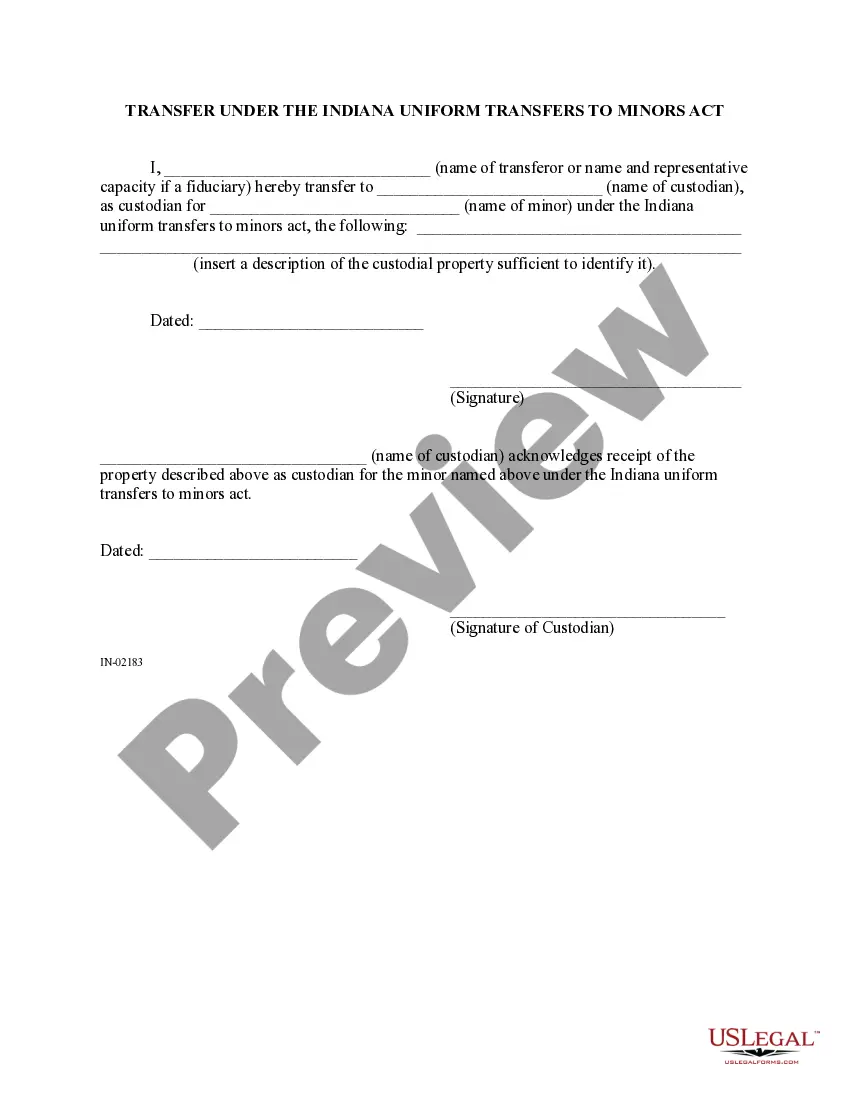

This is a statutory form of transfer under the Indiana Transfer to Minors Act. This form must be used when one desires to transfer property of any kind to a Minor.

Transfer under the Indiana Uniform Transfers to Minors Act

Description

How to fill out Transfer Under The Indiana Uniform Transfers To Minors Act?

Trying to find Transfer under the Indiana Uniform Transfers to Minors Act forms and filling out them can be quite a problem. To save time, costs and effort, use US Legal Forms and choose the right template specially for your state in a few clicks. Our legal professionals draft all documents, so you just have to fill them out. It is really so simple.

Log in to your account and return to the form's page and download the sample. All your downloaded samples are kept in My Forms and they are available always for further use later. If you haven’t subscribed yet, you should sign up.

Have a look at our detailed instructions concerning how to get your Transfer under the Indiana Uniform Transfers to Minors Act template in a few minutes:

- To get an qualified sample, check out its validity for your state.

- Have a look at the form making use of the Preview option (if it’s available).

- If there's a description, go through it to know the specifics.

- Click on Buy Now button if you found what you're trying to find.

- Select your plan on the pricing page and make your account.

- Pick how you wish to pay out by a card or by PayPal.

- Save the file in the preferred format.

You can print the Transfer under the Indiana Uniform Transfers to Minors Act template or fill it out utilizing any web-based editor. No need to worry about making typos because your form may be used and sent away, and published as many times as you wish. Try out US Legal Forms and access to around 85,000 state-specific legal and tax documents.

Form popularity

FAQ

The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee.The donor can name a custodian who has the fiduciary duty to manage and invest the property on behalf of the minor until the minor becomes of legal age.

UGMA and UTMA accounts allow parents to save money and invest, maintain full control until their child is an adult. UTMA stands for Uniform Transfers to Minors Act, and UGMA stands for Universal Gifts to Minors Act. Both accounts allow you to transfer financial assets to a minor without establishing a trust.

You can move money from a custodial account, such as a UGMA (Uniform Gifts to Minors Act) or a UTMA (Uniform Transfers to Minors Act), to a 529 plan.

While you can technically withdraw money from a custodial account before your child reaches the age of majority, you can only do so for the direct benefit of the child.Keep in mind that any funds you take out may also create taxable gains for your child, and that withdrawn money won't have as much time to grow.

You can close a custodial account and suffer no repercussions if you give the funds to the child or transfer them into another account for the child's benefit.You can close the custodial account and establish a regular account at your bank or brokerage firm with the child as the sole beneficiary.

As the custodian of a UTMA/UGMA account, a parent can withdraw money whenever needed to benefit the child.

These deposits are irrevocablethey become permanent transfers to the minor and the minor's account. Typically, UGMA assets are used to fund a child's education, but the donor can make withdrawals for just about any expenses that benefit the minor. There are no withdrawal penalties.

The Uniform Gifts to Minors Act (UGMA) provides a way to transfer financial assets to a minor without the time-consuming and expensive establishment of a formal trust. A UGMA account is managed by an adult custodian until the minor beneficiary comes of age, at which point he assumes control of the account.

In California, the age of majority is 18 while the age of trust termination is 21. As a result, custodians can establish UTMA accounts for a minor and specify that they wait until age 21 to gain control of the funds. Once the account is funded, it is common to invest the funds in stocks, bonds, mutual funds etc.