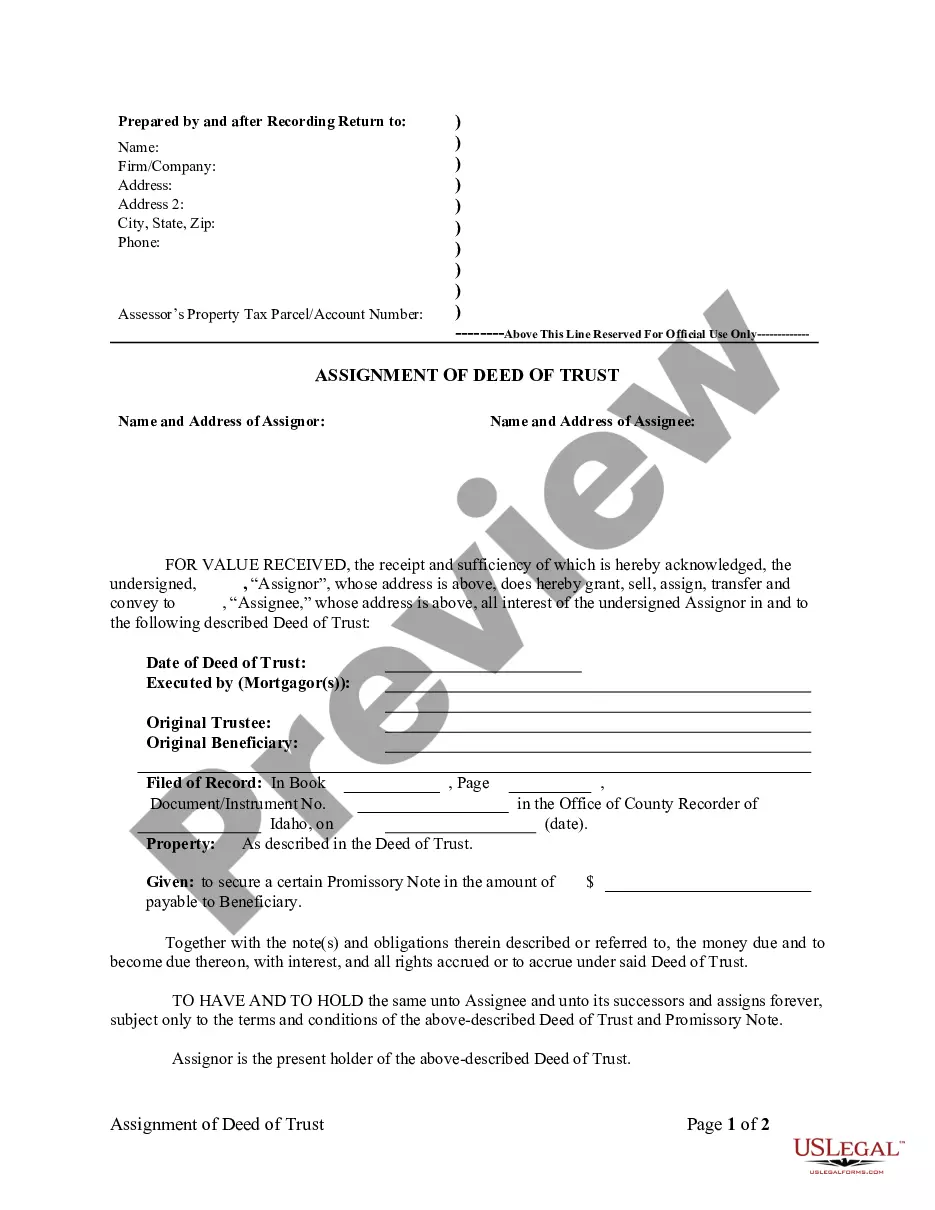

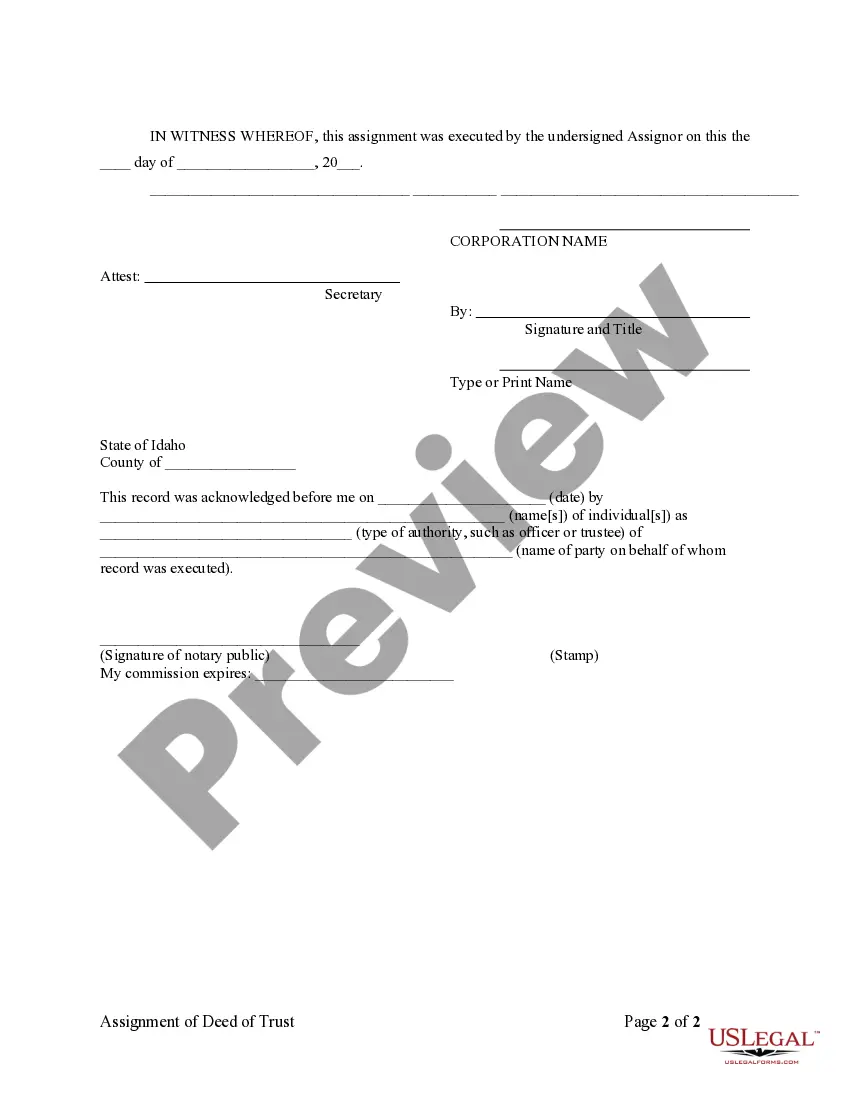

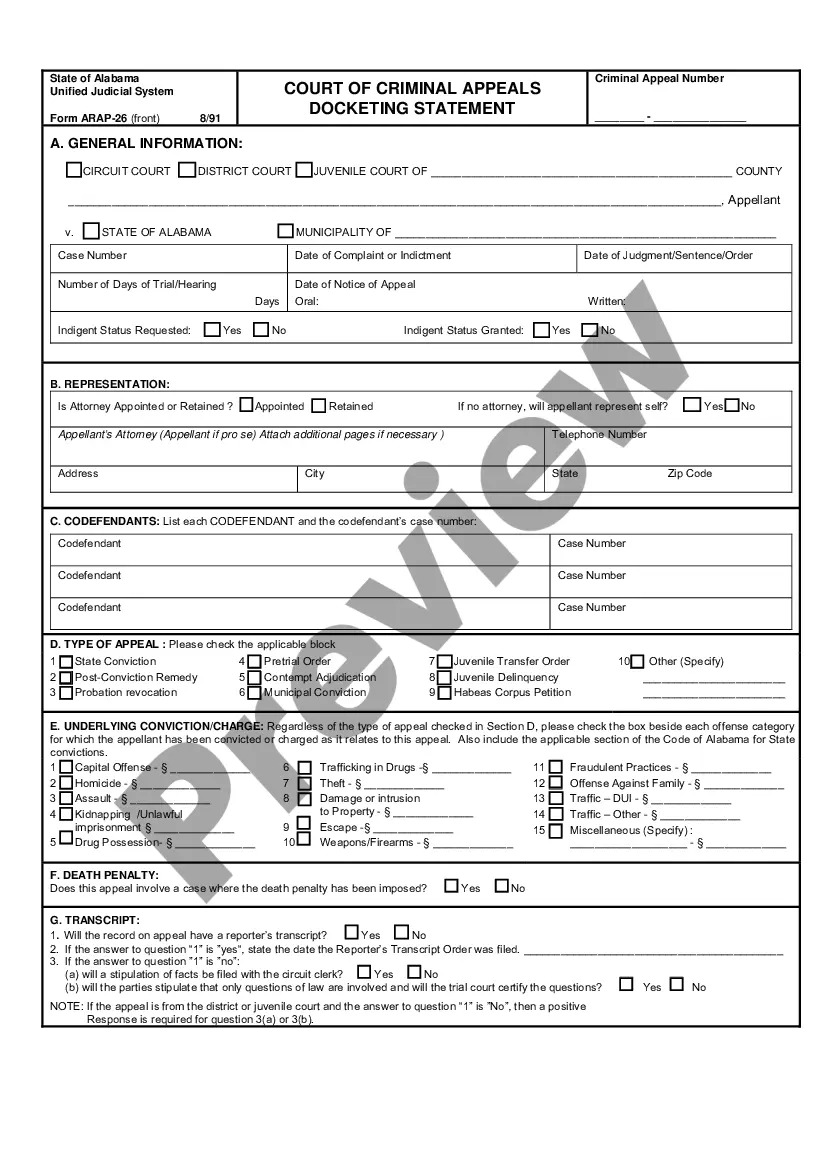

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Idaho Assignment of Deed of Trust by Corporate Mortgage Holder

