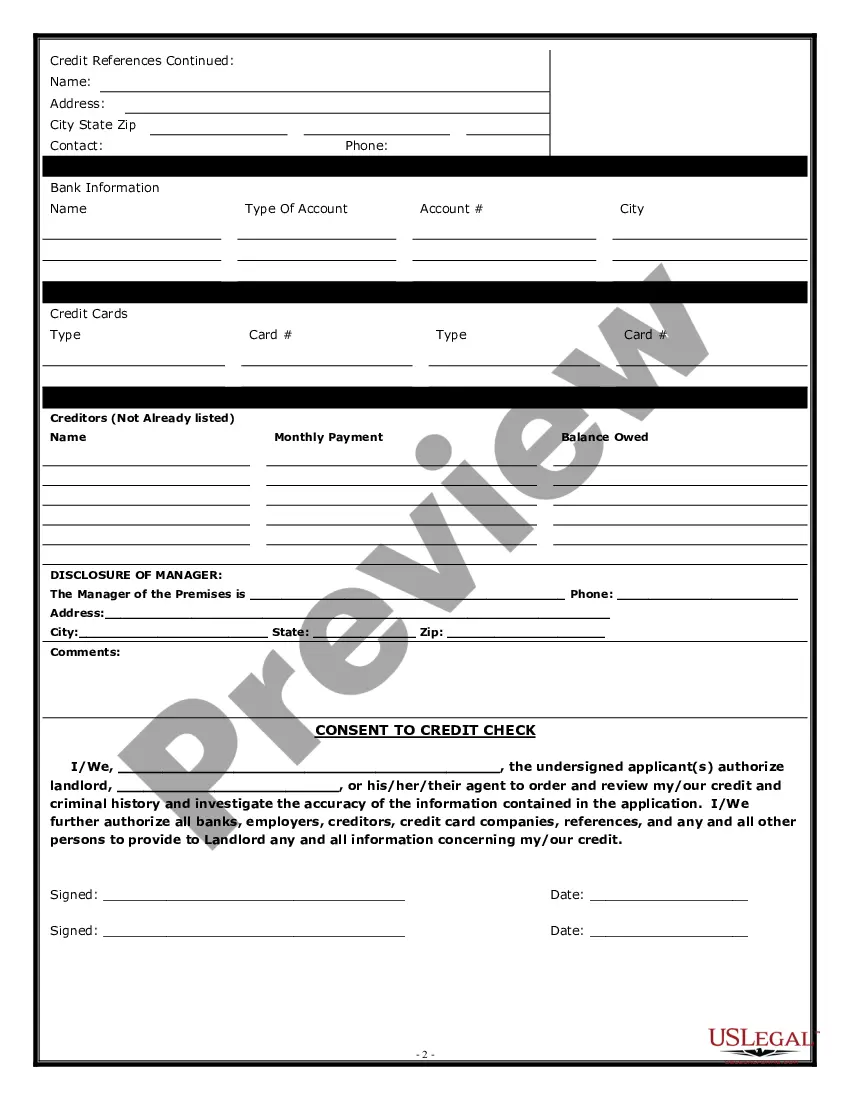

The Commercial Rental Lease Application Questionnaire is a legal document that prospective tenants complete to apply for a commercial lease. It provides landlords with essential information about the tenant, including personal and financial details, and authorizes the release of this information for verification. This form is distinct from residential lease applications, as it focuses on business-related properties and tenancy agreements.

Main sections of this form

- Applicant's personal information and business details

- Disclosure of financial history and references

- Authorization for credit and background checks

- Signatures of all applicants, affirming the truthfulness of information provided

- Details for landlord use, such as proposed rent amount and lease dates

When to use this form

This form should be used when a prospective tenant wishes to lease a commercial property. It is typically required by landlords to assess the suitability of a potential tenant based on their financial stability and business background. Common scenarios include applying for retail space, office units, or industrial properties.

Who needs this form

- Business owners looking to lease commercial premises

- Individuals or entities seeking to establish a business presence in a leased property

- Landlords requiring a comprehensive application for potential tenants

Steps to complete this form

- Provide your personal information, including your name and contact details.

- Enter your business information, including the business name and type.

- List your credit references, including banks and creditors, along with their contact information.

- Sign the form to authorize background and credit checks.

- Ensure all sections of the application are completed and review the information for accuracy before submission.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Leaving sections blank or not providing complete information.

- Failing to sign and date the application.

- Not providing accurate credit references or financial details.

- Overlooking the authorization for credit checks.

Why use this form online

- Convenience of filling out forms from anywhere, at any time.

- Editability allows for easy corrections and updates.

- Instant access to professionally drafted legal documents ensures reliability.

Legal use & context

- Serves as a preliminary step in securing a commercial lease, providing landlords with necessary tenant evaluations.

- Helps establish a professional relationship through transparency in financial disclosures.

- If approved, it is often followed by the completion of a more detailed lease agreement.

Key takeaways

- The Commercial Rental Lease Application Questionnaire is critical for assessing prospective tenants for commercial leases.

- Providing accurate and complete information is essential for application approval.

- This form streamlines the rental application process and facilitates communications between landlords and tenants.

Looking for another form?

Form popularity

FAQ

risk tenant typically has a poor credit score, previous evictions, or insufficient rental history. These factors can indicate potential challenges, leading landlords to view them as more likely to default on payments. Addressing concerns related to these factors can strengthen your Michigan Commercial Rental Lease Application Questionnaire.

