Indiana Warranty Deed from Husband and Wife to a Trust

Overview of this form

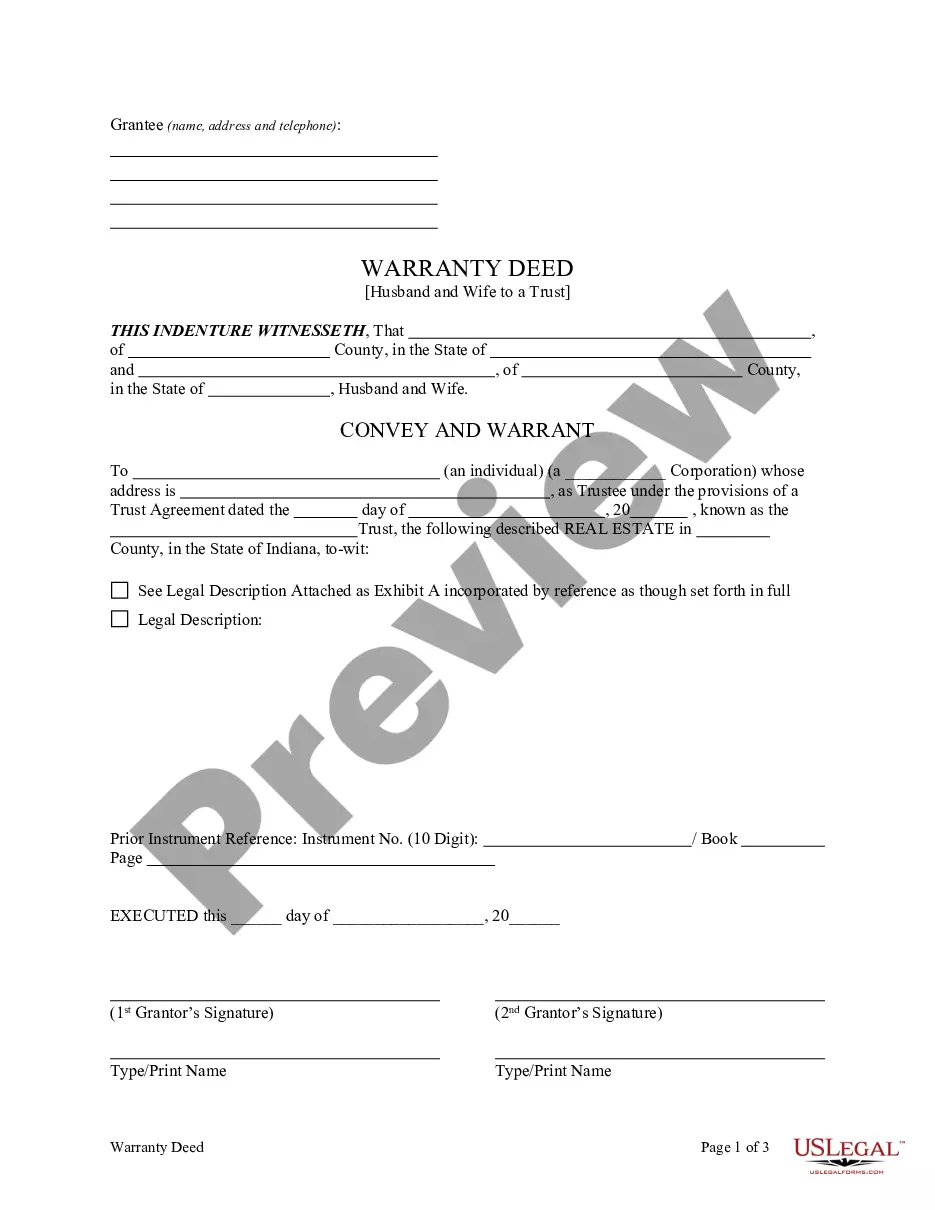

The Warranty Deed from Husband and Wife to a Trust is a legal document used to transfer property ownership from a married couple to a specified trust. This form ensures that the property is transferred with a guarantee that the grantors hold clear title and have the authority to transfer it. Unlike other types of deeds, this warranty deed provides protection to the grantee, or trust, against any future claims to the property, making it a more secure option for transferring assets.

Key parts of this document

- Names and addresses of the grantors (husband and wife).

- Name and details of the grantee (the trust).

- Description of the property being transferred, including legal descriptions.

- Statement of consideration, or the value exchanged for the property.

- Signatures of the grantors, along with dates and acknowledgment of the deed.