Description

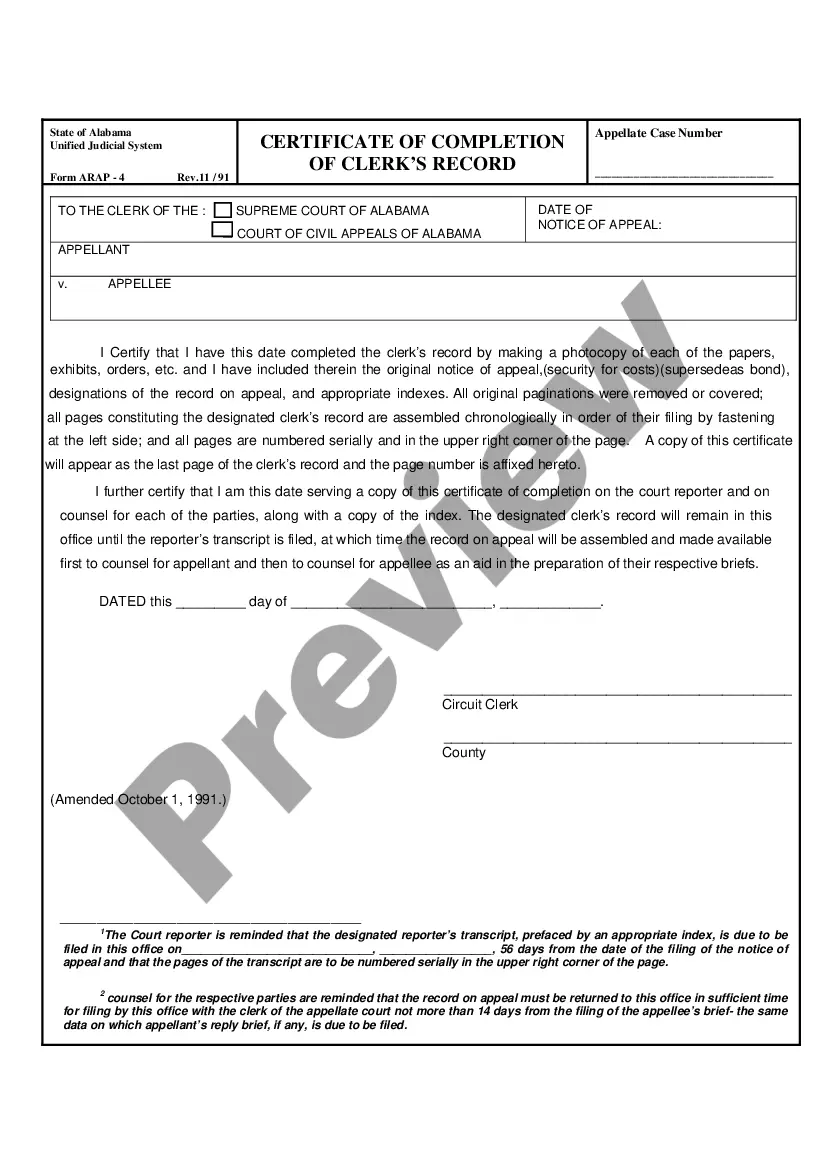

How to fill out Idaho Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Access one of the most comprehensive collections of legal documents.

US Legal Forms is truly a resource to locate any state-specific template in just a few clicks, including examples of Idaho Assignment of Deed of Trust by Corporate Mortgage Holder.

No need to squander hours searching for an accepted sample for court.

After selecting a pricing option, create your account. Pay via credit card or PayPal. Download the document to your device by clicking Download. That’s it! You must submit the Idaho Assignment of Deed of Trust by Corporate Mortgage Holder template and verify it. To ensure that everything is accurate, consult your local legal advisor for assistance. Sign up and easily browse through around 85,000 useful templates.

- To utilize the forms collection, select a subscription and create an account.

- If you have already registered, simply Log In and click on the Download button.

- The Idaho Assignment of Deed of Trust by Corporate Mortgage Holder template will be quickly saved in the My documents section (a section for all forms you download from US Legal Forms).

- To create a new account, follow the simple instructions below.

- When needing a state-specific document, ensure you select the correct state.

- If possible, check the description to comprehend all the details of the document.

