Massachusetts Business Incorporation Package to Incorporate Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Business Incorporation Package To Incorporate Corporation?

Greetings to the largest legal documents repository, US Legal Forms. Here you can acquire any template including the Massachusetts Business Incorporation Package to form a Corporation and save them (as many as you desire). Create official paperwork within a few hours, rather than days or weeks, without costing a fortune on a lawyer.

Obtain your state-specific example in just a few clicks, and feel confident knowing it has been prepared by our licensed attorneys.

If you’re a current subscriber, simply Log Into your account and click Download next to the Massachusetts Business Incorporation Package to Incorporate Corporation you require. Since US Legal Forms operates online, you’ll always be able to access your saved templates, regardless of the device you use. Find them in the My documents section.

Once you’ve completed the Massachusetts Business Incorporation Package to Incorporate Corporation, submit it to your lawyer for verification. It’s an extra measure but an essential one to ensure you’re completely secure. Register for US Legal Forms today and gain access to a vast array of reusable templates.

- If you haven't created an account yet, what are you waiting for? Follow our instructions below to commence.

- If this is a form specific to your state, verify its applicability in your region.

- Review the description (if present) to determine if it’s the correct template.

- Utilize the Preview feature to see additional content.

- If the document meets your requirements, click Buy Now.

- To register your account, select a pricing plan.

- Use a credit card or PayPal account to sign up.

- Download the document in the desired format (Word or PDF).

- Print the document and fill it in with your or your business’s details.

Form popularity

FAQ

Costs and Fees to Incorporate in Massachusetts The state filing fee to incorporate in Massachusetts is $275.00 for up to 275,000 shares plus $100 for each additional 100,000 shares or any fraction of that. It typically takes about 5 to 7 days to incorporate in Massachusetts.

Registered Office. Business Activity. Director's Details. Shareholders' Details. Shareholders' Details. Secretary Details (Not Compulsory) Person with Significant Control (PSC) Details Where the person is not a director, shareholder or secretary.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

Choose a corporate structure. Check Name Availability. Appoint a Registered Agent. File Massachusetts Articles of Incorporation. Establish Bylaws & Corporate Records. Appoint Initial Directors. Hold Organizational Meeting. Issue Stock Certificates.

Choose a Corporate Name. File Articles of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Initial Directors and Hold First Board Meeting. File Annual Report. Obtain an EIN.

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

Articles of Incorporation are a set of formal documents that establish the existence of a company in the United States and Canada. For a business to be legally recognized as a corporation.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

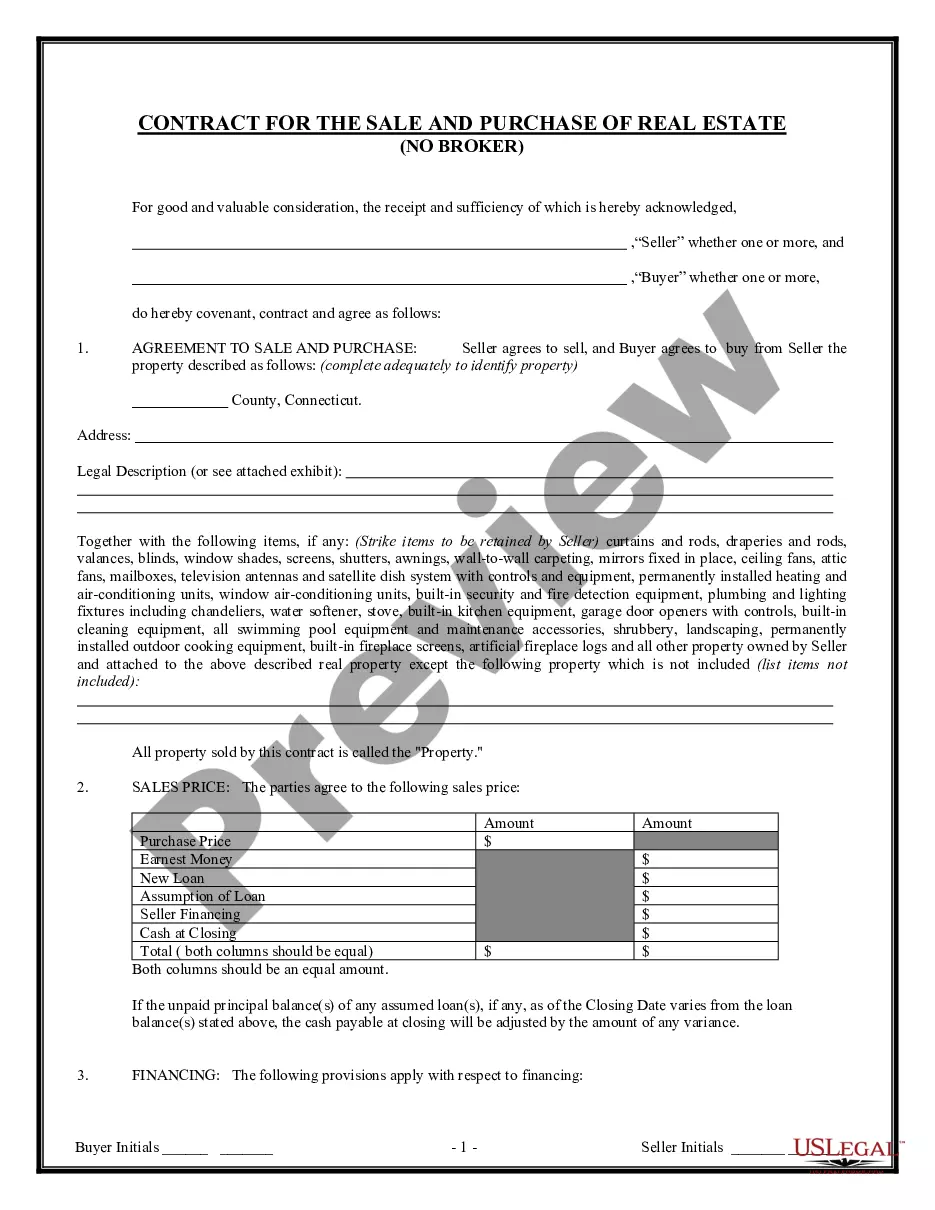

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)