Louisiana Revocation of Anatomical Gift Donation

Overview of this form

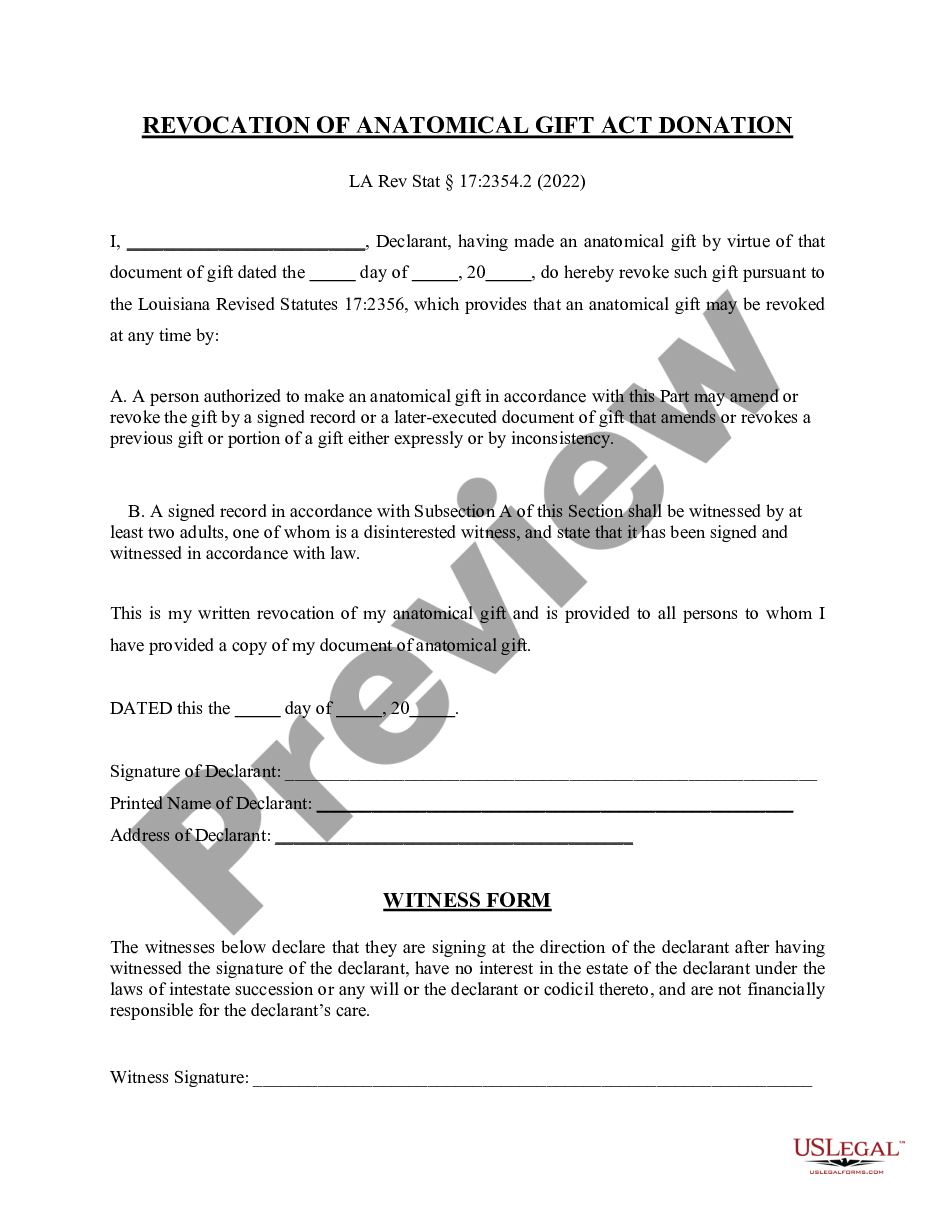

The Revocation of Anatomical Gift Donation form is a legal document that allows an individual to revoke their previous decision to donate body parts or organs upon death. This form differs from the Anatomical Gift Donation form as it specifically communicates the donor's change of heart regarding their donation preference. Executing this revocation ensures that prior directives regarding anatomical gifts are formally nullified, providing peace of mind to the donor and their loved ones.

What’s included in this form

- Identification of the donor and donee (recipient of the anatomical gift).

- Statement affirming the revocation of the previous anatomical gift donation.

- Signature of the donor to validate the revocation.

- Requirement for witnessing the document by at least two adults, including one disinterested witness.

- Date of the revocation to track when the decision was made.

When this form is needed

This form should be used when an individual decides to withdraw their consent for anatomical donation originally expressed through an anatomical gift document. It is ideal for those who have changed their minds due to personal, medical, or ethical reasons and wish to ensure their current wishes are respected upon their passing.

Who should use this form

This form is intended for:

- Individuals who previously executed an Anatomical Gift Donation and now wish to revoke it.

- Persons seeking to ensure their final wishes regarding organ and body part donation are accurately reflected.

- Family members or representatives acting on behalf of someone who can no longer express their wishes.

Steps to complete this form

- Identify yourself as the donor and include necessary identification details.

- Clearly state your intention to revoke the previous anatomical gift donation.

- Sign the form in the presence of at least two adult witnesses, ensuring one is disinterested.

- Date the document to establish when the revocation is effective.

- Distribute copies of the completed form to the donee and retain a copy for personal records.

Does this form need to be notarized?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to have the form witnessed correctly, which can invalidate the revocation.

- Not providing a clear statement of revocation in the document.

- Overlooking to sign and date the form, which is essential for legal validity.

Advantages of online completion

- Convenient access allows users to complete the form from anywhere, at any time.

- Easy to edit and customize to fit individual needs.

- Reliable templates drafted by licensed attorneys ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

The revocation of such a gift, therefore, merely means that the donor has changed his mind and does not want to complete it by the delivery of possession. For the revocation of such gifts, no order of the court is necessary.

With a gift causa mortis, the donor may unilaterally choose to revoke the gift at any time while they are still alive. Additionally, the gift is either revoked or revocable at the donor's discretion, if they survive the conditions that caused them to anticipate death.

Section 126 of Transfer of Property Act, 1882 specifies as to when a gift can be suspended or revoked: If the donor and donee agree that on the happening of a specified event which does not depend on the donor's will, the gift shall be revoked. Any of those cases in which if it were a contract, it might be rescinded.

A gift may be revoked only by a mutual agreement on a condition by the donor and the donee, or by rescinding the contract pertaining to such gift. The Donations mortis causa and Hiba are the only two kinds of gifts which do not follow the provisions of the Transfer of Property Act.

Save as aforesaid, a gift cannot be revoked. Nothing contained in this section shall be deemed to affect the rights of transferees for consideration without notice.

A gift may be revoked only by a mutual agreement on a condition by the donor and the donee, or by rescinding the contract pertaining to such gift. The Donations mortis causa and Hiba are the only two kinds of gifts which do not follow the provisions of the Transfer of Property Act.

A gift is valid and complete on registration.A deed of gift once executed and registered cannot be revoked, unless the mandatory requirement of Section 126 of Transfer of Property Act, 1882 is fulfilled.

The donor and donee may agree that on the happening of any specified event which does not depend on the will of the donor a gift shall be suspended or revoked; but a gift which the parties agree shall be revocable wholly or in part, at the mere will of the donor, is void wholly or in part, as the case may be.

Gift once given cannot be revoked. Gift deed s irrevocable. So once the gift deed s registered it becomes the sole property of the donee I.e., person who received the gift. But in case if the said deed was registered due to threat fraud or by force then it can be revoked and the same has to be proved before the court.