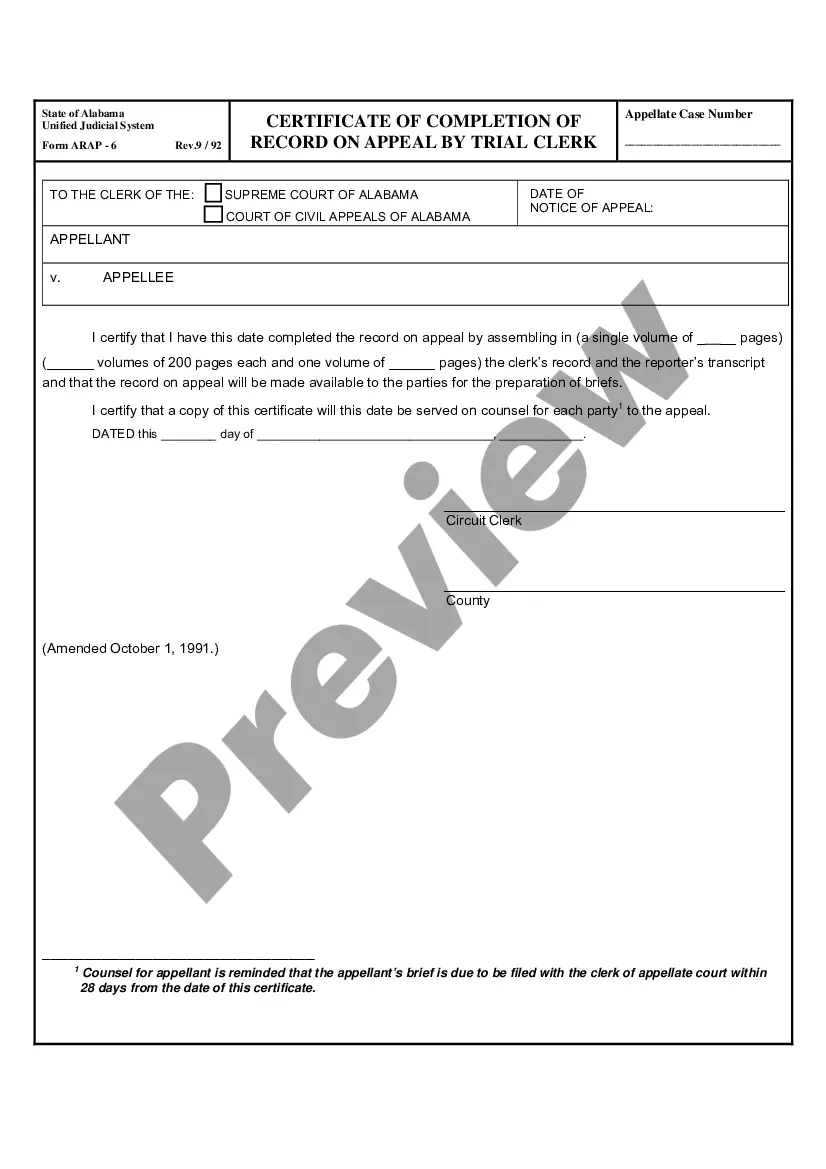

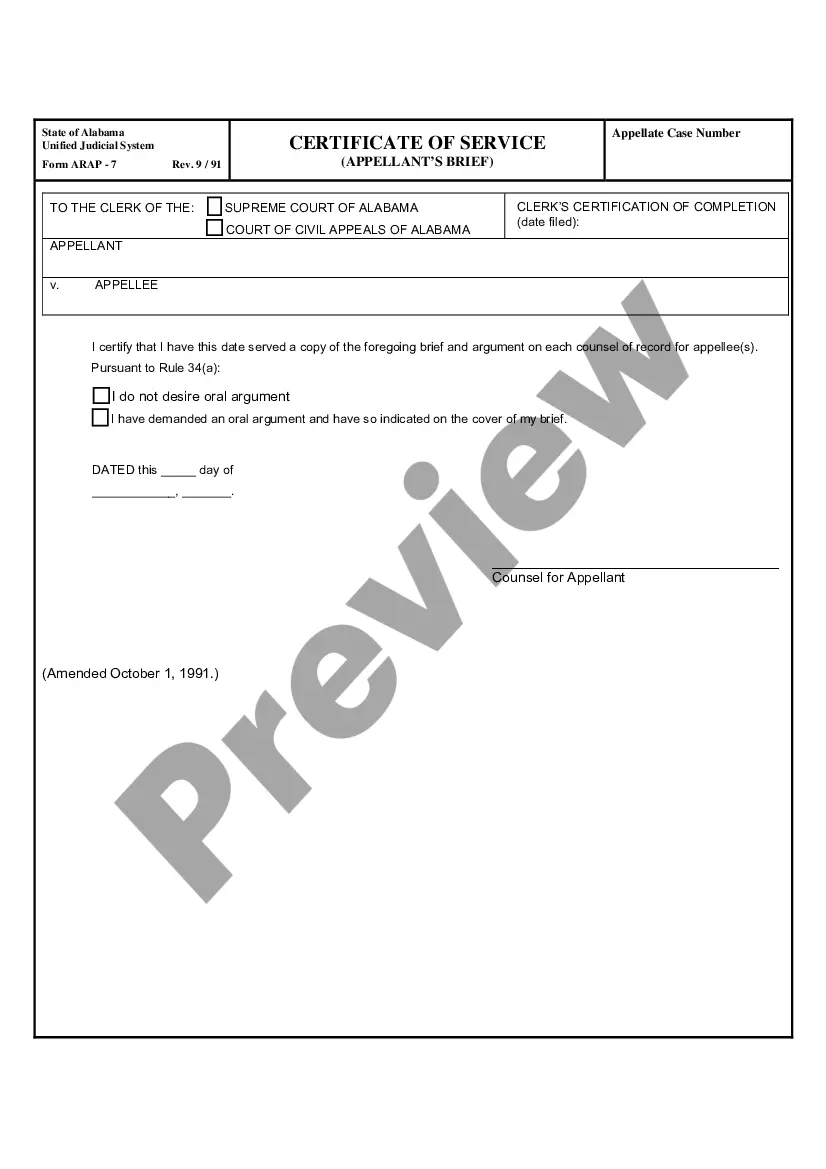

- Make use of the Preview feature if available to review the document's content.

