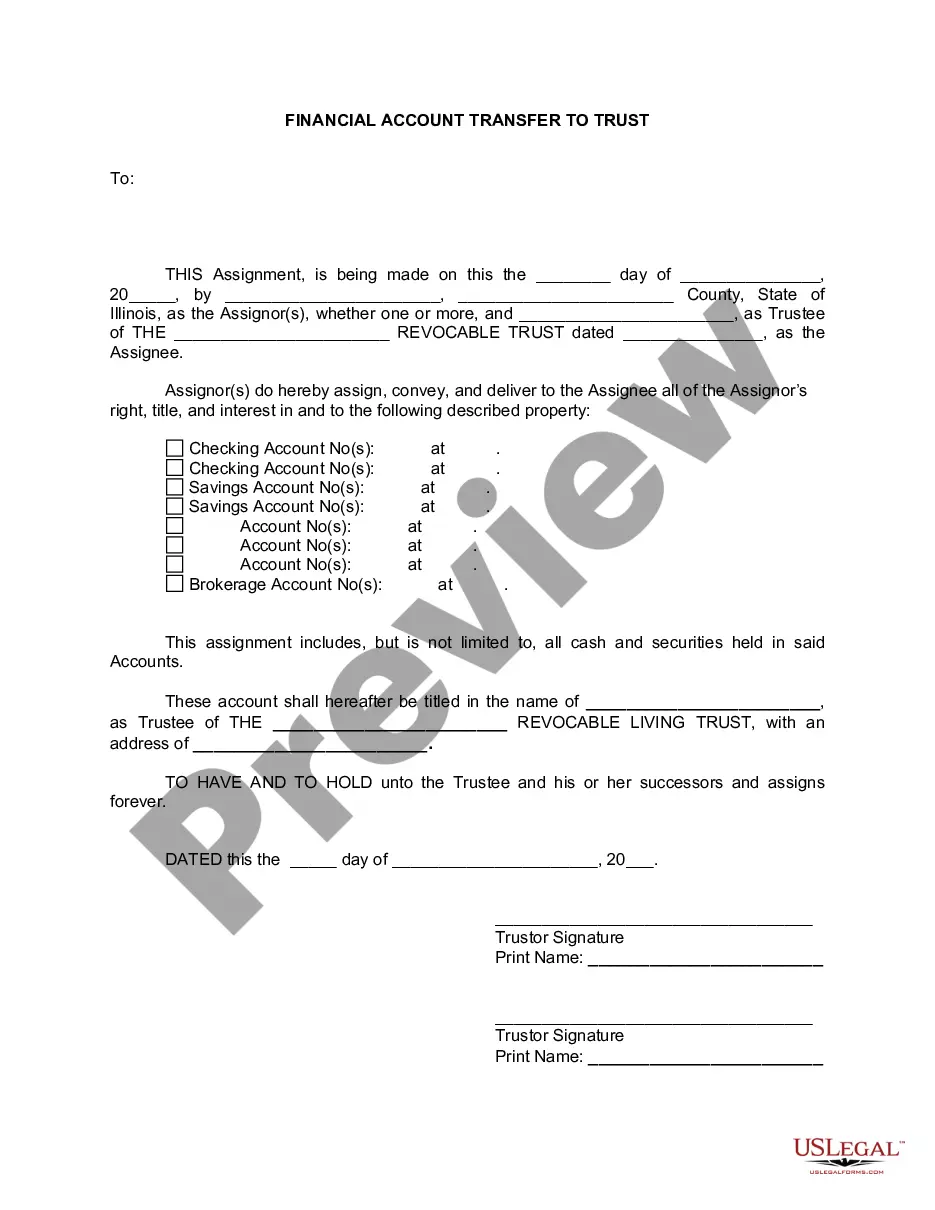

Illinois Financial Account Transfer to Living Trust

Description

How to fill out Illinois Financial Account Transfer To Living Trust?

Searching for Illinois Financial Account Transfer to Living Trust example and finalizing them could be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the suitable template specifically for your state in just a few clicks.

Our attorneys prepare every document, so you merely need to complete them. It genuinely is that simple.

Select your plan on the pricing page and create an account. Choose your payment method using a credit card or PayPal. Save the document in your preferred file format. You can now print the Illinois Financial Account Transfer to Living Trust template or fill it out using any online editor. Don’t worry about making mistakes as your sample can be used and sent, and printed as many times as needed. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the document.

- All of your saved templates are stored in My documents and are accessible at all times for future use.

- If you haven’t subscribed yet, you should sign up.

- Check out our comprehensive instructions on how to obtain the Illinois Financial Account Transfer to Living Trust form in minutes.

- To acquire an authorized example, verify its validity for your state.

- Examine the sample using the Preview function (if available).

- If there’s a description, read it to comprehend the details.

- Click on the Buy Now button if you found what you're looking for.

Form popularity

FAQ

You can add property to your living trust at any time. And because you'll also be the trustee, you can always sell or give away property in the trust, or take it out of the living trust and put it back in your name as an individual. A living trust isn't the only way to save money on probate.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To put checking or savings accounts into the trust, go down to your bank and fill out the institutional paperwork. You don't have to change the name on the checks. When you die, your successor trustee will assume control of the account and distribute the money to your heirs.

Lifetime Gift Tax Exemption The IRS allows you, as of 2014, to give up to $5.34 million in gifts or, after you die, bequests free of estate tax. This means you can put additional money into your irrevocable trust and, as long as you stay below your lifetime limit, it'll be a tax-free transfer.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.