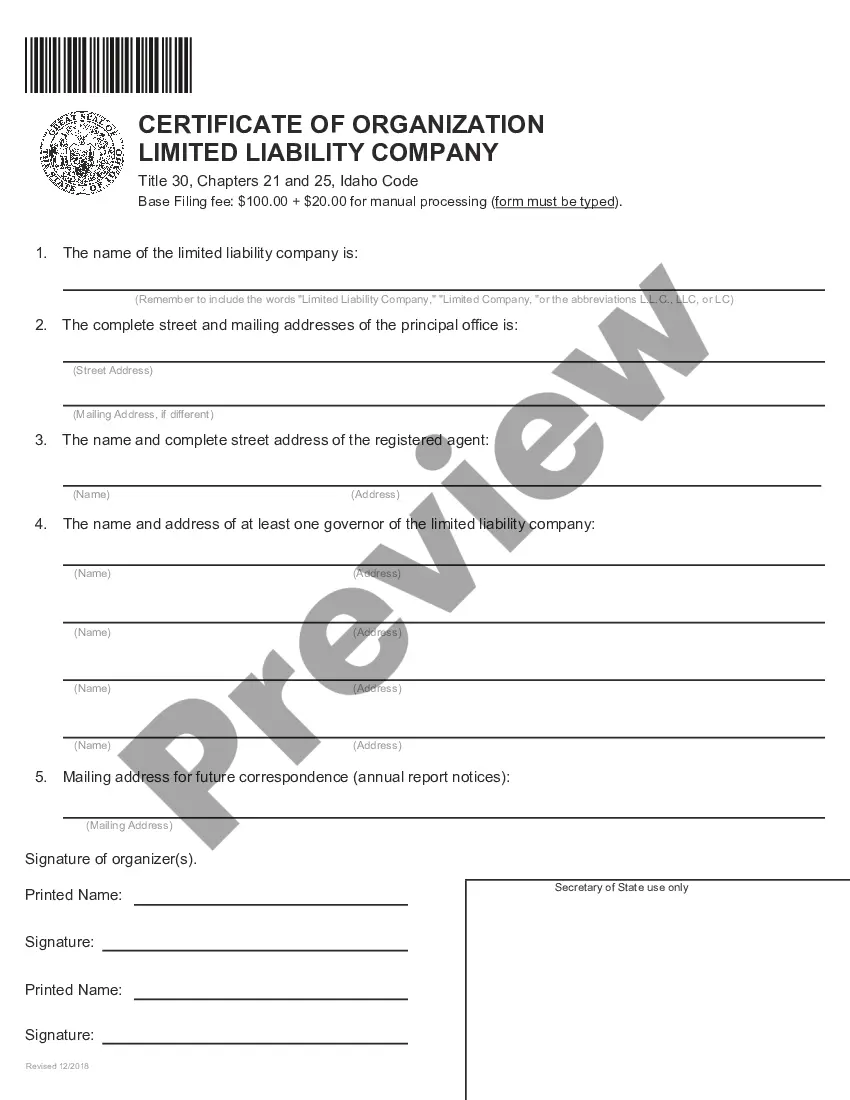

This Professional Limited Liability Company - PLLC Formation Package state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new Professional Limited Liability Company. The form contains basic information concerning the PLLC, normally including the PLLC's name, purpose and duration of the PLLC, the registered address, registered agent, and related information.

Idaho Professional Limited Liability Company PLLC Formation Package

Description

How to fill out Idaho Professional Limited Liability Company PLLC Formation Package?

Access one of the most comprehensive collections of legal documents.

US Legal Forms is a service designed to locate any state-specific file in just a few clicks, such as Idaho Professional Limited Liability Company PLLC Formation Package samples.

No need to spend countless hours searching for a court-accepted example.

Once everything looks correct, click the Buy Now button. After choosing a pricing plan, set up your account. Make payment via card or PayPal. Download the sample to your device by clicking Download. That’s it! You should finalize the Idaho Professional Limited Liability Company PLLC Formation Package template and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and effortlessly access over 85,000 valuable templates.

- To utilize the forms library, select a subscription and create an account.

- If you have already set it up, simply Log In and then click Download.

- The Idaho Professional Limited Liability Company PLLC Formation Package template will be immediately saved in the My documents section (a section for all forms you download on US Legal Forms).

- To establish a new account, follow the straightforward instructions provided below.

- If you need to use a state-specific example, make sure to specify the correct state.

- If available, review the description to grasp all aspects of the form.

- Utilize the Preview option if it’s offered to examine the document's contents.

Form popularity

FAQ

The PLLC files a standard Form 1120, Corporate Income Tax Return, and pays taxes at the regular corporate tax rate. It retains earnings as a corporation, however, and doesn't distribute them to members for personal taxation.

Individual Reports A partnership PLLC must file a Form 1065, Return of Partnership Income, showing income, deductions and any profit or loss. This is an informational return, and no taxes are assessed. A Schedule K-1 with the form shows each partner's share, to be reported on a personal return.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

The owners of a PLLC are called members, and they have an operating agreement that governs how they work together and divide profits and losses. Many professionals start a PLLC because they want to separate their individual liability from their liability as a member of the business or practice.

Choose your management structure. There are two forms of management for LLCs: member-managed and manager-managed. Choose your title. In a single-member LLC, you have the freedom to choose whatever title best reflects your role. Create an Operating Agreement.

A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.