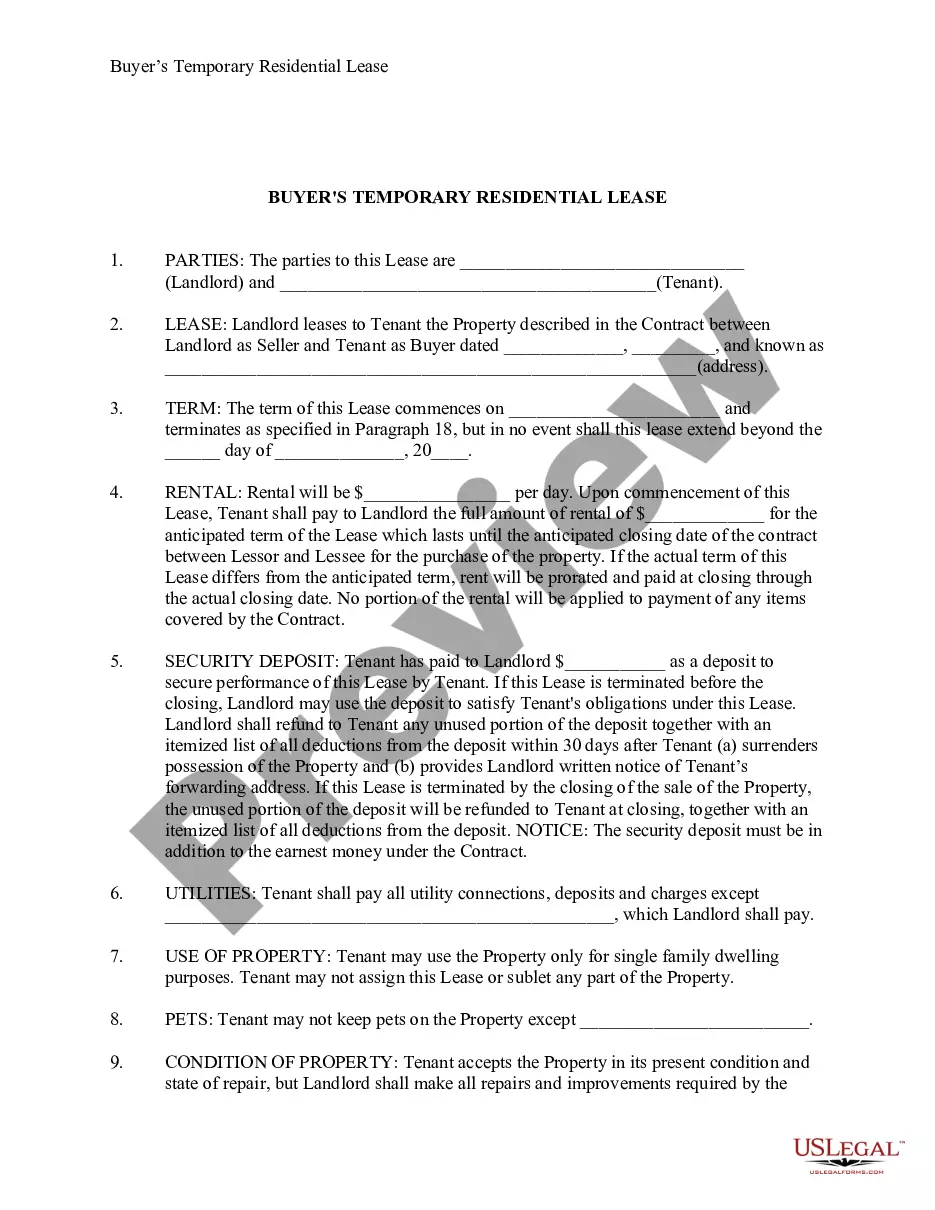

The Person Liable for the Lease. Your Business Structure. How Long You Have Been in Business. The Nature of Your Business. Contact Information. Your Proposed Terms (or, Counter Offer) The Length of the Lease. Condition of the Property.

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

Keep the Ticking Clock in Mind. Think Seriously About Going Long Term. Prioritize Your Wish List. Arm Yourself With Knowledge. Negotiate Your Way to Greater Flexibility. Study Tenant Improvements Before You Head to the Table. Double Check the Details. Enlist the Help of a Tenant Rep Broker.

Specifically, look at the building owner, landlord, zoning laws, environmental expectations and nuisance laws. Know how much you have to pay, what exactly you're covering and how much your rent will increase each year.

Are you building for the future? Is the location safe? Is the office space adequately wired for your business and equipment needs. How much will furniture cost? How much will the rent increase each year? What's included in the lease? Who handles repairs?

The process for retailers qualifying for a commercial lease can vary from landlord to landlord. Landlords consider several factors including tenant mix, personal credit history of the owner, company balance sheet, profit and loss statements, open credit lines, and growth projections.

Every commercial tenant doesn't necessarily need a sterling credit history to lease space from you. But it's good to know what you're getting into ahead of time. Assessing credit helps you know when to add appropriate protections into a tenant's lease agreement.

What Type of Commercial Lease is Given? Are the Terms of the Lease Negotiable? Is the Space Modifiable? What other Tenants are In the Premises? What Amenities are Available? Is the Commercial Lease Assignable?