Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Overview of this form

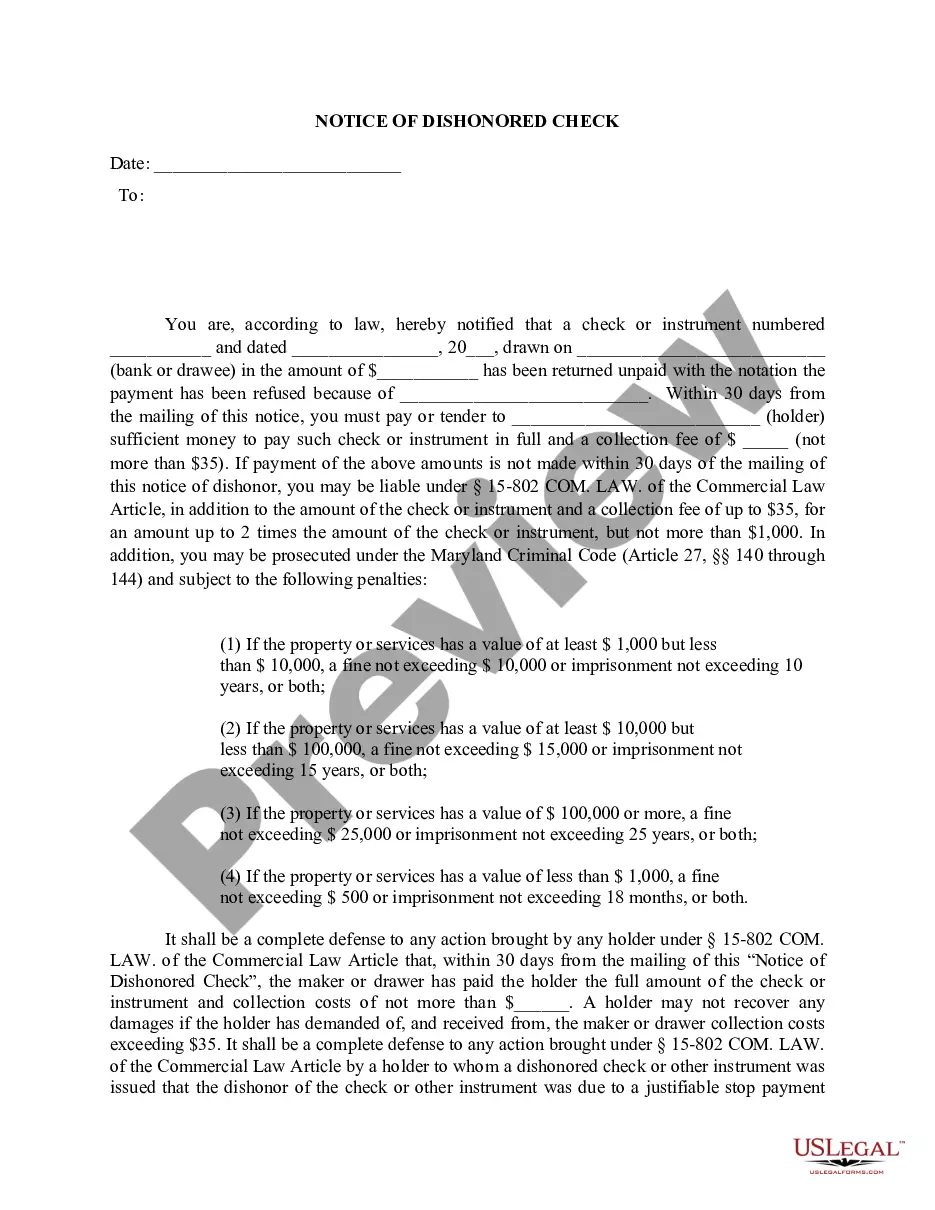

This Notice of Dishonored Check - Civil is a legal document used to inform the payee that a check, also referred to as a bad check or bounced check, has not been honored by the bank. A dishonored check typically occurs when there are insufficient funds or when the checking account does not exist. This notice is essential for businesses or individuals seeking to recover owed amounts, as it may be a legal requirement under state law to notify the check issuer about the dishonor before pursuing further recovery actions.

Form components explained

- Details of the dishonored check, including the amount and date.

- Information about the sender (holder) of the notice.

- Recipient information, including their address.

- Clear statement of the consequences of not paying, as per state law.

- Instructions on how to respond and settle the payment.

Situations where this form applies

This form should be used when a check that you have received has been returned unpaid by the bank. Common scenarios include receiving checks for services rendered, goods sold, or rental payments. If you are trying to collect payment for a debt and have received a bounced check, issuing this notice will serve as a formal communication necessary to pursue recovery actions legally.

Who can use this document

- Individual payees who have received a bounced check.

- Business owners seeking to recover funds from bad checks.

- Landlords who have received dishonored rental payments.

How to complete this form

- Fill in the date the notice is being issued.

- Provide details of the dishonored check, including the check number and total amount.

- Enter your name and address as the holder of the check.

- Include the name and address of the check issuer.

- Sign the notice and print your name and title, if applicable.

Does this document require notarization?

This form does not typically require notarization unless specified by local law. However, it is advisable to check your state's regulations to ensure compliance.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all necessary details about the check, such as the amount and check number.

- Not sending the notice within the required time frame after the check is returned.

- Incorrectly addressing the notice to the wrong individual or entity.

Why use this form online

- Convenient access to your form anytime, allowing for quick issuance.

- Editability ensures you can customize the form according to your unique situation.

- Reliable templates drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

Writing a bad check is considered a wobbler crime in California, meaning it can be charged as either a misdemeanor or felony depending on circumstances of the crime. If the value of the check was under $450, the offense is generally charged as a misdemeanor. If the amount is over $450, you can be charged with a felony.

Writing a bad check is considered a wobbler crime in California, meaning it can be charged as either a misdemeanor or felony depending on circumstances of the crime. If the value of the check was under $450, the offense is generally charged as a misdemeanor. If the amount is over $450, you can be charged with a felony.

You'll need to have 100% of the money required available in your account for the check to be cashed. If you're short on funds, the request to cash the check will be denied, and you'll owe fees to your bank. Plus, the payee may have the right to charge you additional fees.

You may also sue someone who writes you a bad check without having a valid reason for doing so. You may also recover damages equaling three times the amount of the check, up to a maximum of $1,500, if you meet certain conditions: You must send a demand letter to the person who wrote the check.

Contact the bank that placed the negative information on your report. If the information is true, it isn't obligated to change or remove the information. You can, however, write a short explanation of the circumstances surrounding the bad check for inclusion in your report.

Send the letter certified mail. Visit your local district attorney's office if you do not hear back from the debtor. Bring your correspondence with you and a copy of the bad check. He will take the case over, and likely prosecute the check writer.

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.

Bouncing a check can happen to anyone. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Under criminal penalties, you can be prosecuted and even arrested for writing a bad check.This can be seen as a felony in many states, especially when the checks are for more than $500. It's important to note that provision is made for accidents, because bookkeeping mistakes do happen.