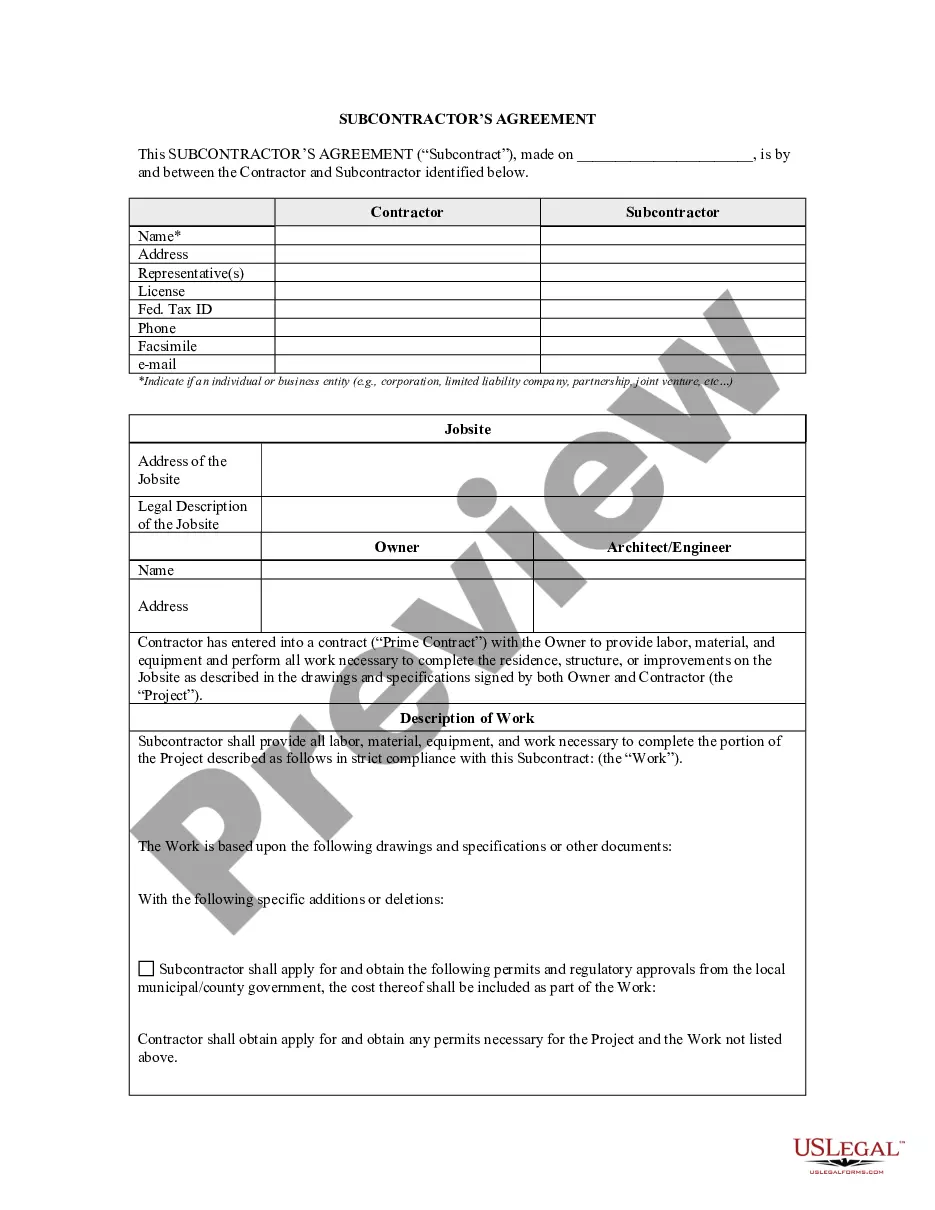

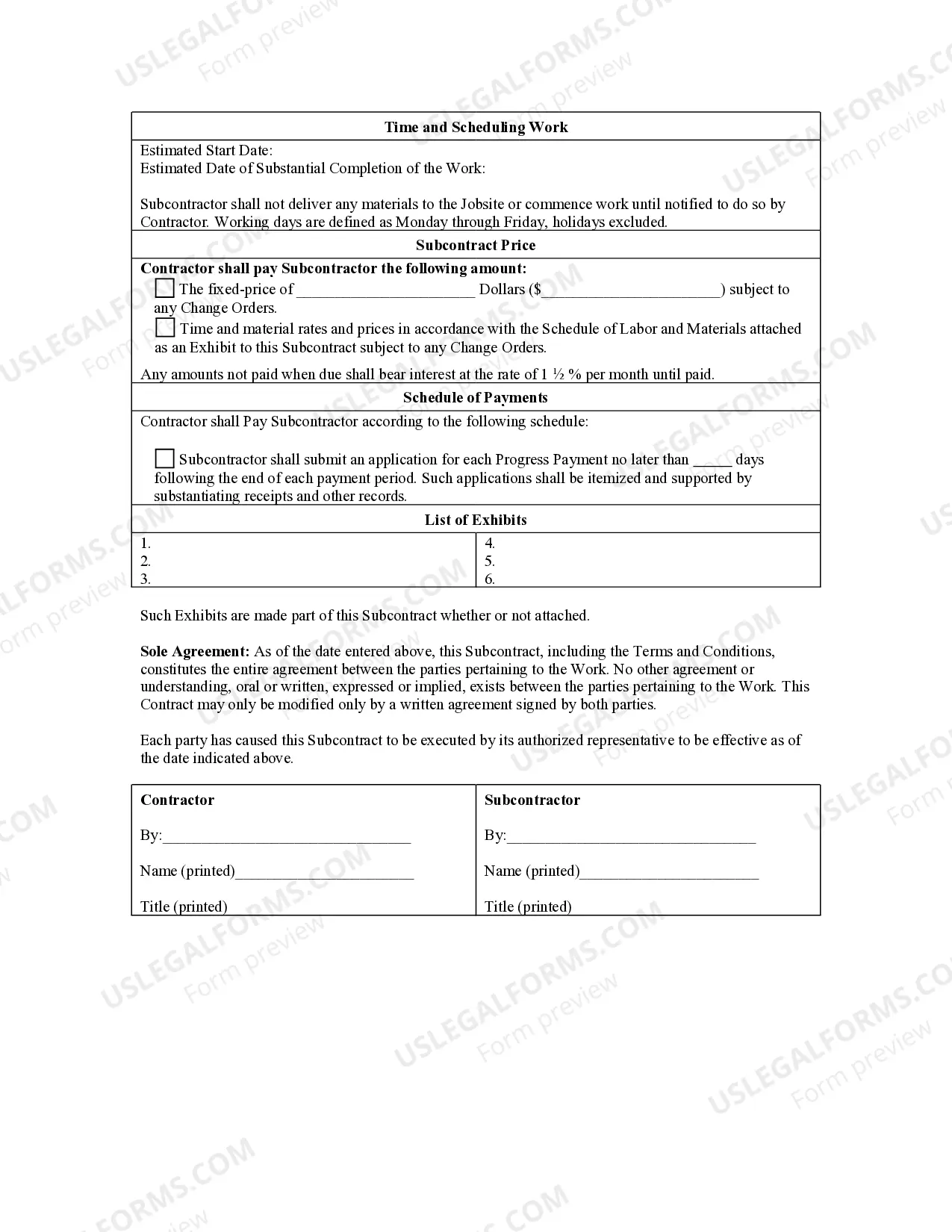

Maryland Subcontractor's Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Subcontractor's Agreement?

Greetings to the finest legal document repository, US Legal Forms. Here you can discover any template including Maryland Subcontractor's Agreement forms and save them (as numerous as you want/require). Prepare official documents within a few hours, rather than days or weeks, without spending a fortune with a legal expert. Obtain your state-specific template in a matter of clicks and feel assured knowing that it was crafted by our certified legal professionals.

If you’re already a subscribed client, just Log In to your account and click Download next to the Maryland Subcontractor's Agreement you require. Since US Legal Forms is an online solution, you’ll always have access to your downloaded documents, regardless of what device you’re using. Find them in the My documents section.

If you don't have an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve completed the Maryland Subcontractor's Agreement, send it to your legal advisor for verification. It’s an extra step but a vital one to ensure you’re fully protected. Register for US Legal Forms today and gain access to a vast array of reusable templates.

- If this is a state-specific template, verify its relevance in your state.

- Review the description (if available) to determine if it’s the correct template.

- Access additional content with the Preview feature.

- If the sample meets your needs, click Buy Now.

- To create an account, choose a pricing plan.

- Utilize a credit card or PayPal account to enroll.

- Download the template in your desired format (Word or PDF).

- Print the document and fill it out with your/your business’s details.

Form popularity

FAQ

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.

Subcontractor agreements outline the responsibilities of each party, to ensure that if a claim were to arise, the responsible party is accountable. A subcontractor agreement provides protection to the company that hired the vendor or subcontractor by transferring the risk back to the party performing the work.

Start with procurement standards. Execute all subcontracts prior to starting your projects. Help those who help you. Award the job to the lowest fully qualified bidder. Use contract scope checklists. Make sure you have tight clauses. Meet to review the proposed subcontract.

A subcontractor has a contract with the contractor for the services provided - an employee of the contractor cannot also be a subcontractor.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

The disadvantages contractors doing this work lie in costs: The hourly expenses are high, and the professionals are independent in that they don't report to supervisors inside the company. These factors make it challenging to control the costs of these subcontracts.