Illinois Facsimile Assignment Of Beneficial Interest (FBI) is a legal document used to transfer ownership of a beneficial interest in an Illinois land trust from one party to another. This document is also known as a “quit claim deed” and is typically used when a property owner wants to transfer their interest in an Illinois land trust to another party. This document needs to be notarized and filed with the county recorder’s office for it to be valid. The different types of Illinois Facsimile Assignment Of Beneficial Interest are Assignment of Beneficial Interest, Release of Beneficial Interest, and Resignation of Beneficial Interest.

Illinois Facsimile assignment Of Beneficial Interest

Description

How to fill out Illinois Facsimile Assignment Of Beneficial Interest?

Engaging with official documentation necessitates focus, precision, and utilizing properly prepared templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Illinois Facsimile Assignment of Beneficial Interest form from our collection, you can be assured it complies with federal and state standards.

Using our service is straightforward and swift. To acquire the necessary document, you simply need an account with an active subscription. Here’s a concise guide for you to obtain your Illinois Facsimile Assignment of Beneficial Interest in just a few minutes.

All documents are designed for multiple uses, such as the Illinois Facsimile Assignment of Beneficial Interest displayed on this page. If you require them again, you can complete them without additional payment - just navigate to the My documents tab in your profile and finalize your document whenever you need. Experience US Legal Forms and efficiently handle your business and personal paperwork in full legal compliance!

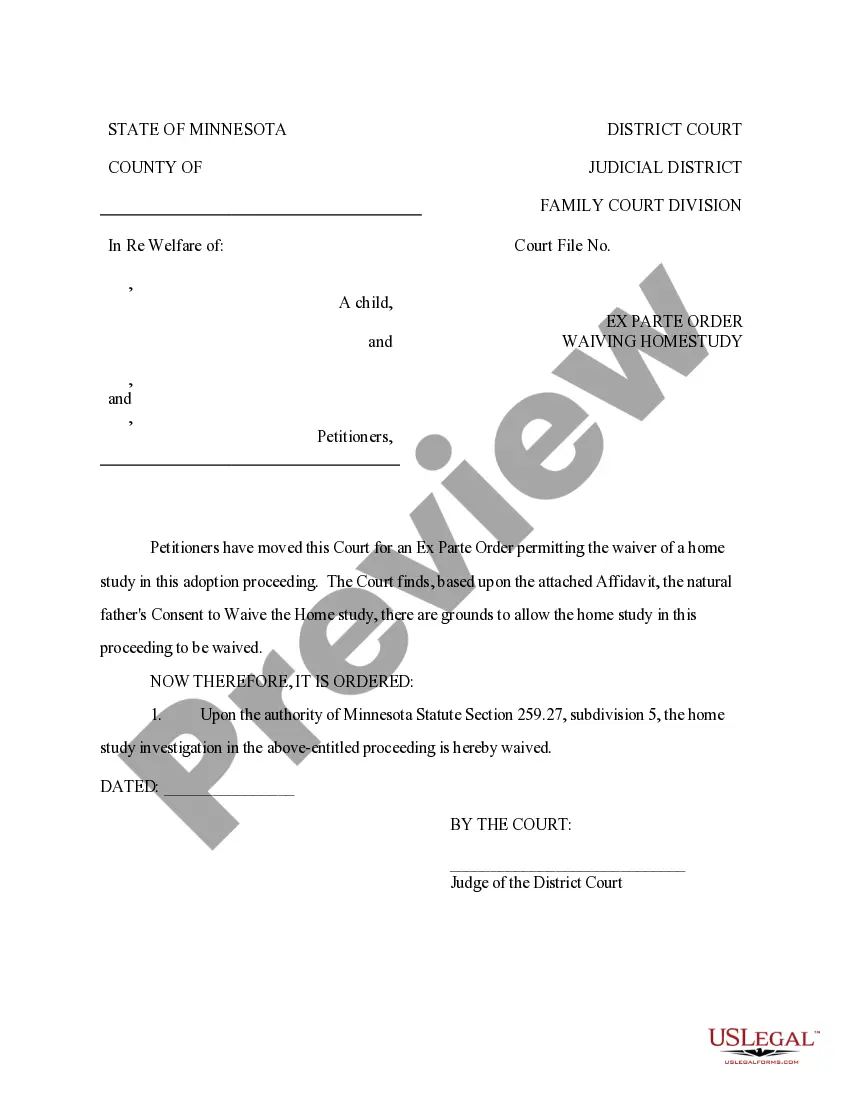

- Make sure to carefully review the form details and its alignment with general and legal stipulations by previewing it or checking its description.

- Look for an alternative official template if the one you accessed does not suit your needs or state regulations (the option for this is located in the corner of the top page).

- Log in to your account and save the Illinois Facsimile Assignment of Beneficial Interest in your preferred format. If it's your first visit to our site, press Buy Now to proceed.

- Create an account, select your subscription option, and pay using your credit card or PayPal.

- Choose the format in which you wish to save your document and click Download. Print the template or use a professional PDF editor to prepare it digitally.

Form popularity

FAQ

Key Takeaways. A beneficial interest is the right to receive benefits from assets held by another party. A Crummey trust is often set up by parents for their children where the beneficiary has an immediate interest. A beneficiary receives income from a trust's holdings but does not own the account.

Assignment of Beneficial Interest means the instrument pursuant to which a BI Seller conveys right, title and interest to the beneficial interest of a LIFT Entity to a Purchaser, the form of which is attached as Exhibit A hereto.

A land trust is used to name one trustee to a property in order to designate and control the income. This directs that income to beneficiaries. The trustee has no other function besides doing as the trust deed instructs.

Collateral assignment of beneficial interest means the Assignment of Beneficial Interest of even date herewith, pursuant to which the Borrower collaterally assigns, and grants to the Bank a first perfected and prior security interest in the Beneficial Interest to secure payment of the Obligations.

However, we hope this article has been helpful in pointing out land trust disadvantages, including the loss of rights and exemptions. Redemption rights can be jeopardized in case of foreclosure. Homestead bankruptcy protection and tax benefits are lost. Lastly, you lose secondary market loan options.

A deed of assignment can be used by property owners to assign their beneficial interest to another party; either a legal owner or a non-legal owner. Most commonly the transfer is between husband and wife for tax purposes on a buy to let.

A land trust is a simple, inexpensive method for handling the ownership of real estate. It is an arrangement by which the recorded title to the real estate is held by a trustee, but all the rights and conveniences of ownership are exercised by the beneficiary whose interest is not disclosed.

A beneficial interest is an interest in land that gives a person a financial share in a property and/or a right to occupy a property. There are three different ways in which a beneficial interest can arise: by express declaration of interests. by resulting trust. by constructive trust.