When this form is needed

This form is useful when a married couple decides to transfer their real estate to a trust for various reasons, such as estate planning, asset protection, or tax benefits. It can be used when the couple wants to ensure that the property is managed according to trust terms, even on the death of one or both grantors.

Who this form is for

- Married couples looking to transfer property to a trust.

- Individuals interested in estate planning and asset protection.

- Real estate owners wanting to secure the ownership of their property within a trust.

Completing this form step by step

- Identify the parties involved, including full names and addresses of the husband and wife, and the name of the trust.

- Provide a complete legal description of the property being transferred.

- Clearly state any consideration for the transfer, if applicable.

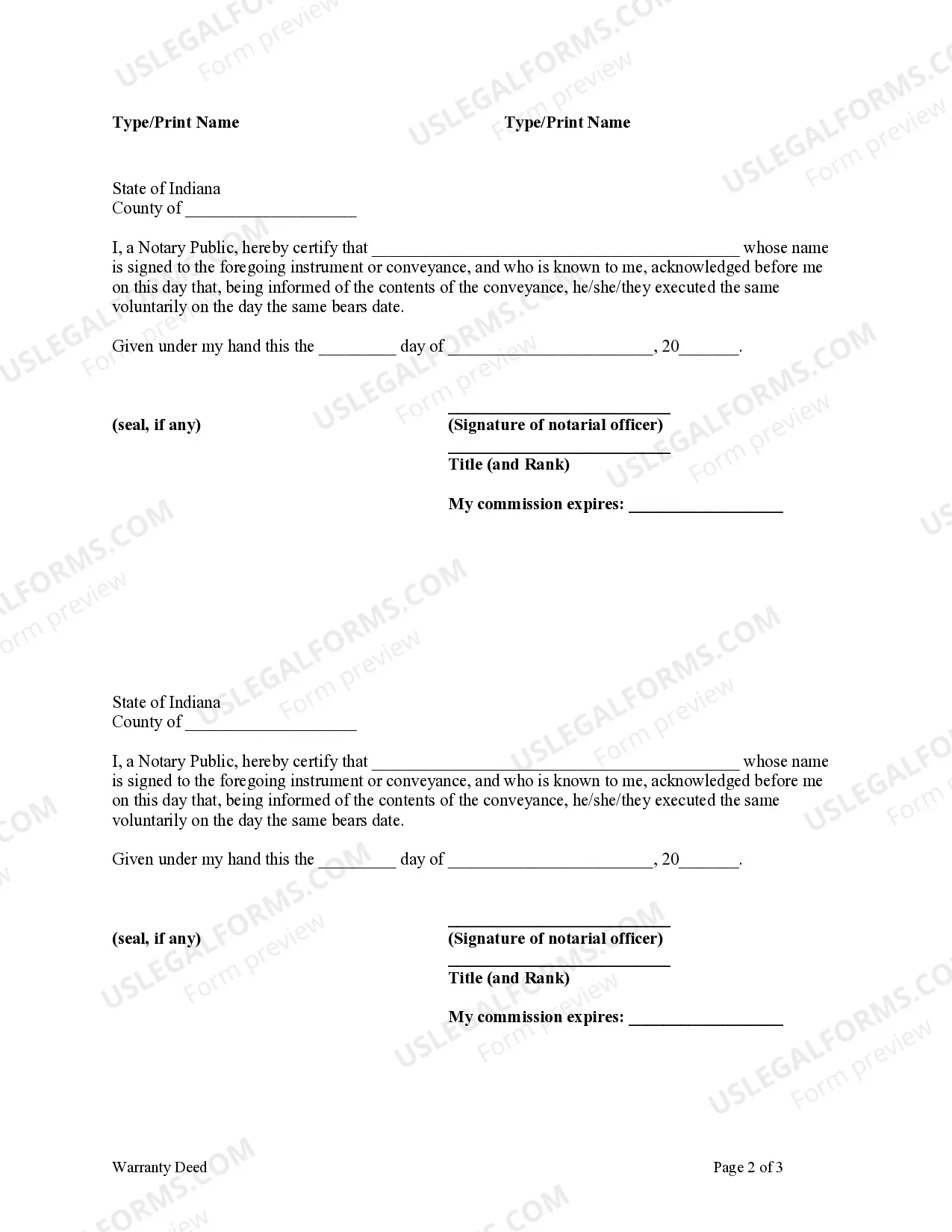

- Ensure that both husband and wife sign the deed in the presence of a notary public, if required in your jurisdiction.

