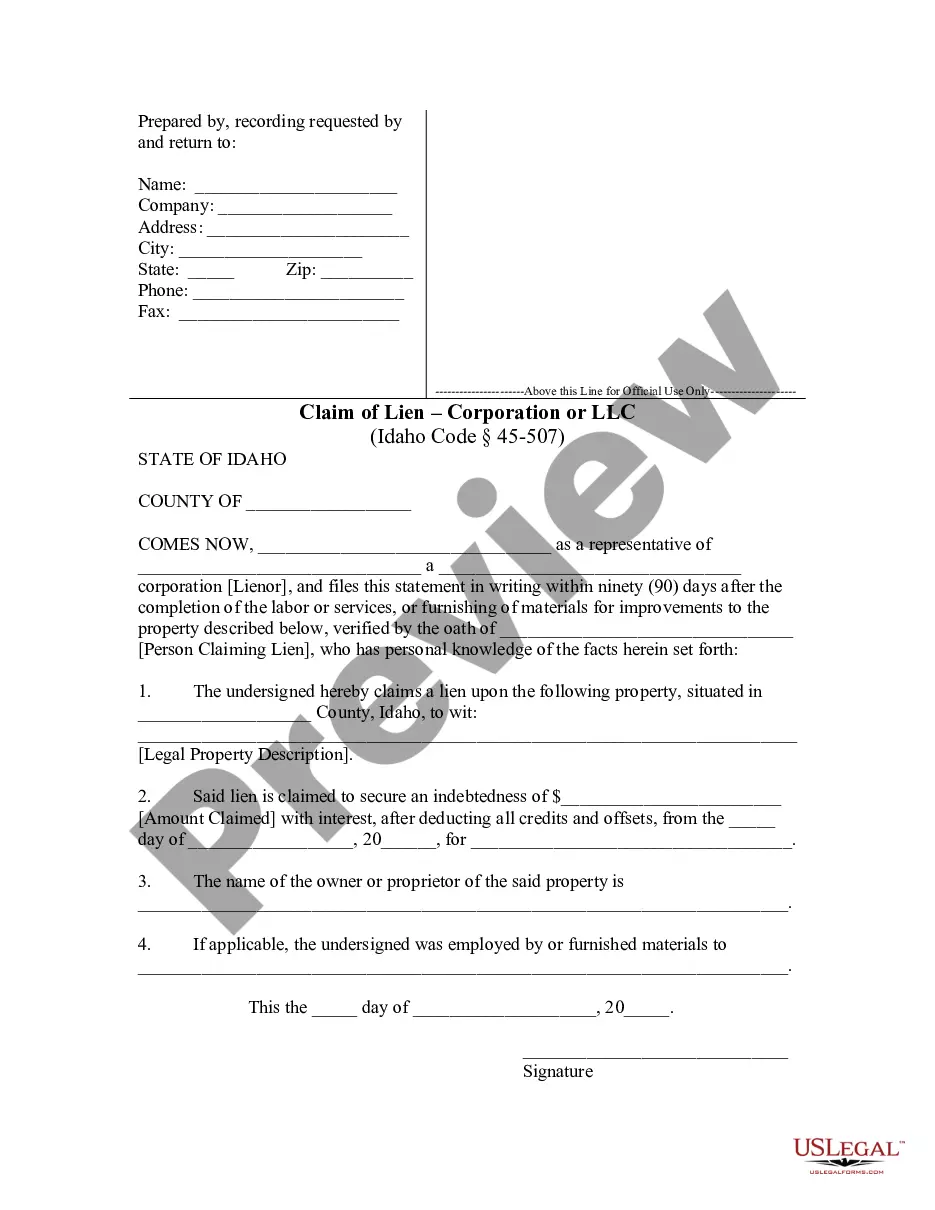

Any person claiming a lien must, within ninety (90) days after the completion of the labor or services or furnishing of materials, file for record with the county recorder for which the property is situated a claim containing a statement of his demand. The claim must be verified by the oath of the claimant and a true and correct copy must be served on the owner or reputed owner by personal service or certified mail.

Idaho Claim of Lien by Corporation or LLC

Description

How to fill out Idaho Claim Of Lien By Corporation Or LLC?

Obtain the most comprehensive collection of approved documents.

US Legal Forms is essentially a platform where you can locate any state-specific document in just a few clicks, including Idaho Claim of Lien by Corporation or LLC templates.

No need to waste several hours of your time searching for a court-acceptable form.

After choosing a pricing plan, create an account. Make payment via credit card or PayPal. Download the sample to your device by clicking Download. That's it! You need to complete the Idaho Claim of Lien by Corporation or LLC form and check it. For assurance that everything is correct, consult your local legal counsel for assistance. Sign up and effortlessly discover around 85,000 useful templates.

- To utilize the forms library, choose a subscription and create your account.

- If you have registered, simply Log In and then click Download.

- The Idaho Claim of Lien by Corporation or LLC template will be immediately saved in the My documents section (a section for every form you store on US Legal Forms).

- To set up a new profile, follow the brief instructions provided below.

- If you need to use state-specific documents, make sure to specify the correct state.

- If available, examine the description to grasp all the details of the document.

- Utilize the Preview option if it's available to review the document's details.

- If everything is accurate, hit the Buy Now button.

Form popularity

FAQ

30-21-102(19)(E) and (F), Idaho Code Governor means, a manager of a manager-managed limited liability company, or a member of a member-managed limited liability company. Line 5. Enter the mailing address for future correspondence.

Governing person means a person, alone or in concert with others, by or under whose authority the powers of the limited liability company are exercised and under whose direction the activities and affairs of the limited liability company are managed pursuant to this chapter and the limited liability company's operating

How much does it cost to form an LLC in Idaho? The Idaho Secretary of State charges $100 to file the Certificate of Organization online and $120 to file by mail. You can reserve your LLC name with the Idaho Secretary of State for $20.

You can start an S corporation (S corp) in Idaho by forming a limited liability company (LLC) or a corporation, and then electing S corp status from the IRS when you apply for your Employer Identification Number (EIN). An S corp is an Internal Revenue Service (IRS) tax classification, not a business structure.

Step 1: Name Your Idaho Corporation. Choosing a business name is the first step in starting a corporation. Step 2: Choose an Idaho Registered Agent. Step 3: Hold an Organizational Meeting. Step 4: File the Idaho Articles of Incorporation. Step 5: Get an EIN for Your Idaho Corporation.

A Claim of Lien must be filed containing a statement of the claimant's demand, the names of relevant parties, and a property description. It must be verified by the oath of the claimant and a copy must be served personally or by certified mail to the property owner. Idaho Code § 45-507.

A corporation becomes an S corporation by filing an S corporation election with the IRS. The election is made on IRS Form 2553, Election by a Small Business Corporation. It must be signed by all the shareholders and timely filed.

To elect for S-Corp treatment, file Form 2553. You can make this election at the same time you file your taxes by filing Form 1120S, attaching Form 2533 and submitting along with your personal tax return.

Form 2553 S Corporation Election. Form 1120S S Corporation Tax Return. Schedule B Other Return Information. Schedule K Summary of Shareholder Information. Schedule K-1 Individual Shareholder Information.