Kansas Closing Statement

About this form

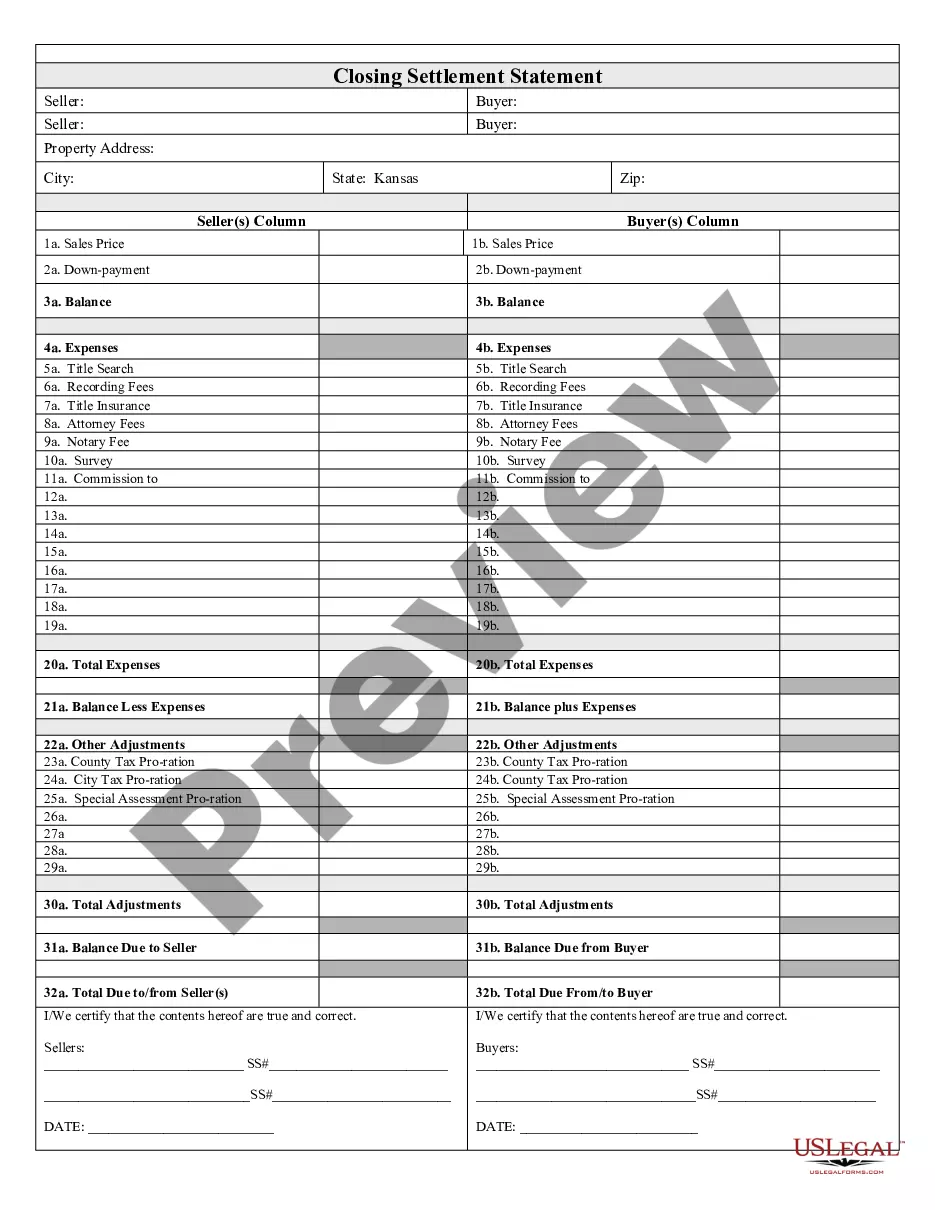

The Closing Statement is a crucial document used in real estate transactions, particularly for cash sales or owner financing agreements. This form serves to summarize the financial aspects of the transaction, detailing all expenses and the final amounts owed by both the buyer and the seller. Unlike other real estate forms, the Closing Statement includes verified and signed declarations from both parties, ensuring transparency and accountability during the settlement process.

Key components of this form

- Balance due to/from seller and buyer.

- Detailed breakdown of expenses including attorney fees and recording fees.

- Pro-ration of taxes and special assessments.

- Certification from both seller and buyer confirming accuracy.

When this form is needed

This form is used during the completion of a real estate transaction when ownership is transferred from the seller to the buyer. It is necessary for both cash sales and transactions involving owner financing, as it details the financial obligations and confirms that both parties agree to the terms outlined in the statement.

Who should use this form

- Home sellers and buyers engaged in a real estate transaction.

- Real estate agents or brokers facilitating the sale.

- Attorneys involved in the closing of the transaction.

How to complete this form

- Identify the parties involved: Seller(s) and Buyer(s).

- Detail all expenses related to the transaction, including title search and attorney fees.

- Calculate the total amount due to or from each party after adjustments.

- Have both the seller and buyer verify the information and provide their signatures.

- Date the closing statement upon completion to formalize the agreement.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include all applicable expenses, leading to incorrect totals.

- Not obtaining signatures from both parties, which invalidates the document.

- Neglecting to double-check the figures, resulting in discrepancies.

Benefits of using this form online

- Easy access to pre-drafted legal language created by licensed attorneys.

- Immediate download and customization for specific transactions.

- Secure storage and retrieval of the document, ensuring it is readily available when needed.

Looking for another form?

Form popularity

FAQ

You'll need to formally close your LLC or Corporation. Otherwise, you can still be on the hook for filing your inactive business' annual reports, filing state/federal tax returns, and keeping up any business licenses.

Complete the Notice of Business Closure (CR-108) Return the completed form to: Kansas Department of Revenue, PO Box 3506, Topeka, KS 66625-3506 or FAX to 785-291-3614. Include information on the date the business was closed. Make sure all tax filings are current.

If you live where a title or escrow company agent handles closing and there are two meetings, it's likely that the seller and the seller's agent or attorney will sign paperwork at one meeting and the buyer, accompanied by her agent or attorney, will sign at a separate meeting.

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.

Unlike the buyer, who may have to attend the closing to sign original loan documents delivered by the lender to the closing, you, as the seller, may or may not need to attend. For either a conventional escrow closing or a table closing, you may be able to pre-sign the deed and other transfer documents.

File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

Complete the Notice of Business Closure (CR-108) Return the completed form to: Kansas Department of Revenue, PO Box 3506, Topeka, KS 66625-3506 or FAX to 785-291-3614. Include information on the date the business was closed. Make sure all tax filings are current.

The Mortgage Promissory Note. The Mortgage / Deed of Trust / Security Instrument. The deed (for property transfer). The Closing Disclosure. The initial escrow disclosure statement. The transfer tax declaration (in some states)