- If everything looks correct, click on the Buy Now button.

Form popularity

FAQ

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

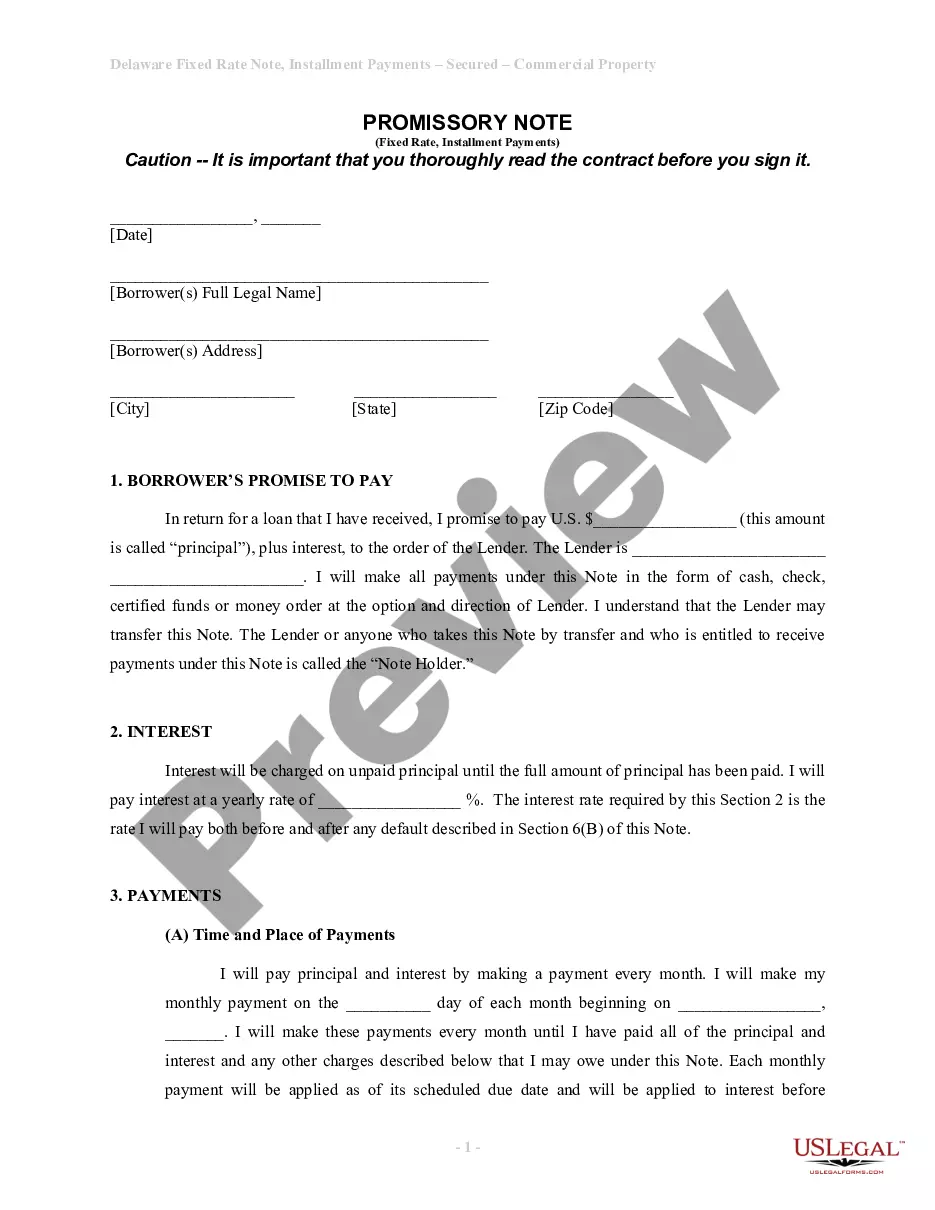

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

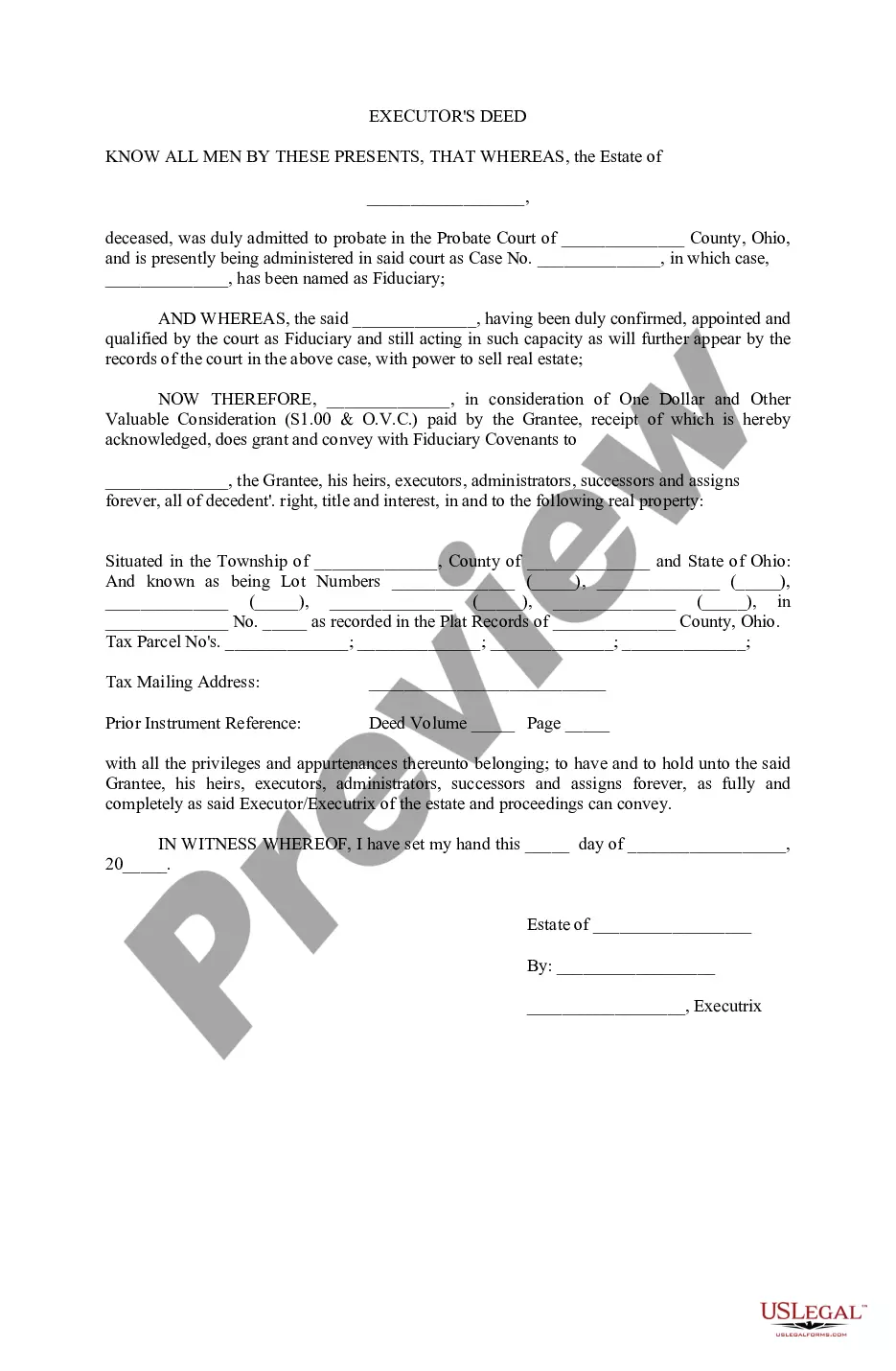

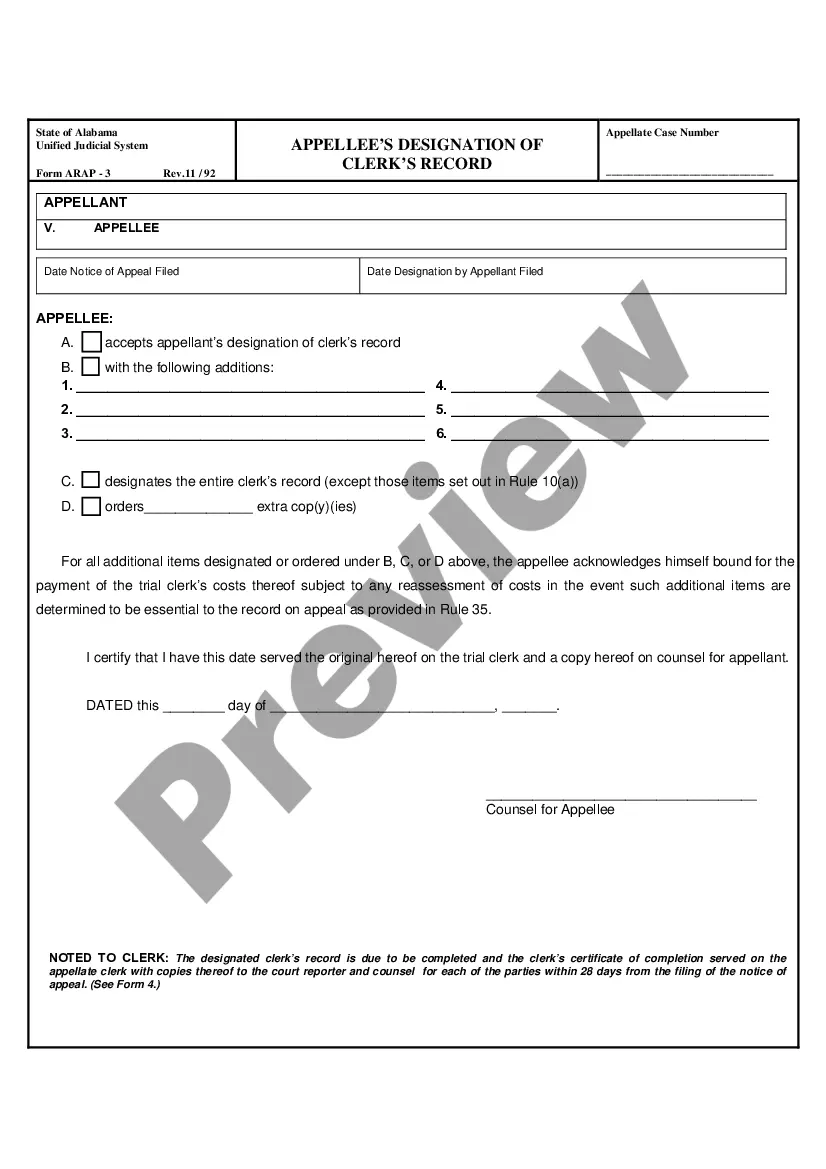

Essentially, the Deed of Assignment (DOA) is a legal document that transfers the ownership of a property from one party to another.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

When a deed of trust is required by state law, it is just one of many forms the parties sign at the real estate closing. Typically, the deed of trust is prepared by the lender, who is agreeing to put up money to finance the buyer's purchase.

Idaho is one of a handful of states that use deeds of trust as the primary form of financing purchases of real property. A deed of trust, similar to a mortgage, is a security instrument that, along with a promissory note, sets out the terms for repaying the loan used to purchase the property.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)