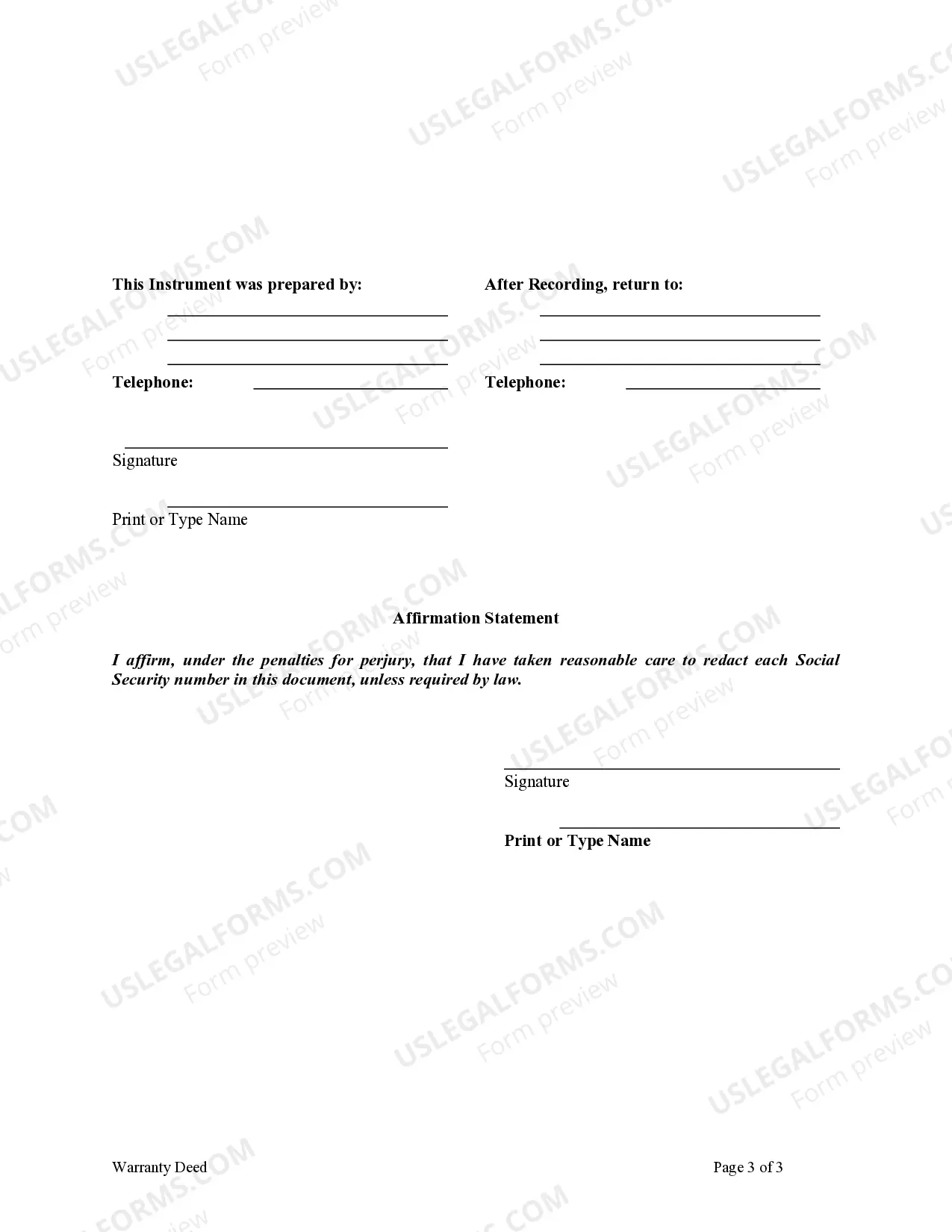

- File the completed deed with the appropriate county or municipal office to update public records.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include a complete legal description of the property.

- Not obtaining a notarization when required.

- Leaving out the names of the trust or spouses.

- Not recording the deed with the appropriate local authority.

Advantages of online completion

- Convenient access to the form from any location.

- Editable formats allow for easy customization of information.

- Drafted by licensed attorneys, ensuring legal compliance and reliability.

Key takeaways

- The Warranty Deed from Husband and Wife to a Trust securely transfers property ownership to a trust.

- It is essential to ensure all required information is included and correctly formatted.

- Notarization is required for validity, protecting both the grantors and the grantee.

Looking for another form?

Form popularity

FAQ

To transfer a property title to a family member in Indiana, you would typically use a deed, such as an Indiana Warranty Deed from Husband and Wife to a Trust. This deed ensures that the family member receives clear ownership of the property, protecting their interests. It's important to prepare the deed correctly and file it with the county recorder’s office. Legal assistance or using platforms like US Legal Forms can simplify this process significantly.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.